What is Good Governance? - Diocese of Johannesburg

advertisement

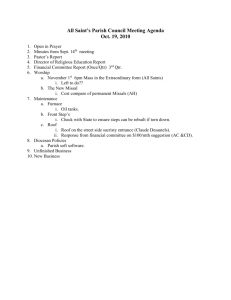

Diocese of Johannesburg Good Governance Workshop May 2011 AGENDA 1. 2. 3. 4. 5. 6. 7. Introduction and Welcome Principals of Good Governance 1. 8 Characteristics as defined by the United Nations 2. Application of above characteristics to Church Councils and Parishes 3. King 3 and Church Tea Practical Guides for control of church income Budgets and their use to monitor parish finances Human Resource Issues 1. Remuneration 2. Clergy versus Laity 3. Memorandum of Understanding 4. Employment Contract 5. Disciplinary Procedures 1. Clergy 2. Laity Close CHARACTERISTICS OF GOOD GOVERNANCE Source: United Nations paper, What is Good Governance?, www.unescap.org/huset/gg/governance.htm (24 December 2006). CHARACTERISTIC Accountability DEFINITION Accountability is a key requirement of good governance. Not only government institutions but also the private sector and civil society organisations must be accountable to the public and to their institutional stakeholders. Who is accountable to who varies, depending on whether decisions or actions taken are internal or external to an organisation or institution. In general, an organisation or an institution is accountable to those who will be affected by its decisions or actions. Accountability cannot be enforced without transparency and the rule of law. CHARACTERISTIC Consensusoriented DEFINITION There are several actors and as many viewpoints in a given society. Good governance requires mediation of the different interests in society to reach a broad consensus on what is in the best interest of the whole community and how this can be achieved. It also requires a broad and long-term perspective on what is needed for sustainable human development and how to achieve such development. This can only result from an understanding of the historical, cultural and social contexts of a given society or community. CHARACTERISTIC Effectiveness and efficiency DEFINITION Good governance means that processes and institutions produce results that meet the needs of society while making the best use of the resources at their disposal. The concept of efficiency in the context of good governance also covers the sustainable use of natural resources and the protection of the environment. CHARACTERISTIC Equity and inclusiveness DEFINITION A society’s well being depends on ensuring that all its members feel that they have a stake in it and do not feel excluded from the mainstream of society. This requires that all groups, but particularly the most vulnerable, have opportunities to improve or maintain their well being. CHARACTERISTIC Participation DEFINITION Participation by both men and women is a cornerstone of good governance. Participation could be either direct or through legitimate intermediate institutions or representatives. Representative democracy does not necessarily mean that the concerns of the most vulnerable in society would be taken into consideration in decision-making. Participation needs to be informed and organised, which requires freedom of association and expression and an organised civil society. CHARACTERISTIC Responsiveness DEFINITION Good governance requires that institutions and processes try to serve all stakeholders within a reasonable timeframe. CHARACTERISTIC Rule of law DEFINITION Good governance requires fair legal frameworks that are enforced impartially. It also requires full protection of human rights, particularly those of minorities. Impartial enforcement of laws requires an independent judiciary and an impartial and incorruptible police force. CHARACTERISTIC Transparency DEFINITION Transparency means that decisions made and their enforcement are achieved in a manner that follows rules and regulations. It also means that information is freely available and directly accessible to those who will be affected by such decisions and their enforcement. It also means that enough information is provided and that it is provided in easily understandable forms and media. King III and Church King III has broadened the scope of corporate governance in South Africa with its core philosophy revolving around leadership, sustainability and corporate citizenship. These key principles are given prominence: •Good governance is essentially about effective leadership. Leaders need to define strategy, provide direction and establish the ethics and values that will influence and guide practices and behaviour with regard to sustainability performance. •Sustainability is now the primary moral and economic imperative and it is one of the most important sources of both opportunities and risks for institutions. Nature, society, and institutions are interconnected in complex ways that need to be understood by decision makers. Incremental changes towards sustainability are not sufficient – we need a fundamental shift in the way institutions act and organise themselves. •Innovation, fairness, and collaboration are key aspects of any transition to sustainability – innovation provides new ways of doing things, including meaningful responses to sustainability. Fairness is vital because social injustice is unsustainable and collaboration is often a prerequisite for change. King III and Church •Social transformation and redress is important and needs to be integrated within the broader transition to sustainability. Integrating sustainability and social transformation in a strategic and coherent manner will give rise to greater opportunities, efficiencies, and benefits, for both the institution and