Berkshire Labour Market Update - January 2015

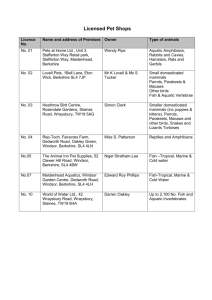

advertisement

THAMES VALLEY BERKSHIRE Overview The Thames Valley Berkshire labour market remains buoyant. Employment continues to grow and unemployment continues to fall (table 1, chart 1 and chart 2). On both measures, Thames Valley Berkshire is one of the best performing sub-regions of the UK. The story isn’t quite as positive for young people, with unemployment amongst 16-24 year olds rising during 2013 and 2014 before levelling off more recently. The number of young people claiming unemployment benefit (estimated to be about 20% of all those who are unemployed) is dropping considerably, nearly halving during 2014. The number of Apprenticeships started by Berkshire residents fell between 2012/13 and 2013/14 for the first time in nine years. However, early indications are that the decline was in the ‘over 24’ age group and that the number of young people starting Apprenticeships has remained stable. Recruitment activity remains strong across the sub-region. In terms of future opportunities, the green light was given in January for a new power station for Slough which is expected to create 320 jobs (mainly temporary construction positions) over the next four years. About this report.. This report provides commentary and data on the state of the Thames Valley Berkshire labour market, giving particular consideration to conditions and opportunities for young unemployed or underemployed people. Labour Market Update reports are produced quarterly as part of the Elevate Berkshire project. Past issues can be found on the Thames Valley Berkshire LEP website: http://thamesvalleyberkshire.co.uk/Data-Research For further information contact: Caroline Perkins Economic Research Analyst caroline@thamesvalleyberkshire.co.uk Twitter: @carolineTVB LABOUR MARKET UPDATE – JANUARY 2015 1 Headline indicators by local authority Bracknell Forest Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts Bracknell Forest Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) 80.9% 4.1% 15.7% 110 (0.9%) Comparison with last available data Increase Decrease Increase Decrease 800 6,700 Decrease Health, Public Services and Care; Business Administration and Law Reading Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts Reading Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) 74.0% 4.6% 22.4% 200 (0.9%) Comparison with last available data Increase Decrease Increase Decrease 1,100 6,700 Decrease Health, Public Services and Care; Business Administration and Law; Retail and Commercial Enterprise Slough Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts Slough Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) 70.6% 8.5% 22.8% 285 (1.9%) Comparison with last available data Decrease Increase No change Decrease 930 6,700 Decrease Business Administration and Law; Health, Public Services and Care West Berkshire Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts West Berkshire Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) 82.9% 3.1% 14.5% 110 (0.7%) Comparison with last available data Increase Decrease Decrease Decrease 1,050 6,700 Decrease Business Administration and Law; Retail and Commercial Enterprise; Health, Public Services and Care 2 Headline indicators by local authority Windsor and Maidenhead Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts Windsor and Maidenhead 81.0% 3.7% 15.9% 130 (1.0%) Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) Comparison with last available data Increase No change Decrease Decrease 680 6,700 Decrease Business Administration and Law; Health, Public Services and Care Wokingham Indicator Employment rate Unemployment rate Economic inactivity rate Young people claiming unemployment benefit 2013/14 Apprenticeship starts Top sectors for Apprenticeship starts Wokingham Thames Valley Berkshire 77.7% 4.5% 18.6% 920 (1.0%) 77.9% 3.4% 19.4% 90 (0.6%) Comparison with last available data Decrease Increase Increase Decrease 790 (excluding 6,700 Decrease Army) Engineering and Manufacturing Technologies (mainly delivered by Army); Business Administration and Law; Health, Public Services and Care; Retail and Commercial Enterprise 3 LABOUR MARKET STORY 1. Jobseekers This section provides a summary of the volume and characteristics of jobseekers within Berkshire. All ages Chart 3 shows that approximately 45,200 Berkshire residents currently aren’t working but would like to. Of these, approximately 27% are claiming the main unemployment benefit (JobSeekers Allowance), 20% are actively seeking work but are not claiming JobSeekers Allowance1 (they will be counted in official unemployment