Profit Planning

advertisement

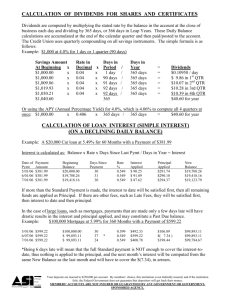

PROFIT PLANNINGBUDGETING Read pg 376 Organize your business Determine when you need cash Baseline to judge how you are doing RoseBowl article Everyone needs to be involved. Should be created from the bottom up not from the top down Handout about fraud 10 Budgets – page 375 Exhibit 9-2 First – Sales – everything based on these # Last – Balance Sheet 1)Sales and 2)Cash Receipts 3)Production Cost of a product: 4)DM ,5)Cash Disb, 6)DL, 7)OH 8)Cost of Goods Manufactured: Unit Product Cost -Book has Ending Finishing Goods Inventory – 9)Selling and Administrative 10)Cash 11)Income Statement 12)Balance Sheet *Sales in Units – determine by quarter *x Sales Price = Total Sales Information that will cause the change in the entire budget * information you must enter Other numbers are calculated 1st qtr 2nd qtr 3rd qtr 4th qtr TOTAL Sales 1st qtr Sales 70% 2nd qtr Sales 3rd qtr Sales 4th qtr Sales TOTAl CASH Rec 30% 70% 30% 70% 30% 70% Sales in Units +*Ending Inventory-FG (% of next quarter) Total Needs - Less Beginning FG – last months ending Required production Production in Units *x Raw materials per unit = Production Needs * +Production for E.I. --% of next quarter Total Needs -Less Beginning Raw Materials – from last quarter * X cost per pound Cost of Raw Materials to be purchased 1st qtr 2nd qtr 3rd qtr 4th qtr TOTAL purch 1st qtr Pur 2nd qtr Pur 3rd qtr Pur 4th qtr Pur TOTAl CASH Dis 50% 50% 50% 50% 50% 50% 50% Production in Units X hours per unit = DL Hours required X average rate =DL $ Use these numbers for overhead driver Variable Fixed Costs (per unit) Costs ( same amount each month) Estimated OH cost/estimated driver =Predetermined overhead rate Selling and G&A same structure Combines all three product costs Direct Materials Budget +Direct Labor Budget +Overhead Budget =Total Manufacturing Cost + Beginning WIP -Ending WIP =Cost of Goods Mfg DON’T USE PAGE 383 IN THE TEXTBOOK. Variable Fixed Costs (per unit) Costs ( same amount each month) Beginning Cash +Cash Receipts Budget = Total Cash incoming Cash Disbursement Budget +Direct Labor Budget +Overhead Budget +S G&A Budget = Total Cash outgoing Cash incoming – Cash outgoing = Cash excess -Minimum required balance = Cash Available Sales Budget -COGS Beginning FG +COGM Budget -Ending FG Gross Profit - Selling G&A Budget = Net Income Cash Budget A/R (Leftovers from Cash Receipts) Inventory (ending FG) Net Property,Plant & Equipment (estimate) =Total Assets A/P (leftovers from DM budget) Long Term Liabilities (estimate) =Total Liabilities Common Stock (estimate) Retained Earning (estimated) +Net Income from Income Statement = Stockholder’s Equity =Total Liabilities and Stockholder’s Equity See Manufacturing project instructions to create your groups fluid spreadsheet.