society. •King II required companies to implement sustainability reporting as a core aspect of corporate governance. Since 2002, sustainability reporting has become a widely accepted practice and South Africa is an emerging market leader in the field. •However, sustainability reporting has not been embraced by non-commercial institutions, and this is to be encouraged.. Key steps for any institution • Values, vision, goals and strategy • Proactive organisation and planning • Day-to-day oversight • Coherent leadership - empowering Management vs Leadership LEADERSHIP MANAGEMENT • Planning and Budgeting • Organising and Staffing Execution • Outcome • Creating an Agenda Developing a human network for achieving agendas John P Kotter • Establishing Direction • Aligning People Controlling and Problem Solving • Motivating, Inspiring Predictability and Order • Produces Change Good Governance – what is it? • Leadership and management of an institution, including a parish • Applies to business and government • King Commission Report gives guidance • Requires commitment to the spirit and not the letter of the guidelines TEA 15 Minutes DIOCESE OF JOHANNESBURG PARISH COUNCIL GOOD GOVERNANCE CONTROL OVER RECEIPTS 1 Sidesperson (TWO) 1 Count collection for each service (separate) 2 Enter cash / cheques and number of envelopes in Collections Register (MUST SIGN REGISTER) 3 Collections locked in parish safe 4 Completes Service Register with number of Attendees / Communicants 2 Parish Office / Church Warden (TWO People) 1 Count collection and matches to Sunday list 2 Envelopes are opened and recorded in the Dedicated Giving / Tithe register 3 The deposit slip is prepared 4 Deposit taken to the bank as soon after Sunday as possible 3 Treasurer / Bookkeeper 1 Uses Deposit book as prime entry in the Cash Book COUNTING OF COLLECTIONS AND BANKING MUST BE PERFORMED BY DIFFERENT PEOPLE DIOCESE OF JOHANNESBURG PARISH COUNCIL GOOD GOVERNANCE CONTOL OVER PAYMENTS 1 Treasurer / Parish Secretary 1 Prepares Payment Requisition (Cheque / Electronic / Cash) 2 Passes to Responsible Portfolios for approval 2 Cheque signatories / church wardens 1 Signs cheque / releases payment 2 Despatches Cheques 3 Bookkeeper / Treasurer 1 Files electronic payment vouchers as proof of payment 2 Enters payments in the Cash Book / Petty Cash Book 4 Automatic debits and credits are recorded at time of bank reconciliation THE BOOKKEEPER / TREASURER CANNOT BE A CHEQUE SIGNATORY OR RELEASE ELECTRONIC PAYMENTS Budgets For monitoring parish income and expenditure BUDGETS AND OTHER INTERNAL CONTROLS CANONS AND RULES Canon 29 Rules: Schedule F DIRECTIONS In terms of Canon 29, Churchwardens (and Chapelwardens) are responsible for the preparation of annual estimates of revenue and expenditure (budgets) and for the execution of Council’s policy on finance. Schedule F provides that: Council shall assist and advise the Churchwardens in the management and control of the revenues of the parish. Churchwardens shall submit to each monthly meeting of Council a full statement of income and expenditure for the preceding month The following specific controls are to be implemented: Receipts issued for all cash received and deposited in the parish bank account All payments shall be approved either by the Churchwardens and Incumbent or by Council and shall be in accordance with the budget approved by vestry No payments shall be approved for which the necessary funds are not available. All cheques / cash requisitions are to be signed by two authorised signatories and all expenditure supported by appropriate vouchers The following checklist is provided to assist in evaluating the adequacy of internal controls which are considered sound : Budgetary control Has an annual budget been prepared and approved by Council and Vestry? Are monthly accounts prepared which measure performance against budget? Are variances from budget explained to Council and approved by it? Controls over income Are there clear procedures in place to record all income, particularly Sunday collections, as soon as possible after receipt and for regular banking? Is any expenditure made from cash income before banking properly recorded and approved? Are these procedures working effectively? Controls over expenditure Are there clear procedures for requesting expenditure e.g. a requisition form which must be supported by vouchers and approved by the responsible portfolio? Are cheques signed by two signatories only after the approved vouchers have been presented? Is a list of cheque and cash payments made, and to be made, presented to Council for approval at each meeting? Are all vouchers properly filed by month for easy reference and safe-keeping? Where electronic banking is done, do both releasers have access to the vouchers when releasing? Accounting records Are suitable books or other forms of accounting record kept which enable monthly accounts to be prepared and will meet the needs of the Auditors or Independent Verifier? If possible list Monthly not just Annual amounts Starting Point Gather Information Dedicated Giving / Tithing records Not the names of parishioners but just amounts. Collections Details Unusual Services Easter Patronal Festival Fixed Other Income Rental from Property Hall Rectory Cell Masts Fund Raising Income Planned fund raising events for the following year Other Income Bequests Unusual Donations Monthly Expenses from prior and current year Fixed Expenses Municipal Accounts Stipends Salaries & Wages Communication Insurance Variable Expenses Fund Raising Major Maintenance Total Income Monthly Total Expenditure