Chapter 20

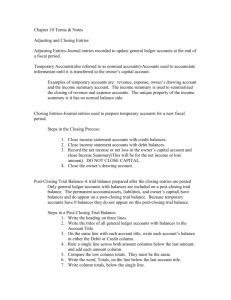

advertisement

Completing the Accounting Cycle for a Merchandising Corporation Making Accounting Relevant At the end of a fiscal period, businesses must “close the accounting records” or clean the slate in order to begin another period. At the end of a school year, what types of activities do you perform? Do you clean out your locker? Do you prepare for a summer job? Section 1 Journalizing Closing Entries What You’ll Learn What steps are followed to close the ledger. What closing entries are required for a merchandising business organized as a corporation. What closing entry is required when a corporation reports a loss. Section 1 The Ownership of a Corporation (con’t.) Why It’s Important Closing the ledger “cleans the slate” so that the next accounting cycle can begin. Section 1 The Ownership of a Corporation (con’t.) Steps for Closing the Ledger …transfer balances of all temporary accounts to a permanent account. 1. Close temporary credit accounts to Income Summary 2. Close temporary debit accounts to Income Summary 3. Close Income Summary to Retained Earnings Section 1 The Ownership of a Corporation (con’t.) Close Temporary Accounts with Credit Balances Section 1 The Ownership of a Corporation (con’t.) Close Temporary Accounts with Debit Balances Section 1 The Ownership of a Corporation (con’t.) Close the Balance of Income Summary to Retained Earnings Section 1 The Ownership of a Corporation (con’t.) Check Your Understanding 1. During the closing process, which account balances are credited to the Income Summary account? 2. Which account balances are debited to the Income Summary account? Section 2 Posting Closing Entries What You’ll Learn How to post closing entries. How to prepare a post-closing trial balance. The accounting cycle for a merchandising business. Section 2 Posting Closing Entries (con’t.) Why It’s Important To prepare the general ledger for the next period, you need to transfer the temporary account balances to the permanent Retained Earnings account. Section 2 Posting Closing Entries (con’t.) Closing the General Ledger After closing entries are recorded in the general journal, they are posted to the general ledger. For each posting the term “Closing Entry” is written in the Description column of the general ledger account. Section 2 Posting Closing Entries (con’t.) Preparing a Post-Closing Trial Balance A post-closing trial balance is prepared at the end of the accounting period to prove that the general ledger accounts are in balance after all adjusting and closing entries are posted. Section 2 Posting Closing Entries (con’t.) Check Your Understanding After all closing journal entries are posted, what is the balance of the temporary accounts?