Product Cycle - Department of Geography and Environmental Studies

advertisement

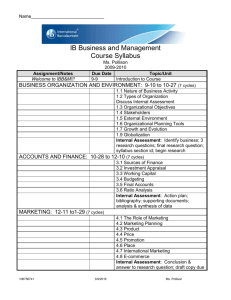

Quiz #2 week of Feb 22, on lectures 3 (Economic Change) and 4 (Finance, Cycles, etc). Study the PowerPoint and use the Study Guide that will be on the website. Questions are taken from the visible PowerPoint slides. More detail is on the hidden slides or slide notes but no questions are taken from them. Data questions: No specifics required unless I say so in lecture but you need to know ‘greater than, increase/decrease’ type answers. Date questions: I give you dates/periods and you have to know what went on. Booms and Busts Evolution of spatial economic systems is marked by periods of prosperity and periods of decline. In the vernacular, they are labeled as booms and busts and have distinct cyclical periodicity. We are going to explore four types of economic periodicity that have been identified: Kondratieff Cycle Inventory Cycle Product Cycle Keynes Cycle But before that we will look at the financial/banking system and how it (didn’t) work. CONTAGION CONTAGION - INTRO 2008 …three years later… INTRODUCTION …now INTRODUCTION Global Connectivity & Finance The 2008 Financial Crisis (a.k.a. Sub Prime Mortgage Affair) Complex cause and effect between: Sub Prime Mortgages Housing bubble Credit derivatives market and bubble Real trouble started in the U.S. with the 1999 GrammLeach-Bliley Act (GLBA). GLBA repealed the 1933 Banking Act called the GlassSteagall Act. The Glass Steagall Act was designed to prevent the financial speculation that caused the Great Depression. The Financial System A Simple Overview of the Financial Sector Financial sector has four primary actors: Retail banks – your savings and credit. Private (investment) banks – trade in stocks, bonds, derivatives. Credit Rating Agencies – who assess risk. Insurance companies – who buy risk. Bank Acts in various countries (prompted by the Great Depression 1929) separated these four players, legally preventing them from trading in each others products. This was done to partition risk and prevent what would later be called “cascade failures”. THE FINANCE SYSTEM A Happy(‘ish) Retail Banking Place Equity (your money) protected to some extent by government deposit insurance and bank reserve requirements. Retail bank pays you interest. Difference between interest paid and interest earned is profit, out of which… Banks’ money protected by insurance companies who buy risk. Retail bank takes your savings and pays you interest. Retail bank lends your savings to mortgages and credit purchases, and secured investments and makes interest. Small risk due to defaults on secured mortgages, loans, credit cards and THE FINANCE SYSTEM bonds. A Risky(‘ish) Private Banking Place Equity (investor’s money) not protected. Private bank takes investors’ money and pays a ROI. Private bank pays you a ROI. Difference between money invested and ROI earned is profit (or loss), out of which… Banks’ money protected by insurance companies who buy risk. Private bank buys all types of investments and makes/loses money. Large risk equivalent with risk of investment. THE FINANCE SYSTEM Risk is assessed by credit agencies. The Happy-Risky’ish Banking System 1933-1999 Equity (your money) protected to some extent by CDIC and bank reserve requirements. Retail Banking Retail bank takes your savings and pays you interest. Retail bank pays you interest. Difference between interest paid and interest earned is profit, out of which… Retail bank lends your savings to mortgages and credit purchases, and secured investments and makes interest. Small risk due to defaults on secured mortgages and loans, and on credit cards. T H E B A N K A C T THE FINANCE SYSTEM Private Banking Equity (investor’s money) not protected. Private bank pays you ROI. Difference between money invested and ROI earned is profit, out of which… Banks’ money protected by insurance companies who buy risk. Insurance Companies Private bank takes investors’ money and pays ROI. Private bank buys all types of investments and makes/loses money. Large risk equivalent with risk of investment. Risk is assessed by credit agencies. Rating Agencies The Unhappy-Very Risky Banking System Equity (your money) protected to some extent by CDIC and bank reserve requirements. Retail Banking Private Banking Equity (investor’s money) not protected. Retail bank takes your savings and pays you interest. Trade in unsecured instruments Retail bank pays you interest. Difference between interest paid and interest earned is profit, out of which… Retail bank lends your savings to mortgages and credit purchases, and secured investments and makes interest. Trade in CDO and MBS Retail banks instruments invent Sub Prime Mortgages Small risk due to defaults on secured mortgages and loans, and on credit cards. High risk due to defaults on unsecured mortgagesTHE FINANCE SYSTEM and loans, and on credit cards. Private bank pays you ROI. Difference between