Activity-Based Costing and Activity

Activity-Based Costing and

Activity-Based Management

2005.09

1

Outline

1 Introduction

2 Explain under-costing and over-costing of products

3 Present three guidelines for refining a costing system

4 Distinguish between the traditional and the ABC approaches to designing a costing system

5 Describe a four-part cost hierarchy

2

6 Cost products or services using activity-based costing (ABC)

7 Use ABC systems for activity-based management

8 Evaluate the costs and benefits of implementing

ABC costing systems

3

Introduction

• Activities generate costs.

• ABC traces costs to activities.

4

Explain under-costing and over-costing of products

5

Under-costing and Over-costing

•

Product under-costing :

A product consumes a relatively high level of total resources but is reported to have a relatively low total cost.

•

Product over-costing:

A product consumes a relatively low level of total resources but is reported to have a relatively high total cost.

6

Under-costing and Over-costing

• Lisa, Rola, and Nancy meet occasionally for lunch.

• Each one orders separate items.

• Lisa order amounts to

$140

Rola consumes

Nancy’s order is

Total

300

160

$600

7

Under-costing and Over-costing

• Assuming they divide the bill equally, what is the average cost per lunch?

• $600 ÷ 3 = $200

• Lisa and Nancy are over-costed.

• Rola is under-costed.

8

Existing Single

Indirect-Cost Pool System

• Cole Corporation manufactures two types of lenses : a normal lens (NL) a complex lens (CL).

• To cost products, Cole currently uses a single indirect-cost rate costing system.

9

Existing Single

Indirect-Cost Pool System

• The cost objects are the total costs of manufacturing and distributing 80,000 normal lenses (NL) and 20,000 complex lenses (CL).

10

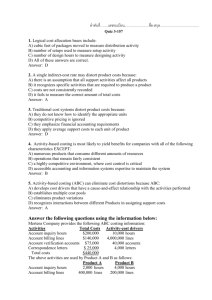

Existing Single Indirect-

Cost Pool System

Normal Lenses (NL)

Direct materials

Direct labor

Total direct costs

$1,520,000

800,000

$2,320,000

• Direct cost per unit:

$2,320,000

÷

80,000 = $29

11

Existing Single Indirect-

Cost Pool System

•

Complex Lenses (CL)

Direct materials

Direct labor

Total direct costs

$ 920,000

260,000

$1,180,000

• Direct cost per unit:

$1,180,000 ÷ 20,000 = $59

12

Existing Single Indirect-

Cost Pool System

•

Indirect costs of $2,900,000 are grouped into a single overhead cost pool.

• 50,000 of direct labor hours are used as the cost-allocation base.

• What is the indirect cost allocation rate?

• $2,900,000 ÷ 50,000 = $58 per direct labor hour

13

Existing Single Indirect-

Cost Pool System

• Cole uses 36,000 direct labor-hours to make

NL and 14,000 direct labor-hours to make

CL.

• How much indirect costs are allocated to each product?

•

NL: 36,000 × $58 = $2,088,000

•

CL: 14,000 × $58 = $ 812,000

14

Existing Single Indirect-

Cost Pool System

• What is the total cost of normal lenses (NL)?

TC = Direct costs $2,320,000 +

Allocated costs $2,088,000 = $4,408,000

• What is the cost per unit?

$4,408,000 ÷ 80,000 = $55.10

15

Existing Single Indirect-

Cost Pool System

• What is the total cost of complex lenses (CL)?

TC = Direct costs $1,180,000 +

Allocated costs $812,000 = $1,992,000

• What is the cost per unit?

UC = 1,992,000 ÷ 20,000 = $99.60

16

Existing Single Indirect-

Cost Pool System

• Normal lenses sell for $60 each and complex lenses for $142 each.

•

Revenue

Cost

Income

Normal

$60.00

55.10

$ 4.90

Margin (Profits) 8.2%

Complex

$142.00

99.60

$ 42.40

29.9%

17

Guidelines for Refining a Costing System

Three Guidelines for refining a costing system:

•

Direct-cost tracing : Classify as many of the total costs as direct costs as is economically feasible.

•

Indirect-cost pools : Expand the number of cost pools until each of these pools is homogeneous .

•

Cost driver: Identify the preferred cost-allocation base (cost driver) for each indirect-cost pool.

18

Refining a Costing System

• The sequence of steps to design, produce, and distribute lenses is as follows:

1 Design of products and process :

The Design Department designs the molds and defines production processes needed (details of the manufacturing operations).

19

Refining a Costing System

2 Manufacturing operations :

Lenses are molded, finished, cleaned, and inspected.

3 Shipping and distribution :

Finished lenses are packed and sent to the various customers.

