Welcome! Prepare for Quiz 3-5!

advertisement

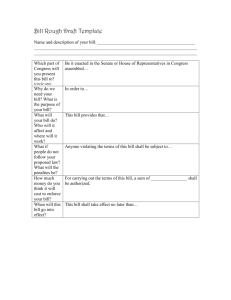

THE BUDGET… • Every year, the President and Congress must appropriate funds • Budget – a policy document allocating burdens (taxes) and benefits (expenditures) DEFICIT, EXPENDITURES, REVENUE • Deficit – an excess of federal expenditures over federal revenues in a fiscal year • Expenditures – federal spending of revenues; major areas of such spending are social services and the military • Revenues – the financial resources of the federal government; the individual income tax and Social Security tax are two major sources of revenue SOURCES OF FEDERAL REVENUE • Income tax – shares of individual wages and corporate revenues collected by the government • Sixteenth Amendment – (1913) explicitly permits Congress to levy an income tax BORROWING • When the federal government wants to borrow money, the Treasury Department sells bonds, guaranteeing to pay interest to the bondholder • Federal debt – all the money borrowed by the federal government over the years and still outstanding ENTITLEMENTS • Policies for which Congress has obligated itself to pay X level of benefits to Y number of recipients COSTS • Social Service • Social Security Act – (1935) passed during the Great Depression; intended to provide a minimal level of sustenance to older Americans and thus save them from poverty • Medicare – (1965) provides hospitalization insurance for the elderly and permits older Americans to purchase inexpensive coverage for doctor fees and other health expenses • National Security SOCIAL INSURANCE TAXES (1940) • Social security taxes – go straight to the Social Security Trust Fund • Social Security covers • Retirees • Survivors • Spouses who are over the age of 65 • Children who are under the age of 18 or are still in school • Disabled MEDICARE (1965) • Medicare is a federal program that helps to pay for older Americans’ health costs. • Some people incorrectly consider Medicare to be part of the Social Security system because taxes that finance part of Medicare are lumped in with those that pay for Social Security. MEDICAID • Medicaid is available only to certain low-income individuals and families who fit into an eligibility group that is recognized by federal and state law. • Medicaid does not pay money to you; instead, it sends payments directly to your health care providers. TAXES AND PUBLIC POLICY • Tax loopholes – a tax break or tax benefit • Tax expenditures – revenue losses that result from special exemptions, exclusions, or deductions on federal tax law HOUSE WAYS AND MEANS & SENATE FINANCE COMMITTEES • Write tax codes subject to the approval of the Congress as a whole CONGRESSIONAL BUDGET AND IMPOUNDMENT CONTROL ACT OF 1974 • An act designed to reform the congressional budgetary process • Its supporters hoped that it would also make Congress less dependent on the president’s budget and better able to set and meet its own budgetary goals CONGRESSIONAL BUDGET OFFICE • Advises Congress on the probable consequences of its decisions • Forecasts revenues AUTHORIZATION AND APPROPRIATIONS • Authorization Bill – an act of Congress that establishes, continues, or changes a discretionary government program or an entitlement • Appropriations Bill – funds programs within limits established by authorization bills