Presentation of Dr MKI, MEMBER,CERC

advertisement

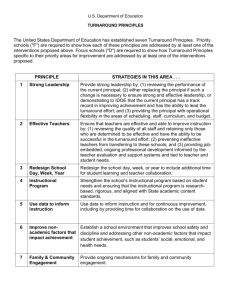

TURNAROUND OF DISCOMS ACCELERATES NEXT STAGE REFORM Dr. M.K.Iyer, Member Central Electricity Regulatory Commission November 17, 2015 1 A OUTLINE OF PRESENTATION • What is Turnaround ? • Role and Responsibilities of Discoms under the Act • Performance of Discoms – Post 2003 • Pull Factors responsible for Poor Performance • Policy Initiatives to improve performance • Turnaround of Gujarat Discom : Case study • Approach by GoI for turnaround of Discoms • Accelerates next stage reform BUSINESS TURNAROUND “Turnaround” connotes the financial recovery of a organization that has been performing poorly for an extended time” “Business Turnaround” is the reversal falling results – sales and profits – through fundamental change. ----------------------------------------------------------------------------------------------------• Turnaround is time dependent, it varies with the time • Turnaround strategy varies with the situation and time to time Strategies In order to implement “turnaround”, an organization must acknowledge the problem, develop and implement problem solving strategy. The problem and solution can be either due to: • External Factors – Policy and external measures (uncontrollable) • Internal Factors – Management and operational level measures BUSINESS TURNAROUND Sustainability – Internal Reform Result Monitoring and adjustments Rollout Plans ( Pilot basis/Holistic basis) Situation/ Problem Assessment Factor Identification (External & Internal) Problem Solving Strategy TURNAROUND STRATEGY Turnaround strategy could be either : A) External Measures: • Policy Rationalization • Business environment B) Internal Measures : • Management Reforms • Financial Reform • Administrative •Technological Adoption • IT enabled management TURNAROUND OF DISCOMS POST ELECTRICITY ACT,2003 6 OBJECTIVES OF THE ACT AND POLICIES – DISCOM Bringing Competition Accountability & Transparency Commercial Viability – Tariff Principles Access to Network Quality & Affordability Renewable Energy – Obligations • Provision for Open Access • Procuring Power - Competitive bidding • Multiple distribution licensees • Establishing SERC and APTEL • Unbundling of the Power Sector and Reorganization of Discom • Tariff Setting – Cost of service principle • State Government Subsidy -to bridge gap • Universal Supply Obligation (USO) • Rural electrification – Government Scheme • Standard of Performance • Consumer Grievance Redressal • Reduction in T&D losses • Mandatory RPOs • REC mechanism PERFORMANCE OF DISCOMS POST ELECTRICITY ACT,2003 8 OPERATIONAL PERFORMANCE OF DISCOMS – POST 2003 All India AT&C Losses 2011-12 26.63% 2012-13 25.45% 2013-14 22.7% Gap in Average Cost of Power Supply and Average Tariff Realised. High AT&C losses. Source : Planning Commission Annual Report 2013-14 on the Working of State Power Utilities & EDs PERFORMANCE OF DISCOMS – POST 2003 Losses increased onwards; have from been 2010 Higher losses is due to increase in per unit cost and inability to control losses. ( Annual Losses in Crore) Source : powermin.nic.in * estimated figure PULL FACTORS FOR PERFORMANCE OF DISCOMS 11 PULL FACTORS RESPONSIBLE FOR POOR PERFORMANCE -DISCOM High Transmission and Distribution (T&D) Losses High Aggregate technical and commercial (AT&C) losses Commercial losses was Rs 16,666 Cr in 2007-08, Rs 37,836 Cr in 2011-12 and now estimated @60000 cr 2014-15 (cont/- PULL FACTORS RESPONSIBLE FOR POOR PERFORMANCE -DISCOM Mismatch between the tariffs and cost of generating power: Cost of supplying electricity Year increased at a rate of 7.4% annually between 1998-99 and 2007-08 2009-10 and average tariff was 2008-09 increased at the rate of 7.1%. 