A Close Look at Unemployment Transition Rates in the 2007-2009

advertisement

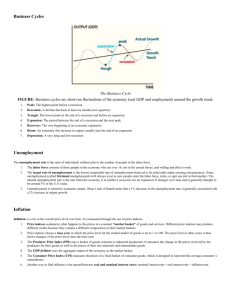

Sundheim 1 Long Has Become Too Long: A Close Look at Unemployment Transition Rates in the 2007-2009 Recession Elizabeth Sundheim December 2012 Advisor: Professor Bryan Engelhardt Abstract Since the trough of our most recent recession, the unemployment rate has began to decline slowly. However, unlike any other recession, the average number of weeks the unemployed remain without a job continues to increase. The lack of correlation has left many perplexed as to how the 2007-2009 recession differs from previous recessions. This paper investigates how unemployment transition rates during the 2007-2009 recession changed in the presence of observable and unobservable heterogeneity compared to previous recessions. Using data from the Current Population Survey and a separated markets approach, the hazard rate for various types of people is estimated using maximum likelihood estimation. Furthermore, I estimate the average lengths of unemployment for various groups of people and the proportion of people falling into these groups to see if the lengths and proportions have changed. Results show that for some types of people the hazard rate has considerably changed compared to previous recessions. Additionally, the findings suggest that while lengths of unemployment for various groups of people have remained unchanged, the proportions of people falling into these groups have changed during our most recent recession. Sundheim 2 Introduction During the 2007-2009 recession, leading news outlets published and broadcasted frightening headlines, portraying the 2007-2009 recession as the worst recession the United States has ever experienced. While many individuals may find this to be true, the 2007-2009 recession is both comparable and contrastable to previous recessions. Similar to previous recessions, the unemployment rate rose drastically during the 2007-2009 recession.1 However, unlike previous recessions, the duration of unemployment for the average unemployed individual during the 2007-2009 recession increased substantially. Ben Bernanke, Federal Reserve Chairman, has referred to this rise as a “national crisis” (Crutsinger 2011). While the duration of unemployment for the average unemployed person did increase during previous recessions, it never increased as high as it did during the 2007-2009 recession. These similarities and differences between recessions are most clearly depicted in Figure 1 and Figure 2. For example, looking at the trends in Figure 1, the average individual in the labor force during the early 1980s and 2007-2009 recessions experienced similar unemployment rates. Looking at the trends in Figure 2, the average individual in the labor force during the early 1980s and 2007-2009 recessions experienced very different unemployment durations. After closely comparing a previous recession with our most recent one, it is evident that the unemployment rate does not always play a direct role in determining the spike in average duration of unemployment during a particular time period. The rapid increase in unemployment duration during the 2007-2009 recession left many distressed and confused. Understanding labor market cycles and fluctuations, many government officials and economists thought that even though this duration rose significantly, it would slowly decrease during the economic recovery. 1 According to the Bureau of Labor Statistics, an unemployed person is one who does not have a job, has actively looked for work in the prior 4 weeks, and is currently available for work (Bureau of Labor Statistics 2011c). Sundheim 3 Now three and a half years after the trough of the recession, what was expected to happen has hardly begun to occur. Throughout the economic recovery of this most recent recession, the average duration of unemployment continued to rise, leaving many still concerned and perplexed. Figure 2 clearly depicts this. From June 2009, the trough of the recession, until October 2012, the average length of unemployment for an individual increased by 16.3 weeks. Figure 1: Unemployment Rate Source: Bureau of Labor Statistics Figure 2: Average Weeks Unemployed Source: Bureau of Labor Statistics In order to better understand the substantial rise in the duration of unemployment, this paper examines how unemployment transition rates have changed throughout the past 4 Sundheim 4 recessions in the presence of observable and unobservable heterogeneity. To determine whether previous recessions were different, I estimate the hazard rate using maximum likelihood estimation for a variety of types of people. Furthermore, I estimate the average lengths of unemployment for various groups of people and the proportion of people falling into these groups to see if the lengths and proportions have changed. All estimations use data from the Current Population Survey. To prevent long unemployment spells from occurring in the future, understanding long term unemployment during the 2007-2009 recession is extremely important for both our economy and the labor market. People who are unemployed for extended periods of time are likely to experience financial hardship (Kaiser Family Foundation 2011). Additionally, as duration of unemployment increases, the unemployed are found to devote less time to job search (Krueger and Mueller 2011). Furthermore, it is probable that the longer a person is unemployed, the less employable they become. It has been found that long unemployment spells lead to a depreciation of a worker’s human capital (Pollak 2012). While not in the labor market, unemployed persons are not always able to keep up with the advancements in their industry and subsequently their skill sets deteriorate. Many policy implications and structural changes to job search programs could possibly result from a better understanding of the hazard rates in the 2007-2009 recession. Background Literature Economists have speculated potential economic and societal factors that have lead to the sharp increase in the duration of unemployment. While testing these factors has certainly helped us begin to comprehend why the 2007-2009 recession experienced unemployment spells unlike any other recession, it has not helped us understand how unemployment duration during the Sundheim 5 2007-2009 recession structurally differed from previous recessions. For both the 2007-2009 recession and previous recessions, examining changes in population parameters and transition rates in the presence of observable and unobservable heterogeneity can potentially aid in the understanding of the increase in the duration of unemployment during our most recent recession. A common misconception is that the unemployed all face a similar situation during a recession, that is being unemployed for a long period of time. Calculating population parameters in the presence of unobservable and observable heterogeneity assists in distinguishing between the varying lengths of unemployment during a