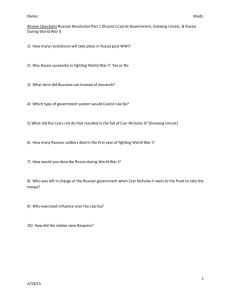

Document

advertisement

вщк Russian Market Overview October, 2009 Contents What Russia is today Food and drinks market Apparel and shoes market Cosmetics and perfume market Accessories for cars market Our contacts 3 12 15 20 25 28 2 What Russia Is Today 3 What Russia is Today (1) Fast-moving economy: Today Russia, along with China and India, is one of the most fast-moving economies of the world. Experts assume that over next few decades fast-moving economies will provide most of the global economic growth. GDP: 2008 GDP is 1 334 billion Euro which is the 7th biggest GDP in the world. GDP per capita is 11 250 Euro. Population: Over 141 million people. The 7th biggest country in the world in terms of population. For the last 15 years there had been population decline in Russia but in August 2009 for the first time in 15 years there was natural population growth by 1000 people. Over 70% of the population lives in the cities. Economically active population: 75 million people, almost 95% of them are involved in employment. Sources: http://www.skolkovo.ru/content/view/350/398/lang,en/ http://ru.wikipedia.org/wiki/%D0%A0%D0%A4 http://news.yandex.ru/yandsearch?cl4url=www.interfax.ru%2Fsociety%2Fnews.asp%3Fid%3D102662&country=Russia 4 What Russia is Today (2) Territory: 1/9 of the Earth land. The biggest country of the world. Location: Europe and Asia. Bordering on 18 countries among which are Norway, Finland, China, North Korea, Japan and the USA (sea border). Trip to Moscow from Tokyo: 10,5 hour flight from Tokyo. Russia is the gateway to CIS - related countries (former part of the USSR territory): Ukraine, Belarus, Kazahstan, Azerbaijan etc. Sources: http://www.skolkovo.ru/content/view/350/398/lang,en/ http://ru.wikipedia.org/wiki/%D0%A0%D0%A4 http://news.yandex.ru/yandsearch?cl4url=www.interfax.ru%2Fsociety%2Fnews.asp%3Fid%3D102662&country=Russia http://www.polets.ru/cgi-bin/sh.pl?Mode=Custom&Lang=&Source=Custom&CityFromFT=%CD%FC%FE%C9%EE%F0%EA&CityToFT=%CC%EE%F1%EA%E2%E0&Day=12&Month=10&Time=00&Period=0&Sort=w 5 What Russia is Today (3) Big cities of Russia: Moscow – capital city with the population of over 10 Mln people. St. Petersburg – second biggest city with the population of over 4,5 Mln people. Besides Moscow and St. Petersburg there are 9 cities in Russia with the population over 1 Mln people: Moscow Chelyabinsk (the Urals region) Kazan (capital of Tatarstan) Nizhny Novgorod (Center of Russia) Novosibirsk (Siberia) Omsk (Siberia) Rostov-on-Don (south of Russia) St. Petersburg Samara (Center of Russia) Ufa (center of Russia) Yekaterinburg (the Urals region) Kazan Nizhny Novgorod Sources: http://www.labor.ru/pressarh.php?id=563 http://ru.wikipedia.org/wiki/%D0%9D%D0%B0%D1%81%D0%B5%D0%BB%D0%B5%D0%BD%D0%B8%D0%B5_%D0%A1% D0%B0%D0%BD%D0%BA%D1%82%D0%9F%D0%B5%D1%82%D0%B5%D1%80%D0%B1%D1%83%D1%80%D0%B3%D0%B0 6 What Russia is Today (4) Level of income and savings: According to federal law, monthly minimum subsistence level in Russia is about 120 Euro. At the same time in 2008 average monthly income per person in Russia was about 500 Euro (approximately 18000 Euro per family per year). And in Moscow average monthly income per person in 2008 was above 1000 Euro (about 40000 Euro per family per year). Sources: http://ru.wikipedia.org/wiki/%D0%A0%D0%A4 http://nalog.consultant.ru/online/?req=doc;base=NBU;n=33936 7 What Russia is Today: Attributes of Social and Economic Classes (SEC) (1) Experts have different points of view on classifying people in Russia and of using different criteria to classify people. Certain experts say that the approach specified below (using combination of education level and income level) is a “western” one and not 100% relevant for Russia. For example, in Europe normally the higher the education level is the higher the income level is. In Russia it is NOT always so, university professor can belong to A class by education (he/ she has got PhD degree etc.) but to C1 or even C2 class by income level. So at the moment in Russia we continue to use combination of education level and income level BUT the main criterion is still income level. While identifying SEC class (especially B class and higher than B) in Russia we normally include lifestyle questions: Number of times per year the person/ his family go abroad, to what countries they go (in case of B class and higher it should be Western Europe or something exotic, not just Turkey and Egypt which is affordable for C1 and C2), fitness centers, educational establishments, HoReCa (restaurant, café, night clubs) they use etc. 8 What Russia is Today: Attributes of Social and Economic Classes (SEC) (2) Education of the main earner of the family Education of respondent Occupation of respondent – IF she IS NOT housewife Occupation of the main earner of the family – RELEVANT in case respondent is HOUSEWIFE E College or secondary OR unfinished secondary College or secondary OR unfinished secondary Worker (E.g. unskilled worker), may be unemployed D Lower than average College or secondary College or secondary Worker, specialist Worker, specialist C2 Average