statistics) and 53% would like a job but haven’t actively sought work in recent weeks. Those in the latter group, many of whom will have caring responsibilities, will not be captured in official unemployment statistics. Young people According to the Annual Population Survey, approximately 9,000 16-24 year olds in Berkshire are unemployed, of whom approximately 20% are claiming JobSeekers Allowance. When students are excluded, the overall youth unemployment figure falls to approximately 6,000, of whom approximately a third are claiming JobSeekers Allowance. In contrast to the wider trend (chart 2), official statistics suggest that unemployment2 amongst 16-24 year olds rose during 2013 and 2014, and is now showing signs of levelling off. Nonetheless, the data suggests that the Thames Valley Berkshire labour market isn’t currently as accessible for young people as it is for those over the age of 24 (chart 4). The number of young people claiming unemployment benefit (Jobseekers Allowance) within Berkshire is relatively low (table 3) and falling. Claimant unemployment rates amongst 18-24 year olds are lower in Berkshire than the regional and national averages. Rates within Slough stand out within the sub-region and are near (but still below) the England average. The proportion of young people claiming unemployment benefit within Berkshire has broadly mirrored the national trend over the last 10 years (chart 5). With the exception of Slough, youth claimant unemployment rates at a local authority level have converged in recent months, with rates currently being more similar across the sub-region than at any time over last 10 years. During 2014, the number of young people claiming JSA in Berkshire halved (chart 6) Table 4 provides further details of where there are pockets of comparatively large numbers of young people claiming unemployment benefit. The top three wards are all in Slough, and 13 of the top 14 wards are either in the Slough or Reading local authority areas. So why are the two measures of youth unemployment going in different directions? One explanation could be the introduction of the JSA sanctions regime in October 2012. National research shows that across England the proportion of unemployed people not claiming JSA rose from 37% in October 2012 to 49% in August 2014. So some people who would previously have claimed may no longer being doing so. 1 2 A proportion will be claiming the Employment and Support Allowance ILO definition (see annex for explanation) 4 Sanctions can be applied if applicants: left their job voluntarily; lost their last job due to misconduct; fail to apply or accept a job that was offered to them; or fail to show they are actively seeking work. Apprenticeship starts Apprenticeships are a key route into employment. There were 6,700 Apprenticeships started by Berkshire residents between August 2013 and July 2014 (table 5). Approximately a quarter of these were Engineering and Manufacturing Technologies Apprenticeships started with the Army at Arborfield Garrison in Wokingham (which will shortly be closing). Other sectors with comparatively high numbers of Apprenticeship starts in Berkshire are Business, Administration and Law; Retail and Commercial Enterprise; and Health, Public Services and Care. The number of Apprenticeships started by Berkshire residents fell between 2012/13 and 2013/14 for the first time in nine years. Whilst the fall was considerable (18%), early indications are that the vast majority of the decline was amongst people in the over 24 age group. A decline of a similar magnitude occurred across England as a whole (table 6). 2. Job opportunities This section provides an overview of short, medium and long-term job opportunities within Berkshire, particularly for young people. Firstly we look at medium to long-term trends at a sectoral level, then we summarise short to medium-term opportunities highlighted in local and trade press, and finally we look at real-time job vacancy data derived from online job postings. Sectors (medium to long-term opportunities) Some key sectors to highlight in terms of the volume of medium to long-term opportunities within Berkshire, particularly for young people, are listed below. ICT: There continues to be high demand for staff from Berkshire’s tech companies with the number of people employed in the sector increasing by approximately 6,000 between 2012 and 20133. Construction: There is predicted to be an increase in demand for construction workers across Berkshire due to ongoing and new regeneration projects. Major players within the sector (including contractors and local authorities) are reporting a lack of skilled staff to meet demand. Results from the Federation of Master Builders’ latest State of Trade Survey for Q4 2014 show small construction firms across the country are experiencing particular difficulties recruiting carpenters, joiners and bricklayers. And are also seeing a rising and significant shortage of roofers, plasterers and site managers (http://www.fmb.org.uk/news-publications/newsroom/pressreleases/2015/january/construction-skills-time-bomb-is-ticking/). The construction of a new power station in Slough (see next section) is predicted to create 300 construction roles. 