- LGO Energy

advertisement

Leni Gas and Oil plc

Corporate Update

24 April 2014

Neil Ritson, CEO

London (AIM): LGO

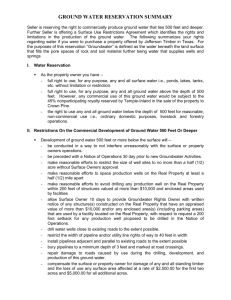

1

Delivering Growth through the Acquisition

of Proven Reserves & Enhancement of

Producing Assets

2

Company Profile

London Stock Exchange

Producing Oilfields

- listed March 2007

- Trinidad and Spain

London HQ

Spain

Trinidad

Staff

Net Production

P2 Reserves

Market Cap

-

50 (98% local)

500 bopd

7.6 mmbbls

£22 million

3

London Management and Board of Directors

Chairman

David Lenigas

Holds a Bachelor of Applied Science in Mining Engineering and has 30 years of resources industry

experience. Until recently he was the Executive Chairman of Lonrho plc. David is also the Executive

Chairman of Stellar Resources plc, Solo Oil plc, Rare Earth Minerals plc and AfriAg plc.

Chief Executive

Officer

Neil Ritson

Chief Operating

Officer

Fergus Jenkins

Director of

Finance

James Thadchanamoorthy

Non-Executive

Director

Steve Horton

Has a BSc in Geophysics. He has worked in the energy sector for over 35 years, initially with BP plc

for 23 years before managing the international operations of Burlington Resources Inc. and more

recently as CEO at Regal Petroleum plc, before founding the Vanguard Energy Group where he was

Chairman and CEO. He is a Director of Solo Oil plc and a Non-Executive at Enovation Resources Ltd.

Is a Chartered Engineer with a BEng in Mining Engineering and a MEng in Petroleum Engineering. He

has over 20 years of experience working in industry, initially in mining before moving to petroleum,

where he has worked for most of his career in mid-sized independent oil companies, including

Enterprise Oil, LASMO, OMV (UK) Ltd and Afren plc.

Has a degree in Chemistry and is a qualified accountant. He has 18 years’ experience, including over

10 years spent at BP where he held a number of commercial and finance leadership positions.

Holds a BSc in Mining Engineering and an MBA. He has 35 years experience working in the energy

industry including 27 years with BP plc where he held executive roles including worldwide Director

of Drilling. He co-founded Silverstone Energy Limited in 2005. Steve is a Non-executive Director of

Seamwell Limited and, until the recent merger, of Valiant Petroleum plc.

4

Topics Today

Trinidad

Goudron Field

Infrastructure

Drilling update

Production

Cedros Peninsula

Goudron Station 207

Spain

Ayoluengo Field update

Pansoinco Partnership

Summary

Share Price Performance

Financing

Ayoluengo Well 37

5

TRINIDAD

6

LGO’s Trinidad Assets

Goudron IPSC (100%) with 2P reserves

of 7.2 mmbbls and over 60 mmbbls of

contingent resources associated with a

future water flood. Active production

from 70 reactivated wells and growth

from imminent 30 well infill drilling

Icacos Field in the Cedros Peninsula

(50%, non-operator), producing ~35

bopd from three wells. Future

opportunities for infill drilling

Over 7,500 acres of largely unexplored

100% owned private oil leases in the

Cedros and adjacent rights held in

partnership with Beach Oilfield Limited

7

Goudron Phase 1: Infrastructure

• Located in the remote primary forests of

the Trinity Hills close to a Wildlife

Sanctuary

Sales Tank Battery #34

• Limited work undertaking for 30 years

• LGO has:

• Doubled sales tank capacity

• Refurbished previous tank facilities

• Repaired bridges and roads

• Installed an entirely new camp

facility

• Extended and restored electrical

power

• Constructed new water treatment

facilities

• Reactivated about 70 old wells

8

Goudron Phase 1: Infrastructure

• A newly commissioned

camp with:

•

•

•

•

•

•

offices

workshops

stores

hot-work area

crew rest area

accommodation

• All key infrastructure is

now in place for the

upcoming 30 well drilling

campaign

and

• for oil production of over

2,000 bopd

Goudron Camp David

9

Goudron Phase 1: Production

• Phase 1 reactivations have now

peaked

• Some reactivations still ongoing with

potential for further recompletions,

gas lift and condensate production

• Considering a long term stable

economic rate of 275 – 325 bopd

from the old wells

• Focus on Phase 2 production which is

budgeted conservatively at 65

bopd/well (IP)

• Upside in new wells estimated +150%

of budget (~160 bopd), downside is

estimated at -25% (~45 bopd)

Goudron Typical Well

10

Goudron Phase 1: Production – Typical Well

Drilled in 1957, completed in 290 feet of Goudron Sand, produced 78,020 bbls over 15 years