recession and the proportion of unemployed persons experiencing these lengths. Calculating transition rates helps explain how the probability of finding a job varies over the duration of unemployment for various unemployed persons. While this paper will explain how transition rates and population parameters in the presence of observable and unobservable heterogeneity have changed throughout several recessions, it will not pinpoint a reason why they have changed. Nevertheless labor economic theory provides potential explanations for these changes. Two theoretical models that very likely may explain these changes are job search intensity and directed search. Economists such as Eckstein, Wolpin, and Moen have greatly explored these theories empirically and theoretically. Search intensity can be defined as the time and effort put into searching for a job or the number of “units of search” supplied by a given individual. Search units are increasing in cost and are chosen optimally to maximize the net returns from job search. Various types of people choose a different number of search units, depending on their search costs, the cost of unemployment, and their expected returns from employment (Petrongolo and Pissarides 2001). During economic downturns, it has been found that the marginal product of search intensity falls both because of a decline in the probability of obtaining a job conditional on a given search Sundheim 6 intensity and because of a decline in the expected present value of income from a job (Shimer 2004). As a result of much discouragement, it is possible that there was a greater decline in search intensity during the 2007-2009 recession compared to previous recessions, causing the unemployed to spend an extended period of time searching for a job. Directed search can best be understood in terms of the decision process that occurs when deciding which job openings to apply to. Assuming a distribution of wage offers, the unemployed can decide between jobs that offer high wages and those that offer low wages. The varying wage offers may be a result of identical firms offering different wages (Burdett and Mortensen 1998) or match heterogeneity (Jovanovic 1979). When appplying to jobs, individuals choose a reservation wage and reject all wage offers below the reservation wage (Petrongolo and Pissarides 2001). An increase in the percentage of the unemployed having a high reservation wage could have greatly increased the duration of unemployment during the 2007-2009 recession. The unemployed may have been more likely to apply to the jobs with higher wages, neglecting the jobs with lower wages. This phenomenon may have created a more competitive labor market for high paying jobs and as a result extending unemployment duration and the job search process for many. Even though economists have not thoroughly examined structural changes in the duration of unemployment during our most recent recession, economists, using a wide variety of methods, have empirically tested possible factors that have lead to the sharp increase in unemployment duration. Such factors include changing characteristics of the labor force, extension of Unemployment Insurance benefits, and weak labor demand. Aaronson, Mazumder, Schechter (2009) investigate the effect of changes in age and other workforce characteristics on the rise in the duration of unemployment. In order to complete their study, they utilize individual-level data Sundheim 7 from the U.S. Bureau of Labor Statistics’ Current Population Survey and an approach called a Blinder/Oaxaca decomposition. Their analysis begins by showing that the significant rise in the average duration of unemployment between the mid-1980s and the mid-2000s can best be attributed to demographic changes in the labor force. In comparison to the early 1980s, Aaronson et al. (2009) find that at the end of 2009 only half of the increase in the average duration of unemployment can be explained by demographic factors that were present much before the recession began, leading them to believe there are new recent factors contributing to the rise. Thus, to further this empirical study, they examine how much of the remaining increase can be attributed to weak labor demand and extensions of unemployment insurance benefits. Their results show that the remaining unexplained increase is due mainly to weak labor demand, which is reflected by low levels of hiring. Only about 10-25% of the increase in the duration of unemployment from mid 2008 to the end of 2009 is associated with extensions of unemployment insurance benefits. One drawback of this study is that Aaronson et al. (2009) do not provide sufficient statistics on how demand is getting distributed. Another economist has also assessed whether the recent surge in unemployment duration can be explained by the extension of Unemployment Insurance (UI) benefits from the normal 26 weeks to a maximum of 99 weeks for most eligible workers. Using the haphazard roll-out of the Emergency Unemployment Compensation and Extended Benefits programs during the 20072009 recession, Rothstein (2011) explores the impact of the recent UI extensions on job search and reemployment. Employing the longitudinal structure of the Current Population Survey (CPS), Rothstein (2011) develops hazards rates for unemployment exit, reemployment, and labor force exit that differ between states, over time, and among individuals with different unemployment durations. Calculating these hazard rates helps Rothstein (2011) distinguish the Sundheim 8 effects of UI extensions from other factors on employment and unemployment outcomes. The results of his study show that extensions of UI benefits had significant but small negative effects on the likelihood that the unemployed, most of which were long-term unemployed, would reenter employment. Because workforce characteristics and extended UI benefits have been found to impact only slightly the substantial rise in the duration of unemployment, Valletta and Kuang (2012) proposed that other factors must hold primary responsibility for the recent rise in unemployment duration and empirically tested these proposed factors. Of these, they believe that the most apparent is the severity and persistence of job losses in comparison to previous recessions. In order to empirically test this, Valletta and Kuang (2012) both follow and add to the approach used by Aaronson et al. (2010) by including measures of cumulative employment losses. The data used in their study comes from the CPS; it includes the most recent recession and its aftermath and the early 1980s recession and its aftermath. Using monthly CPS data on individual unemployment duration for these time periods, they calculate the percentage change in payroll employment relative to the pre-recession peak. They then use this percentage as an explanatory variable in a statistical exercise. Completing this exercise, Valletta and Kuang (2012) find that changes in workforce characteristics and cumulative employment losses explicate much of the increase