3 Source: Business and Employment Register, ONS (released September 2014) 5 Hospitality and leisure: A number of new hospitality, leisure and retail outlets are opening across Berkshire and hotel room occupancy rates4 are at their highest level for the past four years. Employment within the sector is growing, with a 10% increase in employment in the ‘accommodation and food services’ in Berkshire between 2012 and 20135. Logistics: Driver shortages continue to be reported (nationally and locally) in the road haulage industry and experts predict shortages will continue due to the large proportion of the workforce due to retired within the next two years. Salaries are increasing as a result. Business openings and expansions (short to medium term opportunities) The following business openings and expansions were reported in the press between November 2014 and January 2015. The number of jobs these are likely to create are included where available. Reading Components manufacturer, Magal Engineering, has created 12 new jobs and safeguarded another 56 after winning a contract to produce parts for Jaguar Land Rover (Reading Chronicle, November 2014) TeamSport opened a Go Kart track in Reading in December 2014.The new venue, at the end of Cradock Road, is creating 40 jobs with a promise of ‘fast-track’ career opportunities to management (GetReading, December 2014) The American motorcycle company Harley-Davidson is setting up a showroom in Reading in 2015 with the creation of new jobs (Reading Chronicle, December 2014) Pizza Hut in the Oracle is undergoing a revamp which will lead to the creation of 10 jobs (GetReading, December 2014) More than 60 new jobs will be created with the majority in Reading as laundry firm Afonwen plans to open its second branch in the area in May (GetReading, January 2015) Slough A new power station for Slough has been given the green light. The plant will be built at the existing Slough Heat and Power Station site in Edinburgh Road, owned and managed by energy giant SSE, which is behind the project. Construction work will see the demolition of an existing redundant plant and buildings on the site, which will be replaced by the new multifuel combined heat and power generating station. The project is expected to take four years to complete and will generate 300 temporary construction jobs and an additional 20 new full-time roles. (Slough Express, January 2015) 4 5 Source: Tourism South East (data for the South East region) Source: Business and Employment Register, ONS (released September 2014) 6 Bracknell Up to 15 jobs will be created when a new Subway store opens in Bracknell at the end of January 2015 (Get Reading, January 2015) A Pizza Hut delivery store will open at the new West View mini-mall development in Market Street on in March 2015. It will create 25 full and part-time jobs (Bracknell News, February 2015) Newbury Work is set to start on a new Marston's pub and restaurant in Newbury, which will create up to 50 jobs. It is expected to open in the summer of 2015 (South East News, January 2015) Thatcham Sainsbury’s is coming to Thatcham after plans were approved to open a store in Coombe Square. Sainsbury’s says that the store will employ five full-time staff and 20 part-time staff (Newbury Today, December 2014). Online job postings (real-time data) We use a tool called Labour Insight6 to analyse job vacancy trends using information ‘scraped’ from online job postings. This includes vacancies posted on job sites, on recruitment agency websites and on employers own sites. . Key trends between November 2014 and January 2015 are summarised below: The local employers with the most online job postings in the last three months7 were the NHS, Vodafone Group, the University of Reading, AWE, Hewlett Packard and Hilton Worldwide (table 7). The types of roles being recruited for AWE8 are provided in chart 9. Over the last three months three of the top five occupations for online job postings in Berkshire were IT-related. The remaining two occupations being ‘Nurses’ and ‘Other admin occupations’ (chart 7). When looking