money invested and ROI earned is profit, out of which… Private bank takes investors’ money and pays ROI. Private bank buys all types of investments and makes/loses money. Rating Insurance agencies companies buy (high Banks’ money Risk is Large risk buy protected by (high risk) CDO assessed by equivalent insurance risk) CDO with risk of and credit MBS companies agencies. investment. and who buy risk. MBS and rate Rating them lower Insurance Agencies risk! TheThe Unhappy-Very Risky System Largest Failure ofBanking Unregulated Retail Private Capitalism Since 1929 Banking Equity (your money) protected to some extent by CDIC and bank reserve requirements. Banking Equity (investor’s money) not protected. Retail bank takes your savings and pays you interest. Trade in unsecured instruments Retail bank pays you interest. Difference between interest paid and interest earned is profit, out of which… Retail bank lends your savings to mortgages and credit purchases, and secured investments and makes interest. Trade in CDO and MBS Retail banks instruments invent Sub Prime Private bank pays you ROI. Difference between money invested and ROI earned is profit, out of which… Private bank takes investors’ money and pays ROI. Private bank buys all types of investments and makes/loses money. Rating Insurance agencies companies buy (high Banks’ money Risk is Large risk buy protected by (high risk) CDO Mortgages assessed by equivalent insurance risk) CDO with risk of and credit MBS companies Small risk due to defaults on secured agencies. investment. and who buy risk. MBS mortgages and loans, and on credit cards. and rate Rating them lower Insurance High risk due to defaults on unsecured mortgages CONTAGION - WHAT HAPPENED Agencies and loans, and on credit cards. risk! The Effects… CONTAGION - THE RESULTS Who Gets Affected? Financial companies who directly participated lose billions directly and quickly. Financial companies who did not participate but still held loans and insurance policies to banks who did also lost billions. Private individuals who had deposits in bankrupt banks lost billions. Manufacturing that relies on credit to keep production going could not get it so went out of business. Nations (taxpayers) who had to bail out the banks to break the cycle lost billions, whether they were involved or not. CONTAGION - WHAT HAPPENED Where Gets Affected? Everywhere: Developed world economies that: started the problem; held debt from other developed economies; needed credit to keep their manufacturing going; needed customers to keep their economies going. Emerging economies that: held debt from the developed economies; needed credit to keep their manufacturing going; needed customers to keep their economies going. CONTAGION - WHAT HAPPENED The Lead Up… CONTAGION - THE RESULTS A small sample of US bank mergers 1990 to 2009 (Think ecology here – the more complex ecosystems are, the safer. Gramm-Leach-Bliley 37 U.S. FDIC had 8,430 banks registered in August 2008. By Feb 2014 there were 6,799 left. Citigroup bailout $25 billion JP Morgan Chase bailout $25 billion 4 Bank of America bailout $15 billion Wells Fargo bailout $25 billion CONTAGION - WHAT HAPPENED Global Growth in Derivatives, 1998-2013 Nominal value invested in OTC derivatives in 2nd half 2013 = $710 trillion. Gramm-Leach-Bliley This is about an 8-fold increase in value since 1998. 49 times US annual GDP. 775 times Ontario’s GDP. $99,000 for every person on earth. THEMES - CONTAGION 1: Adjusted for inter-dealer doublecounting. 2: Share refers to the percentage of semiannual reporters in the global total. Source: Bank for International Settlements, OTC Derivatives Statistics November 2013 The derivatives bubble is clearly seen in these data. It is over 13 times global market capitalization - the global value of all stocks. At their peak in June 2008, total derivative value was almost $700 trillion – ten times global GDP and seven times what they were in 2000. Trillions of dollars. THEMES - CONTAGION Share by Type of Derivative, 1998-2013 1998 2007 Credit derivatives are CDO and include MBS. Gramm-Leach-Bliley They barely existed in 1998. By 2007 their nominal value was $51.1 trillion (@9% of all derivatives). In 2013 it was still $24.4 trillion. THEMES - CONTAGION 1: Adjusted for inter-dealer doublecounting. 2: Share refers to the percentage of semiannual reporters in the global total. Source: Bank for International Settlements, OTC Derivatives Statistics November 2013 Trillions US$ Credit Derivatives, 2007-2013 CONTAGION - WHAT HAPPENED The boom and then bust of CDO pre- and post 2008 is evident. 1: Adjusted for inter-dealer double-counting. 