Fair Value Measurements and Disclosures

advertisement

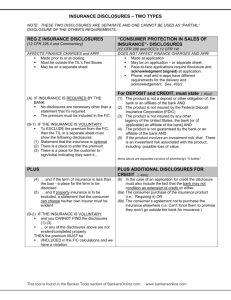

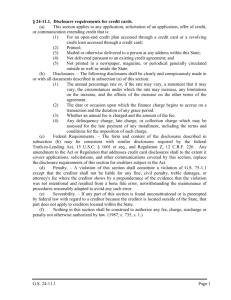

Practical Aspects of Fair Value Measurements The Impact of FAS 157 on Credit Unions October 21, 2008 Fair Value Measurements and Disclosures Presenter: Douglas Winn, Wilary Winn, LLC Fair Value Measurements and Disclosures Agenda Summary of Principles – FAS 157 and 159 Fair Value Hierarchy Significant Changes from Existing Standards Implementation Process and Challenges Required Disclosures Questions and Answers Fair Value Measurements and Disclosures Objective of FAS 157 To define fair value, establish a framework for measuring fair value and expand disclosures about fair value. Scope Applies to other accounting pronouncements that require or permit fair value measurements except: Share-based transactions Practicality exceptions Pronouncements requiring measurements similar to fair value Fair Value Measurements and Disclosures Timing Effective for years after 11/15/07 for financial assets and liabilities Implementation for nonfinancial assets and liabilities has been deferred for one year, except for those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). Fair Value Measurements and Disclosures Examples of Items Deferred Nonfinancial assets and liabilities initially measured at fair value in a business combination that are not subject to fair value measurement subsequently Indefinite-lived intangible assets Fair Value Measurements and Disclosures Examples of Items Not Deferred Financial assets and liabilities measured at fair value under a business combination Instruments within the scope of FAS 107 Impaired-collateral dependent loans measured for impairment under FAS 114 Servicing assets and liabilities Eligible items under FAS 159 including: Financial and nonfinancial derivatives Written loan commitments and best efforts forwards Fair Value Measurements and Disclosures Implementation Steps Determine assets and liabilities that will be required to be measured and reported at fair value – remember that FAS 157 is “principles” based not “rule” based like FAS 133 Identify the principal or most advantageous market Identify the valuation premise Identify market participants Determine the appropriate valuation techniques Prepare appropriate disclosures Fair Value Measurements and Disclosures Implementation Discussion Items Investments Loans receivable Impaired Loans Mortgage Servicing Rights – FAS156 Mortgage Lending Derivatives Shares Fair Value Measurements and Disclosures FAS 157 Key Terms Fair Value: The price that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (exit price). Asset or Liability: The measurement is for a particular asset or liability. Orderly transaction: A transaction that assumes exposure to the market for a period prior to the measurement date to allow for marketing activities that are usual and customary for transactions involving such assets and liabilities; it is not a forced transaction. Market participants: Buyers and sellers in the principal (or most advantageous) market Fair Value Measurements and Disclosures Principal vs. Most Advantageous Principal – The market in which the reporting entity would sell the asset or transfer the liability with the greatest volume and level of activity for the asset or liability. Most Advantageous – The market in which the reporting entity would sell the asset or transfer the liability with the price that maximizes the amount that would be received for asset or minimizes the amount paid to transfer the liability, considering transaction costs. Fair Value Measurements and Disclosures Valuation Techniques Market Approach – Quoted prices in active markets for identical or comparable assets or liabilities Income Approach – Techniques to convert future amounts to a single present amount. Can include matrix pricing Can include present value, option-pricing, and multi-period excess earnings Cost – replacement cost – does not apply to financial assets and liabilities Fair Value Measurements and Disclosures Valuation Inputs Observable inputs – inputs from independent sources on what market participants would use Unobservable inputs – entity’s own assumptions about the assumptions market participants would use Fair Value Measurements and Disclosures FAS 157 Fair Value Hierarchy Level 1 – Quoted prices in active markets for identical assets or liabilities Level 2 – Observable inputs other than quoted prices Level 3 – Unobservable inputs Fair Value Measurements and Disclosures FAS 157 Fair Value Hierarchy Level 1 – Quoted prices in active markets for identical assets or liabilities. Most reliable measure and should be used whenever possible Fair Value Measurements and Disclosures FAS 157 Fair Value Hierarchy Level 2 – Observable Inputs Quoted prices for similar assets or liabilities in active markets. Quoted prices in markets that are not active (e.g. few transactions, prices not current, price quotations vary, little public information, etc.) Observable