at recent online postings by job title (chart 8), three of the top five titles are positions that are common to a wide range of industries (‘Business Analyst’, ‘Account Manager’ and ‘Assistant Manager. The remaining two are more industry specific (‘Registered Nurse’ and ‘Recruiting Consultant’). Communication skills were by far the most commonly cited generic skill mentioned within online job adverts over the last three months in Berkshire, followed by planning, writing, customer service and project management skills (chart 10). The importance of soft skills, such as communication, to commercial success was highlighted in a recent national report sponsored by McDonalds. Further details can be found here: http://www.backingsoftskills.co.uk/The%20Value%20of%20Soft%20Skills%20to%20the%20UK%2 0Economy.pdf 6 See annex for further information Where employer names were provided within online job postings (approximately 40% of postings) 8 Note, the types of roles being recruited for by the NHS and Vodafone Group were provide in the October 2014 Labour Market Update 7 7 Business management, telecoms, sales and IT-related skills were among the most commonly cited specialist skills mentioned within online job adverts over the last three months. (chart 11) The top IT skills requirements of Berkshire employers (where stated in online job postings) are Microsoft Excel, SQL, Microsoft Office and Microsoft Windows (chart 12). 3. Job losses This section provides an overview of major job losses (confirmed and potential) within Berkshire. Berkshire Publisher, Trinity Mirror closed three Berkshire newspapers in December 2014 with the loss of 26 jobs. 10 jobs were created in digital roles across the South East (The Guardian, November 2014) 4. Entry level job opportunities and skills requirements The majority of unemployed and underemployed young people will be seeking ‘entry level’ job opportunities. These tend not to require significant previous experience. Within this section we use the Labour Insight tool9 to gauge the volume and type of entry level opportunities within Berkshire and the skills that employers are looking for within them. Key findings are below: The top occupations being advertised at a salary of less than £20,000 per annum (which are potentially more likely to be accessible for young people without prior experience or qualifications) are ‘administrative occupations’, ‘care workers and home carers’, ‘nursery nurses and assistants’ and ‘sales and retail assistants’ (chart 14). The number of online job postings for Apprentices and Interns declined between September and December 2014 (chart 13). In the last three months, the top three employers10 advertising online for Apprentices in Berkshire were Rush Hair, Reading Borough Council and the NHS (table 8). The top generic skills required by employers in their job postings for Apprentices in the last three months were English and communication skills. These were followed customer service skills and being detailed-oriented. The top ‘specialist’ skill cited within job adverts for Apprentices in the last three months was mathematics. This was followed by business administration, cleaning, telecommunications and administrative support (table 9). 9 See annex for further information Where employer names were provided within job adverts 10 8 5. Key Messages For Elevate Steering Groups Whilst the pool of young people claiming unemployment benefit (and therefore ‘in the system’) is falling considerably, this group only constitutes around 20% of all unemployed young people (33% when students are excluded). There is therefore a pool of young people, who are not claiming unemployment benefit, who may not be receiving official support in their job search. For those working with young people The importance of communications skills to employers could be demonstrated to young people using the information in Chart 10. The types of IT skills required by local employers could be demonstrated to young people using the information in Chart 12. This information could also be valuable to providers to ensure provision is aligned with demand. For those liaising with employers A number of employers who may be interested in taking on, or increasing their intake, of young people, through Apprenticeships and other routes, due to expansions or new ventures are identified within this bulletin. 