sadie*s western wear - Edwards School of Business

advertisement

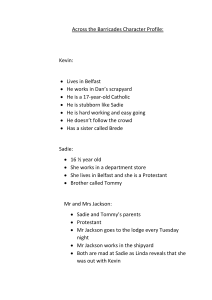

SADIE’S COUNTRY ‘N’ WESTERN SADIE’S COUNTRY ‘N’ WESTERN Sherry Deissner Krista Grahn Chris Harding Zaya Kadyrova Maura Kearney Proposal Outline Business Potential and Proposal Marketing Plan Operations Plan Human Resources Plan Financial Plan Business Value and Profitability Potential and Proposal Sadie’s Country ‘n’ Western Products Western wear Casual wear Rancher’s supplies and tack (saddles, bridles, halters, leads, etc.) Location: Champion, Alberta Potential and Proposal Champion Potential and Proposal Value in the concept One-stop shop idea Fulfills a need of working area residents (farmers and ranchers) Convenience Low prices Mission Statement Sadie’s Country n’ Western is a retailer of country supplies and casual and Western wear for men, women, and children. Sadie’s is dedicated to providing convenience of a onestop destination of choice for families of Southern Alberta at competitive prices. Goals Short term goals: 1) Secure our desired location in the mini mall of Champion, Alberta 2) Acquire the necessary financing 3) Enter into supplier agreements with desirable terms 4) Become profitable in the first few years of operations 5) Achieve market share of 10% in the Vulcan County and 1-2% in surrounding counties Goals Long term goals: 1) Monitor key ratios against industry and achieve performance that is at least at par with industry standards 2) Become a well-recognized brand name in Southern Alberta and Western Canada 3) Maintain healthy positive cash flows from operations 4) Maintain low overhead and other operating costs 5) By year 5 or 7 Sadie hopes to open a new location in Lethbridge, AB. If the current location proves to be as successful as projected, a franchising plan will be created enabling us to open new locations across Southern Alberta and Western Canada. Market Overview Target geographic area Vulcan County and other nearby counties 61,803 people, excluding Lethbridge Aiming to get 10% market share Predominately rural Target population Price-sensitive ranchers and farmers Visitors Industry Overview Target geographic area Industry Overview Competition Economic trends Lammle’s Barriers to entry No direct competition in target area Positive in Alberta Food prices Recession/cost of fuel Consumer trends Marketing Plan Place Product Mini mall Convenience, affordability, necessity Promotion Catalogues Stampede Flyers Billboards Price Revenue and Marketing Costs Operations Plan Organizational Structure Incorporation Positive net income anticipated Protection from personal liability Tax deferral opportunities Operations Plan Site Plan -Mini-Mall on 1st Avenue Main St, Champion Operations Plan Floor Plan st Avenue 1st 1Avenue Clothes Clothes Toys Toys Gifts Tack Gifts Tack Change Change Room rooms Wash Was Room hroo Register Register Storage/Receiving Storage / Receiving Operations Plan Daily Operations Store Manager Hours of Operation Daily Activities Stampede Operations Plan Suppliers Traditional Western Designs Exclusive contracts (Weaver Leather) Stable well known suppliers North American Based suppliers Operations Plan Working Capital Cash $ 50,000.00 Accounts Receivable $ Inventories $ 109,863.43 Accounts Payable $ Total Net Working Capital $ 160,968.21 1,104.78 - Operations Plan Capital Budget Summary Cash Register's and Micro's POS System $ Furniture and Fixtures $ 40,000.00 Leasehold Improvements $ 20,250.00 Trailor $ 15,000.00 Leasing Deposit $ Net Working Capital $ 160,968.21 Total Capital Required $ 248,218.21 6,000.00 6,000.00 Operations Plan Cost of Sales Western wear Casual wear Gifts Saddles Tack $ $ $ $ $ $ Revenue 415,743.83 141,968.75 61,950.00 110,477.50 58,078.13 788,218.20 Markup 85% 85% 65% 60% 85% $ $ $ $ $ $ COS 224,726.39 76,739.86 37,545.45 69,048.44 31,393.58 439,453.73 GPM% 46% 46% 39% 38% 46% 44% $ $ $ $ $ $ GM 191,017.43 65,228.89 24,404.55 41,429.06 26,684.54 348,764.47 Operations Plan Working Capital Management Cash Management Inventory Management Accounts Receivable Accounts Payable Operations Plan Working Capital Management Liquidity management Inventory management AR Policy AP Policy Operations Plan Annual Operating Expenses Gas $ 4,515 Bookkeeping $ 5,040 Electricity $ 9,996 Accounting $ 1,500 Insurance $ 4,000 Legal $ 3,800 Rent $ 35,000 Site Security $ 348 Telephone $ 720 CCA $ 9,775 Office Expenses $ 6,000 Interest Expense $ 7,447 Stampede Wages $ 1,360 Marketing Expenses $ 106,810 Wages $ 72,264 $ 269,935 Human Resources Plan Sadie – Owner Manager Will work full time (40 hrs) Ordering Receiving Hiring, training, and supervision Nightly cash out (when required) Bank deposits Estimated annual salary $45,000 Human Resources Plan Sales associates Will work part time (20 hrs) Customer enquiry and assistance Stocking goods Taking payment and cashier duties (cash out) Wage: $10/hr Training: on-the-job Financial Plan Highlights: Year 1 Year 2 Year 3 Year 4 Year 5 Net income 35,555 156,624 351,491 360,382 369,764 Cash flows from operations 47,741 171,614 362,576 372,937 382,903 Debt / Equity 1.4 0.9 0.5 0.3 0.2 Current ratio 2.7 3.1 3.7 4.9 6.1 Net Present Value Net Present Value $177,317 IRR 44% Financial Plan How does Sadie’s stack up? Gross margin % (GM%) Industry average Year 1 Year 2 Year 3 Year 4 Year 5 47% 42% 41% 41% 41% 41% Financial Plan How does Sadie’s stack up? Pre-tax profit % Industry average Year 1 Year 2 Year 3 Year 4 Year 5 5% 6% 17% 25% 25% 25% Financial Plan How does Sadie’s stack up? Inventory turnover ratio Industry average Year 1 Year 2 Year 3 Year 4 Year 5 3.4 4 4 4 4 4 Financial Plan How does Sadie’s stack up? Current ratio Industry average Year 1 Year 2 Year 3 Year 4 Year 5 1.7 2.7 3.1 3.7 4.9 6.1 Financial Plan – Sensitivity Analysis Sources of Financing Capital (financing required) $124,000 Character Collateral Capacity Conclusion Competitive advantage Low prices Untapped market potential Low labour and overhead costs Moderate risk Simple business model Profitable Q&A