nstedb

advertisement

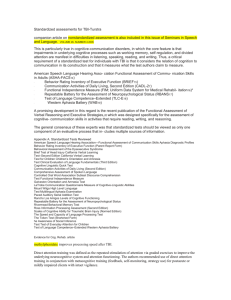

Innovation Practices Dr B K Shukla Scientist G Department of Science & Technology National Science & Technology Entrepreneurship Development Board (NSTEDB) www.nstedb.com The “way we’ve always done it” isn’t always the way we should do it! Some key initiatives of GoI on Innovation • Focus on Innovation through political will and public policy (NInC, STI Policy 2013) • Decade of Innovation • International S&T Cooperation focused on innovation and wealth creation • Various schemes/instruments to promote innovation (TePP, SBIRI, TDDP, NMITLI, TDB, GITA,TIDE, NIF) Focus of STI Policy – Special reference to TBIs and science led entrepreneurship • Launching newer mechanisms for nurturing TBIs and science led entrepreneurship • Orting STI driven entrepreneurship with viable and highly scalable business models • Investing in young innovators and entrepreneurs through education, training and mentoring • Promoting mechanisms such as “Small Idea Small Money” and “Risk Idea Fund” to support Innovation Incubators NSTEDB ESTABLISHED IN 1982 TO PROMOTE KNOWLEDGE BASED TECHNOLOGY DRIVEN ENTERPRISES NSTEDB INSTITUTIONAL CAPACITY SUPPORT MECHANISMS BUILDING SERVICES STED EAC PORTAL IEDC FDP VIDEO STEP EDP BUS PLAN TBI TEDP TECHNOLOGYBUSINESS INCUBATION DST’s Incubator Network 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 a 23 24 25 26 27 28 29 30 61 59 IKP, Hyderabad ICRISAT, Hyderabad University of Hyderabad University of Delhi Sriram Inst. TBI, Delhi IAN-TBI, Delhi NID-NDBI, Ahmedabad Nirma Labs, Ahmedabad CIIE, IIM Ahmedabad MICA, Ahmedabad NSIC, Rajkot NDRI, Karnal MDI, Gurgaon BITS, Meshra Composites Tech. Park, Bangalore E health-TBI, Bangalore MIT, Manipal JSS STEP, Mysore NIT, Surathkal BEC-STEP, Bagalkot NIT, Calicut Technopark- TBI, Trivandrum Amrita TBI, Kollam IIT-SINE, Mumbai MITCON, Pune NCL-VC, Pune D.K.T.E. Textile Engg, Kolhapur STP, Pune MANIT, Bhopal KIIT University, Bhubaneshwar 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 57 58 60 64 58 62 56 22 63 63 59 60 61 62 63 64 Thapar University, Patiala GNEC-STEP, Ludhiana BITS, Pilani KEC, Perundurai VIT -TBI, Vellore Anna University - TBI, Chennai University of Madras, Chennai IIT-RTBI, Chennai BAIT, Sathyamangalam Periyar - TBI, Thanjavur SPEC-TBI, Chennai TREC-STEP, Tiruchirapalli PSG-STEP, Coimbatore PSG-Nanotech TBI, Coimbatore TNAU, Coimbatore Vel Tech, Chennai JSSATE - TBI, NOIDA Amity - TBI, NOIDA KIET, Ghaziabad IIT, Kanpur IT-BHU, Varanasi HBTI, Kanpur IIT, Roorkee Ekta-TBI, Kolkata IIT, Kharagpur ITIH, Trvandrum Agnel –PCCE TBI, Verna ,Goa Adhiyamaan TBI, Hosur BITS-TBI, Hyderabad Technovate TBI, Bangalore IIIT , Hyderabad COE, Trivandrum Villgro TBI, Chennai Ginserv, Bangalore Innovation Support Initiatives Seed Support System for technology driven start ups Capacity building of incubator managers Platforms for Incubators to Network Nationally and Internationally Service Tax exemptions to incubator and incubatees Service Tax Exemption to Incubatees In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 2994 (32 of 1994), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby exempts taxable services provided by an entrepreneurs located within the premises of a Technology Business Incubator (TBI) or Science and Technology Entrepreneurship Park (STEP) recognized by the National Science and Technology Entrepreneurship Development Board (NSTEDB) of the Department of Science and Technology Government of India from the whole of the service tax leviable thereon under section 66 of the said Finance Act subject to the conditions. Conditions for Service Tax Exemption The exemption contained in this notification shall apply subject to the following conditions, namely i) The Entrepreneurs enters into an agreement with the TBI of the STEP as an incubatee, to enable himself to develop and produce hi-tech and innovative products; and ii) the total business turnover of such entrepreneur does not exceed fifty lakh rupees during the previous financial year; Provided that the exemption contained in this notification shall apply for a period of three years from the data on which such entrepreneur enters into an agreement with the TBI or the STEP. Explanation: The exemption for taxable services under this notification shall not be available for any taxable services provided or to be provided immediately after the total business turnover of the entrepreneur exceeds fifty lakh rupees during a given financial year. This notification shall come into force on the 1st day of April, 2007. INDIA INNOVATION FUND • FOCUS ON IP ASSET CREATION IN EMERGING & FRONTIER TECHNOLOGIES • JOINTLY CONCEIVED BY DST, ICICI KNOWLEDGE PARK, BHARTI AIRTEL, TCS AND NASSCOM • FUND SIZE 48 CRORES (USD 96 mn) • PPP INITIATIVE OF DST INDIA INNOVATION FUND • FOCUSSED TECH AREA FOR INVESTEMENT – PHARMA, AUTO INFOTRONICS, TELECOM, MEDICAL DEVICES AND INTELLIGENT TRANSPORT SYSTEM • INVESTMENT IN START-UPS HAVING IP /wEPDwU The Power of Ideas is an entrepreneurial platform created by The Economic Times in association with the Department of Science and Technology to seek, reward, nurture and groom business ideas by connecting them with relevant evaluators, mentors and investors ...... www.ideas.economictimes.com India Innovation Growth Programme • DST-Lockheed Martin Inc. supported • Scouts innovations annually • Selected innovators are mentored thrrough US University faculty • 30 innovators are awarded • Innovators are provided follow-up support by FICCI FOR MORE DETAILS WE ARE AVAILABLE AT – www.nstedb.com www.techno-preneur.net Thank You