in the unemployment duration of the recent recession compared to the early 1980s recession. For example, unemployment duration was 15.7 weeks longer for the 12 months leading up to August 2011 than for the 12 months leading up to January 1985. Of those weeks, 4.1 can be explained by changes in workforce characteristics and 7.5 can be explained by the longer length and persistence of employment losses during the most recent recession. Therefore, there are still 4.1 weeks that remain unexplained. They find that this number of weeks is only Sundheim 9 slightly larger than the estimated 3.5-week effect of extended UI benefits discussed in Daly et al. (2011). In conclusion, they find that weak labor demand is the primary explanation for the increase in the duration of unemployment. Nonetheless, Valletta and Kuang (2012) do not provide us with enough insight as to how this weak labor demand is getting distributed. While each of these factors that the economists have researched has affected the rise in unemployment duration in some way, they all cannot fully explain the increase. The question as to why there has been an increase in the duration of unemployment still remains unanswered. Data Individual level CPS data from the Integrated Public Use Microdata Series (IPUMSUSA) was used to examine maximum likelihood estimators and hazard rates in the presence of observable and unobservable heterogeneity. The individual level CPS data set captures duration of unemployment, for the CPS has been asking participating respondents their duration of unemployment since 1948. The question about unemployment duration is asked to a specific group of respondents, including unemployed people who were not interviewed in the prior month and newly unemployed people. The length of unemployment duration for an unemployed person is automatically updated for those who continue to be unemployed in the following month (Bureau of Labor Statistics 2011a). Duration of unemployment represents the length of time (through the current survey week) during which unemployed persons are continuously looking for work. For persons on layoff, the duration of unemployment differs. It represents the number of full weeks since the end of the person’s most recent layoff (Bureau of Labor Statistics 2011b).2 2 The CPS duration measure has not remained consistent since it was first recorded. A few changes with regards to maximum recorded value have been made. The first change occurred in January 1994 when the maximum was increased from 99 weeks to 117 weeks. Also, in 1994 there was a questionnaire adjustment. This adjustment slightly increased the duration of unemployment for people who are unemployed in consecutive survey months (Valletta and Kuang 2012).The second change, a notable one, occurred in January 2011. Up until January 2011, the CPS allowed unemployed survey respondents to report unemployment Sundheim 10 To account for observable heterogeneity, a few individual level CPS descriptive variables were chosen to divide the numerous observations into four specific groups. A separated markets approach is preferred due to its flexibility over a proportional hazards model. This approach is similar to that used in Flinn (1986) and Eckstein and Wolpin (1995). The individual level CPS data was broken down into the following groups: 16-34 year olds who have less than a high school diploma and those who have a high school diploma (or the equivalent) but no further education, 16-34 year olds who have completed some college but no degree and those who have received an Associate’s Degree, Bachelor’s Degree, Master’s Degree, Professional Degree, or Doctorate Degree, 35-54 year olds who have less than a high school diploma and those who have received a high school diploma (or the equivalent) but no further education, 35-54 year olds who have completed some college but no degree and those who received an Associate’s Degree, Bachelor’s Degree, Master’s Degree, Professional Degree, or Doctorate Degree. A further breakdown than that mentioned above would have resulted in too few observations to be in each group. For instance, an additional breakdown by occupation would cause group totals to fall far below 300 observations. Understanding the structure of the duration of unemployment during the 2007-2009 recession required comparing the 2007-2009 recession to previous recessions. To remain consistent when comparing recessions, the data used to compare recessions came from the March data set following the trough of each recession. Specifically, the March CPS data set was chosen due to the fact that it is known to have a key supplement and is the standard month to use. The trough of each recession was determined by the National Bureau of Economic Research, the durations of up to 2 years. If a person reported as being unemployed for longer than 2 years, his/her unemployment duration was entered in the data set as 2 years. However, starting in January 2011, there was a large increase in the maximum duration of unemployment that could be reported by a participant; the CPS allowed unemployed survey respondents to now report unemployment durations of up to 5 years. Because the data used in my empirical analysis does not include the year 2011, this drastic increase in the average length of unemployment will not affect my results. Sundheim 11 official attributor of US business cycle expansions and contractions. For the early 1980s recession, the trough occurred in November 1982 and therefore March 1983 data was used. For the early 1990s recession, the trough occurred in March 1991 and therefore March 1992 data was used. For the early 2000s recession, the trough occurred in November 2001 and therefore March 2002 data was used. For the 2007-2009 recession, the trough occurred in November 1982 and therefore March 1983 data was used. Method and Estimation Flinn (1986) explores whether an unemployed person’s probability of finding a job decreases the longer he or she is unemployed. In doing this, the work provides a method to estimate parameters of alternating renewal process models of labor market attachment in the presence of observable and unobservable heterogeneity. Assuming a Weibull distribution, he used maximum likelihood estimation to estimate the distribution parameters (Flinn 1986). While employing Flinn’s methodology and framework, my goal is to compare and contrast hazard rates across time for various demographic groups to determine how the transition rates have changed. The Weibull distribution has a simple distributional form. Despite this simplicity, changes in the Weibull distribution’s two parameters (alpha and lambda) allow the distribution to take a variety of shapes. However, the Weibull distribution was not used in my empirical analysis due to its lack of sufficient flexibility. Because it allowed for relatively more flexibility and is non-monotonic, the Lognormal distribution was used. Like the Weibull distribution, the Lognormal is most commonly used to model failure times. Changes in the two parameters of