2: Share refers to the percentage of semiannual reporters in the global total. Source: Bank for International Settlements, OTC Derivatives Statistics November 2013 Trillions of Dollars Beginning in 1999 MBS issuances begin to grow rapidly, the majority being issued by government mortgage agencies. Gramm-Leach-Bliley CONTAGION - THE RESULTS The Results… CONTAGION - THE RESULTS The Bubble Begins to Burst…………. Foreclosures 1st quarter 2008 In the U.S. … Gramm-Leach-Bliley Foreclosures 1988-2007 CONTAGION - THE RESULTS Foreclosures 1988 to 2008 Housing Prices Annual Change in Home Prices CONTAGION - THE RESULTS Industrial Output CONTAGION - THE RESULTS Employment Job Openings Unemployment Rate CONTAGION - THE RESULTS Discretionary Retail Sales CONTAGION - THE RESULTS UK Housing Prices Adjusted for Inflation 2008 And the offshore loop wired in European nations, in classic contagion fashion. 2008 1975 1999 CONTAGION - THE RESULTS Spain Housing Prices 2008 1999 CONTAGION - THE RESULTS Ireland - Housing Prices Dublin Eire 2008 1999 CONTAGION - THE RESULTS Canada - Housing Prices 140.00 120.00 100.00 80.00 60.00 40.00 20.00 0.00 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Index Number (2007 = 100) 160.00 Canada Toronto Edmonton St. John's Winnipeg Vancouver Montreal Calgary Victoria Canada - Housing Prices 2007-11 150 Index Number 140 130 120 110 100 90 80 2007 Canada St.John's Toronto Calgary Victoria 2008 2009 2010 2011 Major Metropolitan Areas Montreal Winnipeg Vancouver Edmonton The Co$t… CONTAGION - THE COST Cost of TARP (Well known bailout program): $750 billion Cost of 50 other US federal government programs, guarantees and write-downs: $14.4 trillion CONTAGION - THE COST Annual value of US GDP: $14.2 trillion A Reprise on Global Dollars Global GDP in current dollars, 2012 = $72.9 trillion. Global market capitalisation 2012 = $53.2 trillion. U.S. GDP in current dollars, 2012 = $16.2 trillion (22%). U.S. market capitalisation 2012 = $18.7 trillion (35%). Cost of 2008 financial crisis by 2012 = $22 trillion (US alone). 33% of global capitalization value lost = $17.6 trillion. US bank bailouts = 734 ($204,808,576,320) Current notional cost of global derivatives: $600 trillion. Amount spent on cancer research by Nation Cancer Institute: @$2.5 billion CONTAGION - THE COST Sources: http://www.gao.gov/assets/660/651322.pdf. http://data.worldbank.org/data-catalog/world-development-indicators. In 2009 Robert Rubin, Alan Greenspan and Larry Summers formed to so called “committee to save the world” that developed the finance sector bailout plans in the U.S. to the tune of $14 trillion. THEMES - CONTAGION In 1999 Robert Rubin, Alan Greenspan and Larry Summers fought for and won the repeal of the GlassSteagall Act thereby deregulating the financial sector that allowed the 2008 crisis to occur. Contagion and Cascade Failure The 2008 CDO/MBS crisis is example of the cascade failure that results from a contagion. Triple A financial securities considered almost risk free - “as good as cash”. Risk estimate on the CDOs and MBSs was evaluated by credit rating agencies at about 1% - they might lose 1% of their value. They lost 20%. But credit agencies were underestimating risk on the very derivatives they were buying. AND THE LEGACY? CONTAGION - THE COST CONTAGION - THE COST OVERALL DEBT AS A % OF GDP EU & Japan, Korea most indebted With China & India holding that debt http://www.economist.com/blogs/buttonwood/2010/06/indebtedness_after_financial_crisis Top Ten Debtor Countries by Volume External debt Per capita Country % of GDP US dollars US dollars World $56,900,000,000,000 $8,422 98% United States That is,$13,450,000,000,000 US$13.45 Trillion $43,758 94% United Kingdom $9,088,000,000,000 $147,060 416% Germany $5,208,000,000,000 $63,493 155% France $5,021,000,000,000 $80,209 188% Netherlands $3,733,000,000,000 $226,503 470% Spain $2,410,000,000,000 $52,588 165% Italy $2,328,000,000,000 $39,234 101% Ireland $2,287,000,000,000 $515,671 1004% Japan $2,132,000,000,000 $702,714 205% Luxembourg $1,994,000,000,000 $4,028,283 3854% Canada 13th $833.8 Billion GDP Growth Growth just now beginning to climb back to 2007 levels in the worst affected countries. U.S. Housing and Labour Markets Both are leveling off, albeit at low and high levels respectively. The other downside of capitalist democracies. In the 2000 presidential election, 80% of the $314 million contributed to the Bush campaign and the Republican National Committee, came from corporations or individuals employed by them. The WSJ investigated how many industries were lobbying for policies and concessions as a return on their "investment." http://www.wsj.com/articles/SB983833353790355901 Have we finally learned a lesson? Perhaps not… In December big US banks succeeded in getting parts of the Dodd-Frank Act2 repealed, especially the Volker Rule that stopped them from trading in the more speculative derivatives – such as CDOs. The “big US banks” in question (and their 2008 bailouts) were: Citigroup ($25 billion) Bank of America ($15 billion) J.P.Morgan Chase ($25 billion) Goldman Sachs ($10 billion) Morgan Stanley ($10 billion) 2A final irony: the full name of the Act is the Dodd Frank Wall Street Reform and Consumer Protection Act (neither of which it appears to have done). Have we finally learned a lesson? Perhaps not… According to the Bank for International Settlements, the global derivatives market is now at $710 trillion – 20% higher than in 2007. The “big US banks” hold about 30% of that amount, with Goldman Sachs holding about $48 trillion and Citibank about $62 trillion. Only 5% of those holdings are in what are considered “safe” instruments: regulated, transparent, exchange-traded products. The rest are in what the NYT1 calls “…far more lucrative, opaque over-the-counter products.” 