Monthly Fixed Variable Combined Apply Inflation / Other Factor Not necessarily the same for all items Compare Income to Expenditure Adjust Expenditure Budget to match Income Budget if necessary Compare Actual to Budget Monthly Explain Variances Human Resource Issues DIOCESE OF JOHANNESBURG MEMORANDUM OF AN UNDERSTANDING BETWEEN _______________ AND THE PARISH COUNCIL OF __________________ AS REPRESENTED BY ___________________________________________________________________ The overall focus of the cleric’s ministry within the parish: ________’s main responsibility as Rector / Priest in Charge / Assistant Priest at __________ will be_________________________________________________________________ The aim is to work in a transparent way to encourage and empower the ___________ congregation to grow in every respect as quickly as possible. See Ordination service and Institution of the Priest The expectation of the cleric’s spouse in joining in the life of the parish: ____________ The understanding in regard to the following:Diocesan package: The normal diocesan package will apply. – (This is spelt out in great detail giving the exact package that will be processed by Salaries department once the appointment is made) Housing: ____________ will / will not live in the parish house / flat. Gardening: Electricity, water, rates and maintenance of the housing: The parish meets these costs in the normal way. Insurance of household contents: The parish will meet this cost in the normal way. (All insured through J.I.F.) Retreats, Books & Vestments: The parish will reimburse ____________ for expenditure up to the Diocesan limits. Use of Telephone and Cellphone: A landline is to be installed in the ____and the parish will meet the monthly call charges up to an amount of _____ per month. ____________ has a cell phone and the parish will meet the expenses related to calls at the rate of _____ per month. Transport/Transport allowance: The parish will be responsible for all reasonable expenditure on the car including petrol expenses at the rate of a tank per week. (This varies dramatically from parish to parish and depends on if there is a car allowance or a parish car) Offering: An Easter offering will be taken for the priest-in-charge at ___________. (This is sometimes in the form of a December / other month bonus) Postgraduate studies: ____________ Day off: ____________ day off is ________. The parish will be advised of this and be asked to respect it. Vacation: As per Diocesan Rules. (28 calendar days including 4 Sundays) Long leave: Long leave will be taken as per the diocesan Rules. (3 Months every 6 years) Fees (Weddings, baptisms, etc.) – This should go to the parish. Areas; of interest & involvement: Involvement in parish administration & finances: The Treasurer handles the money and the bookkeeping and so ____________ will not be part of the financial management except as a member of the executive and the council. ____________ will, however, be expected to oversee the work done by all the staff although, for example, the details of the garden are managed by others. (Clergy should always be one of the cheque signatories / electronic signatories) Other points covered: Review between cleric and churchwardens (archdeacons) This agreement together with the allowances will be reviewed annually. Signature of: Cleric Date Minuted in the minutes of the parish council of the: Signature of: Churchwarden Copy: Churchwarden Bishop of Johannesburg Diocesan Secretary Salaries Department – Diocesan Office And the parties who signed above. Date CONTRACT OF EMPLOYMENT made and entered into by and between The Anglican Diocese of Johannesburg Darragh House 13 Wanderers Street Johannesburg (hereinafter referred to as “the Employer” and represented by the Diocesan Secretary of the Diocese) and Name Identity Number: 999999999999999 Address (hereinafter referred to as “the Employee”) PREAMBLE It is hereby recorded that the Employer and the Employee have entered into a contract of employment which shall be governed by the terms and conditions outlined below. BASIC CONDITIONS OF EMPLOYMENT ACT/LABOUR RELATIONS ACT This agreement is subject to the provisions of the Basic Conditions of Employment Act, No. 75 of 1997, where applicable, and as amended from time to time, as well as the Labour Relations Act, No. 66 of 1995, where applicable, and as amended from time to time and all and any general conditions of employment of the Employer, including such policies and procedures as may be in force from time to time, unless hereinafter stipulated to the contrary. JOB DESCRIPTION 2.1 The Employee will be employed as __________. The function of the __________ is more fully outlined on the attached Job Description 2.2T he Employee undertakes to :- 2.2.1 Report to _______________, on a regular basis; and 2.2.2 Perform such duties as are assigned to him / her by the Employer from time to time. 2.2.3 Perform such duties as more fully outlined in the attached Job Description for __________________ 2.3 Apart from the duties entailed in the position and undertakings referred to in paragraphs 2.1 and 2.2 above, the Employee undertakes to perform such other work as she may be assigned from time to time without the payment of additional remuneration. REMUNERATION 5.1 It is recorded and agreed that the total remuneration payable by the Employer to the Employee shall be a monthly package of R99,999 (Amount in words rand) payable monthly in arrears. In addition to this there will be a medical aid allowance, currently R9,999.00 (Amount in words) per month also payable monthly in arrears. The ______ normally pays a 13th cheque in December as an annual bonus but this is not guaranteed and depends on individual circumstances and the financial position of the __________ 5.2 Payment of the Employee’s salary shall be made into the Employee’s bank account at a financial institution of her choice. 