the Lognormal distribution (mu and sigma) allow for much more flexibility than changes in the Weibull distribution’s two parameters. After graphing the Probability Density Function and Sundheim 12 Cumulative Distribution Function of both the Weibull and Lognormal, this difference in flexibility can most clearly be seen Figure 3. Figure 3: Cumulative Distributive Function Probability Density Function Similar to Flinn (1986), this analysis investigated observable and unobservable heterogeneity. As mentioned earlier, observable heterogeneity was controlled for based on a separated markets approach. After separating the data into four different groups, preliminary work relayed not controlling for unobservable heterogeneity for each group does not generate nearly as good a fit as accounting for unobservable heterogeneity within each group. Focusing on the conditional distribution of unemployment spells in the presence of unobservable heterogeneity, I considered characteristics of a group of people that are unobservable to a researcher (i.e. characteristics of people that are not available in a data set). By controlling for unobservable heterogeneity, I was able to determine whether within one group of people there are many different types of people. This further breakdown of a group is not initially possible when only looking at observable characteristics available in a data set. While accounting for Sundheim 13 unobservable heterogeneity does not reveal what exact characteristics further separate a group of a people, it allows for inferences to be made about how and when different types of people ‘match’ in the labor market. Accounting for unobservable heterogeneity, each of the four demographic groups was broken down into two further groups. Further breakdowns did not cause the log likelihood value to increase substantially, indicating that two unobservable groups were sufficient. Estimates of the population parameters in the presence of unobservable heterogeneity were determined where the population distribution was assumed to be Lognormal. Assuming a Lognormal distribution, it was important to correct for the length-biased sampling problem due to the possibility that the data sample is dominated by people who are unemployed for extended periods of time. Adjusting for length biasness, the following equation was used to solve for the population parameters and log likelihood value in the presence of unobservable heterogeneity: 1 − 𝐹1 (𝑡) 1 − 𝐹2 (𝑡) ℒ = ∑ log (𝑝1 ( ) + 𝑝2 ( )) µ ̅̅̅1 µ2 ̅̅̅ Where 𝐹𝑖 (𝑡) = ∫ 𝑡𝜎 1 𝑖 √2𝜋 𝑒 1 )(ln 𝑡− µ𝑖 )2 2𝜎𝑖 2 −( 𝑑𝑡, µ𝑖 = 𝑒 µ𝑖 + 𝜎𝑖 2 2 . The log likelihood value, or the maximum likelihood estimator, found above can be defined as the most likely values of distribution parameters for a set of data. It is found by maximizing the value of the likelihood function. Not only was the maximum likelihood estimator calculated for the unrestricted case for each recession, but also for several restricted cases (all population parameters for each recession were set equal to the 2007-2009 populations parameters, the unobservable heterogeneity parameter, p, for each recession was set equal to the 2007-2009 population parameter, p, and the hazard parameters, µ1,𝜎1, µ2 , 𝜎2 , for each recession were set Sundheim 14 equal to the 2007-2009 hazard parameters, µ1,𝜎1, µ2 , 𝜎2 ). The likelihood ratio test allowed me to determine how the 2007-2009 recession, if at all, differed from the three previous recessions. Without calculating the mean and median, it is initially difficult to determine the length of unemployment exhibited by the population parameters, µ and 𝜎. Knowing the mean and median associated with a particular µ and 𝜎 assists in comparing two different groups and different recessions to one another. The equation to determine the mean of the Lognormal distribution is 𝑥 = ℯ µ+𝜎 2 /2 . The equation used to determine the median of the Lognormal distribution is 𝑥̂ = ℯ µ . After calculating the population parameters and the log likelihood value in the presence of unobservable heterogeneity, the hazard rate was calculated. The hazard rate is the instantaneous rate of an individual leaving a state given that the individual has not left the state as of a certain time (Flinn 1986). Namely, it is the probability that an individual transitions at a particular time. For the Lognormal distribution, the hazard rate is not constant over the time interval(0, ∞). The following equations were used to solve for the hazard rate: 𝐻𝑎𝑧𝑎𝑟𝑑 𝑅𝑎𝑡𝑒 = f(𝑡)⁄[1 − 𝐹(𝑡)], 𝑤ℎ𝑒𝑟𝑒 𝑓(𝑡) = 𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦𝐷𝑒𝑛𝑠𝑖𝑡𝑦 𝐹𝑢𝑛𝑐𝑡𝑖𝑜𝑛 = 1 𝑡σ√2𝜋 ∞ 𝐹(𝑡) = 𝐶𝑢𝑚𝑚𝑢𝑙𝑎𝑡𝑖𝑣𝑒 𝐷𝑒𝑛𝑖𝑠𝑡𝑦 𝐹𝑢𝑛𝑐𝑡𝑖𝑜𝑛=∫0 1 𝑒 𝑒 𝑡σ√2𝜋 1 − ( 2 )(ln 𝑡−µ)2 2σ , 𝑎𝑛𝑑 1 )(ln 𝑡−µ)2 2σ2 −( 𝑑𝑡. When differentiating between homogenous groups of people within different recessions, the likelihood ratio test was utilized to test for statistical significance. The likelihood ratio test Sundheim 15 tests for homogeneity of parameters and thus helps indicate the homogeneity of a distribution function across groups (Flinn 1986). The likelihood ratio test was used in this empirical analysis to determine how the 2007-2009 recession differed from the three previous recessions, thus the reason for re-estimating the likelihood function. Nevertheless, the test was also employed to determine the homogeneity among other recession groupings (1.1983, 1992 and 2002; 2.1992 and 2002; 3. 1983 and 2010). The first grouping was chosen to determine whether the early 1980s, early 1990s, and 2002 recessions were at all similar if the primary likelihood ratio test indicated that the 2007-2009 recession differed from them. The second and third were chosen conditional on the similar unemployment rates during those recessions. The likelihood ratio test provides the means for comparing the maximum likelihood estimator under one hypothesis, termed the alternate hypothesis, against the maximum likelihood estimator under another more restricted hypothesis, termed the null hypothesis. For example, the null and alternate hypotheses shown below were used to determine whether the 2007-2009 differed from previous recessions. H0: µ183 = µ192 = µ102 = µ10 1 𝜎183 = 𝜎192 = 𝜎102 = 𝜎110 HA: Not all population parameters are equal In order to fail to reject the alternate hypothesis, the null hypothesis must be rejected. We can define L1 as the maximum log likelihood estimator when parameters are not restricted, and we can define L0 as the maximum log likelihood estimator when parameters are restricted. The difference between the two log likelihoods is calculated and then multiplied by two, known to be a Chi squared statistic. To then compute a p value, the likelihood ratio must be evaluated assuming a Chi Distribution with the necessary degrees of freedom. The degrees of freedom are Sundheim 16 equal to the difference between the number of parameters being evaluated in the alternate hypothesis compared to the null hypothesis. This p value is compared to a critical value to determine whether or not you reject or fail to reject your null