Taxation, income distribution, and efficiency

advertisement

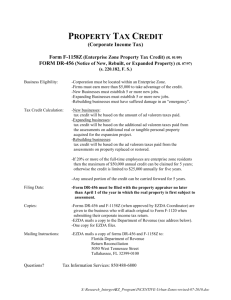

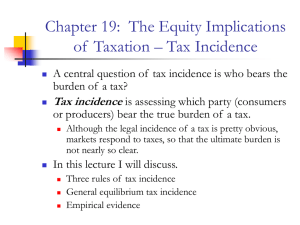

Taxation, income distribution, and efficiency Today: Some basic tax theory Begin Unit 4 Today Chapters 14 and 15 An introduction to some basic theories related to taxation Taxation Taxes are typically used to finance public projects Deadweight loss comes with most forms of taxation Taxation and income distribution The US federal tax system has been set up so that people with high incomes have higher average tax rates Do people consume more leisure with high marginal tax rates? Public project financing To be answered later People with high tax rates probably have high willingness to pay for many public projects See Table 14.3, p. 327 Some terminology Statutory incidence Who legally has to pay for the tax Economic incidence How much does real income change to all parties due to a tax? Some terminology Lump sum tax Proportional tax Average tax rate is independent of income Progressive tax A tax that has to be paid no matter how a person behaves Average tax rate increases with income Regressive tax Average tax rate decreases with income Some terminology Unit tax A tax that is paid per unit of a good Ad valorem tax A tax that is a percentage of the purchase price Partial equilibrium models With partial equilibrium models, only one market is examined at any one time Ignores possible spillover effects Usually easier to analyze than general equilibrium models Two types of taxes analyzed Unit tax Ad valorem tax Unit tax You have likely seen unit taxes before Econ 1 (or equivalent) Econ 100A/B (or equivalent) Either the buyer or seller pays a given dollar amount for each unit sold or purchased $ 2.60 Before Tax After Tax Partial Equilibrium Models 2.40 Consumers Pay $1.20 $1.40 2.20 Suppliers Receive $1.20 $1.00 S1 2.00 S0 1.80 1.60 1.40 1.20 1.00 0.80 D1 D0 0.60 0 1 2 3 4 5 6 7 Quantity 8 Ad valorem taxes Assume that the consumer pays an ad valorem tax Example: 6% sales tax The ad valorem tax shifts the demand curve by the same percentage (relative to the horizontal axis) See Figure 14.7, p. 315 Other types of taxes Taxes from working Income tax Social Security tax Hospital insurance tax (Medicare) Capital taxes Taxes on profits Accounting profits Economic profits Tax incidence and capitalization Suppose that we value land as the net present value of the yearly income from the land Assume that the land has value for T years T could be infinity Then the value of the land will be PR = $R0 + $R1/(1 + r) + $R2/(1 + r)2 + … + $RT/(1 + r)T Tax incidence and capitalization Suppose that a new tax is implemented on each piece of land New value of the land Yearly income falls by the amount of the tax PR’ = $(R0 – u0) + $(R1 – u1)/(1 + r) + $(R2 – u2)/(1 + r)2 + … + $(RT – uT)/(1 + r)T Value of the land drops by u0 + u1/(1 + r) + u2/(1 + r)2 + … + uT/(1 + r)T Tax incidence and capitalization Capitalization process When a new tax is implemented, the new price falls by the net present value of the total taxes that will have to be paid General equilibrium models When a tax affects a large portion of the economy, partial equilibrium models may not accurately predict the overall effects to the economy General equilibrium models are needed to analyze situations that affect more than one market Changes in consumption due to taxes Recall that people typically consume less of a good or service once it is taxed Example: Yacht tax in the early 1990s Tax on yachts over $100,000 purchased in the US People bought yachts in other countries Net economic impact $16.6 million in taxes collected (less than the $31 million predicted) Less income tax paid by workers (7,600 jobs lost in the US) Study of taxation graphically Individual behavior Excess burden in a market with horizontal supply See Figure 15.7, p. 343, and Figure 15.9, p. 347 Subsidies See Figure 15.5, p. 340 Taxes on labor See Figure 15.2, p. 333 See Figure 15.6, p. 342 Pigouvian taxes See Figure 5.4, p. 83 Recall double dividend hypothesis Industry with negative externality Pigouvian tax Reduces excess burden If tax proceeds are used to reduce other taxes, excess burden from these taxes are lowered Criticism: An environmental tax could lead to an increase in the excess burden in the labor market An economist’s analysis Given an amount of revenue that is generated, taxes should be imposed such that one of the following goals is achieved Excess burden is minimized Social welfare is maximized The real world Taxes are often imposed that have the lowest amount of political resistance Excess burden seems less important than revenue generation Sometimes efficiency is completely ignored How does personal income get taxed? The personal tax system used by the federal government requires many steps to understand Chapter 17 Highlight the basic structure, marginal tax rates, and other aspects of the federal tax structure For next lecture: Read p. 380-406 Today vs. tomorrow With a tax system currently in place, we should ask how changes in tax policy affect current and future behavior Chapter 16 has more on this Marginal excess burden Tax avoidance versus tax evasion Focus reading on p. 353-362 and 370-376 for next lecture Summary Taxation of efficient markets typically leads to excess burden Unit tax Ad valorem tax Taxes on land lower the income potential for the land, lowering its value Subsidies usually lead to excess burden also