Relocation Reimbursement

advertisement

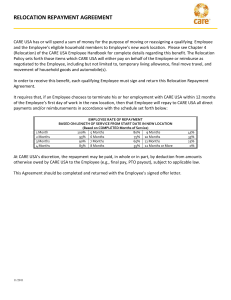

By Javier Martinez, Director of Payroll Management Services October 2008 Relocation Reimbursement What are we going to cover? • Internal Revenue Service Requirements • UTSA Requirements Relocation IRS Requirements Initial Tests of Deductibility Deductible Moving Expenses Reporting Initial Test of Deductibility Time Test During 12 month period immediately following the move, employee must work full time for at least 39 weeks. What if he does not stay 39 weeks? What do we do? Answer: Nothing Initial Test of Deductibility Distance Test New workplace must be 50 miles further from employee’s former residence. Old Work New Work 10 miles 60 miles Home Relocation IRS Requirements Initial Tests of Deductibility Deductible Moving Expenses Reporting Deductible Moving Expenses Only two types of deductible Relocation Expenses Transportation of Household goods Traveling Deductible Transportation of Household Goods Reasonable expenses incurred … Packing Moving Insuring Storing In-Transit ○ 30 day limit ○ From old residence and before delivery to new residence Employer can pay Moving Company directly Deductible Relocation Travel Expenses Reasonable expenses incurred… Transportation ○ Flights ○ Automobile (Self-drive) Mileage: $0.27 per mile (Effective 07/01/2008) Actual Receipts Lodging Relocation IRS Requirements Initial Tests of Deductibility Deductible Moving Expenses Reporting Qualified Relocation Expense Initial Tests of Deductibility Deductible Relocation Expense Relocation expenses must pass both criteria… Qualified Relocation Expense Wages “All remuneration for employment, including the cash value of all remunerations (including benefits) paid in any medium other than cash” IRC §3121(a) Great News! Qualified Relocation Expenses reimbursements are Non-Taxable Fringe Benefits Amounts paid or reimbursed by the employer are a non-taxable fringe benefit to the extent the moving expenses qualify for a deduction and if the employee did not deduct them in a previous year. IRC §132(a)(6), §132(g) Reasonable Expenses “Reasonable” Expenses What are reasonable expenses? What does this mean? Relocation expenses are deductible only to the extent they are reasonable under all circumstances related to the move. IRS Reg §1.217-2(b)(2) Transportation Expenses Packing Moving In-transit storage Includes specialized Movers ○ Pianos ○ Oversea Shippers Traveling Expenses Transportation Lodging Non-deductible Expenses (IRS Pub 521) Any part of the purchase price of the new home Car Registration (tags) Driver’s License Expenses of buying or selling a home Home improvements to help sell your home Loss on the sale of home Mortgage Penalties Pre-move house hunting expenses Real Estate Taxes Refitting of carpet and draperies Return trips to former residence Security Deposits Storage Charges (excluding In-Transit) Relocation Expense Reimbursement Reporting How does the IRS know? Answer: We are required to tell them. Relocation Expense Reimbursement Reporting to IRS Qualified Moving Expenses Reimbursement: Form W-2: Box 12 Code P ○ i.e. P 1200.00 Non-Qualified Non-Deductible: Form W-2: Box 1 , 3, and 5 Relocation Reimbursement What are we going to cover? • Internal Revenue Service Requirements • UTSA Requirements UTSA Relocation Reimbursement Requirements Relocation Authorization Relocation Limit Reimbursement Criteria Relocation Reimbursement Payment Procedure UTSA Relocation Amount Authorization Vice-President Level Authorization Required Vice-President may delegate Delegation of Authority Memo UTSA Relocation Amount Limit 10% of Computed Annualized Salary of the prospective employee Not required to offer Relocation Reimbursement, nor to the employee limit Exception to 10% Limit: Approval by Vice President Business Affairs (or ) Approval by President UTSA Relocation Reimbursement Criteria Qualified Transportation of Household Goods Qualified Travel Qualified Lodging Meals* Pre-move House Hunting* Temporary Housing* Storage* *Taxable Income to the employee Relocation Payment Process Reimbursement Process: submit to Payroll Offer Letter of Employment (must contain Relocation Amount) Original Receipts Local Funds Voucher ○ Employee’s Signature ○ Account Signer Approval Authority ○ Vice-President Approval Authority (one of the following) On Offer Letter Email attached to Offer Letter Co-sign Local Voucher Delegation of Authority Memo on file with Payroll Office Direct Pay to Moving Company via P.O. UTSA Relocation Reimbursement Questions?