Home

A corporation’s net income or net

loss is closed to Retained Earnings.

After posting the closing entries,

accountants prepare a post-closing

trial balance.

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Journalize closing entries for a merchandising corporation.

Post closing entries to the general ledger accounts.

Prepare a post-closing trial balance.

Describe the steps in the accounting cycle.

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

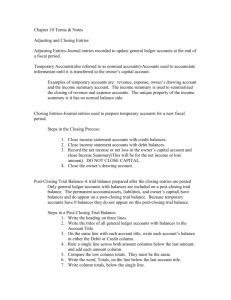

Steps for Closing

the Ledger

Section 20.1

Journalizing

Closing Entries

1

Steps for

Closing the

Ledger for a

Corporation

Close accounts with balances in

the Income Statement Credit

column to Income Summary.

2

Close accounts with balances in

the Income Statement Debit

column to Income Summary.

3

Close Income Summary to

Retained Earnings.

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Steps for Closing

the Ledger

Section 20.1

Journalizing

Closing Entries

Closing Entries

Needed for a

Corporation

See page 592

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Steps for Closing

the Ledger

Section 20.1

Journalizing

Closing Entries

Closing Entries Needed for a

Corporation (continued)

Home

Glencoe Accounting

See page 593

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing Entry to

Transfer a Net Loss

Section 20.1

Journalizing

Closing Entries

If there is a net loss, credit Income Summary for the amount

and debit Retained Earnings for the amount.

See page 594

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

When closing the general ledger, write Closing Entry for each

posting in the Description column of the general ledger account.

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Closing the

General Ledger

Section 20.2

Posting Closing Entries

Partial General

Ledger at the

End of the

Fiscal Period

(continued)

Home

Glencoe Accounting

See pages 596 – 600

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Preparing a Post-Closing

Trial Balance

Section 20.2

Posting Closing Entries

A post-closing trial

balance is prepared at

the end of the

accounting period to

prove the general

ledger accounts are in

balance.

See page 600

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Completing the Accounting

Cycle for a Merchandising

Business

Section 20.2

Posting Closing Entries

See page 601

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Question 1

To journalize the closing entries, put the following in order:

Close temporary accounts with debit balances.

2

________

1

Close temporary accounts with credit balances. ________

3

Close the Income Summary account to Capital. ________

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Question 2

How is a post-closing trial balance different from other trial balances?

The post-closing trial balance is prepared after closing entries

in which temporary account balances have been transferred to

the capital account.

The post-closing trial balance has only permanent or balance

sheet accounts.

Other trial balances include both temporary and permanent

accounts.

Home

Glencoe Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

End of

Home