hypothesis. The results of the likelihood ratio test were evaluated at a 5% significance level. Results 16-34 Year Olds with a High School Diploma After controlling for unobservable heterogeneity during the four recessions, those in the 16-34 year old age group who have received a high school diploma or less were broken down into two distinct groups. While in some respect these groups remained similar throughout the different recessions, they become increasingly different. They remained the same such that there was one group during each recession that remained unemployed for a much longer period of time compared to the other group. Referencing Table 2, the group that remained unemployed for a longer length of time will be referred to as Group #1, while the group that experienced a shorter duration of unemployment will be referred to as Group #2. Differentiating between which group of the two remained unemployed for a longer period of time and which was unemployed for a shorter period of time requires comparing the µ(s) of both groups. The group with the larger µ signifies the group that was unemployed for a greater length of time. For example, Group #1 for the early 1980s recessions has a µ =2.7951 and a 𝜎 =0.3186, and Group #1 for the early 1990s recession has a µ =2.8291 and a 𝜎 =0.2827. Therefore, Group #2 for the early 1980s recession has a µ =.9045 and 𝜎 =0.7518, and Group #2 for the early 1990s recession has a µ =0.7712 and 𝜎 =0.7170. The average duration of unemployment for Group #2 remained relatively the same throughout the four recessions. During the early 1980s, early 1990s, 2002, and 2007-2009 Sundheim 17 recession, the average duration of unemployment was 4, 3, 2, and 4 weeks respectively. However, the proportion of the people in that group was by far the smallest during the 20072009 recession. Unlike Group #2, the average duration of unemployment for Group #1 fluctuated throughout the four recessions. The average duration of unemployment during the four recessions was 15, 18, 9, and 18 weeks, respectively. The proportion of people in this group was the largest during the 2007-2009 recession. Even though the early 1990s and 2007-2009 recession had a similar average length of unemployment, the proportion of people who experienced this length greatly differed. About 14% of the unemployed fell in this group in the early 1990s recession and about 45% of the unemployed fell in this group in the 2007-2009 recession. The graphed hazard rates for both Group #1 and Group #2 clearly depict the differences between the four recessions. As can be seen from the graphed hazard rates for Group #1, the probability of finding a job during the early 1980s, early 1990s, and 2007-2009 recessions followed the same pattern, the probability of finding a job steadily increased during the first 25 weeks of unemployment but then slowly leveled off for the remaining weeks of unemployment. However, during the 2002 recession, the probability of leaving unemployment increased rapidly during the first five weeks but then slowly dropped as the length of unemployment increased. Group #2 experienced a similar hazard rate during the four recessions. During about the first 10 weeks, the probability of finding a job quickly increased. As time progressed, the probability of finding a job slowly dropped. One notable difference is that unemployed in the 2007-2009 recession were least likely to find a job during the first 10 weeks of unemployment compared to the three previous recessions. Sundheim 18 As can be seen from the results of the Likelihood Ratio test in Table 2, the early 1980s recession, the early 1990s recession, and the 2002 recession are statistically different from the 2007-2009 recession. In addition to the 2007-2009 recession statistically differing from the three previous recessions in the completely constrained case, the small p values in the other constrained cases exemplify that neither the size of the groups nor the lengths of unemployment are statistically similar throughout the four recessions. Knowing that the 2007-2009 recession differed from the previous three recessions, the similarity between other recessions was tested in Table 3. First, the likeness of the 2002 recession to the early 1990s and early 1980s recession was investigated. The small p value indicates that the 2002 recession statistically differs from the 1992 and 1983 recessions. Second, the likeness of the 2002 recession to the 1992 recession was investigated. The magnitude of the p value indicates that the 2002 recession is not statistically similar to the 1992 recession. Finally, the likeness of the 2010 recession to the early 1980s recession was investigated. Again the small p value indicates that the 2010 recession statistically differs from the early 1980s recession. In conclusion, 16-34 year olds with a high school diploma or less in the 2007-2009 recession experienced a unique unemployment situation compared to the three previous recessions. 16-34 Year Olds with at Least Some College Similar to the previous demographic group, those in the 16-34 year old age group who have at least completed some college can be broken down into two distinct groups. Again, the group that remained unemployed for a longer period of time will be referred to as Group #1, while the group that experienced a shorter duration of unemployment will be referred to as Group #2. Group #2 experienced a very similar average duration of unemployment throughout the four recessions, with durations of 4, 3, 3, and 3 weeks. Comparable to those with a high Sundheim 19 school diploma or less, this group is by far the smallest during the 2007-2009 recession. Only 48% of people fell into this group during the 2007-2009 recession compared to 80% during the early 1980s recession, 84% during the early 1990s recession, and 84% during the 2002 recession. Compared to Group #2, the average duration of unemployment for Group #1 did not remain as consistent during the past four recessions. The average duration of unemployment was 15 weeks during the early 1980s recessions, 17 weeks during the early 1990s recession, 12 weeks during the 2002 recession, and 17 weeks during the 2007-2009 recession. 