9 TABLES AND CHARTS Local authority level figures of note are highlighted in tables using the following key: High Low Table 1: Labour Market Participation Bracknell Forest Reading Slough West Berkshire Windsor and Maidenhead Wokingham Thames Valley Berkshire South East England Employed Number Rate 64,100 80.9 83,300 74.0 66,000 70.6 81,700 82.9 77,000 81.0 84,200 77.9 456,200 77.7 4,146,000 76.0 24,607,200 72.5 Unemployed Number Rate 2,700 4.1 4,000 4.6 6,200 8.5 2,600 3.1 2,900 3.7 2,900 3.4 21,400 4.5 214,800 4.9 1,740,900 6.6 Economically inactive Number Rate 12,400 15.7 25,300 22.4 21,300 22.8 14,300 14.5 15,200 15.9 21,000 19.4 109,400 18.6 1,096,700 20.1 7,570,300 22.3 Source: Annual Population Survey, Oct 2013-Sept 2014, Office for National Statistics Note 1: Rates do not sum to 100 due to varying denominators Note 2: Unemployment measured using ILO definition (see Annex for further information) Table 2: Economic inactivity Want a job Thames Valley Berkshire South East England 21.8 27.1 25.0 Do not want a job Student 78.2 72.9 75.0 30.6 27.8 26.5 Looking after family / home 30.6 25.7 25.9 Source: Annual Population Survey, Oct 2013-Sept 2014, Office for National Statistics Note: Rates do not sum to 100 due to varying denominators 10 Longterm sick 12.2 16.7 20.9 Retired 12.3 16.8 14.7 Other 14.2 12.9 12.0 Jan 2004-Dec 2004 Apr 2004-Mar 2005 Jul 2004-Jun 2005 Oct 2004-Sep 2005 Jan 2005-Dec 2005 Apr 2005-Mar 2006 Jul 2005-Jun 2006 Oct 2005-Sep 2006 Jan 2006-Dec 2006 Apr 2006-Mar 2007 Jul 2006-Jun 2007 Oct 2006-Sep 2007 Jan 2007-Dec 2007 Apr 2007-Mar 2008 Jul 2007-Jun 2008 Oct 2007-Sep 2008 Jan 2008-Dec 2008 Apr 2008-Mar 2009 Jul 2008-Jun 2009 Oct 2008-Sep 2009 Jan 2009-Dec 2009 Apr 2009-Mar 2010 Jul 2009-Jun 2010 Oct 2009-Sep 2010 Jan 2010-Dec 2010 Apr 2010-Mar 2011 Jul 2010-Jun 2011 Oct 2010-Sep 2011 Jan 2011-Dec 2011 Apr 2011-Mar 2012 Jul 2011-Jun 2012 Oct 2011-Sep 2012 Jan 2012-Dec 2012 Apr 2012-Mar 2013 Jul 2012-Jun 2013 Oct 2012-Sep 2013 Jan 2013-Dec 2013 Apr 2013-Mar 2014 Jul 2013-Jun 2014 Oct 2013-Sept 2014 Jan 2004-Dec 2004 Apr 2004-Mar 2005 Jul 2004-Jun 2005 Oct 2004-Sep 2005 Jan 2005-Dec 2005 Apr 2005-Mar 2006 Jul 2005-Jun 2006 Oct 2005-Sep 2006 Jan 2006-Dec 2006 Apr 2006-Mar 2007 Jul 2006-Jun 2007 Oct 2006-Sep 2007 Jan 2007-Dec 2007 Apr 2007-Mar 2008 Jul 2007-Jun 2008 Oct 2007-Sep 2008 Jan 2008-Dec 2008 Apr 2008-Mar 2009 Jul 2008-Jun 2009 Oct 2008-Sep 2009 Jan 2009-Dec 2009 Apr 2009-Mar 2010 Jul 2009-Jun 2010 Oct 2009-Sep 2010 Jan 2010-Dec 2010 Apr 2010-Mar 2011 Jul 2010-Jun 2011 Oct 2010-Sep 2011 Jan 2011-Dec 2011 Apr 2011-Mar 2012 Jul 2011-Jun 2012 Oct 2011-Sep 2012 Jan 2012-Dec 2012 Apr 2012-Mar 2013 Jul 2012-Jun 2013 Oct 2012-Sep 2013 Jan 2013-Dec 2013 Apr 2013-Mar 2014 Jul 2013-Jun 2014 Oct 2013-Sept 2014 Chart 1: Employment rate trends (2004 – 2014) 80.0 78.0 76.0 74.0 72.0 70.0 68.0 66.0 64.0 Thames Valley Berkshire Thames Valley Berkshire 11 England Source: Annual Population Survey, Oct 2013-Sept 2014, Office for National Statistics Chart 2: Unemployment rate trends (2004 – 2014) 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 England Source: Annual Population Survey, Oct 2013-Sept 2014, Office for National Statistics Note: Unemployment measured using ILO definition (see Annex for further information) Chart 3: Number of jobseekers by definition (all ages) 27% Unemployed and claiming JSA , 12,300 53% Would like a job but haven't actively sought work in recent works, 23,800 Unemployed but not claiming JSA, 9,100 20% Source: Annual Population Survey, October 2013 – September 2014, ONS and Claimant Count Statistics, March 2014 (mid-point of Annual Population Survey timeframe), DWP 12 Chart 4: Labour market participation of 18-24 year olds (Thames Valley Berkshire) 60 50 % 40 30 20 10 0 Jul 2012-Jun 2013 Oct 2012-Sep 2013 Employed Jan 2013-Dec 2013 Apr 2013-Mar 2014 Unemployed Jul 2013-Jun 2014 Oct 2013-Sep 2014 Economically inactive Source: Annual Population Survey, Oct 2013-Sept 2014, Office for National Statistics Note: Young people who are working whilst studying are categorised as being employed. Table 3: 18-2411 unemployment benefit claimants – December 2014 Total Number Rate Bracknell Forest 110 0.9% 10 0.1% Reading 200 0.9% 35 0.2% Slough 285 1.9% 55 0.4% West Berkshire 110 0.7% 20 0.1% Windsor and Maidenhead 130 1.0% 20 0.2% 90 0.6% 5 0.0% 920 1.0% 145 0.2% 14,035 1.4% 3,050 0.3% 142,375 2.3% 37,140 0.6% Wokingham Thames Valley Berkshire South East England Over 6 months Number Rate Source: DWP, January 2015 11 18-24 year old rather than 16-24 year old age bracket used due to negligible number of 16-17 year olds claiming unemployment benefit 13 Chart 5: 18-24 year olds claiming unemployment benefit, 2004 – 2014 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 April 2004 April 2005 April 2006 April 2007 April 2008 April 2009 Bracknell Forest Slough Windsor and Maidenhead Thames Valley Berkshire April 2010 April 2011 April 2012 April 2013 Reading