inputs such as interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, credit risks, default rates, etc. Market-corroborated inputs Fair Value Measurements and Disclosures FAS 157 FSP 157-c Measuring Liabilities Clarifies FAS 157 Issue – Potential lack of observable markets or observable inputs for the transfer of a liability because in most cases an entity extinguishes a liability by settling it. FSP states that in the absence of a quoted price in an active market, an entity may measure the fair value at the amount it would receive if it were to issue the liability at the measurement date. Fair Value Measurements and Disclosures FAS 157 Significant Changes Use of an exit price versus an entry price. Transaction costs are expensed if initial measurement is at fair value. Entity’s own credit risk must be considered when measuring the fair value of liabilities – nonperformance risk. Fair value of a block of financial instruments traded in an active market is “price X quantity”. No block adjustments. Fair Value Measurements and Disclosures FAS 159 – Fair Value Option for Financial Assets and Liabilities Permits entities to elect to measure eligible items at fair value May be applied instrument by instrument, with certain exceptions Election is irrevocable May not be applied to portions of instruments Effective for fiscal years beginning after November 15, 2007 Fair Value Measurements and Disclosures FAS 159 – Eligible Items Financial assets and financial liabilities A firm commitment involving only financial instruments (e.g. best efforts forward sales contract) Written loan commitments Insurance contracts, warranty agreements and host financial instruments resulting from the separation of a nonfinancial derivative from a nonfinancial hybrid instrument Fair Value Measurements and Disclosures FAS 159 – Ineligible Items Consolidated investments in subsidiaries Consolidated interests in variable interest entities Employers’ and plans’ obligations for employee benefit obligations, employees stock options and other deferred benefit compensation arrangements Financial assets and liabilities recognized under leases Deposit liabilities, withdrawable on demand Financial assets classified under shareholder’s equity Fair Value Measurements and Disclosures FAS 159 – Election Dates When the entity first recognizes the eligible item When the entity enters into an eligible firm commitment Specialized accounting principles for a financial asset cease to apply The accounting treatment for an investment in another entity changes and ceases to apply (e.g. an investment must now be accounted for on the equity method) An event that requires fair value accounting at inception but does not require re-measurement at each subsequent reporting date (e.g. business combination – FAS 141R) Fair Value Measurements and Disclosures FAS 157 Effect on Existing Standards – Relevant Changes EITF 02-03 Initial measurement of derivatives APB 21 Interest on Receivables and Payables FAS 15 Troubled Debt Restructurings FAS 65 Mortgage Banking Activities FAS 107 Fair Value Disclosures FAS 114 Impaired Loans FAS 115 Investments in Debt and Equity Securities FAS 133 Derivatives FAS 140 Transfers and Servicing FAS 141 Business Combinations FAS 142 Goodwill FAS 156 Servicing Fair Value Measurements and Disclosures Summary of Credit Union Assets Cash AFS investments Other investments 1st mortgages Other real estate loans New car loans Used car loans Other loans Other assets 9% 8% 11% 22% 12% 11% 11% 11% 5% 100% Fair Value Measurements and Disclosures Investments Equity securities with a “readily determinable fair value” under FAS 115 must be recorded at fair value as either a “trading security” or as available for sale Debt securities can also be recorded at fair value as a “trading security”, as an “available for sale” security or as “held to maturity” Fair Value Measurements and Disclosures Investments Trading or AFS securities are subject the measurement and disclosure requirements of FAS 157 Held to maturity securities are not within the scope of the FAS 157 disclosure requirements. However, the fair value and unrealized gains and losses for disclosures required under FAS 115 must be measured in accordance with FAS 157 Fair Value Measurements and Disclosures Impaired Investment Securities An investment security is considered impaired if its fair value is less than its cost. If a security is impaired, the institution must determine if the impairment is temporary or other than temporary Important to determine if the security is to be evaluated for OTTI under FAS 115 (generally) or EITF 99-20 (below AA rated securities in ABS transactions) Fair Value Measurements and Disclosures Impaired Investment Securities A security is temporarily impaired under FAS 115 if the institution determines that: The security will recover its fair value; The recovery period can be reasonably estimated; and The recovery period will not adversely affect the institution’s ability to manage liquidity risk Fair