1http://dealbook.nytimes.com/2014/05/13/derivatives-markets-growing-again-with-few-new-protections/?_r=0 THEMES - OTHER Economic Cycles - Models The Kondratieff (or long wave) Cycle. Forty to sixty year cycle. Schumpeter’s Innovation-Invention cycle. Mensch’s causal mechanism. The Inventory Cycle. Four year cycle. Relationship between supply & demand, and inventory to sales ratios. The Product Cycle. Based on process of bringing products to market. The Keynesian Cycle. Less a cycle and more a macro-economic system. ECONOMIC CYCLES - INTRO ECONOMIC CYCLES - KONDRATIEFF WAVES The Kondratieff Long Wave (a.k.a. K-Waves, super-cycles) Industrial revolutions not smooth but comprised of: A succession of innovations. Occurring at roughly fifty year intervals. Punctuated by major economic depressions. Characterised by the collapse of the former growth industries that: Had overshot needs and were overbuilt. Were overprotective. Were hostile to innovations that threatened their status quo. Russian economist Nicolai Kondratieff postulated (1925) that the industrial nations experienced successive cycles of growth and decline of about fifty years periodicity. ECONOMIC CYCLES - KONDRATIEFF WAVES Stock index line Wholesale Price index line 1789-1844 1845-1896 1896-1949 ECONOMIC CYCLES - KONDRATIEFF WAVES 1949-2010? A fifth Kondratieff? Electrification Chemicals Autos/Oil Stock Steam indexTechnology line Autos/Oil ITC Rail/Steel Technology Bio Nano Environmental Technology Robotics Price index line 17891844 18451896 18961949 ECONOMIC CYCLES - KONDRATIEFF WAVES 19492010? 2010?-2070? How Do Kondratieff Waves Work? Kondratieff Waves are well accepted in financial economic analysis but not in mainstream economics but hasn’t stopped them from trying to figure out a process for them. Two main causal mechanisms exist to explain them: Schumpeter’s invention/innovation cycle. Mensch’s metamorphosis model, based on… … the Product Cycle, and… … the Inventory Cycle. ECONOMIC CYCLES - KONDRATIEFF WAVES ECONOMIC CYCLES - INNOVATION AND INVENTION Schumpeter’s Invention/Innovation Cycle Schumpeter (one of the great economists) said that K-Waves coincide with long periods of invention accumulation followed by bursts of innovation. That is, inventions are made into new and different products or innovations. For example, the bright idea (invention) gets made into the light bulb (innovation). These are adopted and produced, and go on to replace the previous similar innovation (e.g. gaslights). Each peak in the K-wave coincides with these new innovations on the market. ECONOMIC CYCLES - INNOVATION AND INVENTION Production and Adoption Replaces ECONOMIC CYCLES - INNOVATION AND INVENTION Schumpeter’s Invention/Innovation Cycle Percent of Peak Development E.G. POWER SOURCES Various types of increasingly more efficient power sources replace one another. Water Power Coal Oil/Petroleum Spatial Constraints on Location Loosen 1800 Kondratieff Periods ? 1850 1900 ECONOMIC CYCLES - INNOVATION AND INVENTION 1950 2010 Schumpeter’s Invention/Innovation Cycle Percent of Peak Development E.G. TRANSPORTATION Various types of increasingly more efficient transportation modes replace one another. Inland waters Railroads Motor vehicles Surfaced Roads Spatial Constraints on Location Loosen 1800 Kondratieff Periods ? 1850 1900 ECONOMIC CYCLES - INNOVATION AND INVENTION 1950 2010 Mensch’s Metamorphosis Model ECONOMIC CYCLES - MENSCH METAMORPHOSIS Mensch’s Metamorphosis Model Why should the invention/innovation cycle work at all? Based on capital seeking best places to invest, which leads to… The Product Cycle and The Inventory Cycle Both of which supply these opportunities because the invention -> innovation cycle requires production and inventory. ECONOMIC CYCLES - MENSCH METAMORPHOSIS Growth in investment & prosperity Mensch’s Metamorphosis Model Capital shifts to paper investment, companies maintain product status quo, marketing ‘innovations’ prevail, company value based on growth, risk avoidance increases. Capital shifts to safe assets (e.g. gold), companies contract & maintain profit though decreasing costs, bubble valuations prevail, risk Causal Mechanisms: avoidance high. Other Possible Coincident Capital seeks Saturation accumulated Demographics – Spans Two Generational Periods Stagnation inventions to War – Saturation Level Coincident With Conflicts innovate into Acceleration products, companies are undervalued, risk avoidance low. Inventions Decline Rapid growth Initial entry Capital