West Berkshire Wokingham England Source: DWP, July 2014 Chart 6: 18-24 year olds claiming unemployment benefit, 2014 2,000 1,800 -49% (880 young 1,600 people) 1,400 1,200 1,000 800 600 400 200 0 Source: DWP, January 2015 14 April 2014 Table 4: Number of 18-24 year old unemployment benefit claimants by ward (top 14 wards) – December 2014 Top 20 Wards Local Authority District Sep-14 Baylis and Stoke Slough 45 30 Change over last 3 months -15 Chalvey Slough 45 30 -5 Central Slough 40 30 -10 Whitley Reading 40 30 -10 Wexham Lea Slough 35 25 -10 Britwell Slough 25 25 0 Kedermister Slough 25 25 0 Battle Reading 20 25 -5 Minster Reading 25 20 -5 Cippenham Meadows Slough 25 20 -5 Church Reading 25 20 -5 Farnham Slough 20 20 0 Oldfield Windsor and Maidenhead 20 20 0 Kentwood Reading 15 20 5 Source: DWP, January 2015 15 Dec-14 Table 5: Apprenticeship Starts (August 2013 – July 2014) (provisional) Reading Slough West Berkshire 210 350 260 210 170 180 1,370 10 10 ** 30 10 20 90 Engineering and Manufacturing Technologies 130 110 90 190 90 1,400* 2,020 Construction, Planning and the Built Environment Information and Communication Technology 10 20 20 40 20 20 130 50 70 50 50 40 50 290 150 250 170 220 120 170 1,080 50 30 20 30 20 50 190 Business, Administration and Law 170 260 300 270 180 180 1,370 Grand Total 790 1,100 930 1,050 680 6,630 Per 1,000 working age population 10.3 10.1 9.9 10.7 7.5 2,080 (790 excluding Army) 8.0 (excluding Army) Health, Public Services and Care Agriculture, Horticulture and Animal Care Retail and Commercial Enterprise Leisure, Travel and Tourism Thames Valley Berkshire Bracknell Forest Wokingham Windsor and Maidenhead Home Local Authority of Learner 9.4 Source: Skills Funding Agency, 2014 Note 1: *The vast majority (1,290) of which are with the Army at Arborfield Garrison Note 2: Some missing data due to small numbers, totals may not tally between tables 10 and 11. Table 6: Apprenticeship Starts 2005/06 to 2013/14 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 Local Authority Bracknell 350 340 400 470 520 810 860 990 800 Forest Reading 400 390 540 570 690 1,330 1,350 1,320 1,130 Slough 310 380 430 460 480 780 1,020 1,060 930 West 460 520 710 700 720 1,020 1,180 1,220 1,060 Berkshire Windsor and 260 320 370 370 450 660 750 870 690 Maidenhead Wokingham 1,560 1,830 2,020 2,380 2,660 2,520 2,460 2,720 2,110 Thames Valley 3,340 3,780 4,470 4,950 5,520 7,120 7,620 8,180 6,720 Berkshire South East 23,440 26,520 32,160 35,040 39,120 58,340 66,850 68,960 60,220 England 172,600 181,800 221,500 237,100 276,900 453,000 515,000 504,200 434,600 Source: FE data library https://www.gov.uk/government/statistical-data-sets/fe-data-library-apprenticeships 16 Table 7: Employers with the most online job postings (November 2014 to January 2015) Employer Approx. no. job Postings NATIONAL HEALTH SERVICE >100 VODAFONE GROUP >100 UNIVERSITY OF READING 31-100 AWE (ATOMIC WEAPONS ESTABLISHMENT) 31-100 HEWLETT PACKARD COMPANY 31-100 HILTON WORLDWIDE 31-100 THE ROYAL BOROUGH OF WINDSOR AND MAIDENHEAD 31-100 ORACLE 31-100 MICROSOFT 31-100 JOHN LEWIS PARTNERSHIP 31-100 READING BOROUGH COUNCIL 31-100 JOHNSON GROUP LIMITED 10-30 FOSTER WHEELER 10-30 CDK GLOBAL 10-30 THAMES WATER 10-30 WOKINGHAM BOROUGH COUNCIL 10-30 COVANCE LIMITED 10-30 READING COLLEGE 10-30 HIGHLAND GROUP HOLDINGS 10-30 SLOUGH BOROUGH COUNCIL 10-30 MCDONALD'S RESTAURANTS 10-30 TRAVIS PERKINS 10-30 HUTCHISON 3G UK LIMITED 10-30 MERCURY INTERACTIVE 10-30 HS MARSTON AEROSPACE LIMITED 10-30 MITCHELLS & BUTLERS 10-30 Source: Labour Insight, Burning Glass Technologies, January 2015 Note 1: Approximately 40% of online job postings include an employer name, the information in the table above is therefore not exhaustive 17 Chart 7: Online Job Postings - Top Occupations (November 2014 to January 2015) 0 200 400 Programmers and software development professionals (2136) IT business analysts, architects and systems designers (2135) Nurses (2231) Other administrative occupations n.e.c. (4159) Information technology and telecommunications… Business sales executives (3542) Managers and proprietors in other services n.e.c. (1259) Management consultants and business analysts (2423) Web design and development professionals (2137) IT user support technicians (3132) Sales accounts and business development managers (3545) Human resources and industrial relations officers (3562) IT operations technicians (3131) Sales related occupations n.e.c. (7129) Sales and retail assistants (7111) Customer service occupations n.e.c. (7219) Marketing and sales directors (1132) Managers and directors in retail and wholesale (1190) IT project and programme managers (2134) Chartered