College, higher also accepted College, higher also accepted Specialist, qualified worker Specialist, qualified worker C1 Higher than average Higher Higher Specialist, senior level manager (E.g. head of department, team) Specialist, senior level manager (E.g. head of department, team) Income by selfidentification scale Monthly income per family in US Dollars * Av. family – 3 members We can hardly make ends meet, sometimes we do not have enough money for basic things like food and clothes Less than 500 We have enough money for food and clothes but buying durables (fridge or washing machine) is a problem We have enough money for food, clothes and durables but cannot afford a car We have enough money for food, clothes and durables but cannot afford a car OR We have enough money for food, clothes, durables, car but cannot afford apartment 500 - 1000 1001 - 2200 2201 - 5000 9 * PLEASE note that in case of regional cities the income will be closer to bottom of scale AND in case of Moscow – the capital city – income will be closer to high end of scale. What Russia is Today: Attributes of Social and Economic Classes (SEC) (3) Education of the main earner of the family Education of respondent Occupation of respondent – IF she IS NOT housewife B Higher – the majority, however theoretically could be college At the same time part of B class can have MBA Higher, theoretically could be college Most probably senior level manager BUT can be housewife Occupation of the main earner of the family – RELEVANT in case respondent is HOUSEWIFE Senior level or top managers, can work for big multinational companies OR own a small or medium-sized business A Higher – the majority, however theoretically could be college At the same time part of A class can have MBA Higher, however theoretically could be college It does NOT matter, can be housewife Top manager, owner of companies Income by self-identification scale Monthly income per family in US Dollars * Av. family – 3 members We can afford anything, including buying new car, house, apartment 5001 - 20000 We can afford anything, including buying new house, apartment in Russia or abroad. A class consumers have houses, apartments at certain (prestigious) areas of Moscow. Representatives of A class/ their families can live abroad, own property abroad PLEASE note that by foreign property here we mean expensive houses, apartments in Western Europe or USA and NOT a small house in Bulgaria which even C1 class can afford now. Over 20000 * PLEASE note that in case of regional cities the income will be closer to bottom of scale AND in case of Moscow –10 the capital city – income will be closer to high end of scale. What Russia is Today: Attributes of Social and Economic Classes (SEC) (4) Rough estimations of share of various SECs: A + B – about 7-10% NB! Please note that the share of very rich people is less than 1%. C1 – 10-15% C2 + D – about 60% E - about 15%. 11 Food and Drinks Market in Russia 12 Food and Drinks Market in Russia General Tendencies (1) Before recession food and drinks market in Russia was rapidly growing: Retail trade growth – by 13% in value terms in 2008. Experts assumed that the main reasons for market growth were as follows: Personal income increase that was typical for the Russian market before crisis; Relatively low consumption level (as compared to European and American markets) which ensured possibilities for consumption growth. Growth of supermarket/ hypermarket retail channels of medium/ average and above average segments. Impact of recession on food and drinks market: Growth of consumer interest towards “discounter” retail chains (low segment). Decrease of sales of ready-made food in high segment chains (previously office clerks/ middle level managers could easily afford buying ready-made food for lunch in Azbuka Vkusa chain, today this segment of our customers tried to reduce their expenses and do not visit Azbuka Vkusa that often). 13 Food and Drinks Market in Russia General Tendencies (2) The following tendencies in consumption were typical for the Russian food and drinks market: Increase of interest towards instant food/ semi-prepared products. Increase of interest towards healthy food (E.g. growth of “bio segment” of diary products: dairy products containing vitamins, minerals). NB! Both consumers and experts (E.g. doctors) believe that many products available at supermarkets, especially fruit and vegetables are not healthy enough: their ripening is boosted by chemicals, they do not contain vitamins any more. Growing interest towards “eco” products: grown in the ecologically clean areas, without chemicals: E.g. there are small farms in Moscow region which specialize in growing such products and provide part of consumers with them. NB! Only consumers with above average income can afford it. Growing fruit and vegetables at “dachas” (summer cottages) for one’s family is also popular with Russians (mostly consumers with below average and average income). Considerable growth of baby food category. Reason for this is baby boom which was in Russia in the last few years. Growth of Internet sales. Sources: http://researchandmarkets.ru/lists/4540/news.html http://www.rb.ru/biz/markets/show/68/ 14 Apparel and Shoes Market in Russia 15 Apparel Market General Tendencies of the Russian Market (1) In 2007 the apparel market volume in Russia was 40 billion US Dollars. Before recession it was constantly growing by 15-20% per year. However, due to recession, in 2008, according to expert estimations, it was about the same level – 40-41 billion US Dollars. The main players at the Russian apparel market are international companies which first paid more attention to Moscow and St. Petersburg and are now expanding to other regions of Russia. At the moment international apparel players have a bigger share at the Russian market as compared to the local players. Overall, there are about 120 international apparel retail chains in Russia. The annual turnover of each of these chains is about 80-100 million US Dollars. The following leading international brands in mass market/ average segment are active at the Russian market: Benneton Zara Mango Finn Flare Hugo Boss etc. Sources: http://www.4p.ru/main/research/33794/ http://marketing.rbc.ua/publication/26.02.2009/2879 http://bd.restko.ru/market/1955 http://china.marketcenter.ru/content/doc-2-9469.html 16 Apparel Market General Tendencies of the Russian Market (2) In general experts note that the share of Russian brands at the apparel market has been recently increasing. Popular Russian apparel brands are as follows: Sela Gloria Jeans OGGI Kira Plastinina Tvoe However, even local retail chains manufacture most part of their products (80%) in China and not in Russia. One of the segments where Russian manufacturers were successfully developing in the past few years is suit for men (of average price). Sources: http://www.4p.ru/main/research/33794/ http://marketing.rbc.ua/publication/26.02.2009/2879 http://bd.restko.ru/market/1955 h 17 Apparel Market General Tendencies of the Russian Market (3) Recession time in Russia had effected Russian apparel market both in a negative and in a positive way: Negative impact: Drop of sales, consumer purchase activity. During recession period more than 30% of consumers in Russia gave up buying apparel in the first quarter of 2009 and 15% bought a cheaper brand. Positive impact: Rental rates for shops went down which gives advantages to new players at the market. In 2009 the following international brands have entered the Russian market: H&M Kika River Island One Step New Look IKKS GAP Palmers “We have a tough policy related to rental rates. Before recession rental rates in Moscow were higher than in New-York, Paris or Tokyo. Now the rates have gone down” (H&M management). Example of average annual rental rates for shops per square meter in US Dollars: 1800 in May 2008 Vs. 1100 in May 2009. Sources: http://www.advertology.ru/article71135.htm Article “Start-up with a discount”/ “Sekret Firmy”, # 6 (287) June 2009 18 Shoes Market General Tendencies of the Russian Market According to statistics, in Russia consumer buys 1,8-2 pair of shoes per year on average, which is similar to China (about 2 pair of shoes per year) and less than in Europe (3,8-4,5 per year per capita) and the USA (6,5 per year per capita). The range of various price segments is from less than 30 US Dollars per a pair of shoes (low segment) to more than 250 US Dollars per a pair of shoes (high segment). NB! In case of high segment the price can exceed 1000 US Dollars per a pair of shoes. The Russian market is occupied by international brands, the share of Russian brands is quite small. Most of imported shoes come from China. The following tendencies are typical for the Russian market: Italian shoes are traditionally perceived as shoes of high quality but only people with average, above average income can afford them. In Winter most Russians wear boots with fur (natural or artificial) inside. Due to a lot of mud and water (melted snow) on the streets in early Spring, late Autumn and Winter time quite often the leather of boots, shoes leather is damaged by these negative factors. In Winter in Moscow special chemicals are used by municipal authorities to melt snow and ice in order to make roads, streets less slippery, these chemicals also damage leather of shoes, boots. Sources: http://www.restko.ru/market/213 19 Cosmetics and Perfume Market 20 Cosmetics and Perfume Market in Russia: General Tendencies (1) For the recent 5-7 years annual growth of Russian cosmetics and perfume market was 10-15%. In 2007 the volume of the Russian cosmetics and perfume market was 8,6 billion US Dollars. In 2008 the volume of the Russian cosmetics and perfume market was 9,3 billion US Dollars. According to Cosmetics and Perfume Association of Russia, potential volume of the Russian market is 18 billion US Dollars, so at the moment the market is far from being full. In value terms 75% of the Russian cosmetics and perfume market is occupied by international companies. The leading international players in Russia are as follows: Procter & Gamble, L`Oreal, Beiersdorf, Colgate-Palmolive, Unilever, Schwarzkopf & Henkel, Gillette, Estee Lauder, Oriflame, Avon. The