52% of 16-34 year olds who have at least completed some college wound up in Group #1, clearly the largest percentage in this group compared to previous recessions. Even though the early 1990s and 2007-2009 recession had a similar average length of unemployment for Group #1, the proportion of people who experienced this length greatly differed. About 16% of the people fell in this group in the early 1990s recession and about 52% fell in this group in the 2007-2009 recession. Over the duration of unemployment, the hazard rates for 16-34 year olds who have completed at least some college follow similar patterns to those of 16-34 year olds with a high school diploma or less. As can be seen from the graphed hazard rate for Group #1, the probability of finding a job during the early 1980s and 2002 recession steadily increased during the first five weeks of unemployment. However, after about 15 weeks, the probability of finding a job slowly decreased. Unlike the early 1980s recession and 2002 recession, the probability of leaving unemployment did not start to spike until about 15 weeks for the early 1990s recession and 2007-2009 recession. Not until about 25 weeks did the probability of leaving unemployment begin to level off. Within the first few weeks of unemployment, the unemployed in Group #2 had a relatively high probability of receiving a job. However, over time the probability of finding a job slowly decreased. Compared to the other recessions, the unemployed during the 2007-2009 Sundheim 20 recession had difficulty finding a job in the first weeks of unemployment. However, after about 3 weeks, they fared the best in receiving a job. Referencing the results of the Likelihood Ratio test, the early 1980s recession, the early 1990s recession, and the 2002 recession are statistically different from the 2007-2009 recession. Despite the 4 recessions differing from each other, the relatively large p value for length exemplifies the lengths of unemployment are statistically similar at a 95% confidence interval. Knowing that the 2010 recession differed from the previous three recessions, the similarity between other recessions was tested in Table 5. First, the likeness of the 2002 recession to the early 1990s and early 1980s recession was investigated. The small p value indicates that the 2002 recession statistically differed from the 1992 and 1983 recession. Second, the likeness of the 2002 recession to the 1992 recession was investigated. Assuming a 95% confidence interval, it can be seen the magnitude of the p values indicates that the 2002 recession is statistically similar to the 1992 recession. Finally, the likeness of the 2010 recession to the early 1980s recession was investigated. Again the small p value indicates that the 2010 recession statistically differs from the early 1980s recession. 35-54 Year Olds with a High School Diploma or Less Those who are 35-54 years old and have received a high school diploma or less can be broken down into two distinct groups. Group #1, representing those unemployed for a long period of time, experienced almost the same length of unemployment throughout the four recessions. During each recession, the unemployed remained unemployed for an average of about 23 weeks. Knowing that unemployment insurance exhausts at 26 weeks, it is likely that the unemployed waited until right before their unemployment insurance expired before finding a job. Seeing the consistency of this number throughout the recessions, it is apparent that most people Sundheim 21 in this group received unemployment insurance. Even though the unemployment duration for Group #1 remained consistent throughout the four recessions, the probability of the unemployed falling into this group fluctuated. The probability of an unemployed person falling into this group during the early 1980s recession and the early 1990s recession was 25%. However, during the 2002 recession, the probability was about 13%. The largest percentage (50%) of the unemployed in Group #1 was seen in the 2007-2009 recession. In comparison to Group #1, those in Group #2 experienced a very short duration of unemployment throughout the four recessions, with average durations of 4, 5, 4, and 5 weeks. Because the probability of being in Group #1 was relatively low during the 1990s, 1980s, and 2002 recession, the probability of falling in Group #2 was much higher during these recessions. Thus, the probability of the unemployed in the 2007-2009 recession falling in this group was comparatively low. For Group #1, unlike previous demographic groups, the probability of finding a job did not fluctuate throughout unemployment. As can be seen from the graphed hazard rate, the probability of finding a job right around 23 weeks was very high. Group #2 followed a similar pattern to the previously discussed demographic groups. During about the first 10 weeks of unemployment, the probability of finding a job quickly increased in all four recessions. Over time, though, the probability slowly decreased. However, in the initial weeks of unemployment, the unemployed suffered more in the 2007-2009 recession than the three previous recessions. Referencing the results of the Likelihood Ratio test, the 2007-2009 recession statistically differed from the early 1980s recession, the early 1990s recession, and the 2002 recession. Additionally, the small p values found for the less constrained cases indicate that the size of the groups and lengths of unemployment statistically differ throughout the four recessions. However, the magnitude of the p value associated with lengths being equal was much greater than the p Sundheim 22 value associated with the size of the groups being equal. Thus, throughout the four recessions, the lengths of unemployment were far more similar than the proportional size of Group #1 and Group #2. As with the other demographic groups, the similarity between other recessions was tested in Table 7 using the likelihood ratio test. In the first case, the small p value exemplifies that the 2002 recession differed from the early 1990s and early 1980s recessions. In the second case, the early 1990s recession and 2002 recession statistically differed. Finally, in the third case, it can be seen that the 2007-2009 recession statistically differed from the early 1980s recession. As is evidenced from these further tests, this demographic group experienced a unique unemployment situation compared to previous recessions. 35-54 Year Olds with at Least Some College The results for Group #1 in this demographic group are almost identical to those of 35-54 year olds with a high school diploma or less. Again, this could be the result of the unemployed finding a job right before their unemployment insurance expires. The probability of an unemployed individual falling in this group is also very similar. During the early 1980s, early 1990s, 2002, and 2007-2009 recessions, the percentages amounted to 27%, 23%, 13%, and 54%, respectively. Those in Group #2 experienced a very short duration of unemployment throughout the four recessions, with average durations of 5, 4, 4, and 6 weeks. Because the probability of being in Group #1 was relatively low during the 1990s, 1980s, and 2002 recession, the probability of falling in Group #2 was much higher during these recessions. Unlike the previous three recessions, the probability of falling into Group #2 during the 2007-2009 recession was similar to falling into Group #1. Similar to Group #1 for the previous demographic group, the probability of finding a job did not fluctuate throughout the duration of unemployment. The probability of finding a job Sundheim 23 hovered around 23 weeks. Group #2 followed a pattern similar to the previously discussed demographic groups. During the first eight weeks of unemployment, the unemployed experienced a high probability of receiving a job in all four recessions. As time progressed, the