Report of Head of Finance, Property and Revenue Services

advertisement

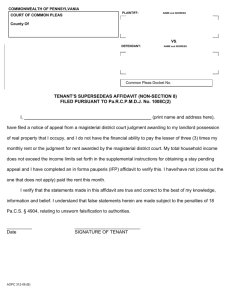

Head of Finance, Property & Revenue Services To Portfolio Holder for Resources on th 16 January 2015 PROPERTY TRANSACTION REPORT ACQUISITION OF COMMERCIAL PROPERTY (DONCASTER) 1. SUMMARY This report seeks approval to acquire an additional commercial property within the United Kingdom. It is a Key Decision as the capital expenditure is in excess of £250,000. The decision is to be taken under the General Exception provisions (Paragraph 2.15 Part 4 Council Constitution refers). The Chair of Select Commission has been advised of the proposed decision in accordance with the Constitution. 2. RECOMMENDATIONS To be resolved by Portfolio Holder for Resources 3. 3.1 (i) That the Council acquires the long leasehold interest in the commercial property identified in Appendix D (site plan) and Appendix F (photographs) for the purchase price set out in Appendix A. (ii) That approval be given to Opt to Tax the subject land identified in Appendix D. (iii) That the Corporate Asset Manager be authorised to determine final terms and conditions of acquisition. BACKGROUND In order to assist with achieving a balanced General Fund budget Property Services have been tasked with reviewing the performance of its existing commercial portfolio, together with identifying suitable strategic property acquisitions to bring new income streams into the Council. A search for suitable commercial property was undertaken by Property Services. Contact was made with external agents at a local, regional and national level. The Council’s property acquisition criteria were provided and a number of suitable properties were identified, some were available on the open market, some were ‘off market’. The properties covered a variety of sectors and location, but they all met the Council’s requirements, namely level and longevity of rental income, potential for rental growth and strength of Tenant covenant. The investment criteria are detailed in paragraph 4. 4. PROPOSAL – PROPERTY INVESTMENT RATIONALE 4.1.1 The Head of Finance, Property & Revenue Services has identified a sum of £460,000 per annum in the draft budget proposals for the financial year 2015/16. After due consideration, it was proposed that this requirement should be met by a proprietary asset or assets capable of producing a stable income of extended duration capable of periodic increase. 4.2 In consideration of the Council investing in such commercial property it was proposed that an objective set of criteria will used to identify and grade a potential asset. The sieving mechanism was referred to as the Five Q’s, Q standing for ‘Quality’. This was designed to address what was believed to be the constituent and salient characteristics of an investment that matched the Council’s requirements. The criteria and weighting for each ‘Quality’ focused on the strength of the following: 4.1.2 Income 45% The income produced by the asset was viewed as being the most important element of a potential acquisition. The income is governed by the Lease currently in place. To assess this, the category of income was split into sub categories: Lease Length: The length of the current contractual agreement in place and the period of time over which rent is paid. Longer agreements were viewed more positively than shorter ones, with twenty five years aspirational. Rent Review Pattern: The frequency and methodology by which the passing rent is reviewed. This represents the number of times during the term of the Lease that the rent can have the potential to be increased. It is the norm within the commercial property market that the rent is reviewed either to the current Market level or in line with the Retail Price Index. If there has been no increase in rent levels between the reviews, then the rent will not be increased. The more frequent the rent review, the more opportunity for the rent to increase, and were thus viewed more favourably. Rent reviews linked to the Retail Price Index (RPI) were desirable. Break Option: The ability of the Tenant to end the Lease before its contractual end date is becoming more common in commercial Leases. They have the effect of guaranteeing the income only for the period up until the next Break Option. A lack of Break Options within a Lease was viewed as desirable. % of Floor Area: The percentage of a building’s floor space that was occupied by a particular Tenant. In a multi let property, it was important that reference be made to the areas occupied by specific Tenants, meaning that appropriate weighting to income would be given if, in a 10,000 sq. ft. building 1,000 sq. ft. was occupied by a Tenant of international repute and 9,000 sq. ft. was occupied a small scale, local operator. Vacancy: The occupancy level of the properties under consideration was assessed as part of the scoring matrix. It was deemed prudent to purchase a fully occupied property, and one that did not have the risk of long term vacancy and the resultant pressure of re-letting vacant space. Fully let properties were scored more highly than vacant/part vacant ones. Management: The intensiveness of the property’s management was also assessed. A property let to a single occupier on a Full Repairing & Insuring Lease, whereby all responsibility for external and internal repair and insurance rests with the Tenant, would be, theoretically the least involving of properties, with multi let Tenants on internal repairing and insuring being the most intensive. The interaction between geographic location and management intensity is a significant consideration. 