11

Goudron Phase 2: Development Drilling

• Production to date, using primary

pumped wells, has achieved recovery

of less than 4 million barrels

• Significant parts of the field have not

be swept, especially at Cruse level

• Previous drilling techniques can be

vastly improved

• A program of 30 new development

wells, infilling and extending the

field, is now underway

• Rig mobilisation started 16th April

• STATUS: rig components and

equipment transferred to the field

and rig-up underway

Rig 20 at Palo Seco

12

Goudron Phase 2: Well H18 EJ7

H18EJ7

H18 EJ-7 is the

first new well

on Goudron

for 33 years

Goudron

Sands are

productive in

offset wells

Gros Morne is

productive in

nearest well

Lower Cruse

sands are

productive in

some wells

13

Cedros Peninsula

14

LGO Cedros Lease Position

Installing new well tanks

Beach Oilfield Cedros Leases

FRM-1 Deep Well

3D Seismic

LGO Cedros Leases

In-line 4100

Icacos Field

Bonasse Field

Icacos Leases

Galpha Point

15

LGO Cedros – 3D Seismic Data

South

Installing new well tanks

0 sec

North

Icacos

Southern Range Anticline

1 sec

2 sec

In-line 4100

3 sec

16

Plans for the Cedros

• In collaboration with Beach Oilfield

re-evaluate all existing data and

wells

Installing new well tanks

• Acquiring a soil geochemistry

survey to isolate micro-seepage and

areas of fractionated light oil

• Fly a high resolution gravity and

magnetics survey

• Acquire additional 2D seismic data

if necessary to define well locations

• Drill at least one deep exploration

well to test the potential at Herrera

Sandstone level

Galpha Point Mud Volcano

17

Unexplored deep prospectivity

Oil impregnated Herrera Sandstone

from ~10,000 feet sub sea, thrown up

by the Galpha Point Mud Volcano

Installing new well tanks

18

SPAIN

Ayoluengo Field, Cantabrian National Park, Spain

19

Spanish Assets

Onshore Northern Spain

Cantabrian mountains between

Burgos and Santander

Ayoluengo Oilfield

Discovered 1964

Produced 18 mmbbls

Oil in place 104 mmbbls

Hontomin Oilfield

Discovered 1968

Test production only

Oil in place < 4 mmbbls

Tozo Gas Field

Discovered 1965

Test production only

Gas in place 5 bcf

20

Ayoluengo Potential

• Future opportunities to enhance

production through the sidetracking of existing wells to reach

unswept oil

• Major investment only justified

once the Concession is extended

• Concession extension process to

commence in 2014

• Probable timeline to complete

extension 18-24 months

• Seismic, sedimentological and

engineering studies now

underway in parallel

Ayoluengo Field

21

Wider Spanish Potential

• Development of Hontomin as a

low cost satellite to Ayoluengo

using existing 3D seismic and

re-entry of existing wells

• Development of Tozo as either

a micro-Compressed Natural

Gas or Gas-to-Wire project

• Deepen Ayoluengo to the

proven Liassic reservoirs

• Sub-lease the shale gas

exploration potential in the

Sedano trough?

• Secondary or tertiary recovery?

Cantabrian Massif at Sergentes

22

Proposed Pansoinco Partnership

• Italian privately owned oil and

gas maintenance and

operations group

• Create access to Pansoinco’s

resources to enhance

production at no cost to LGO

for 3 years

• LGO’s predicted 3-year

cashflow is advanced to the

date of transaction

• Incentivises Pansoinco to invest

in production growth and seek

a concession extension to 2027

Well work over Ayoluengo

23

How it works…

2500

LGO receives estimated 3-year discounted cashflow

2000

Revenue interest

reverts to 65:35%

Quarterly Net Revenue ('000 Euro)

1500

1000

Pansoinco makes a return

500

0

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

4Q16

1Q17

2Q17

-500

Pansoinco invests

-1000

-1500

-2000

-2500

Base revenue

LGO net

Pansoinco planned investment

Pansoinco net case

24

Why it works…

At the end of the 3-year period:

• Ownership of revenue reverts

to 65:35%

• LGO’s 35% revenue is greater

than the 100% of base revenue

that would have resulted

• In the interim LGO has had use

of $2.8 million to deploy in

Trinidad

600

Quaterly Net Revenue ('000 Euro)

• Pansoinco have made a

worthwhile return on their

investment (IRR > 30%)

700

500

400

300

200

100

0

4Q16

Base revenue

1Q17

LGO net

2Q17

Pansoinco net case

25

CONCLUSIONS

26

Share Price Progression

Equity

£1.3

Royalty

Reduction

BOLT

Pansoinco

Partnership

Reduced taxation

500 bopd

Goudron

CEC

High Court

Mobilisation

27

Conclusions

• Phase 1 production at Goudron from legacy wells now planned to

stabilise at a long-term rate of roughly 275-325 bopd

• Phase 2 development drilling underway in next few days; forecast to

take total production to 2,000 bopd within 18 months

• Once some of the new wells have been drilled LGO will develop a

Phase 3 water flood development plan and issue a new CPR

• Exciting medium term opportunity in the Cedros peninsula

• Relationship with Pansoinco could provide a short-term cash boost

and a long-term value driven partnership in Spain

• Debt funding based on established cash-flow and underlying

reserves at Goudron is still actively being sought

• New production-based opportunities in Trinidad are being reviewed

28

Thank you for your attention

29

Forward Looking Statements

Certain statements in this presentation are “forward looking statements” which are not based on

historical facts but rather on the management’s expectations regarding the Company's future growth.

These expectations include the results of operations, performance, future capital, other expenditures

(amount, nature and sources of funding thereof), competitive advantages, planned exploration and

development drilling activity including the results of such drilling activity, business prospects and

opportunities. Such statements reflect management's current beliefs and assumptions and are based

on information currently available.

Forward looking statements involve significant known risks, unknown risks and uncertainties. A

number of factors could cause the actual results to differ materially from the results denoted in these

statements, including risks associated with vulnerability to general economic market and business

conditions, competition, environmental and other regulatory changes, the results of exploration,

development drilling and related activities, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and underinsured losses and other factors, many

of which are beyond the control of the Company.

Although these statements are based upon what management believes to be reasonable assumptions,

the Company cannot assure investors that the actual results will be consistent with these forward

looking statements.

30