seeks accumulated inventions to innovate into Innovations products, companies are undervalued, risk avoidance low. ECONOMIC CYCLES - MENSCH METAMORPHOSIS <KONDRATIEFF WAVELENGTH> Initial entry TIME ECONOMIC CYCLES - PRODUCT CYCLE The Product Cycle Four stage cycle in the development and decline of a product. Length depends on the product and/or product group (e.g. T.V.s versus autos). Nested consecutive sets of product cycles typify the rapid growth, acceleration, and saturation stages of the K-Wave – the so called spring, summer and autumn stages. Sales & Profits Monopoly Competition Sales Profits R&D Introduction Growth ECONOMIC CYCLES - PRODUCT CYCLE Maturity Saturation The Product Cycle - Consumers Four types of consumers, one each for the product market periods. Will explore this more in Diffusion lecture. Sales Monopoly Competition Late Majority Early Majority Early Adopters R&D Introduction Laggards Growth Maturity ECONOMIC CYCLES - PRODUCT CYCLE Saturation ECONOMIC CYCLES - INVENTORY CYCLE The Inventory Cycle Has two phases – growth and decline. Length depends on the type of product and/or product group (e.g. clothing, T.V.s, autos). Cyclical interplay between production & inventory, demand, competition and, especially, investment. Investment is the mechanism that starts the cycle of growth again, after product saturation due to competition stalls it. Therefore the inventory cycle is meshed intimately with the product cycle. ECONOMIC CYCLES - INVENTORY CYCLE The Inventory Cycle Jobs created so more demand follows. Growth creates demand. Inventory increases to cope with increased demand. Production increases to supply inventory. Increased competition leads to oversupply and market saturation. Sales decrease, production continues, inventory increases, imbalance occurs. Jobs lost, demand Investment in decreases. inventory increases… Production decreases as growth then decreases. decreases due to saturation, inventory is used up and not replaced. Under utilization of INVESTMENT IN Bleeding off of capital to carry production capacity leads UNDERVALUED inventory leads to declining to declining stock prices. STOCK. dividends and stock prices. ECONOMIC CYCLES - INVENTORY CYCLE Investment in company leads to jobs and growth in demand starts again. ECONOMIC CYCLES - PEAKES, TROUGHS, LAGS Peaks, Troughs and Lags Peaks: Occur when a cycle reaches its zenith. Not always a good thing - precursor to trough. Happen in later stages of product and inventory cycles. Market is hot - people invest unwisely in overvalued stocks causing bubbles. ECONOMIC CYCLES - PEAKES, TROUGHS, LAGS Peaks, Troughs and Lags Troughs: Occur when a cycle bottoms out. Not always a bad thing – precursor to growth. Happens in earlier stages of product and inventory cycles. Market is cool – people invest wisely in undervalued stocks and new products. ECONOMIC CYCLES - PEAKES, TROUGHS, LAGS Peaks, Troughs and Lags Lags: Occurs when effect is slower than cause. Occurs always, but sometimes get elongated. Is the root of synchronization issues: Remedies for an effect are too slow and happen too late, making cycles ‘stumble’ over one another. Remedy for cause of one problem may exacerbate cause of another. Good example is Keynesian model. ECONOMIC CYCLES - PEAKES, TROUGHS, LAGS ECONOMIC CYCLES - KEYNES John Maynard Keynes - 1936 Macroeconomic model involves complex interplay of the product and inventory cycles and how they affected national economies by generating peaks and troughs of economic growth. Cyclical interplay between production, inventory, demand, competition and especially investment, generated periods of inflation during peaks and unemployment during troughs. Government investment or taxation could be used to control inflation or unemployment. Model was used in the late 1930s and in the post war years providing governments with a tool for controlling unemployment and inflation. ECONOMIC CYCLES - KEYNES How The Keynesian Model Works STABLE CLOSED SYSTEM INCOME EARNED = INCOME SPENT Money is spent on local goods by Employees work to Entrepreneurs workers, investors, make products, invest and produce governments. earn and spend goods to satisfy AGGREGATE income. demand. DEMAND INJECTIONS: LEAKAGES: Investment from abroad. Investment to abroad. Government spending. Government taxes. Export earnings. Import purchases. EFFECTS: EFFECTS: Spending power rises. Spending power falls. Aggregate demand rises. Aggregate demand falls. Excess money but same stock of goods. Factories close. RESULT: RESULT: ECONOMIC CYCLES - KEYNES INFLATION UNEMPLOYMENT UNSTABLE OPEN SYSTEM. INCOME EARNED ≠ INCOME SPENT Fiscal Policy and Monetary Policy Key to Keynesian macroeconomic model is aggregate demand - the name given to how much capital is floating around in an economy. Producing and selling stuff drives employment and prices, so… Do too little, aggregate demand falls and you get unemployment. Do too much, you get too much money chasing too few goods and you get