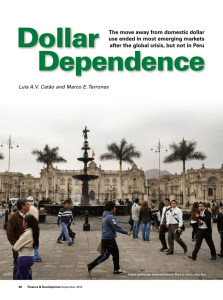

Dollarization: Pro and Con

advertisement

The Dollarization of Latin America: Beneficial or Detrimental to Economic Growth Iris Ceballos Wei-Han Chang Ryan Higashihara Keren Nahum Adriana Montes Michael Pham What is Dollarization? • Official: Foreign country adopts the dollar as their national currency – Eliminates old currency in favor of the dollar • Unofficial: Foreigners hold bank deposits in dollars to avoid high rates of inflation. Advantages • Avoids currency and balance of payments crises • Strengthens financial institutions, lowering possibility of inflation – Creates positive sentiment toward investment • Closer integration with global and U.S. economies – Lower transaction costs and assured stability of prices Disadvantages • • • • Loss of control over monetary policy Loss of profits from seignorage Loss of national identity Loss of lender last resort Arguments for: • Ecuador’s positive reaction: – Drop in inflation rates • 60% to 23% in 2001 • 16% in January of 2002 • Expectations of single digit rates by 2003 Arguments for: • Ecuador cont. – GDP growth of 5.4% in 2001: highest in Latin America – Increase in purchasing power – Increased stability and confidence in financial institutions • Standard and Poor’s upgrading of bonds from negative to stable Arguments Against: • • • • • Ecuador Lack of history Dependency on the United States Rich gets richer and the poor are SOL Not a quick solution for their long-term economic problems Arguments Against: • Argentina would have been in a worse stage if they went to full dollarization • Panama: stop of cash flow Conclusion: Pro • • • • • LOWER inflation LOWER transaction costs Higher CONFIDENCE for investors INCREASED purchasing power DISCIPLINE for irresponsible countries Conclusion: Con