120-1

McGraw-Hill/Irwin

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

220-2

CHAPTER TWENTY

MARKET TESTING CONTINUED:

CONTROLLED SALE

AND FULL SALE

320-3

A-T-A-R and the

Market Testing Methods

Figure 20.1

420-4

Controlled Sale by Informal Selling

• Used for business-to-business products, also

consumer products sold directly to end users.

• Train salespeople, give them the product and

the selling materials, and have them make calls

(in the field or at trade shows).

• Real presentations--and real sales--take place.

520-5

Controlled Sale by Direct Marketing

More secrecy than by any other controlled sale

method.

The feedback is almost instant.

Positioning and image development are easier

because more information can be sent and more

variations can be tested easily.

It is cheaper than the other techniques.

The technique matches today's growing technologies

of credit card financing, telephone ordering, and

database compilation.

620-6

Controlled Sale by Minimarkets

• Select a limited number of outlets -- each store

is a minicity or “minimarket”

• Do not use regular local TV or newspaper

advertising, but chosen outlets can advertise

product in their own flyers and windows

• Can do shelf displays, demonstrations, etc.

• Use rebates, mail-in premiums, or some other

method to get names of purchasers for later

follow-up

720-7

Controlled Sale by Scanner Market Testing

• Audit sales from grocery stores with scanner

systems (and perhaps humans) -- over a few

markets or national system

• Sample uses:

– Can use the data as a mini-market test

– Can compare cities where differing levels of sales

support are provided

– Can monitor a rollout from one region to the next

820-8

Minimarkets and Scanner Testing: IRI’s

BehaviorScan and InfoScan

• Cable TV interrupt privileges

• Full record of what other media (such as magazines) go into

each household

• Family-by-family purchasing

• Full record of 95 percent of all store sales of tested items from

the check-out scanners

• Immediate stocking/distribution in almost every store is

assured by the research firm.

Result: IRI knows almost every stimulus that hits each individual

family, and it knows almost every change that takes place in

each family's purchase habits.

920-9

The Test Market

• “Several” test market cities are selected

• Product is sold into those cities through the

regular trade channels and advertised at

representative levels in local media

• Once used to support the decision whether to

launch a product, now more frequently used to

determine how best to do so

• The best data to offer potential resellers

20-10

10

Pros and Cons of Test Marketing

Advantages:

Disadvantages:

• Risk Reduction

• Cost ($1 mill+)

– monetary risk

– channel relationships

– sales force morale

• Strategic Improvement

– marketing mix

– production facilities

• Time (9-12 months+)

– hurt competitive advantage

– competitor may monitor

test market

– competitor may go

national

• Competitor can disrupt

test market

20-11

11

A Risk of Test Marketing:

“Showing Your Hand”

Figure 20.2

•Kellogg tracked the sale of General Foods' Toast-Ems while they were in test

market. Noting they were becoming popular, they went national quickly with PopTarts before the General Foods' test market was over.

•After having invented freeze-dried coffee, General Foods was test-marketing its

own Maxim brand when Nestle bypassed them with Taster's Choice, which went on

to be the leading brand.

•While Procter & Gamble was busy test-marketing its soft chocolate chip cookies,

both Nabisco and Keebler rolled out similar cookies nationwide.

•The same thing happened with P&G’s Brigade toilet-bowl cleaner. It was in test

marketing for three years, during which time both Vanish and Ty-D-Bol became

established in the market.

•General Foods' test market results for a new frozen baby food were very

encouraging--until it was learned that most of the purchases were being made by

competitors Gerber, Libby, and Heinz!

20-12

12

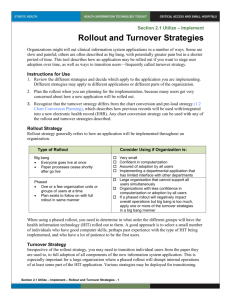

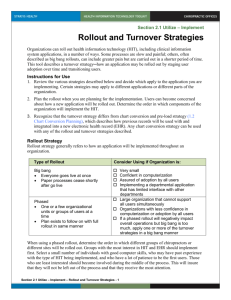

The Rollout

• Select a limited area of the country (one or several

cities or states, 25% of the market, etc.) and monitor

sales of product there

• Starting areas are not necessarily representative

– The company may be able to get the ball rolling

more easily there

– The company may deliberately choose a hard area

to sell in, to learn the pitfalls and what really drives

success.

• Decision point: when to switch to the full national

launch?

20-13

13

Types of Rollout

• By geography (including international)

• By application

• By influence

• By trade channel

20-14

14

Patterns of Information Gained

During Rollout

Figure 20.4

20-15

15

Risks of Rollout

• May need to invest in full-scale production

facility early

• Competitors may move fast enough to go

national while the rollout is still underway

• Problems getting into the distribution channel

• Lacks national publicity that a full-scale launch

may generate

20-16

16

Probable Future for Market Testing

Methods

Figure 20.5

• Test marketing

• Pseudo sale

• Minimarket

• Rollout

(“dinosaur”)

(incomplete)

(flexibility & variety)

(small, fast, flexible)