inflation. The two approaches to controlling an economy are called fiscal policy and monetary policy. ECONOMIC CYCLES - FISCAL AND MONETARY POLICY Fiscal Policy and Monetary Policy Fiscal policy tries to influence aggregate demand by controlling leakages and injections through (e.g.): Investment in public works (puts capital in). Raising taxes (takes capital out). Encourage/discourage exports/imports (in and out). Done by government departments. Monetary policy tries to influence aggregate demand by controlling the money supply: Interest rates (encourage/discourage spending). Create/remove money itself (increase/decrease available capital). Done by a nation’s central bank. ECONOMIC CYCLES - FISCAL AND MONETARY POLICY Keynesian Model Uses Fiscal Policy To Control Economy STABLE CLOSED SYSTEM INCOME EARNED = INCOME SPENT Employees work to make products and earn and spend income. Money is spent on local goods by other workers, investors, governments. AGGREGATE DEMAND Entrepreneurs invest and produce goods to satisfy demand INJECTIONS: LEAKAGES: Investment abroad Investment abroad POLICY to TOOL: POLICYfrom TOOL: Government spending Government taxes Export earnings Import purchases Control leakages by: Control injections by: EFFECTS: EFFECTS: MoreSpending government LessSpending government powerspending. rises power spending. falls Reducing taxes. Increasing taxes. Aggregate demand rises Aggregate demand falls Excess money but same stock of goods Control Control exports. Factoriesimports. close. RESULT: RESULT: ECONOMIC CYCLES - KEYNES This is called fiscal policy INFLATION UNEMPLOYMENT Monetarists use Monetary Policy To Control Available Capital STABLE CLOSED SYSTEM INCOME EARNED = INCOME SPENT Employees work to make products and earn and spend income. Money is spent on local goods by other workers, investors, governments. AGGREGATE DEMAND Entrepreneurs invest and produce goods to satisfy demand INJECTIONS: LEAKAGES: Investment abroad Investment abroad POLICYtoTOOL: POLICYfrom TOOL: Government spending Government taxes Export earnings Import purchases Control leakages by increasing ControlEFFECTS: injections by EFFECTS: money available decreasing money Spending poweravailable rises Spending power through falls lowering rates, through raising interest rates, Aggregate demand rises Aggregate interest demand falls Excess money butmoney same stock of goods increasing money decreasing supply. Factories close.supply. RESULT: RESULT: This is called monetary policy INFLATION UNEMPLOYMENT The Keynesian Model Stumbles Injections >Leakages=Inflation Leakages>Injections=Unemployment Therefore inflation and unemployment are inversely related. They supposedly cannot happen together. But they did, starting in the 1970s with a phenomena called stagflation. Stagflation of 1970s occurred due to the increasing complexity of leakages and injections… ECONOMIC CYCLES - KEYNES The Keynesian Model Stumbles But the Keynesian model has one fatal flaw, if it can be called that. The model relies on sufficient lag times to separate the effects of injections and leakages. Each of these either alleviates or exacerbates the problems they are designed to solve, depending on when its effects are felt. The 1970s saw several factors that decreased the required lag times… ECONOMIC CYCLES - KEYNES The Keynesian Model Stumbles Increasing size of financial sector and its invisible leakages, along with… IT advances and speed/volume of financial decision making, along with… Increasing complexity and porosity of territorial and aspatial regulatory boundaries though which leakages and injections occurred. Oil crisis & decline of U.S. and Euro industry and with it the loss of employment and thus demand. Cheap products distort supply and demand relationships. ECONOMIC CYCLES - KEYNES ECONOMIC CYCLES - SUMMARY STABLE CLOSED SYSTEM Growth creates Capital shifts to paper investment, Capital shifts to safe INCOME EARNED = INCOME SPENT demand companies maintain product status assetsincreases (e.g. gold), Inventory to cope Money is spent on Jobs created, more with increased demand quo, marketing contract & Employees work to ‘innovations’ local goods by othercompanies demand follows Entrepreneurs invest prevail, company based oninvestors,maintain profit though make products and valueworkers, Production increases and costs, produce goods growth avoidance increases decreasing bubble earn and risk spend governments. to supply inventory Monopoly Competition Increased competition to satisfy demand valuations prevail, risk income. AGGREGATE Capital seeks Railroads Motor leads tovehicles oversupply and Inland waters Stock avoidance high Sales decrease, production DEMAND Saturation market saturation indexinventions to continues, inventory increases, Stagnation line innovate into INJECTIONS: imbalance occurs Jobsproducts, lost, demand Investment in Sales Surfaced Acceleration Investment from abroad Decline Vietnam Civil War decreases inventory increases, WW 1 companies are War