and certified accountants (2421) Marketing associate professionals (3543) Business and related associate professionals n.e.c. (3539) Chefs (5434) Financial accounts managers (3538) Nursery nurses and assistants (6121) Source: Labour Insight, Burning Glass Technologies, January 2015 18 600 800 1,000 1,200 1,400 1,600 Chart 8: Online Job Postings – Top Job Titles (November 2014 to January 2015) 0 50 100 Business Analyst Account Manager Registered Nurse Recruiting Consultant Assistant Manager Solutions Architect Java Software Developer Social Worker Staff Nurse Marketing Manager Sales Executive Software Development Engineer Store Manager Project Manager Sales Manager Auxilliary Nurse Software Developer Network Engineer Chef Asp .Net Developer .Net Developer Security Engineer Contract Manager Sales Consultant Technical Support Engineer Source: Labour Insight, Burning Glass Technologies, January 2015 19 150 200 250 300 Chart 9: Top Titles in Job Postings by AWE (November 2014 to December 2015) 0 1 2 Quality Engineer Systems Engineer Mechanical Engineer Information Technology Manager Electronics Engineer Engineering Technician Mechanical Design Engineer Software Development Engineer Transport Driver Safety Specialist Assistant Manager Electronics Technician Quality Inspector Engineer - Plant Integrity Engineering - Speculative Vacancies Engineering Analyst - Senior Specialist Aerodynamic And… Engineering Manager Engineering Model Developer Radiological Protection Advisor Radiological Protection Epure Reliability Engineer Reward Analyst Safety Assessment Specialists Network Specialist Neutralisation Technologies Scientist Source: Labour Insight, Burning Glass Technologies, January 2015 20 3 4 5 6 7 8 Chart 10: Top Generic Skills Requirements Stated in On-line Job Postings (November 2014 to January 2015) 0 1,000 2,000 3,000 Communication Skills Planning Writing Customer service Project Management Microsoft Excel Organisational Skills Problem Solving Building Effective Relationships Detail-Orientated Team Work Microsoft Office Microsoft Windows English Computer Skills Leadership Creativity Research Troubleshooting Presentation Skills Budgeting Quality Assurance and Control Staff Coordination Management Meeting Deadlines Source: Labour Insight, Burning Glass Technologies, January 2015 21 4,000 5,000 6,000 7,000 Chart 11: Top Specialist Skills Requirements Stated in On-line Job Postings (November 2014 to January 2015) 0 200 400 Business Management Telecommunications SQL Sales Business Development Oracle Technical Support Key Performance Indictators LINUX JavaScript Microsoft C# Accountancy Java .NET Programming ITIL Information Technology Industry Experience C++ SQL Server Rehabilitation Cisco Mentoring Business Analysis Collaboration Business Process It Support Source: Labour Insight, Burning Glass Technologies, January 2015 22 600 800 1,000 1,200 1,400 Chart 12: Top IT Skills Requirements Stated in On-line Job Postings (November 2014 to January 2015) 0 200 400 Microsoft Excel SQL Microsoft Office Microsoft Windows Oracle LINUX JavaScript Microsoft C# Java .NET Programming ITIL C++ SQL Server Microsoft Powerpoint SAP UNIX Scrum Prince Transmission Control Protocol / Internet Protocol (Tcp / Ip) jQuery Extensible Markup Language (XML) Microsoft Sharepoint Domain Name System (DNS) Enterprise Resource Planning (ERP) MySQL Source: Labour Insight, Burning Glass Technologies, January 2015 23 600 800 1,000 1,200 1,400 1,600 1,800 Chart 13: Job postings for Apprentices and Interns (Berkshire)12 350 300 250 200 150 100 50 0 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Apprenticeships Sep-14 Oct-14 Nov-14 Dec-14 Internships Source: Labour Insight, Burning Glass Technologies, January 2015 (rounded to nearest 10) Table 8: Top employers advertising online for Apprentices (November 2014 to January 2015) Employer RUSH HAIR READING BOROUGH COUNCIL NATIONAL HEALTH SERVICE SSP SLOUGH BOROUGH COUNCIL LADBROKES NEWBURY LIMITED GREENE KING TGI FRIDAYS BUSY BEES CHILDCARE LTD BMW GROUP SOUTH ESSEX COLLEGE ZAROMCO RECYCLING LTD BARCLAYS L&Q HEADMASTERS TONI GUY LIMITED Source: Labour Insight, Burning Glass Technologies, January 2015 12 Numbers are likely to be an overestimation. Whilst a de-duplication exercise is undertaken it is likely that some vacancies posted on multiple sites will be double-counted. 