14.1.2 Dispute Resol..

advertisement

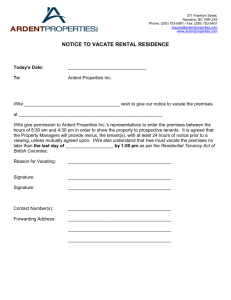

90 Dispute Resolution Need for Dispute Resolution • • The many unique and complex relationships that exist among Canadians inevitably produce conflicts and disputes that need to be resolved. There are many different types of disputes. Some common types that many people have 90 to deal with are: 1. Consumer protection 2. Landlord and tenant agreements 3. Employment law Consumer Protection • Consumer protection laws in Canada (introduced in the late 1960s) are in place to – ensure that consumers are given accurate and correct information. – protect consumers from products that are unreliable, hazardous, or dangerous. 90 – regulate activities around the sale of goods. • There are federal and provincial laws that are meant to protect consumers from being exploited or taken advantage of. Federal Laws • A series of federal laws in place to protect consumers are reflected in the Competition Act. • This includes the establishment of the Competition Bureau—a federal agency that oversees competitive markets and protects consumers. 90 • The Competition Bureau can investigate and prosecute those who violate federal legislation and exploit consumers. • Specific areas of focus include conspiracy, misleading advertising, and protecting personal information. Conspiracy • A conspiracy aimed at reducing competition and consumer choice violates federal law. • Price fixing occurs when multiple competitors agree to set prices at a certain level, which guarantees them profits while taking away real choice from the consumer. This is also known as 90 a cartel. • A cartel may also market share, in which the participants split a market geographically to limit competitors. • If a cartel reaches a secret agreement to fix prices, split markets, or for some other purpose that reduces consumer choice, they are guilty of bid rigging. Misleading Advertising • Businesses and advertisers are allowed to promote or advertise their products and services. • The nature and content of their advertisements must be honest and cannot mislead or deceive potential consumers. 90 • If a seller knowingly or recklessly misleads a consumer, the seller can be charged under the Competition Act and may have to pay compensation to the consumer. Protecting Personal Information • Each year, more and more personal information enters cyberspace as Canadians become increasingly adept at conducting financial transactions over the Internet. • The Personal Information Protection and Electronic Documents 90 Act (in effect since 2004) aims to protect the personal information of consumers. • It includes all businesses, banks, airlines, and telecommunications companies. What is Personal Information? • Personal information includes: – – – – – – – – name age height weight financial records 90 medical records employee and student files any personal ID numbers Provincial Laws • In addition to federal laws, each province and territory has its own version of a consumer protection act. • Each province also has its equivalent of the federal Consumer Protection Bureau. • Some of the areas90 that are commonly covered by provincial legislation include: – – – – door-to-door sales loan scams credit reporting disclosure of credit costs Door-to-Door Sales • Sellers who look for consumers on a door-todoor basis must register with a provincial Consumer Protection Bureau. • Many people are caught off guard and feel pressured into buying products from door-todoor salespeople who 90 can be very persuasive. • As a result, there is a mandatory cooling-off period, established by law, during which a buyer may cancel a contract made with a door-to-door salesperson without giving a reason. Loan Scams & Credit • Over the past several years, there have been numerous cases of loan scams in all parts of Canada (e.g. guaranteeing loans to people with bad credit while charging advance fees) • In many loan scams, the actual loan is not secured and often not provided. 90 • Each Canadian adult has a credit rating, which affects his or her ability to obtain credit, including loans, credit cards, and mortgages. • The law requires any business that offers the sale of goods on credit to fully disclose the cost of obtaining that credit (e.g. interest rates, administrative fees). Landlord & Tenant Law • A landlord is a property owner who allows another party, the tenant, to occupy or use his or her property in return for a payment. • Each province has its own laws that govern the relationship between landlords and tenants. • A contract between90a landlord and tenant for the rental of a property is called a lease. • The landlord is also known as the lessor and the tenant is the lessee. Tenancy Agreements • Standard tenancy agreements include: – – – – Name and address of the landlord Name and address of the tenant Period of possession of the rented property Statement that the tenant is granted exclusive possession of the rented property – Specific address of90the property that is rented – Amount of rent to be paid and when it will be paid – Any services and utilities included in the rent • A fixed-term tenancy rents the property for a specific time with an expiration date. • A periodic tenancy rents the property for a regular period of time and is renewed at the end of each period. Responsibilities Landlords must… – – – – – – make sure the rental unit is reasonably safe. provide the tenant with a receipt if rent is paid in cash. complete repairs and keep the unit in good condition. pay any bills that are included in the rent (utilities). investigate complaints 90 about any tenants. abide by any tenancy agreement or legislation. Tenants must… – – – – – pay the rent on time. keep the unit clean. repair any damage they cause. make sure not to disturb or endanger others. abide by any tenancy agreement or legislation. Terminating a Tenancy • There are several ways to terminate a tenancy: 1. Subletting: A tenant assigns the tenancy to a third party. The tenant maintains the rights of the lease. 