Waikalua Loko (circa 2000) *A*OHE PAU KA *IKE I KA HALAU HO

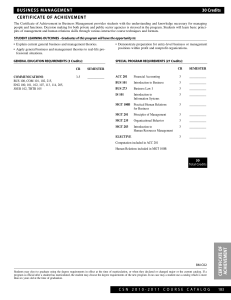

advertisement

Waikalua Loko (circa 2000) ‘A’OHE PAU KA ‘IKE I KA HALAU HO’OKAHI Not all knowledge is learned in one school Kāhea Loko ( 1995- 2002) Objectives: •Create social studies, science, and language arts curricula utilizing Hawaiian Fishponds as a resource; • Meet Hawaii content and performance standards; • Provide professional development opportunities for teachers; •Encourage teachers to use the community as a classroom. Ma ka hana ka ‘ike: “the knowledge is in the doing” Aloha ‘Āina, Love of the Land ( 2003- 2012) • Aloha ‘Āina builds on the success of Kāhea Loko. It incorporates not only the fishpond, but the entire ahupua’a from the mountain to the sea. Hawaiian Engineering Rigor Model of Culture-based Education Spiritual Realm Novermber 2010 NH Career Planning System 9 The AKAMAI Initiative Self-Determination from a Financial Perspective What do we want? • The goal of Native Hawaiians is Self Determination – A better quality of life: • • • • Education Health Career General well-being (spiritual, emotional, etc.) – Being in control of our own destiny The Critical Path • But there is only one best path; or “Critical Path,” and that is through education • The lynchpin on that Critical Path (and indeed all paths) is the dependence on the yield generated by the management of Alii Trust assets Reliance on Yield on Alii Trust Assets Self Determination Lynchpin on the Critical Path to Self Determination Additional Yield Multiple? • The natural byproducts of having NH Asset Mgt firms managing Alii Trust Assets are myriad, and all in alignment with Alii Trusts’ goals, and serving Alii Trusts’ constituents: – – – – – Management fees kept locally, in local economy NH owners/principals = NH profits Hire NH employees in high skill/high paying positions Opportunities to hire NH ancillary support services Greater wealth; greater opportunity to improve education, health, and general welfare – NH Asset Mgrs will have a better understanding of the awesome responsibility/honor of managing Alii Trust Assets because we come from the neighborhoods served by Alii Trust funded programs No Handouts, No Excess Risk • There are no additional risks assumed by the Alii Trusts by having NH Asset Mgt firms manage trust assets because: – Management of Alii Trust assets done competitively in the open market; not part of an in-house management program – Market forces will ensure that only firms delivering the best risk-adjusted returns will be engaged – If NH Asset Mgt firms manage trust assets, it is because they earned this right in a free and competitive marketplace Focus on the Lynchpin • We need to develop a program to achieve selfdetermination from a financial perspective • A world-class, training program that focuses on producing NH financial talent capable of competing in the open market for jobs at top ranked non-NH asset mgt firms • Eventually, a percentage of these trainees will go on to start their own NH Asset Mgt Firms capable of competing in the open market for the management of Alii Trust Assets A Better Way… • What if: – Instead of continuously funding the program with grants, the Alii Trusts made an INVESTMENT in a new NH Asset Mgt Firm? – The NH Asset Mgt Firm is owned by a non-profit whose mission is to RUN THE FINANCIAL ANALYST TRAINING PROGRAM – The Alii Trusts hold positions on the BOD of the non-profit parent to ensure their interests are being represented A Better Way… • What if: – The profits of the NH Asset Mgt Firm are used to fund the training program • The Alii Trusts still get yield on their INVESTMENT (a source of cash) instead of continuously funding the training program directly via grants (yet another drain on cash) • The NH Asset Mgt Firm then BECOMES THE “TRAINING VEHICLE” used to ensure our students get THE BEST training/exposure to actual operations of a real asset mgt firm, with PAID internships so they can focus on, and get paid to study rather than work odd jobs The AKAMAI Initiative • A self-funding vehicle to self determination from a financial perspective The AKAMAI Initiative The AKAMAI Foundation MARKETING The Kama’aina Ex-Pat Database EDUCATION The Asia-focused Financial Analyst Training Program AKAMAI Capital, LLC Japan Fund, LP China Fund, LP AKAMAI AKAMAI Capital literally translated means “Smart Money.” The word AKAMAI as used in the AKAMAI Initiative and AKAMAI Capital is an acronym for: Ala Pi’i [to ascend] - Organize the Hawaii fund management industry; K āhea [to call out] - Market Hawaii to the Asia-focused fund management industry; demonstrate our compelling value proposition vis-à-vis Australia, Hong Kong, Singapore, and Tokyo; A lu [to unite] - Bridge gap between industry, academia, and State, as well as other interested parties; M ahi [to cultivate] – Develop a 5-year Asia-focused Financial Analyst Training Program (AFATP) from high school thru undergraduate degree (and beyond via continuing education), and a world-class, Asia-focused AKAMAI [smart] Lab & Conference Center; A mo [to bear the burden of oversight] – Aggregate data, monitor, and report financial literacy and industry growth milestones & metrics; I mi [to seek] – Continual search for improvement of the process; We are all connected… Define your pond. How is it connected to your community? How are we preparing our youth to connect to their pond, community and world? 21