20

Distinguish between the traditional and the ABC approaches to designing a costing system

21

Activity-Based Costing System

• ABC systems refine costing systems by focusing on individual activities as the fundamental cost object.

22

Activity-Based Costing System

ABC:

(1) calculates the costs of individual activities

(2) assigns costs to cost objects (such as products and services) on the basis of the activities undertaken (consumed) to produce each product or service.

23

Activity-Based Costing System

Activities

Cost of Activities

Cost of Product,

Service, or Customer

24

Activity-Based Costing System

• A cross-functional team at Cole Corporation identified 7 key activities:

– Design products and processes

– Set up molding machine

– Operate machines to manufacture lenses

– Maintain and clean the molds

25

Activity-Based Costing System

– Set up batches of finished lenses for shipment.

– Distribute lenses to customers.

– Administer and manage all processes.

26

Activity-Based Costing System

Molding machine setup data for NL and CL:

NL CL

• Total quantity produced 80,000

20,000

• No. produced per batch

• Number of batches

250

320

50

400

• Setup time per batch 2 hours 5 hours

• Total setup hours

640 2,000

27

Activity-Based Costing System

• Total setup costs are $409,200.

• What is the setup cost per setup hour?

A: $409,200 ÷ 2,640 hours = $155

• What is the setup cost per direct labor hour?

A: $409,200 ÷ 50,000 = $8.184 (p.13)

28

Activity-Based Costing System

• (ABC) Cost allocation using setup-hours:

•

NL: $155 × 640 = $ 99,200

CL: $155 × 2,000 = $310,000

Total $409,200

• (TCS) Cost allocation using direct labor-hours:

NL: $8.184 × 36,000 = $294,624 (O. costing)

CL: $8.184 × 14,000 = $114,576 (U. costing)

Total $409,200

29

Activity-Based Costing System

How should Cole Co. allocate setup costs?

A: Setup costs should be allocated on the basis of setup hours .

• Why?

• There is a strong cause-and-effect relationship between setup-related overhead costs and setup-hours, a resource-consuming costing model .

30

A four-part cost hierarchy

31

Cost Hierarchies

• A cost hierarchy is a categorization of costs into different cost pools on the basis of the different types of cost drivers (cost-allocation bases).

32

Cost Hierarchies

• ABC systems commonly use a four-part cost hierarchy to identify cost-allocation bases (cost drivers):

1 Unit-level costs

2 Batch-level costs

3 Product-sustaining costs

(or Customer-sustaining costs)

4 Facility-sustaining costs

33

Unit-Level Costs

– are resources consumed by activities performed on each individual unit of product or service.

• Direct material

• Direct labor

• Energy

• Machine depreciation

34

Batch-Level Costs

– are resources consumed by activities that are related to a batch (group of units) of product rather than to each individual unit of product.

• Setup costs

• Procurement costs

• Material moving costs

• Inspection costs

35

Product-Sustaining Costs

– are resources consumed by activities undertaken related to individual products or services.

• Design costs

• Design change costs

• Engineering costs

36

Facility-Sustaining Costs

– are resources consumed by activities that cannot be traced to individual products but related to the organization as a whole.

• General administration costs

– Rent

– Building security

37

Cost products or services using activity-based costing (ABC)

38

Implementing

Activity-Based Costing

• Step 1: Identify the chosen cost objects.

The objective is to calculate the total costs of designing, manufacturing, and distributing NL and CL.

39

Implementing

Activity-Based Costing

• Step 2: Identify the direct costs of the product.

Cole identifies direct materials costs and direct labor costs as direct costs.

Mold cleaning and maintenance costs of

$360,000 are also identified as direct costs of the lenses.

40

Implementing

Activity-Based Costing

• The existing cost system classifies mold cleaning and maintenance costs ($360,000) as part of the

$2,900,000 indirect costs.

• Recall that indirect costs were allocated to products using direct labor-hours .

41

Implementing

Activity-Based Costing

• Mold cleaning and maintenance costs of

$360,000 are batch-level-costs. Why?

• Because these costs consist of workers’ wages for cleaning molds after each batch of lenses is run.

42

Implementing

Activity-Based Costing

• Mold cleaning and maintenance costs of $360,000 under ABC system:

•

$360,000 / 720 batches = $500 / batch

•

NL: 320 batches * $500 = $160,000

•

CL: 400 batches * $500 = $200,000

43

Implementing

Activity-Based Costing

• Allocation of mold cleaning and maintenance costs

$360,000 under traditional costing system:

•

$360,000 / 50,000 D.L.hours = $7.2 per D.L.hour

•

NL: 36,000 hours * $7.2 = $259,200 vs. $160,000

•

CL: 14,000 hours * $7.2 = $100,800 vs. $200,000

44

Implementing

Activity-Based Costing

• Mold cleaning and maintenance costs of $360,000 under two costing systems:

