E & D - masbo

advertisement

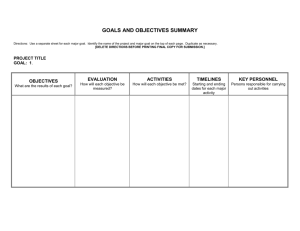

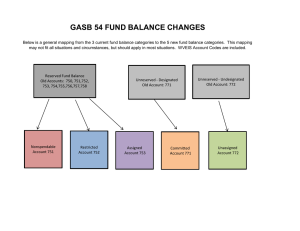

E&D Camie Lamica May 14, 2015 What is E & D • Excess & Deficiency – Consists of over budget revenues received, under budget expenditures, and prior year E & D balance – Cumulative amount E&D • Also called the "surplus revenue" account, this is the amount by which cash, accounts receivable, and other assets exceed a regional school district's liabilities and reserves as certified by the Director of Accounts. The calculation is based on a year-end balance sheet, which is submitted to DOR by the district's auditor, accountant, or comptroller as of June 30. The regional school committee must apply certified amounts exceeding five percent of the district's prior year operating and capital costs to reduce the assessment on member cities and towns. Source: Department of Revenue What does DOR need? • Combining Balance Sheets for ALL account groups • Cash Reconciliation amounts=Treasurer and General Ledger • Detail analysis of E & D • Accounts Receivable amount received within 60 days of 6/30 year end • Revenue Budget and actuals • Unspent prior year encumbrance amount Summary of All Fund Types General Fund Special Revenue Fund • Grants and Revolving Capital Project Fund Fiduciary Funds * Trust and Agency Where do you start? • • • • Reconcile GL cash with Treasurer Post all year end receivables and payables Close out prior year encumbrances Trial balances for each fund account should be final What do you need to do financials? • Trial Balance FINAL for EACH fund by account For EACH account • Revenue and Expenditure Statement • Balance Sheet Balance Sheet • Assets = • Cash • Due to/Due From • Accounts Receivable • Liabilities + • Accounts Payable • Accrued Payroll • Withholding accounts • Fund Balance • Reserve for Encumbrance • Reserve for Subsequent Year Budget • Unreserved Fund Balance What to check for? • Always make sure Prior Year ENDING balance is the same as the Current Year BEGINNING balance How do I put it together? • Start with Fiduciary Funds – Trust & Agency – Trust accounts – scholarships and other donations – Agency accounts – student activity funds • Revenue and Expenditure Statement – For each Fund Account record prior year ending fund balance, current year revenue, current year expenditures and verify ending fund balance is same on the worksheet as Trial Balance • Balance Sheet – For each Fund Account record assets, liabilities, prior year ending fund balance and current year ending fund balance on the worksheet verifying same on Trial Balance • Prepare Combining Fiduciary Fund Statements T&A Worksheets What’s next? • Move to the Capital Project Funds and prepare the Revenue & Expenditure Statement and Balance Sheet for each one of those accounts • Then move to the Special Revenue Funds and prepare both statements for all grants and then all revolving accounts • Prepare Combining Statements for EACH FUND TYPE separately (CPF, SRF) General Fund • All GF budget operations and assessments • Budget versus actual = revenue & expenditures • Assessments • Detailed Fund Balance Analysis • Prior year encumbrance remaining balance • Current year encumbrance amount GF Worksheets Things to Remember • Deficits – any deficit fund balance in ANY fund account WILL BE DEDUCTED from the GF ending fund balance to certify E & D amount • 5% limit for E & D balance • Circuit Breaker – FY2015 year end balance no greater than FY2015 reimbursement • October 31 filing deadline DOR Certification Resources • Chapter 71, 16B ½ • 603 CMR 41.06