of 1812 Roads Government spending Profits riskProduction then decreases decreases as growth undervalued, Late Majority Early Majority Export earnings Price decreases and inventory is used up Rapid growth Initial entry index avoidance low EFFECTS: up and not replaced line 0 Under utilization of Spending power rises Capital seeks accumulated INVESTMENT INAggregate Inventions Early Adopters demand risesinto Laggards Bleeding off of capital to carry inventions to innovate production capacity leads WW 2 UNDERVALUED Innovations Cost Revenue Excess Profit inventory leads to declining money but same stock of goods to declining products, companies are Initialstock entryprices STOCK dividends and stock prices RESULT: undervalued, risk avoidance 1949-2010?low 1789-1844 1845-1896 ECONOMIC CYCLES - SUMMARY1896-1949 TIME INFLATION of Peak PercentSales Profits &Development YES THIS WILL BE ON THE TEST Spatial Constraints Loosen Kondratieff Periods <KONDRATIEFF WAVELENGTH>? ECONOMICES OF SCALE - INTRO Economies of Scale Definition: The reduction in unit costs of production realized when more units are produced. I.E. The more units you make the cheaper each unit is to make. Definition: The reduction in costs of production realized from clustering together with other economic activities. I.E. The more economic activities gather together, the cheaper it becomes to produce things. BUT ONLY TO A POINT. BUT ONLY TO A POINT. ECONOMICES OF SCALE - INTRO Economies of Scale Economics of ISE: Localization effects: • Cost per unit reductions. • Effects of like industry clustering. • Productivity increases. • Reduced cost of inputs. • Revenue enhancements. Urbanization effects: Limitations of ISE: • Effects of shared resource pool. • Indivisibility thresholds. • Effects of shared infrastructure. • Matching inputs to scales. • Linkages. • Mass consumption required. • More demand. • Downtime. ECONOMICES OF SCALE - INTRO Goal: Increase profits by reducing unit costs of production • Economics of ISE: • Cost per unit reductions. • Production function, diminishing returns, marginality. • Productivity increases. • Capitalization, bulk buying, specialization of production process. • Revenue enhancements. • Control of market share/price through volume. • Limitations of ISE: • Indivisibility thresholds. • Matching inputs to scales. • Mass consumption required. • Downtime. ECONOMIES OF SCALE - INTERNAL The Production Function A production function is the relationship between quantity of inputs and quantity of outputs, & is given by: Y = f(x1, x2, .., xn) Factors of production Where: Y is the output x is the quantity of various inputs And the function is defined as: Y = f(x1 | x2, .., xn) varies | fixed That is, only one variable is allowed vary in quantity while the others are fixed. The production function gives rise to the law of diminishing returns. ECONOMIES OF SCALE - INTERNAL The Law of Diminishing Returns OUTPUT If every unit of input produced the same unit of output the production function would be a 45 degree line. But… INPUT ECONOMIES OF SCALE - INTERNAL The Law of Diminishing Returns OUTPUT A production function is affected by the law of diminishing returns to scale, which states that as the quantity of one variable of input is increased while the others are held constant, the output or total product will… then at a diminishing rate (<450)… reach a maximum (=00)… then at a constant rate (= 450)… first increase at an increasing rate (>450)… INPUT ECONOMIES OF SCALE - INTERNAL then decline. Marginality Important concept in economics because it demonstrates that “best” and “most” are not the same. Marginality is a measure of the output you get from the last unit of input. In other words, why invest more input than you need to in order to produce output. Most of us think of reward as getting the most we can but marginality thinks of reward as getting the most for the least. ECONOMIES OF SCALE - INTERNAL MEASURE OF INPUT Total production millions of units 0 0 1 2 3 4 5 6 7 DIMINISHING RETURNS Inputs of labour in millions of person hours 100 250 375 476 550 MEASURES OF OUTPUT Marginal product in millions of units (difference between each new unit of output for each new unit of input) 100-0= 250-100= 375-250= Highest marginal production Average production millions of units per million person hours (total production/input) 0 100 100 150 125 125 125 101 74 50 600 Highest 119 average 110 production. 100 30 630 90 -6 8 624 ECONOMIES OF SCALE - INTERNAL Maximum amount of production. 