Telkom

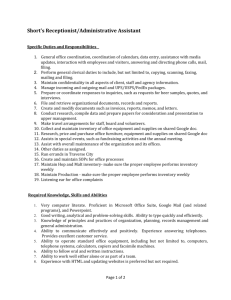

advertisement

Telkom South Africa Madiba Magic James Barber Angela Fung Sandeep Toshniwal Becky Voorheis Case Background • Setting – February 1997 – Post-apartheid, privatization phase in South Africa – Bidding war for 30% ownership in Telkom • currently owned 100% by the SA government • Protagonists – South African government – SBC Communications Inc. – Telekom Malaysia Major Themes I. Opportunity II. Risks &Concerns III. Thintana Consortium IV. Valuation Major Themes I. Opportunity II. Risks &Concerns III. Thintana Consortium IV. Valuation I. Opportunity • Telecommunications • Telkom • South Africa I. Opportunity • Telecommunications – Lucrative, “safe” investment in emerging markets • fairly reliable cash flows • high growth prospects • ROE = 20-30% for “high readiness” developing countries (McKinsey & Co.) • low betas when regressed on the domestic market (higher when regressed on the U.S.) I. Opportunity • Telkom – The only wire-line telecommunications provider in South Africa – State-enforced monopoly for 5 more years with an option for a 6th (expires in 2003) – Needs a partner with technical skill – Open to using outside management expertise I. Opportunity • South Africa – End of apartheid opened SA to foreign investment • new government friendly to foreign investment – A hybrid of the 1st and 3rd worlds • highly developed manufacturing sector, infrastructure – A “gateway” to Africa • “Sets the pace for the rest of Africa.” • the most diverse, advanced economy in Africa • 40% of telecom traffic in all of Africa – Real option • an export/import platform into Africa, Mid-East, Asia I. Opportunity • South Africa (continued) – high, unmet demand for telecommunications • growing ability to pay, but still no access • low teledensity – 1 line per 100 blacks, 60 lines per 100 whites • U.S. DoC: telecom in SA a “leading sector of U.S. exports and investment.” – several U.S. telecommunications companies are already operating there • AT&T, Lucent, Motorola, Sprint, Hughes, Iridium Major Themes I. Opportunity II. Risks &Concerns III. Thintana Consortium IV. Valuation II. Risks & Concerns • Country Risks • Company Risks Country Risks • Violence – highest murder rate in the world – investors cite crime as the biggest deterrent to doing business in SA • Openness to Foreign Investment – remnants of pre-democratic era remain in foreign exchange controls, privatization, and competition • Credit Rating – Institutional Investor: 46/100 – Moody’s: Baa3 (non-investment grade) Country Risks • Poor Economy & Income Inequality – 2nd highest Gini Coefficient in the world (.61) – Low GDP/Capita, life expectancy, literacy, health conditions – Rand consistently devalued since 1986 – Johannesburg Stock Exchange (JSE) “weak” in recent years • Political Uncertainty – unproven leadership – right-wing backlash Company Risks • Technical Disrepair – # of customers actually shrinking (unheard of in 3rd world) – “high prices, slow service, aloof bureaucracy, bloated workforce, and a network engineered for white neighborhoods.” • Debt Burden – Telkom had borrowed to meet capital expenditures – extreme debt levels (some foreign denominated) • D/E = 1.4 in 1996 – average effective rate = 16.7% Company Risks • Competition from Cellular Service – not much more expensive and more reliable – more cost-effective, especially in rural areas – Telkom owned 50% of one provider (Vodacom), SBC owned 15.5% of the only other one (MTN). • Racial Tension – Telkom begins to promote blacks • white backlash - 5,300 workers strike Company Risks • Copper Cable Theft – – – – – “As soon as we fix one line, another is stolen.” sold for copper content theft a “major concern” to SBC 4,112 cables stolen in 1996 at a cost of $41.1 million Rand switch to fiber-optics ... thieves have to dig up to discover they’re not made of copper Major Themes I. Opportunity II. Risks &Concerns III. Thintana Consortium IV. Valuation III. Thintana Consortium • Rationale & Structure • Telekom Malaysia • SBC Communications, Inc. Rationale & Structure • Previously rival bidders – better chance to beat Deutsche Telekom together • Joined to leverage their respective strengths – SBC: technology & modernization – Telekom Malaysia: developing countries • 30% would be split – 18% SBC – 12% Telekom Malaysia Telekom Malaysia • Expertise in rural telecommunications • Presence in a number of emerging markets, including Ghana, India, Malawi, Sri Lanka • Worked with the SA government before • Largest publicly-listed company in Malaysia • Profitable SBC Communications • One of the world’s leading telecom firms – Fortune 25 company – Rated Most Admired Telecom Co in ‘95 & ‘96 • Aggressive M&A activity after deregulation • Operations on 5 continents, 8 countries, and 13 U.S. states • Focus on high-growth international markets Major Themes I. Opportunity II. Risks &Concerns III. Thintana Consortium IV. Valuation IV. Valuation • Major uncertainties Discussion • What actually happened & our model Major Uncertainties • Exchange rates – consistent devaluation • Taxes – effective rate = 23%, marginal rate = 35% • Depreciation on assets – 12%/year vs. accelerated method • Post-Monopoly scenario – competition – revenue decline Major Uncertainties • Listing of shares – SA government plan in 2003 – use a P/E model? – comparables appropriate? • Management – 4 board seats enough – middle managers? • Cost of capital – which method? Discussion Valuation - Key Results March 1997: Thintana wins the bid Our Value Telkom Valuation R 18.47 billion 30% stake R 5.54 billion Dollar Value $ 1.24 billion SBC Value R 18.58 billion R 5.59 billion $1.261 billion Valuation Key Assumptions Growth in Sales per line Growth in Operating Costs Depreciation (% of Fixed Assets) Effective Rate of Tax Discount Rate Perpetual Growth Rate Change in Working Capital Growth Exchange Rate Depreciation 16.00% 13.90% 12.00% 35.00% 20.11% 2.00% 13.90% 10% Tornado Analysis Growth in Sales per line Growth in Operating Costs 10% 22% 19.80% 8% Discount Rate 25.22% 15% Depreciation (% of Fixed Assets) 8% 16% Effective Rate of Tax 40% 30% 1% Perpetual Growth Rate 19.80% 8% Change in Working Capital Growth (30,000 (20,000 (10,000 ,000,00 ,000,00 ,000,00 0) 0) 0) 3% - 10,000, 20,000, 30,000, 40,000, 50,000, 60,000, 70,000, 000,000 000,000 000,000 000,000 000,000 000,000 000,000 Net Present Value in Rands Assumptions • Growth in sales and costs per line – Based on historical figures and Telkom’s statements • Depreciation – Allowed rate of depreciation by South Africa • Tax Rate – Maximum tax rate applicable in South Africa • Change in Working Capital – Linked to operating costs WACC = 20.11% Beta Risk Free Rate of Return Market Premium Return on Equity Return on Debt (before tax) Tax Rate Return on Debt (after tax) Debt to Equity Ratio 1.2 15.39% 7% 23.79% 16.73% 35.00% 10.87% 0.71 Model Results Net Present Value in Dollars $ SBC's & Malaysia's stake (30%) in dollars $ NPV of Net Profits SBC's & Malaysia's stake (30%) in dollars $ 776,745,906 233,023,772 2,919,028,182 875,708,455