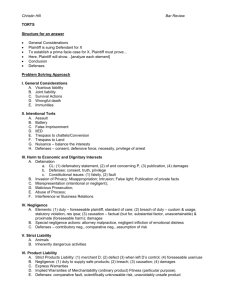

Liability Insurance IRM 403 Lecturer : S. Masiyiwa

advertisement