Business Transition

advertisement

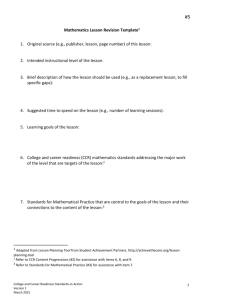

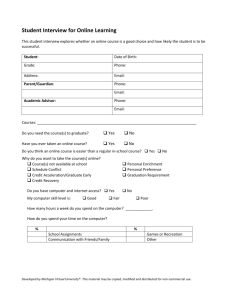

THERE MUST BE SOME KIND OF WAY OUT OF HERE! Presented by: R.A. Bobbi Hayes, CPA, CFE, CEPA Partner with Accounting & Consulting Group, LLP Importance of Business Transition: 12 million Baby Boomers (born 1946-1964) own privately held businesses in the United States. Their illiquid wealth within these businesses is estimated to be over $10 trillion. 70% of these businesses will change hands in the next ten years. 2 Importance of Business Transition: 250,000 Baby Boomers turn 65 every month. Roughly 17% of baby boomers now report they are retired – up from 10% in 2010. At age 66, 39% still working full time, at age 68, 32% still working full time 3 EE = Employee Equivalent 8,326 businesses with 500-999 EEs 82,334 businesses with 100-499 EEs 508,249 businesses with 20-99 EEs 4,320,290 businesses with 1-19 EEs 17,646,062 Non-EE businesses Source: VIP Forum analysis of the Survey of Consumer Finances, 2008 4 66% of all businesses with employees, nearly 4 million companies, are owned by baby boomers. In 2013, 84% of all construction companies were owned by baby boomers (FMI). M0st construction companies plan to transition internally (MBO, ESOP, or family). 5 52% of owners do not have the management team to support them if they were to leave tomorrow. 17% expect to sell to a third party. Very few will be successful due to presence of an inadequate management team. 6 37% expect to sell to employees. 24% expect to sell or gift to family. 17% expect to do a combination of selling to both employees and family. 5% plan to just liquidate. 7 The process by which you plan an transition from your illiquid business. Business owners need to monetize and protect the wealth that is trapped in these businesses. 8 Sales of businesses occur in cycles Ten Year Transfer Cycle 1980 1990 2000 Estimated 2010 Deal Recession Deal Recession Almost Recession (Buyer’s Market) (Seller’s Market) (Neutral Market) 1983 1993 2003 2013 1988 1998 2008 2018 1990 2000 2010 2020 Source: Rob Slee 9 60% of construction company owners have a formal plan in place to ensure continuity of operations in event of death. (FMI) 39% of construction company owners have a formal plan in place to transition themselves out of management the business. (FMI) 10 The average business owner spends 80 hours preparing a business plan and only 6 hours preparing for their transition. This is not a way to maximize value of your biggest monetary investment (generally)! 11 Privately-Held businesses typically are: The largest asset/investment that an owner or family will possess. The primary source of income for an owner and family. Vehicles for paying bills as well as accumulating and transferring wealth. The source of pride/legacy. 12 So, how will millions of Business Owners: Convert their illiquid, primary asset to cash? Replace the income from the business? Transfer their business wealth to the next generation? Protect their legacy? Remove themselves from personal liability and bonding? 13 Transitioning a business is a process, not an event. Is only an event if 3 D’s (death, disability, divorce). Needs a written plan. To build an transition strategy plan you need information and a perspective on what you are trying to accomplish. Ongoing monitoring. 14 A comprehensive road map to successfully transition a private business. It asks and answers all of the issues concerning: Your business (value, value preservation, value enhancement). Your personal needs (legacy). Your financial position and needs. Legal issues (trust, gift, etc.). Addresses tax questions involved in selling a privately owned business OR gifting to heirs. 15 It is assumed that most of an owner’s wealth is tied to their business Another safe assumption is that an owner would like to protect that wealth through diversification Key Question Think about what percentage of your total net worth is tied up in your privately-held business? (if you know the value of your business) 16 Private Business Owner Stock is usually a concentrated position for that owner. It can be more than 80% of owner’s net worth. Owners needs DIVERSIFICATION of assets. Greater diversification means spreading risk over many holdings. 