Value Measurements and Disclosures Impaired Investment Securities A security is other than temporarily impaired if the institution determines that: The institution will be unable to collect all of the interest payments and outstanding principal owed or The required recovery period will adversely affect the institution’s ability to manage liquidity risk Fair Value Measurements and Disclosures Impaired Investment Securities To determine if a security is temporarily or other than temporarily impaired the institution must consider: The severity and duration of impairment The historical and implied volatility of the security Recoveries or additional declines in fair value The financial condition and near-term prospects of the issuer Whether the market decline was security specific or caused by macroeconomic conditions Fair Value Measurements and Disclosures Loans Receivable Real estate loans Auto loans Mortgage loans held for sale Fair Value Measurements and Disclosures Real Estate Loans – Key Valuation Assumptions Interest rate – fixed or variable Contract term – balloons, hybrids, etc. Lien position Closed or open ended Source – retail versus wholesale Underwriting – including credit score and advance rate Prepayment rate Default rate Loss severity Fair Value Measurements and Disclosures Auto Loans – Key Valuation Inputs Interest rate Contract term Source – direct versus indirect Underwriting – including credit score and advance rate Prepayment rate Default rate Loss severity Fair Value Measurements and Disclosures Troubled Debt Restructurings – Measuring Impairment Present value of expected future cash flows discounted at the loan’s effective interest rate Loan’s observable market price Fair value of collateral if loan is collateral dependent The latter two alternatives are viewed as practical expedients Fair Value Measurements and Disclosures Mortgage Loans Held for Sale FAS 65 amended – loans are to be measured at the lower of cost or fair value (not market) Can elect under FAS 159 to account for loans at fair value, which we generally recommend – level 2 in hierarchy Entity could also elect FAS 133 fair value hedge, which we believe is unnecessarily complex to accomplish same purpose Fair Value Measurements and Disclosures Mortgage Servicing Rights (MSRs) Servicing is inherent in all financial assets and becomes a distinct asset or liability in one of three circumstances: Results from a transfer of assets that meets “sale” accounting Results from a transfer to a QSPE Is acquired or assumed and not related to the financial assets of the servicer Fair Value Measurements and Disclosures MSR Asset vs. MSR Liability Benefits of servicing are expected to exceed “adequate compensation” as determined by the marketplace – if they do not then a “servicing liability” exists Adequate compensation is based on the specified servicing fees and other benefits demanded in the marketplace to perform the servicing Servicing assets and liabilities are initially recorded at their fair value Servicing assets and liabilities must be reported separately An servicing asset can become a servicing liability over its life and vice versa Fair Value Measurements and Disclosures Mortgage Servicing Rights FAS 156 requires that servicing rights be initially recorded at their fair value (not relative fair value) in accordance with FAS 157 Industry believes MSRs are Level 2 or Level 3 assets based on a discounted cash flow model Fair Value Measurements and Disclosures How to account for the MSR after initial recording? The ongoing accounting depends on the methodology selected to measure the asset. FAS 156 allows the asset to measured in one of two ways: 1) Amortization Method 2) Fair Value Method An institution may select either method, but cannot switch methodologies unless it moves to the Fair Value method at the beginning of the fiscal year. It cannot go back to the Amortization method after it has elected Fair Value. Fair Value Measurements and Disclosures Required disclosures under FAS 156 1) Management’s basis for determining classes of servicing assets and liabilities 2) Description of risks inherent in the servicing asset and liabilities and instruments used to mitigate this risk in the income statement 3) The amount of servicing fees, late fees, and ancillary fees earned, including a description of where each item is reported on the income statement Fair Value Measurements and Disclosures Additional disclosures for Fair Value Methodology under FAS 156 The change in the carry amount of the asset including: 1. Beginning and ending balances 2. Additions to the asset 3. Disposals 4. Changes in fair value resulting from: 5. a. Changes in valuation inputs or assumptions used in the model b. Other changes in fair value and a description of those changes Other changes that impact the balance and a description of those changes A description of the valuation techniques used to estimate the fair value Fair Value Measurements and Disclosures Mortgage Banking Commitments Interest