4.1.3 Tenant 25% The financial standing and viability of the Tenant was also considered and objectively scored using the Dun & Bradstreet ratings. Dun & Bradstreet are an internationally recognised financial referencing agency. 4.1.4 Location 10% Location was deemed to be an important consideration when critiquing the asset. It is important to acquire an asset in an area that is viewed to be economically buoyant and has the ability of sustainable financial and economic growth, over the life time of the asset. To this end, areas were categorised as sub regional, regional cities, secondary cities, prime cities and capital cities. Greater scoring weight was given to capital cities. 4.1.5 Sector 10% The sector that the property traded in was also deemed to be of significance. The strength of the sector was viewed in relation to its location, rather in isolation. Theoretically, a hotel in Leicester would be scored lower than a hotel in London, as the investment market would view that, although operating in the same sector of the economy, that the interaction between sector and location meant that one was far more desirable an asset than the other. 4.1.6 Building 10% The age and construction of the building was also reviewed and taken into account in the decision making process. The potential for future structural repair, retro fit and refurbishment expenses for both the Council and the Tenant, should be limited as much as possible. A modern, well-constructed, energy efficient building was scored highly. Mansfield District Council did not wish to purchase a property let on a long term, which would not structurally last the duration of that period. A scoring matrix based on these factors was produced and was utilised in identifying a suitable commercial property to acquire for the Council. A scoring matrix for the subject property identified in 3.10 onwards is shown Appendix B. 4.2 PROPOSAL – COMMERCIAL PROPERTY ACQUISITION 4.3 A review of the commercial properties currently available and the application of the Five Q’s scoring matrix identified that the subject property (Appendix B refers) as the most appropriate against the Council’s criteria. 4.4 The property is currently being marketed by Steadman Brierley Limited, a specialist Investment Agency practice. The vendor is willing to deal with the Council on a 1-2-1 basis on the basis that a formal offer is made swiftly. If this is not forthcoming it is likely that the vendor will sell to another party. 4.5 In order to take the subject proposal forward and give further consideration to the proposed acquisition, the following matters have been identified as being necessary and prudent:(i) Negotiations to Acquire – The property has been offered to the Council by a 3rd party firm of Surveyors. It is industry standard practice that the Agent is then retained by the Council to represent them throughout the acquisition of the property. The Council will incur a fee of £40,000 of the eventual purchase price for their representation and specialist professional advice. (ii) Pre-Contract Enquiries –The pre-contract enquiries and discussions with the vendor’s agent and solicitor will be undertaken by Property Services, the Council’s Agents and Legal Services in order to protect the Council’s position and minimise risk associated therewith. (iii) VAT Advice – The property has been elected for VAT and it anticipated that the sale will be treated as a transfer of a going concern. Accountancy will seek the advice of LAVAT (the Council’s VAT specialist advisors) on this matter and their advice will form part of the pre-contract enquiries. 5. TOTAL ACQUISITION COSTS – these are set out in Appendix A. 6. OPTIONS AVAILABLE 6.1 There are 2 options available: - 6.2 Option A – Acquire the identified commercial property. (Preferred Option) The recommendation proposal represents a proactive use of the Council’s assets and re-aligns them in a way which is beneficial for both the General Fund in the short to mid-term. The proposal supports the Council’s Medium Term Financial Strategy in securing a significant revenue income stream to the General Fund. An additional income stream of £460,000 has been identified in the 2015-2016 budget and the proposed acquisition would produce an income stream of £331,410 per annum, with effect from date of acquisition. The passing rental is reviewed on a five yearly basis, in line with RPI. 6.3 Option B – Do Nothing. The 2015-2016 draft budget includes an additional income of £460,000 to maintain a balanced budget. Failure to invest in a commercial property would result in a shortfall to the Council budget which would have to be made from other savings or additional income sources. 7. RISK ASSESSMENT OF RECOMMENDATIONS AND OPTIONS Option Option A – Purchase the subject asset Risk Type Strategic Risk Risk Assessment Outside administrative district Risk Level Low Risk Detail The strategy of reinvestment has been designed to utilise the best available assets regardless of location. The Council intends to maximise the longevity and safety of income streams and those investments are not available within the administrative boundaries of the district. Management Knowledge Risk Gap Low Strategic Risk Business failure of current Tenant Low Operational Risk Property Management Problems Accessibility Low Operational Risk Knowledge Gap Low The subject property is of a type, quality and Tenant profile that is not replicable locally and has not been previously been owned by the Council. However, the property will be let on Full Repairing and Insuring terms and issues are capable of being dealt with by Property Services. The