2. Mutual agreement: Landlord and tenant agree to end the lease early. 3. Surrendering the 90lease: A tenant expresses the desire to leave the property, or surrender the lease. The tenant is still responsible for the remainder of the lease unless the landlord agrees to release him or her from it. 4. Assignment: A tenant transfers the rights of the lease to a third party. 5. Termination Notice: Commonly referred to as eviction notices, a writ of possession allows a landlord to repossess a rental property and evict the tenants. Employment Law • Each employer-employee relationship is based on contract law, whether it is explicit or implicit. • In Canada, terms of any employment are covered by: – – – – Human rights laws Employment standards 90 and safety laws Labour laws Common laws as they relate to employment contracts • Many employees are represented by unions— organizations that represent and negotiate for employees of a particular business. Human Rights • The most common human rights concern in labour law is protecting against discrimination. • Prohibited grounds for discrimination in the workplace include (but are not limited to): – – – – – – – – age sexual orientation 90 sex or gender religion or creed race or skin colour political beliefs ethnic origin mental or physical disability Employment Standards • Each province has basic protections in place for employees. Some protections are general, while others are geared toward specific occupations. • In each province, there is a minimum wage and rules regarding work hours. 90 • All full-time employees must also be allowed to take statutory holidays off, such as Victoria Day or Canada Day. • Every employee in Canada is usually entitled to some vacation each year (the minimum for fulltime employees is usually 2 weeks in a year) as well as vacation pay. Termination & Dismissal • There are rules regarding quitting and being fired from a job. • If an employee wants to quit or resign, it is standard to provide the employer with one or two weeks’ notice, depending on how long the employee worked there. 90 • If an employer wants to fire an employee who has passed an initial probationary period, the employer must provide advance notice, unless the employee is being fired for a just cause. (e.g. stealing from the employer). • An employee who feels that he or she should not have been fired can file a wrongful dismissal lawsuit. Health and Safety • Each province has its own version of an Occupational Health and Safety Act, which aims to reduce the number of injuries that occur on the job. • Generally, employees have the right to refuse work they believe is 90 unsafe, unless they agree to a risky job (e.g. firefighters). • Employers are also obligated to provide WHMIS training so their employees can recognize potentially dangerous materials. • WHMIS stands for Workplace Hazardous Materials Information System. Workers’ Compensation • A workers’ compensation fund is a scheme that exists in each province that pays benefits to employees who are injured on the job or are suffering from health problems they obtained in the workplace. • Employers pay into90this fund as a type of no-fault insurance. If one of their employees suffers an injury, the employee can apply for compensation to the fund and the employer can avoid paying personally. Unions • Over the years, many unions have been established and continue to exist in Canada. • One of the main responsibilities of unions is to negotiate collective agreements for the employees they represent. • A collective agreement is a contract that results 90 from collective bargaining between a union and an employer. • For a union to be considered official, it must be certified with a labour relations board. • The ultimate weapon unions have is the ability to strike—a partial or complete withdrawal of services to further their contract demands. Independent Contractors and Self-Employment • Employers are increasingly moving away from hiring traditional employees, and toward hiring independent contractors, or self-employed workers. • An independent contractor provides services to clients, but is not an employee of a company. • The fact that these people are not employees has implications on tax law,90tort law, and labour law: – Businesses do not pay independent contractors’ Canada Pension Plan, employment insurance, or benefits. – Businesses are not liable for injuries a contractor suffers on the job. • Independent contractors work for themselves, own their own tools, and act as their own bosses. • The number of self-employed people in Canada has risen greatly as the economy changes and businesses try to keep costs to a minimum.