probability slowly decreased. The probability of finding a job in about the first eight weeks of unemployment was by far the lowest in the 2007-2009 recession. However, the unemployed in this recession had the highest probability of leaving unemployment as unemployment duration increased. Evidenced by the results of the Likelihood Ratio test, the 2007-2009 recession statistically differed from the early 1980s recession, the early 1990s recession, and the 2002 recession. Additionally, the small p values found for the less constrained case, size of the groups, indicates that the size of the groups statistically differed throughout the four recessions. However, the relatively large p value associated with the other less constrained case exemplifies that the unemployment lengths are statistically similar at a 95% confidence interval. Testing for similarity between recessions in Table 9 showed results similar to the previous demographic group. Like 35-54 year olds with a high school diploma or less, not one of the three tests indicates statistical likeness between recessions. Despite the lack of statistical significance, the p values for this demographic group were larger compared to the previous demographic group. Furthermore, despite not finding statistical significance after conducting the additional Likelihood Ratio tests for the different demographic groups, it is important to note that the p values for these additional tests were much larger than those found in the tests examining the likeness of the 2007-2009 recession to the previous 3 recessions. Sundheim 24 Conclusion According to my findings, an important dimension of the severe unemployment situation has been ignored. During the 2007-2009 recession and aftermath, there was great focus on the long unemployment spells of the unemployed. As a result, the fact that a proportion of the unemployed experienced a bearable unemployment situation was often overlooked. A proportion that my results indicate has been present during the past four recessions. Controlling for unobservable heterogeneity, I was able to differentiate between those who were unemployed for a long period of time and also those unemployed for a short period of time. Using a separated markets approach while accounting for unobservable heterogeneity provided me with a more detailed explanation of the unemployment situation for different demographic groups. In most cases, the results indicate that the lengths of unemployment of those unemployed for long periods of time and short periods of time has remained relatively the same throughout the past four recessions. However, the results show that the proportion of people in these groups greatly differs. For most demographic groups, the proportion of people unemployed for a long period of time increased substantially during the 2007-2009 recession. Also, many of the unemployed had greater difficulty securing a job during the initial weeks of unemployment compared to previous recessions. Some noteworthy conclusions can also be made from making comparisons between demographic groups across both age and education groups. My results suggest that age rather than education has a greater effect on an individual’s unemployment situation. Despite splitting 35-54 year olds into two different groups based on their education, it was found that the two groups were unemployed for similar lengths of time throughout the four recessions. This holds true for the 16-34 year old age group as well. It is difficult to draw any conclusions of this sort when comparing education groups rather than age groups. Sundheim 25 Only providing descriptive results, this analysis does not provide exact reasons as to why the lengths of unemployment remained relatively the same but the probability of falling into a particular group differed between the 2007-2009 recession and the three previous recessions. A discussion of various labor economic theories can assist in better understanding this phenomenon and as a result propose further research questions. Firstly, many economists have suggested that the unemployment situation in the 2007-2009 recession could be attributed to cyclicality. Considering the results of my analysis, I cannot conclude that this phenomenon is a result of cyclicality. For cyclical unemployment to have been a possibility, the demand for unemployed labor would need to have been greater than the supply of unemployed workers. Because the durations of unemployment did not drastically change during the 2007-2009 recession, this fails to be a possibility. Furthermore, economists have discussed structural unemployment as a cause of the unemployment situation during the 2007-2009 recession. Unlike cyclicality, structural unemployment offers a possible explanation of my results. During the 2007-2009 recession, structural changes in the economy may have negatively impacted a large number of people, causing the proportion of those unemployed for a long period of time to substantially increase. As mentioned in the literature review, search frictions, such as search intensity and directed search, may also provide an interpretation of my results. Even though search frictions have not been frequently speculated as a possible explanation of the unemployment situation, the results appear to fit the theories. A greater proportion of those unemployed for a long period of time may have needed to exert greater search intensity or instead had a higher reservation wage in the job search process. Sundheim 26 Bibliography Aaronson, D., Mazumbder, B., & Schechter, S. (2009). What is behind the rise in long-term unemployment? Economic Perspectives, 34 (1-2), 28-51. Burdett, K. & Mortensen, D. (1998). Wage Differentials, Employer Size, and Un-employment. International Economics Review, 39(2), 257- 273. Bureau of Labor Statistics. (2011a, July). Changes to Data Collected on Unemployment Duration. Retrieved from http://www.bls.gov/cps/duration.htm Bureau of Labor Statistics. (2011b, August). Concepts and Definitions of Data Derived from the Current Population Survey. Retrieved from http://www.bls.gov/opub/gp/gpapnda.htm Bureau of Labor Statistics. (2011c, April 18). Labor Force Statistics from the Current Population Survey: How the Government Measures Unemployment. Retrieved from http://www.bls.gov/cps/cps_htgm.htm#unemployed Bureau of Labor Statistics, United States Department of Labor. (2012). Databases, Tables, & Calculators by Subject [Data Sets]. Retrieved from http://www.bls.gov/data/ Crutsinger, M. (2011, September 28). Federal Reserve Chairman Ben Bernanke: Long-Term Unemployment A ‘National Crisis.’ Huffington Post. Retrieved from http://www. huffingtonpost.com/ Daly, M., Hobijn, B., Şahin, A., & Valletta, R. (2011). A Rising Natural Rate of Unemployment: Transitory or Permanent? ( FRBSF Working Paper 2011-05, forthcoming in Journal of Economic Perspectives). Eckstein, Z. and Wolpin, K. (1990). Estimating a Market Equilibrium Search Model from Panel Data on Individuals. Econometrica, 58(4), 783–808. Flinn, C. (1986). Econometric Analysis of CPS-Type Unemployment Data. Journal of Human Resources, 21(4), 456-484. IPUMS-CPS, Minnesota Population Center, University of Minnesota. (n.d.). Integrated Public Use Microdata Series: 1983-2010 [Data sets]. Retrieved from http://cps. ipums.org/cps/ Jovanovic, B. (1979). Job Matching and the Theory of Turnover. Journal of Political Economy, 87(5), 972-990. Kaiser Family Foundation/NPR. (2011). Long-term Unemployed Survey, 1-35. Sundheim 27 Krueger, A., & Mueller, A. (2011). Job Search, Emotional Well-Being, and Job Finding in a Period of Mass Unemployment: Evidence from High-Frequency Longitudinal Data. Brookings Papers on Economic Activity, 1-57. Petrongolo, B., & Pissarides, C. (2001). Looking into the Black Box: A Survey of the Matching Function. Journal of Economic Literature, 39(2), 390-431. Pollak, A. (2012). Unemployment, Human Capital Depreciation, and Unemployment Insurance Policy. Journal of Applied Econometrics, doi: 10.1002/jae.2275. Rothstein, J. (2011). Unemployment Insurance and Job Search in the Great Recession. (National Bureau of Economic Research, Inc, NBER Working Papers: 17534). Shimer, R., (2004). Search Intensity. (University of Chicago Unpublished Paper). Retrieved from http://home.uchicago.edu/shimer/wp/intensity.pdf Valletta, R., & Kuang, K. (2012). Why is Unemployment Duration so Long? (FRBSF Economic Letter). Sundheim 28 Table 1: Current Population Survey Summary Statistics Demographic Group 16-34: High School 16-34: College 35-54: High School 35-54: College Year Number of Observations Mean Unemployment Length 1983 4293 18.44 1992 2495 14.45 2002 2548 13.71 2010 3226 26.75 1983 1092 17.91 1992 896 15.78 2002 913 13.86 2010 1579 26.09 1983 1644 22.81 1992 1238 22.19 2002 1339 17.13 2010 2256 32.22 1983 470 24.40 1992 738 21.91 2002 1059 18.33 2010 1786 34.20 Sundheim 29 Table 2: 16-34 Year Olds with a High School Diploma or Less Unconstrained Mean Number of Weeks 1983:Mu1 2.7951 15.11 Median Number of Weeks 14.21 Sigma1 Mu2 Sigma2 P1 1991:Mu1 Sigma1 Mu2 Sigma2 P1 2002:Mu1 Sigma1 Mu2 Sigma2 P1 2010:Mu1 0.3186 0.9045 0.7518 0.2124 2.8291 0.2827 0.7712 0.7170 0.1402 2.0277 0.5406 0.6325 0.5713 0.3774 2.8726 3.77 2.93 Sigma1 Mu2 Sigma2 P1 Likelihood 0.2796 1.1722 0.6694 0.4528 Likelihood Ratio p value 3.03E+04 Ps Equal Lengths Equal Constrained 2.3601 0.4803 0.7625 0.6507 0.2689 17.62 16.93 2.76 2.16 1.9146 0.6080 0.6089 0.5935 0.1313 8.79 7.60 2.22 1.88 18.38 17.68 4.04 3.23 1.9434 0.5634 0.6137 0.5490 2.9039 0.1079 2.7287 2.8201 0.2665 1.2016 0.6928 0.4149 0.3413 0.8250 0.7245 0.5608 0.3021 0.8624 0.7404 0.2433 3.04E+04 3.04E+04 3.07E+04 24 2.49E-05 48 3.13E-06 756 2.12E-151 Sundheim 30 Table 3: Likelihood Ratio Tests between Recessions 1983, 1992, and 2002 Recessions Unconstrained Constrained Likelihood Likelihood Ratio p value 2.13E+04 2.13E+04 146 2.48E-26 1992 and 2002 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 1.08E+04 1.08E+04 12 3.48E-2 1983 and 2010 Recessions Likelihood Likelihood Ratio p value Unconstrained 1.95E+04 Constrained 1.96E+04 260 3.93E-54 Sundheim 31 Hazard Rates for 16-34 Year Olds with a High School Diploma or Less Sundheim 32 Table 4: 16- 34 Year Olds with at Least Some College Unconstrained 1983:Mu1 Sigma1 Mu2 Sigma2 P1 1991:Mu1 Sigma1 Mu2 Sigma2 P1 2002:Mu1 Sigma1 Mu2 Sigma2 P1 2010:Mu1 Sigma1 Mu2 Sigma2 P1 Likelihood Likelihood Ratio p value 2.6537 0.3519 1.0767 0.7065 0.1953 2.7892 0.2685 0.9171 0.6943 0.1647 2.3987 0.4120 0.7949 0.7390 0.1550 2.8198 0.2817 1.0734 0.5781 0.5188 1.10E+04 15.11 Median Number of Weeks 14.21 3.77 2.93 Mean Number of Weeks Ps Equal Lengths Equal Constrained 2.1353 0.5183 0.8452 0.6137 0.1999 16.87 16.27 3.18 2.50 11.98 11.01 2.91 2.21 17.45 16.77 3.46 2.93 1.9651 0.5713 0.7149 0.5417 0.1330 1.7292 0.6015 0.5639 0.6446 2.8406 0.2737 1.0763 0.6154 0.4934 0.0679 2.8162 0.2817 0.9824 0.7081 0.4853 2.7942 0.2900 0.9765 0.6954 0.2758 1.10E+04 8.6 3.51E-02 1.10E+04 14.6 2.64E-01 1.12E+04 265 1.21E-47 Sundheim 33 Table 5: Likelihood Ratio Tests between Recessions 1983, 1992 and 2002 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 6.64E+03 6.66E+03 32.4 3.43E-04 1992 and 2002 Recessions Unconstrained Constrained Likelihood Likelihood Ratio p value 4.00E+03 4.01E+03 7.2 2.06E-1 1983 and 2010 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 7.03E+03 7.07E+03 91 4.14E-18 Sundheim 34 Hazard Rates for 16-34 Year Olds with at Least Some College Sundheim 35 Table 6: 35-54 Year Olds with a High School Diploma or Less Unconstrained 1983:Mu1 Sigma1 Mu2 Sigma2 P1 1991:Mu1 Sigma1 Mu2 Sigma2 P1 2002:Mu1 Sigma1 Mu2 Sigma2 P1 2010:Mu1 Sigma1 Mu2 Sigma2 P1 Likelihood Likelihood Ratio p value 3.1267 0.0001 1.1981 0.6858 0.2462 3.1268 0.0001 1.3572 0.5379 0.2459 3.1267 0.0001 1.1364 0.6351 0.1266 3.1267 0.0001 1.5338 0.5433 0.4994 1.72E+04 22.79 Median Number of Weeks 22.79 4.19 3.31 Mean Number of Weeks Ps Equal Lengths Equal Constrained 0.9332 0.6167 2.5784 0.4164 0.2662 22.80 22.80 4.49 3.89 22.79 22.79 3.81 3.12 22.79 22.79 5.37 4.64 2.4182 0.5130 1.2471 0.3903 0.2321 0.8316 0.6262 1.7608 0.6912 1.5357 0.5445 3.1292 0.0010 0.5021 0.1117 3.1293 0.0010 1.2845 0.6047 0.5358 1.3002 0.6171 3.1293 0.0010 0.6941 1.74E+04 1.72E+04 1.74E+04 3.62E+02 3.76E-78 4.60E+01 6.94E-06 4.16E+02 2.99E-79 Sundheim 36 Table 7: Likelihood Ratio Tests between Recessions 1983, 1992 and 2002 Recessions Unconstrained Constrained Likelihood Likelihood Ratio p value 1.06E+04 1.06E+04 68 1.08E-10 1992 and 2002 Recessions Unconstrained Constrained Likelihood Likelihood Ratio p value 6.29E+03 6.34E+03 98 1.40E-19 1983 and 2010 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 1.09E+04 1.10E+04 136 1.27E-27 Sundheim 37 Hazard Rates for 35-54 Year Olds with a High School Diploma or Less Sundheim 38 Table 8: 35- 54 Year Olds with at Least Some College Unconstrained 1983:Mu1 Sigma1 Mu2 Sigma2 P1 1991:Mu1 Sigma1 Mu2 Sigma2 P1 2002:Mu1 Sigma1 Mu2 Sigma2 P1 2010:Mu1 Sigma1 Mu2 Sigma2 P1 Likelihood Likelihood Ratio p value 1.3648 0.625 3.129 0.0010 0.7278 1.1736 0.6818 3.1293 0.0010 0.7745 1.1472 0.6784 3.1293 0.0010 0.8660 1.5711 0.5766 3.1292 0.0010 0.4612 1.10E+04 4.76 Median Number of Weeks 3.91 22.85 22.85 Mean Number of Weeks Ps Equal Lengths Equal Constrained 2.7505 0.3495 1.1962 0.5560 0.7124 4.08 3.23 22.86 22.86 3.96 3.15 22.86 22.86 5.68 4.81 22.86 22.86 0.7924 0.6420 2.3344 0.5215 0.7808 1.1681 0.5505 0.8731 0.5982 1.5756 0.5758 3.1292 0.0010 0.4592 1.11E+04 1.56E+02 1.34E-33 0.8755 1.2634 .6490 3.1292 0.0010 0.4108 1.10E+04 1.80E+01 0.116 1.2980 0.6540 3.1292 0.0010 0.6539 1.12E+04 3.32E+02 1.21E-61 Sundheim 39 Table 9: Likelihood Ratio Tests between Recessions 1983, 1992 and 2002 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 5.71E+03 5.72E+03 29 1.25E-03 1992 and 2002 Recessions Unconstrained Constrained Likelihood 4.45E+03 4.46E+03 28.6 2.78E-05 Likelihood Ratio p value 1983 and 2010 Recessions Likelihood Likelihood Ratio p value Unconstrained Constrained 6.57E+03 6.60E+03 55.8 8.93E-11 Sundheim 40 Hazard Rates for 35-54 Year Olds with at Least Some College