Rate Lock Commitments (IRLCs) Forward Loan Sales Commitments Fair Value Measurements and Disclosures IRLCs Agreements under which a lender agrees to extend credit to a borrower under certain terms and conditions in which the interest rate and maximum amount of the loan are set prior to funding. IRLCs for mortgage loans to be held for sale are derivatives Three accounting changes: Prior guidance required initial valuation to be zero – FAS 157 requires fair value Prior guidance required that the value not include the value of the servicing right – the opposite is now required Origination revenues and costs were capitalized – they are now recognized as generated or incurred Fair Value Measurements and Disclosures Valuation of IRLCs Primary components: Projected sales price of the loan based on market interest rates Projected fallout rate Decay in the value of the borrowers option due to the passage of time Remaining origination costs to be incurred Fair Value Measurements and Disclosures IRLCs Valuation Example Loan amount A Rates up Loan at Inception 50 bp $ 100,000 $ 100,000 Lock in interest rate 6.375% Market interest rate Rates dow n Loan Processing 100 bp Approved Close $ 100,000 $ 100,000 $ 100,000 $ 100,000 6.375% 6.375% 6.375% Loan at 6.375% 6.375% 6.375% 6.875% 6.875% 5.875% 5.875% 5.875% 102.75% 100.75% 100.75% 104.75% 104.75% 104.75% Servicing Value 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% Origination costs to be incurred C 1.00% 1.00% 0.50% 0.50% 0.00% 0.00% 100.50% 100.50% 100.50% 100.50% 100.50% 100.50% -0.25% 3.75% Market value w ith servicing B Price to borrow er D Value as percent of loan (1) E Dollar value A * E F Pull through percentage G 1.25% $ 1,250.00 -0.75% $ (750.00) $ 30.00% 45.00% Derivative Value F * G $ 375.00 $ (337.50) $ Amount recorded $ 375.00 $ (712.50) $ (250.00) $ 3,750.00 60.00% 60.00% (150.00) $ 2,250.00 187.50 $ 2,400.00 4.25% $ 4,250.00 4.25% $ 4,250.00 80.00% 100.00% $ 3,400.00 $ 4,250.00 $ 1,150.00 $ 850.00 Fair Value Measurements and Disclosures IRLC Journal Entries Journal Entrie s De s cription IRLC De bit A $ Cre dit Incom e State m e nt 375 Origination income IRLC $ $ 375 $ 500 $ 3,875 $ 500 IRLC $ 4,250 Cash $ 100,500 $ (375) $ 500 Cas h Ware hous e 375 Record initial value Origination expense B $ 500 Cash $ (500) $ (500) Record origination costs IRLC C $ 3,875 Gain on IRLC $ $ 3,875 (3,875) Record changes in value Origination expense D $ 500 Cash $ 500 Record origination costs Warehouse loan E $ 104,750 $ 104,750 $ (4,250) $ (100,500) Record loan f unding $ 110,000 $ 110,000 $ (3,250) $ - $ (101,500) $ 104,750 Fair Value Measurements and Disclosures IRLCs Derivative asset and derivative liability In general, cannot be offset for accounting purposes Level 3 in hierarchy Fair Value Measurements and Disclosures Forward Sales Commitments Mandatory forward sales commitments are derivatives and are accounted for at fair value Best efforts sales commitments are not derivatives Can elect to account for them at fair value Fair Value Measurements and Disclosures Forward Sales Commitments Derivative asset and derivative liability In general, cannot be offset for accounting purposes Level 2 in hierarchy Fair Value Measurements and Disclosures Summary of Credit Union Liabilities and Equity Interest payable Share drafts Regular shares Money market shares Share certificates Other shares Other liabilities Equity 4% 9% 23% 14% 28% 10% 1% 11% 100% Fair Value Measurements and Disclosures Share drafts, regular shares, money market shares Fair value is the amount payable on the reporting date Core deposit intangibles are not included, it is a separate asset the recognition of which has been deferred under FAS 157 Fair Value Measurements and Disclosures Share Certificates Interest rate Term Early redemption Discount rate Fair Value Measurements and Disclosures FAS 157 Required Disclosures for Each Major Category of Assets and Liabilities The fair value at the reporting date The level within the fair value hierarchy For level 3 items, a reconciliation of beginning and ending balances attributable to the following: Total gains or losses for the period (realized and unrealized) segregating those gains and losses included in earnings, and a description of where they are reported in the income statement Purchases, sales, issuances and settlements (net) Transfers in or out of Level 3 The amount of gains and losses from level 3 items that are still held and where they are reported on the income statement Valuation techniques used and discussion of changes if any Fair Value Measurements and Disclosures Disclosures Example for Items Measured and Reported on a Recurring Basis Total Carrying Amount in Statement of Statement Financial 107 Fair Position at Value 12/31/08 Estimate Available for Sale Securities Assets / Liabilities Measured at Fair Value at 12/31/08 Quoted Prices in Active Markets for Identical Assets Level 1 Significant Significant Other Other UnObservable observable Inputs Level Inouts 2 Level 3 75 75 