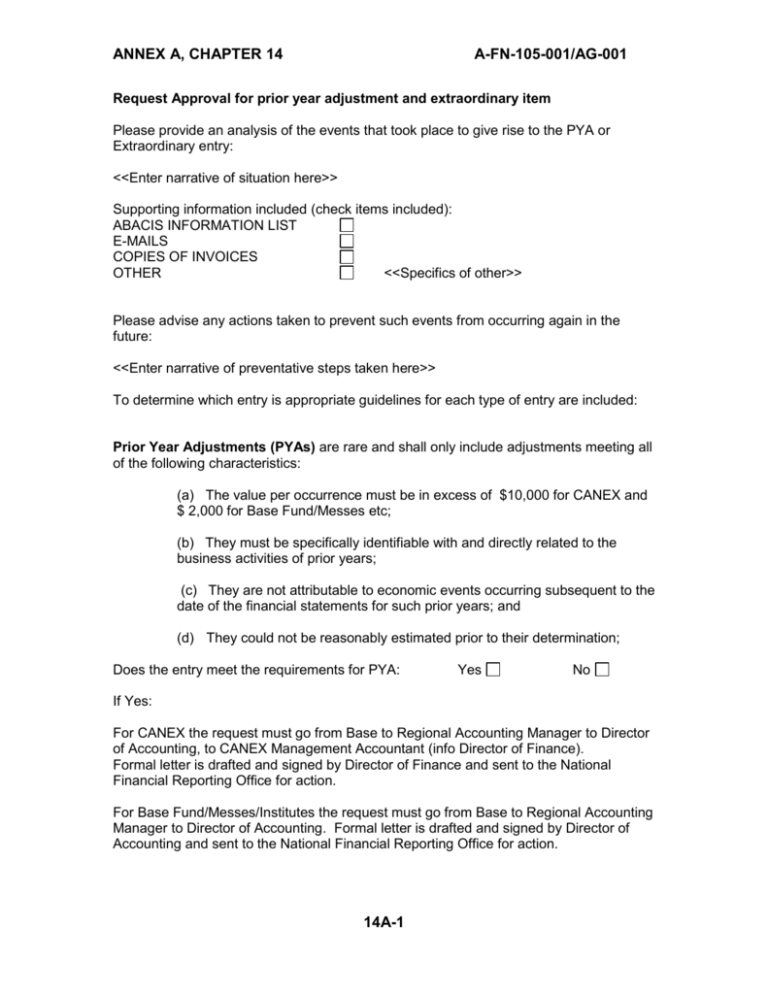

Prior Year Adjustment (PYA)/Extraordinary Revenue/Expense Form

advertisement

ANNEX A, CHAPTER 14 A-FN-105-001/AG-001 Request Approval for prior year adjustment and extraordinary item Please provide an analysis of the events that took place to give rise to the PYA or Extraordinary entry: <<Enter narrative of situation here>> Supporting information included (check items included): ABACIS INFORMATION LIST E-MAILS COPIES OF INVOICES OTHER <<Specifics of other>> Please advise any actions taken to prevent such events from occurring again in the future: <<Enter narrative of preventative steps taken here>> To determine which entry is appropriate guidelines for each type of entry are included: Prior Year Adjustments (PYAs) are rare and shall only include adjustments meeting all of the following characteristics: (a) The value per occurrence must be in excess of $10,000 for CANEX and $ 2,000 for Base Fund/Messes etc; (b) They must be specifically identifiable with and directly related to the business activities of prior years; (c) They are not attributable to economic events occurring subsequent to the date of the financial statements for such prior years; and (d) They could not be reasonably estimated prior to their determination; Does the entry meet the requirements for PYA: Yes No If Yes: For CANEX the request must go from Base to Regional Accounting Manager to Director of Accounting, to CANEX Management Accountant (info Director of Finance). Formal letter is drafted and signed by Director of Finance and sent to the National Financial Reporting Office for action. For Base Fund/Messes/Institutes the request must go from Base to Regional Accounting Manager to Director of Accounting. Formal letter is drafted and signed by Director of Accounting and sent to the National Financial Reporting Office for action. 14A-1 ANNEX A, CHAPTER 14 A-FN-105-001/AG-001 Extraordinary Items include provisions for revenues and losses exceeding $ 2,000 which: (a) by their nature are not typical of the normal business activities of the entity; (b) are not expected to occur regularly over a period of years; and (c) are not considered as recurring factors in any evaluation of the ordinary operations of the entity. An example is the loss or write-down of inventory due to a flood or freezer malfunction. Does the entry meet the requirements for Extraordinary: Yes No If Yes: For CANEX the request must go from Base to Regional Accounting Manager to Director of Accounting, to CANEX Management Accountant (info Director of Finance). Formal letter is drafted and signed by Director of Finance and sent to the National Financial Reporting Office for action. For Base Fund/Messes/Institutes the request must go from Base to Regional Accounting Manager to Director of Accounting. Formal letter is drafted and signed by Director of Accounting and sent to the National Financial Reporting Office for action. 14A-2 ANNEX A, CHAPTER 14 A-FN-105-001/AG-001 National Financial Reporting Office will only action PYAs and Extraordinary items if either Director of Accounting or Director of Finance has given their approval. National Financial Reporting Office will action adjustment however Base Accounting can fill in entries if they are known: Accounting entries: DR DR DR DR DR DR DR DR CR CR CR CR CR CR CR CR Register Number: Note added to statement: Include relevant details including amount of adjustment and when adjustment was actioned in the accounting system. For Example: Extraordinary – Inventory Lost in Cafeteria Fire – $6,543, Actioned February 08 Note: If there are multiple entries for PYA or Extraordinary then the statement will include a total of all entries to ensure they balance to the financial statement. 14A-3