TCS ABC

• NL $259,200 $160,000 (O. costing)

• CL $100,800 $200,000 (U. costing)

45

Implementing

Activity-Based Costing

Normal Lenses (NL)

Description Cost Hierarchy

Category

Direct materials Unit-level $1,520,000

Direct labor Unit-level 800,000

Mold cleaning & maintenance

Total direct costs

Batch-level 160,000

$2,480,000

46

Implementing Activity-Based

Costing

Complex Lenses (CL)

Description Cost Hierarchy

Category

Direct materials Unit-level $ 920,000

Direct labor Unit-level 260,000

Mold cleaning & maintenance

Total direct costs

Batch-level 200,000

$1,380,000

47

Implementing

Activity-Based Costing

• Step 3: Select the cost drivers (cost-allocation bases) to use in allocating activity costs to the products.

48

Implementing

Activity-Based Costing

Six activities were identified.

1 Design

2 Molding machines setups*

3 Manufacturing operations

4 Shipment

5 Distribution

6 Administration

49

Implementing

Activity-Based Costing

• Step 4: Identify the activity costs associated with each cost driver (cost-allocation base).

• Overhead costs incurred are assigned to activities, to the extent possible, on the basis of a cause-and-effect relationship.

• Total molding machines setup costs are

$409,200.

50

Implementing

Activity-Based Costing

• Step 5: Compute the rate per unit of each cost driver (cost allocation base) used to allocate molding machines setup costs to the products.

•

Setup hours: NL CL Total

640 2,000 2,640

•

$409,200 ÷ 2,640 = $155 per setup hour.

51

Implementing

Activity-Based Costing

• Step 6: Compute the setup costs allocated to the products.

•

NL: $155 × 640 hours = $ 99,200

•

CL: $155 × 2,000 hours = 310,000

Total $409,200

52

Implementing

Activity-Based Costing

• Setup cost of $409,200 under traditional costing system:

•

$409,200 / 50,000 D.L.hours = $8.18 D.L.hour

•

NL: 36,000 hours * $8.18 = $294,600

•

CL: 14,000 hours * $8.18 = $114,600

53

Implementing

Activity-Based Costing

• Setup cost of $409,200

ABC TCS

NL $ 99,200 $ 310,000 (O. costing)

CL $294,600 $114,600 (U. costing)

54

Implementing Activity-Based

Costing

• Step 7: Compute the costs of the products by adding all direct and indirect costs assigned to them.

• NL and CL would show three direct cost categories.

1 Direct material costs

2 Direct labor costs

3 Mold cleaning and maintenance costs

55

Implementing Activity-Based

Costing

• NL and CL would show six activity cost pools.

1 Design

2 Molding machine setups

3 Manufacturing operations

4 Shipment

5 Distribution

6 Administration

56

Use ABC systems for activity-based management

57

Activity-Based Management

• ABM describes management decisions that use activity-based costing information to improve profits.

– Product mix and pricing decisions

– Customer mix and pricing decisions

– Cost reduction and process improvement decisions

– Design decisions

58

Product Pricing and Mix Decisions

• ABC provides more accurate product cost information and gives management insight into the cost structures for making and selling diverse products.

59

Cost Reduction and Process

Improvement Decisions

• Value-added activities vs.

Non value-added activities

60

Design Decisions

• Management can identify and evaluate new designs to improve operating performance by evaluating how product and process designs affect activities and costs.

• Companies can work with their customers to evaluate the costs and prices of alternative design choices.

61

Evaluate the costs and benefits of implementing

ABC costing systems

62

ABC Systems Are Most

Beneficial When...

– significant amounts of indirect costs are allocated using only one or two cost pools.

– all or most costs are identified as output unit-level costs.

– products make diverse demands on resources because of differences in volume, process steps, batch size, or complexity.

63

ABC Systems Are Most

Beneficial When...

– products that a company is well-suited to make and sell show small profits while products for which a company is less suited show large profits.

– complex products appear to be very profitable and simple products appear to be losing money.

64

ABC Systems Are Most

Beneficial When...

– operations staff have significant disagreements with the accounting staff about the costs of manufacturing and marketing products and services.

65

Limitations of ABC Systems

• The main limitations of ABC are the measurements necessary to implement the system.

• ABC systems require management to estimate costs of activity pools and to identify and measure cost drivers for these pools.

66

Limitations of ABC Systems

• Activity-cost rates also need to be updated regularly.

• Very detailed ABC systems are costly to operate and difficult to understand.

67

ABC In Service And

Merchandising Companies

• The general approach to ABC in the service and merchandising areas is very similar to the approach in manufacturing.

• Costs are divided into homogeneous cost pools and classified as unit-level, batch level, product, or service-sustaining and facility sustaining costs.

68

END

Thank You

69