17 An owner might be maxing out their 401k and IRA, but the rest of their cash usually goes to supporting their lifestyle and the company. 18 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 19 The Personal Assessment of the business owner’s readiness for an transition 1. What do you want to achieve? 2. Are you Financially Ready for the transition? 3. Are you Mentally Ready for the transition? 20 The transitioning owner’s goals for their transition will be the driver behind an transition planning engagement What would you most like to achieve with the transition from your business? Legacy to Heirs Reward Loyal EE’s/Employee Transfer (ESOP) Cash Out & Continue to Work Cash Out and Leave Fund Retirement Lifestyle 21 Business owners must work with their team of advisors to put together a WRITTEN plan that: Identifies and prioritizes financial and non- financial goals. Establishes a business, professional and personal strategy to achieve the goals. Sets a time frame (3-5 years generally). Lists post-transition activities. 22 Owner Transition Planning Advisor Quarterback Insurance Advisor M&A / Valuation CPA Wealth Management Advisor Family Business Coach Attorney 23 Transition planning involves the integration of business-level planning and reflects the owner’s circumstances and needs with financial, professional and personal goals. 24 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 25 The transitioning owner’s financial readiness for an transition will be a strong determinant of what options are realistically available for their transition Consider - What amount of investable assets in your account will be sufficient to satisfy your post-transition lifestyle? 26 Relying on sale proceeds to finance retirement = lower financial readiness Don’t need to rely on sale monies = higher financial readiness 27 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 28 How you, the owner, view your transition is critical. Too many business owners are emotionally attached to their businesses. When truly seen for what your business is (which is an investment) you can make better financial decisions. 75% of business owners profoundly regretted selling twelve months later. 29 Are you ready to leave? How involved are you in the day-to-day running of the business? Do you have a plan as to how you will spend leisure time away from the business? Are the thoughts and habits of running a business so routine that you won’t know what to do after the transition? 30 Are you ready to leave? Do you view the business as providing a good return on invested capital, or more interested in the lifestyle that the business provides? Will you be able to think clearly throughout the transition process so that the decisions you make are based on objective criteria instead of the subjective ways in which you feel about the transition? 31 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 32 Financially Ready and Ready to Go More transition options, lower daily involvement in business, value of business not large % of assets. Financially Ready but Chooses to Work More transition options, typically daily involvement in business, value of business not large % of assets. 33 Stay and Grow Less transition options, daily involvement in business, value of business large % of assets, sees value in growing business. Get Me Out! Less transition options, typically daily involvement in business, value of business large % of assets, not prepared for financial transition, but is ready nonetheless (BURNED OUT!). 34 High Financially Ready but choose to work Financially Ready & Ready to Go Low Stay & Grow Get me out for whatever you can Financial Readiness High Low Mental Readiness 35 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 36 1. Sale of the Business to third party 2. Private Equity Group (PEG) Recapitalizations 3. Employee Stock Ownership Plans (ESOPs) 4. Management Buyouts (MBO) 5. Gifting Programs 6. Shut Down – Orderly Liquidation of Assets 37 The primary transition options fit into our transition Quadrant Chart Financial Readiness MBO, Gift, ESOP Gift, Charity, ESOP, Sell PEG Recap., ESOP, Grow Bus., Increase Savings Get me out for whatever you can Mental Readiness 38 39 A simpler way to view these transfer options is to see them as: Internal Transfers Employee Stock Ownership Plans