leading Russian players are as follows: Kalina, Nevskaya Kosmetika, Svoboda, Novaya Zarya (low and average price segment). Sources: http://www.park.ru/rubric.parkru?d=18&m=5&y=2008&rc=116&r=467 http://www.marketcenter.ru/DataBase/Marketing_Research/view.asp?lc=2&id=304 http://www.e-xecutive.ru/community/articles/1081490/ 21 Cosmetics and Perfume Market in Russia: General Tendencies (2) There are following cosmetics sales channels in Russia: Retail chains specializing in cosmetics and perfume: L’Etoile (average segment), Douglas Rivoli (higher segment), Rive Gauche (average segment), Ile de Beaute (average, average to higher segment). Supermarkets (any chain where consumers make their regular purchases). Direct sales/ marketing (buying cosmetics from the company representative). Open markets (kiosks, small pavilions at big open space specializing in various categories, including cosmetics). NB! This sales channel is more popular with consumers of below average income. Pharmacies. According to expert estimations, this channel is becoming more popular. Branded cosmetics retail chain – only Yves Rocher. Buying cosmetics in the Internet. Buying cosmetics by catalogue by post – very small share. Other channels (small kiosks, cosmetics departments in big stores selling different categories of products). Sources: http://www.park.ru/rubric.parkru?d=18&m=5&y=2008&rc=116&r=467 http://www.marketcenter.ru/DataBase/Marketing_Research/view.asp?lc=2&id=304 22 Cosmetics and Perfume Market in Russia: General Tendencies (3) Perfume: The share of international companies at the Russian perfume market is 97%. Leading international players at the Russian perfume market are as follows: Procter & Gamble, L'Oreal и Estee Lauder, LVMH. About 80% of perfume sold in Russia is imported. Leading exporting countries are as follows: Germany, France, Poland. NB! According to expert estimations, the share of Japan as perfume exporter to Russia is growing. Sources: http://marketing.rbc.ua/publication/23.09.2008/2340 23 Cosmetics and Perfume Market in Russia: General Tendencies (4) Impact of recession: According to experts estimations, the decrease at the Russian cosmetics and perfume market in 2009 (as compared to 2008) could be 5-10% in natural terms. However, in value terms there might be an increase at the market since prices of cosmetics have grown. The reason for prices growth is US Dollar and Euro rate growth which effects prices of imported products. Decrease in premium segments. Recession made retail chains delay their plans of aggressive development: Before recession many retail chains specializing in cosmetics and perfume announced opening of a big number of new outlets in the chain in the next few years. However in 2009 they had to delay their projects due to the fact that now it is much more difficult to get bank loans for such development. Sources: http://retail.bl.by/articles/detail129972/ http://www.e-xecutive.ru/community/articles/1081490/ 24 Accessories for Cars Market 25 Accessories for Cars Market In Russia: General Tendencies (1) In general accessories for cars market is linked to car/ automotive market. In 2008 car market volume in Russia was 69 billion US Dollars. As compared to 2007 volume in value terms the market grew by 29% and in natural terms the market grew by 14%. Experts explain the difference in growth rates by the following factors: Part of Russian consumers switched to more expensive cars. Prices for cars went up. In first half of 2008 the market was growing while in the second half of 2008 there was a decrease at the market. But at the very end of 2008, in December, there was market growth again. Experts explain this burst of consumer activity at the end of the year by the fact that part of consumers had enough money to buy a new car without taking bank loan, so they were eager to buy a new car at the end of 2008 before increase of customs tariffs and hence prices in January. Sources: http://www.avto.ru/review/post_13858.html 26 Accessories for Cars Market In Russia: General Tendencies (2) International players at the Russian car market in 2008 experienced sales growth while Russian manufacturers experienced downturn in sales: Honda sales grew by 131% PSA Peugeot Citroen - by 67% Volkswagen Group - by 62% Mazda – by 45% Suzuki – by 34% Hyundai – by 30% GM Group – by 30% Toyota Group – by 29% Sales of cars of Russian brands went down by 9%. Car manufacturers continue to consider Russia, along with other BRIC countries as the market with big prospects: E.g. Toyota together with its subsidiary company Daihatsu is working on a new car model which costs less than 10000 US Dollars specially for markets of Brazil, Russia, India and China. The model of the new car will be adapted to specific needs of each of the four markets and will be launched in early 2010s. Sources: http://www.avto.ru/review/post_13858.html http://bfm.ru/articles/2009/10/16/toyota-razrabatyvaet-mashinu-dlja-rossii-deshevle-10-tysjach.html 27 Our Contacts Head office Russia: 119049 Moscow, Kaluzhskaya square 1 Tel: +7 495 926 72 00 Marina Ponedelkova marina.ponedelkova@marketprofile.ru 28