78 Internal Economies of Scale – Margins of Production 700 Quantity at which maximum output Quantity at which is reached and marginal returns marginal returns to inputs begin to to inputs reaches internal is not declinescale economies zero. 600 500 400 300 200 Point of to produce as much as you can get. Quantity at which It is to produce as much asreturns you can average to get for as to little as you inputs havebegin to give. decline 100 0 0 1 -100 Total output 2 3 4 5 6 7 Units of Input Marginal output Average output ECONOMIES OF SCALE - INTERNAL 8 The Cost Curve COST A cost curve is produced by the way fixed and variable costs combine Total cost curve is the sum of the fixed and total costs. Fixed cost is constant with quantity produced. E.G. rent of factory. Variable cost increases with quantity produced. E.G. raw materials. QUANTITY PRODUCED ECONOMIES OF SCALE - INTERNAL Cost Curve Data But when we consider unit costs, the lines become curvilinear. A B C D=B+C B/A C/A D/A Units of Fixed Costs Variable Total Costs Fixed Unit Variable Total Unit Output of Costs of of Cost of Unit Cost of Cost of (millions) Production Production Production Production Production Production 1 2 3 4 5 6 7 8 9 10 10 10 10 10 10 10 10 10 10 10 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 ECONOMIES OF SCALE - INTERNAL 10.00 5.00 3.33 2.50 2.00 1.67 1.43 1.25 1.11 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 11.00 6.00 4.33 3.50 3.00 2.67 2.43 2.25 2.11 2.00 COST CURVES PLOTTED 20 18 16 Costs 14 12 10 8 6 4 2 0 1 2 3 4 5 6 7 8 9 Output Fixed Costs Variable costs ECONOMIES OF SCALE - INTERNAL Total costs 10 UNIT COST CURVES PLOTTED 20 18 16 NOTE:WHEN COSTS ARE AVERAGED OVER NUMBER OF UNITS, UNIT COSTS DECREASE AT A DECREASING RATE OVER NUMBER OF UNITS PRODUCED. Unit Cost 14 12 10 8 6 Effect of diminishing returns seen here in the different unit cost curve slopes. 4 2 0 1 2 3 4 5 6 7 8 9 Output Fixed Costs Fixed unit cost Variable costs Variable unit cost ECONOMIES OF SCALE - INTERNAL Total costs Total unit cost 10 Average Unit Cost Internal Economies of Scale Unit Cost Curve Diseconomies of scale Economies of scale Costs per unit decrease but at different rates C1 Q1 Quantity of Output ECONOMIES OF SCALE - INTERNAL Effect of diminishing returns seen here. The ability to produce many units at lower costs per of theDiseconomies unit gives aEconomies manufacturer opportunity to reduce scale the profit prices, increasescale demand, and soof maintain margin per unit. But profits increase and decrease to scale as well. Increasing Decreasing profit to profit to scale scale Profit Per Unit Maximum Profit Per Unit Quantity of Output ECONOMIES OF SCALE - INTERNAL Revenue per Unit Average Unit Cost Internal Economies of Scale Profit Generated Per Unit Example - Assembly costs of various small cars in E.U. At 15,000 units produced, assembly cost per unit = @$870 At 45,000 units produced, assembly cost per unit = @$400 At 195,000 units produced, assembly cost per unit = @$220 ECONOMIES OF SCALE - INTERNAL http://www.tms.org/pubs/journals/JOM/0108/Kelkar-0108.html Example – Parts fabrication cost of various small cars, EU At 12,000 units produced, fabrication cost per unit = @$2,100 for Audi and Lupo Hybrid and @$1,250 for Lupo Steel. At 195,000 units produced, fabrication cost per unit = @$950 for Lupo Hybrid & Audi, & @$500 for Lupo. Steel ECONOMIES OF SCALE - INTERNAL http://www.tms.org/pubs/journals/JOM/0108/Kelkar-0108.html Parts cost breakdown for small cars, EU 60,000 cars annually 95,000 cars annually Largest returns to scale found in tooling costs ECONOMIES OF SCALE - INTERNAL http://www.tms.org/pubs/journals/JOM/0108/Kelkar-0108.html Restrictions on Internal Economies Indivisibility threshold: To be cost effective, machines must produce at their maximum output. Large scale operations require large scale inputs: Upstream, instream, and output bottlenecks always appear as scale increases. Mass consumption required: Large scale mass output requires mass consumption that can absorb the output. Downtime: The unit cost curve for machine downtime is infinite, the reason why retooling is expensive. ECONOMIES OF SCALE - INTERNAL Ford Motor Company, Rouge River Plant Largest integrated factory in the world in 1928. 93 buildings, 16 million square feet, 100,000 employees. Had its own dock, electrical plant, and steel smelting plant, a glass making plant, and over 160 kilometers of internal railroad. Ran into issues daily with supplying the plant, getting output off the site, and with mechanical problems. A classic example of scale diseconomies. ECONOMIES OF SCALE - INTERNAL Definition: The reduction in costs of production realized from gathering together with other economic activities. I.E. The more economic activities gather together, the cheaper it becomes to produce things. Localization effects: Effects of similar industries clustering. Urbanization effects: Effects of shared resource pool. Effects of shared infrastructure. Linkages. More demand. ECONOMIES OF SCALE - EXTERNAL STORES URBANISATION ECONOMIES Logistics Forestry Packaging HR consultants LOCALISATION ECONOMIES Upholstery Automakers Light bulbs Metal fabricating Finance Janitorial supply Paper air filters Wood veneer Electronics Batteries Transportation Glass products Rubber products Labour pool ECONOMIES OF SCALE - EXTERNAL PEOPLE Wiper blades Localisation Economies The jewelry and gun quarter, Highgate, London ECONOMIES OF SCALE - EXTERNAL