Management Buyout Gifting or External Transfers Private Equity Group Recapitalization Sale to an Outside Buyer 40 Owners may choose to transition their business via a sale to an industry buyer, competitor. This type of transitioning owner is generally aware that this is the way to get the highest price, however most owners have unrealistic expectations of values that will be extremely difficult to meet. Sale to an Outside Buyer Synergy Value 41 Owner gets the highest value. But likely loses their job. They give up strategic & financial control of business if they do stay on as part of deal. No future value is available – no income stream from business. 42 Owners will not receive the highest value Rarely an option for construction contractors. Investment value includes a multiple of earnings, no synergies paid for If some equity is kept, could get second bite of apple later when PEG transitions Recapitalization Investment Value 43 An ESOP allows for: The creation of a buyer for the company’s shares. Diversification for the owner, maintain control. Increase Company cash flow (tax deduction for stock purchase). Benefit to employees. 44 Owner receives lower value. They do not sell control or bring in new partners. Owner keeps their job, salary, perks (reasonable). Owner participates in future value of business. A properly installed ESOP can boost morale of employees. ESOP Fair Market Value 45 Owner may choose to transition by selling the company to the management team. A High Level of financial readiness is recommended due to the inherent uncertainties involved with converting employees into owners. Management Buyout Investment Value 46 Special issues with management buyouts: The employees don’t have the money to buy your business – current owner holds a note. The managers do not take risks like you. Your relationship with the managers changes from employer/employee to partners. You are negotiating with the people who worked for you. The business will likely need to serve as collateral for the transition to function properly. 47 MBO benefits are: The managers know the business, so value is maintained through continuity. There is an affinity towards this group who helped build the wealth in the company. A controlled transition that can occur over many years, providing flexibility to deal with structure and taxes. You can maintain control. A management buyout does not require a third party. 48 You may choose to make gifts of stock to family members or others A High Level of financial readiness is recommended due to the fact that the owner is gifting away assets Larger estate planning techniques are likely required Intra-family transfers can have lots of drama Gifting Program Fair Market Value 49 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 50 Value is determined by Transition Channel Internal Transfer External Transfer Employee Stock Ownership Plans Private Equity Group Recapitalization Gifting Sale to an Outside Buyer Fair Market Value “Market Value” Discounts May Apply Investment Value Synergy Value Management Buyout 51 Most construction owners (48%) expect to sell for book value (shareholders’ equity). 40% of construction company owners expect to sell for a multiple of earnings cash flow. Owners most often think “4 to 5 times.” Very few deals are made at that level. 52 1. Setting Transition Goals 2. Financial Readiness Mental Readiness 3. Identify Type of Transitioning Owner You Most Resemble 4. Learn & Choose Your Transition Option 5. Understand the Value of the Option You Choose 6. Execute Your Transition Strategy Plan to Reach Your Goals and Protect Your Wealth 53 1. EXECUTIVE SUMMARY 8. TAX ANALYSIS 2. YOUR GOALS AND OBJECTIVES 9. RECOMMENDATIONS 3. PERSONAL CONTINGENCY PLAN 4. YOUR BUSINESS: A BASELINE VALUATION 5. VALUE FACTOR ANALYSIS 6. VALUE ENHANCEMENT OPPORTUNITIES 10. ACTION PLANS 11. PROFESSIONAL ADVISORS 12. GLOSSARY 13. EXHIBIT A: PRESALE DUE DILIGENCE CHECK LIST 14. EXHIBIT B: LIMITED SCOPE BUSINESS VALUATION REPORT 7. TRANSITION OPTIONS AND CONSIDERATIONS 54 Comments and suggestions are appreciated! R.A. Bobbi Hayes, CPA, CEPA, CCIFP, CFE, CFF Partner Accounting & Consulting Group, LLP 2700 San Pedro NE 505-883-2727 bhayes@acgsw.com Alamogordo ¤ Albuquerque ¤ Carlsbad ¤ Clovis ¤ El Paso ¤ Hobbs ¤ Lubbock ¤ Roswell