subject property is a newly built hotel. It is highly unlikely that Travelodge Limited will cease trading. However, due to the property’s location, if this did occur there would be interest from other occupiers of similar size and reputation to occupier the property on similar terms. Mansfield District Council currently owns a property outside its administrative boundary, and it is not envisaged that the management of the subject property would present an issue. A site visit can be completed within working hours. As mentioned previously, all proprietary matters arising from the ownership of the subject property are capable of being dealt with by the Council’s Property Services section, however 3rd Party advice can be sought, as and when, from the Doncaster property Financial Risk Failure to Opt to Tax High Financial Risk Opt to Tax Low profession. Do nothing and the conditions of the TOGC will not be met. This would result in VAT being added to the purchased price and no VAT being charged on the rental income. This would risk breaching the partial exemption limit. This option is not recommended. Elect to tax the property as shown on the boundary map in Appendix D, which would enable the conditions of a TOGC to be met and reduce the risk of breaching the partial exemption limit. This is the preferred option. 8. ALIGNMENT TO COUNCIL PRIORITIES 8.1 In order to deliver its Corporate Plan and Medium Term Financial Strategy, the Council has to ensure its land and property assets are used effectively for the delivery of services either directly in the case of operational properties or indirectly with non-operational properties. The acquisition of an additional commercial property will create a new income stream and assist in delivery of these objectives. 9. IMPLICATIONS (a) Relevant Legislation - (b) S.120 Local Government Act 1972 S.1 Local Government Act 2003 S.12 Local Government Act 2003 S.13 Local Government Act 2003 S.1 The Localism Act 2011 The Local Authorities (Capital Finance Accounting) (England) Regulations 2012. and Human Rights - The Human Rights Act 1998 is not contravened as an individual is not directly affected by the recommendation. (c) Equality and Diversity - It is considered that the proposed actions are fair and equitable in their content and are not discriminative on the grounds of equality and human rights. (d) Climate change and environmental sustainability – No implications on the Council. Crime and Disorder No implication (e) (f) Budget /Resource The capital programme was amended and an additional budget of £9.8M approved by Council 16 th December 2014. The cost of the acquisition of this property is contained within this capital sum. As outlined in the report the rental income stream from this property will assist with the draft budget for 2015/2016. 10. COMMENT OF STATUTORY OFFICERS Head of Paid Service: No specific comments. Section 151: - The budgetary implications are as set out in the report. VAT implications: These are set out in the report. Monitoring Officer: In addition to S120 of the Local Government Act 1972 which empowers a principal council to acquire by agreement land inside or outside its area, under the general power of competence set out in Section 1 of the Localism Act 2011: (1) A local authority has power to do anything that individuals generally may do. (2) Subsection (1) applies to things that an individual may do even though they are in nature, extent or otherwise— (a) unlike anything the authority may do apart from subsection (1), or (b) unlike anything that other public bodies may do. (3) In this section “individual” means an individual with full capacity. (4) Where subsection (1) confers power on the authority to do something, it confers power (subject to sections 2 to 4) to do it in any way whatever, including:- (a) power to do it anywhere in the United Kingdom or elsewhere, (b) power to do it for a commercial purpose or otherwise for a charge, or without charge, and (c) power to do it for, or otherwise than for, the benefit of the authority, its area or persons resident or present in its area. The Council would have all the necessary powers to purchase assets anywhere in the United Kingdom. Any procurement of expert estates or property advice would be a Part B Service under the Public Contracts Regulations 2006 (The Regulations). Although any procurement would fall below the current threshold for a service contract of £172,514 and the Regulations themselves do not require any form of prior advertising or competitive tendering of Part B services it would be prudent to ensure that any procurement of services on a key project complies with the general obligations of transparency, equal treatment, non discrimination and proportionality that derive directly from the Treaty on the Functioning of the European Union. The Local Government Act 2003 (S1 and S2) gives the local authority the power to borrow and invest money for any purpose relevant to its functions. The council has a fiduciary responsibility to ensure public funds are safeguarded and it should be noted that even prior to exchange of contracts if a letter of intent or similar is issued by the council, it can be potentially deemed as legally binding. The council must ensure that robust due diligence is carried out by qualified and competent advisors, if the council does not have the expertise in-house, prior to entering into a contract. 9.0 CONSULTATION 9.1 None 10. BACKGROUND PAPERS None Report Author Designation Telephone E-mail - Philip Colledge - Principal General Practice Surveyor & Corporate Asset Manager - 01623 463231 - pcolledge@mansfield.gov.uk