24 Table 9: Top Generic and Specialised Skills Requirements in online job postings for Apprentices (November 2014 to January 2015) (ranked in order of demand) Generic Specialised English (skill in high demand) Mathematics (by far the greatest skill in demand) Communication Skills (skill in high demand) Business Administration Computer Skills Cleaning Customer service Telecommunications Detail-Orientated Administrative Support Team Work Workshops File Management Repair Writing Sales Creativity First Aid Microsoft Excel Social Media Teaching Accountancy Microsoft Office Taking Messages Quality Assurance and Control Promotional Support Problem Solving Spreadsheets Staff Coordination Midwifery Organisational Skills Singing Quick Learner Administrative Functions Typing Mailing Research Order And Invoice Processing Time Management Mentoring Building Effective Relationships Tutoring Positive Disposition Child Care Planning Cooking Policy Implementation Stock Control Telephone Skills Source: Labour Insight, Burning Glass Technologies, January 2015 25 Chart 14: Job postings with a salary of less than £20,000 per annum (full-time positions) (November 2014 to January 2015) 0 20 40 Other administrative occupations n.e.c. (4159) Care workers and home carers (6145) Nursery nurses and assistants (6121) Sales and retail assistants (7111) Customer service occupations n.e.c. (7219) Nurses (2231) Business sales executives (3542) Chefs (5434) Health associate professionals n.e.c. (3219) IT user support technicians (3132) Elementary storage occupations (9260) Welfare and housing associate professionals n.e.c. (3239) Human resources and industrial relations officers (3562) Managers and directors in retail and wholesale (1190) Van drivers (8212) Receptionists (4216) Elementary construction occupations (9120) Sales related occupations n.e.c. (7129) Teaching assistants (6125) Debt, rent and other cash collectors (7122) Textile process operatives (8113) Sales administrators (4151) Programmers and software development professionals (2136) Cleaners and domestics (9233) Kitchen and catering assistants (9272) Source: Labour Insight, Burning Glass Technologies, January 2015 26 60 80 100 120 140 160 180 200 Data sources All data presented within this paper is the latest available at 31 January 2015. Some key points to note regarding the data sources used in this paper are outlined below. Unemployment measures Unemployment can be measured in different ways. Within this paper we present unemployment figures derived from the Annual Population Survey, conducted by the Office for National Statistics, and administrative figures collated by the Department for Work and Pensions (DWP) via JobCentre Plus local offices. The Annual Population Survey capture the International Labour Organisation (ILO) definition of unemployment, which is when people are without a job, are available to start work in the next fortnight and have actively sought work within the past four weeks or have found a job and are waiting to start. This measure includes both Jobseeker Allowance and non-Jobseeker Allowance claimants, providing a more accurate picture of those people out of work. DWP ‘claimant count’ unemployment data is a record of the number of claimants of Jobseekers Allowance (JSA). This data is released more frequently (monthly) and is actual numbers rather than a survey estimation. Online job postings (Labour Insight) The intelligence from online job postings presented within this paper has been sourced from Labour Insight, a tool developed by technology company Burning Glass Technologies. The tool processes information from real-time job postings ‘scraped’ from the internet. Burning Glass Technologies estimate that they capture approximately 90% of job adverts that are placed online (from jobs boards, recruitment agency websites and directly from employers’ own websites giving a good indication of hiring activity and the level of demand for people with different types of skills. A thorough de-duplication exercise is undertaken by Burning Glass Technologies, however, it is likely there will be some double counting of job adverts when they are posted on multiple sites. The main limitation of the methodology is that the intelligence that can be gathered is only as good as the information that employers and agencies include within job adverts. So, for example, whilst the vast majority of job adverts will include a job title and skills requirements, many will not include a salary, qualifications required or an employer’s name. Another limitation is that it can be difficult to ascertain where precisely a job is located. If a postcode is provided within a job advert then this can accurately be coded to a town and / or local authority area. However, an employer recruiting in Theale, which is in West Berkshire but borders Reading, may advertise the job location as being ‘Reading’ which would result in the job being coded to the Reading local authority area. 27