5.3 Any increases, where applicable, shall be solely at the discretion of the Employer and dependent upon the Employee’s performance as well as the overall financial performance of the Employer. HOURS OF WORK 6.1 Normal Hours 6.2 Overtime Hours ANNUAL LEAVE 7.1 The Employee shall be entitled to _________working days paid leave per annum and entitled to accumulate a maximum of ________days leave; any leave accumulated in excess thereof shall be forfeited. After three years of complete service the number of working days leave per annum shall be increased to _________ 7.2 Leave must be applied for in writing and may only be taken at a time mutually convenient to the Employer and the Employee. 7.3 The Employee shall not be entitled to payment in lieu of leave. SICK LEAVE 8.1 During each period of thirty-six (36) consecutive months of employment the Employee shall be entitled to paid sick leave equivalent to the number of days the Employee works during a period of six (6) weeks. However, during the first six (6) consecutive months of employment the Employee will be entitled to one (1) working days’ sick leave for each completed period of twenty six (26) days worked. 8.2 For any absence from work for a period of more than two (2) consecutive days or on more than two occasions during a period of eight (8) weeks, the Employee will be required to submit a certificate signed by a registered medical practitioner stating the nature and duration of the Employee’s ailment before sick pay will be awarded. FAMILY RESPONSIBILITY LEAVE 9.1 Upon completion of the first four (4) months of employment, the Employee shall be entitled to three (3) days paid family responsibility leave per annum to be taken:9.1.1 when the Employee’s child is born; or 9.1.2 when the Employee’s child is sick; or 9.1.3 in the event of the death of the Employee’s spouse or life partner, parent, adoptive parent, grandparent, partner, child, adopted child, grandchild or sibling. 9.2 The Employee, upon request, will be required to furnish the Employer with reasonable proof of the event contemplated in 9.1 above for which the leave is required. CODES, PROCEDURES, RULES AND REGULATIONS 10.1 The Employee shall conform to all codes, procedures, rules and regulations which have been or may be promulgated by the Employer from time to time which will include the Constitution and Canons of the Anglican Church of Southern Africa and Rules of the Diocese. 10.2 The Employer reserves the right to amend any of its codes, procedures, rules and regulations subject to reasonable notice to the Employee. 10.3 Copies of the Employer’s codes, procedures, rules and regulations shall be accessible to the Employee at the Employer’s premises on request. The Employee further undertakes that she would familiarize himself with the documents mentioned herein and that this would entirely be his responsibility. CONFIDENTIALITY 11.1 The Employee hereby confirms that she will not at any time, directly or indirectly, use, publish, disseminate, disclose or otherwise avail himself of, or derive any profit from, whether for his own benefit or for the benefit of any other party, any confidential information pertaining to the Employer and its affairs unless she is specifically directed to do so by the Employer. 11.2 The Employee agrees that upon termination of his employment or upon the Employer’s request at any other time, she will immediately deliver to the Employer all such documents and other items (including correspondence, notes, minutes, memoranda and/or other documents and items of whatever nature), including all copies of same, which came into the Employee’s possession during his employment with the Employer and which in any way concern the business, finance or affairs of the employer. BREACH 12.1 The Employee acknowledges that the Employer will suffer financial harm and loss should the Employee breach any of the undertakings given by him in terms of this agreement. 12.2 Upon a breach by the Employee of any of the undertakings given by him in terms of this agreement, the Employer shall be entitled to enforce the undertaking or cancel this agreement and in any event to claim and recover from the Employee any damages arising from such breach and any costs incurred. DEDUCTIONS The Employee hereby agrees that the Employer may deduct from his remuneration any amount, which the Employee might owe the Employer from time to time. The Employer shall also be entitled to make any legal deductions from the Employee’s remuneration including UIF and P.A.Y.E. or S.I.T.E, if and where applicable. GENERAL 14.1 This document constitutes the sole record of the agreement between the parties. 14.2 No party shall be bound by any representation, warranty, promise or the like not recorded herein. 14.3 No addition to, variation, or agreed cancellation of this agreement shall be of any force or effect unless in writing and signed by or on behalf of the parties. 14.4 The Employer and the Employee shall, on at least a bi-annual basis, review the employee’s performance and shall, after consensus, use such review as the basis for any remuneration adjustment 14.5 The terms of this agreement shall be reviewed on at least an annual basis in ________ of each year. Signatures Disciplinary Procedures Clergy Laity