75 60 15 - Securities Held for Investment 125 135 50 - 50 - Auto Loans 100 110 - - - - Mortgage Loans Held for Sale (a) 165 165 165 - 165 - 20 20 20 - - 20 B/E Forward Sales Commitments (a) (15) (15) (15) - (15) - Long Term Debt (50) (55) (40) - (40) - IRLCs (a) Elected to measure and report at fair value Fair Value Measurements and Disclosures IRLCs - Level 3 Beginning Balance 10 Total gains or losses (realized/unrealized) 1 Issuances and Settlements 9 Tranfers in and/or out of Level 3 - Ending Balance Unrealized gains or losses for items still outstanding at December 31, 2008 20 1 Fair Value Measurements and Disclosures Required Disclosures for Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis (e.g. impaired assets) The fair value at the reporting date and the reasons for the measurements The level within the fair value hierarchy For level 3 items, a description of the inputs used and the information used to develop them Valuation techniques used and discussion of changes if any Fair Value Measurements and Disclosures Required Disclosures – FAS 157-2 The fact that the entity has only partially adopted FAS 157 as a result of electing the deferral Each major category of assets and liabilities recognized or disclosed at fair value amounts that were not measured in accordance with FAS 157 Fair Value Measurements and Disclosures Required Balance Sheet Disclosures – FAS 159 Must separately report items measured at fair value Reasons for electing fair value Reasons for not electing fair value for similar items For each line item on the balance sheet that includes fair value items: The aggregate carrying amount of items included in the line item ineligible for the fair value option The difference between the aggregate fair value and aggregate unpaid principal balance of: Information to show how the line item relates to FAS 157 and 107 disclosures Loans and long-term receivables (except FAS 115 securities) for which the option has been elected Long-term debt instruments for which the fair value option has been elected Certain additional information for instruments that would have been reported under the equity method and loans that are 90 days or more past due Fair Value Measurements and Disclosures Required Income Statement Disclosures – FAS 159 Gains and losses from changes in fair value included in earnings Description of how dividends and interest are measured and where they are reported For loans and other receivables – gains and losses arising from changes in instrument specific credit risk and how the credit risk gains and losses were determined For liabilities with fair values that significantly changed – gains and losses arising from changes in instrument specific credit risk, qualitative information about the reasons for the changes, and how the credit risk gains and losses were determined Fair Value Measurements and Disclosures Implementation Challenges Process capabilities – especially re capture of recurring level 3 data Determining level 1, 2 or 3 – discuss with your auditors FASB’s Valuation Resource Group is working on issues but does not release minutes Fair Value Measurements and Disclosures Auditing Fair Value PCAOB Staff Audit Practice Alert No. 2 – Auditing Fair Value Measurements and the Use of Specialists Four major areas: 1. Auditing fair value measurements 2. Fair value hierarchy classifications 3. Use of specialists 4. Use of pricing services Fair Value Measurements and Disclosures Auditing Fair Value Measurements Obtain understanding of client’s fair value processes Evaluate reasonableness of assumptions, including consistency with market information Consider whether reliance on historical information is justified – be especially careful re level 3 inputs Determine if client has applied methodologies consistently Fair Value Measurements and Disclosures Auditing Fair Value Hierarchy Consider incentives to inappropriately classify – level 2 when it should be level 1 thereby allowing more discretion or judgment Fair Value Measurements and Disclosures Auditing Fair Value Use of specialists – when to use Does auditor have necessary skill and knowledge Significant use of unobservable inputs Complexity of the valuation technique Materiality of the fair value measurement Fair Value Measurements and Disclosures Auditing Fair Value Using the work of a specialist Obtain understanding of the methods and assumptions used Make appropriate tests of data provided to specialist Evaluate whether the specialist’s findings support the assertions in the financial statements Evaluate the specialist’s qualifications Fair Value Measurements and Disclosures Auditing Fair Value Use of pricing services Determine nature of information provided Active market, observable inputs, mark to a model Adjust audit procedures accordingly including gaining an understanding of the model and input assumptions Price based on principal or most advantageous market Is the price provided by the service realizable? Fair Value Measurements and Disclosures Questions?