2009-10 After 2007-08 onwards, the gap 2010-11 of average cost of supply and 2011-12 average tariff increased significantly: Average Unit Cost Tariff per Unit Gap Gap as between % of Cost and Unit Tariff Cost 4.04 3.06 0.98 24% 4.60 3.26 1.34 29% 4.71 3.27 1.44 30% 5.06 3.67 1.39 27% 5.70 4.39 1.31 23% PULL FACTORS RESPONSIBLE FOR POOR PERFORMANCE -DISCOM Debt Spiral: Working Capital have consistently increased due to high losses and liquidity problems Banking sector’s short term exposure to Discoms is quite substantial, and was about Rs. 1.5- 1.7 trillion as on March 2012, which is 3-3.6% of banking credit and 45-52% of total power credit Banks reluctant to fund these losses – in turn stretching payments to their creditors Subsidy : • Discoms on an all-India basis is about Rs. 43,000 Cr in FY 2012, which represents an increase of 13% from FY 2010. There are issue in realizations. ISSUES IN DETERMINING RETAIL TARIFF Policy Directives ( specific tariff for BPL consumers, agriculture consumers etc.) Cross – subsidization within the category of consumers Capacity to pay (consumer) High power purchase cost FINANCIAL RESTRUCTURING PLAN FOR DISCOMS 16 FINANCIAL RESTRUCTURING PLAN KEY FEATURES Cabinet Committee on Economic Affairs (CCEA) approved the much awaited scheme for Financial Restructuring of State Distribution Companies (Discoms) on September 24, 2012: Key Features: • Proposed to restructured debt worth Rs 1.9 Lakh Crores • 50% of the outstanding short-term liabilities (STLs) of Discoms as of March 31, 2012 will be taken over by state governments. • First converted into bonds to be issued by Discoms to participating lenders, backed by a state government guarantee. • Balance 50% of STL will be rescheduled by lenders and serviced by Discoms with a principal moratorium of three years Eight States -Tamil Nadu, Uttar Pradesh, Rajasthan, Haryana, Jharkhand, Bihar, Andhra Pradesh and Telangana availed the scheme. Most of these states have failed to meet the performance criteria specified in the scheme. FINANCIAL RESTRUCTURING PLAN DEFECTS Though FRP provides immediate relief to Discoms- but it was temporary and not designed with long term solutions There were major unresolved issues facing the power sector, such as: Coal shortage Land, environment clearance Regulatory Transparency Tariff hikes Operational inefficiencies Subsidy dependence Free power to some sections of the population EFFECTIVE TURNAROUND PLAN SYNERGY WITH ADDRESSING PROBLEMS Resolve the Problems (Long Run Solutions) • • • • • • • Coal shortage Land, environment clearance Regulatory Transparency Tariff hikes Operational inefficiencies Subsidy dependence Free power to some sections of the population Debt Restructuring (Short Run Solutions) • Debt support from Government • Internal resource generation improving efficiency and tariff pricing suitably Effective and bold measures to address the problems for long term solutions and debt restructuring for short run solutions Turn around of the Discoms TURNAROUND OF GUJARAT DISCOMS: A Case Study 20 Gujarat Power Scenario in 2002 State’s installed capacity: 8756 MW Peak deficit: 20% Power cut / Load shedding of 4-5 hrs Low voltages due to inadequate transmission network and substations Erratic power supply due to mixed load of agriculture and villages T&D losses as high as 34.20% - rampant power theft Severe voltage fluctuations and transformer failure Retail tariff – not cost reflective Poor billing and collection efficiency Loss of Rs 2543 Crs in 2000-01 Accumulated losses Rs 8286 Crs before unbundling Steps for Turnaround Unbundling of the Sector GEB unbundled on 01.4.2005 into 7 Companies in segments for better administration, efficiency & consumer services 1 Holding & Co-ordinating Co. 1 Generation Co. 1 Transmission Co. 4 Distribution Co. each in South, Central, Gujarat North & West Aggressive capacity addition- In 2009, Gujarat becomes surplus state Growth of Installed Capacity Growth of Installed Capacity (MW) (conventional + Non Conventional) Addition of 6296 MW 30179 23883 8756 2002 2014 2017 Steps taken – Distribution Investment made from 2002 onwards – Rs 16,550 Crs More than 500% rise (up to 2001-02 – Rs. 3340 Crs) Feeder Segregation – Jyoti Gram Yojana – Rs. 1300 Crs Highest cash incentive of Rs 1100 crs under APDRP Revenue rise from Rs 7,274 Crs to Rs 29,000 Crs – 11 % CAGR Average tariff rise from Rs 1.93 to Rs. 4.68 – 7 % CAGR Jyoti Gram Yojana (24x7 Supply) Specially Designed Transformers (SDT) on Agricultural Feeders for 1- phase power to farmers living on farms Execution in just 30 months (March 2006) Load Management with JGY Prior to JGY • 8 to 14 hours 3-ph power • 10 to 12 hrs single phase • 4 to 5 hrs no power supply After JGY with SDT • 24 hrs 3-ph power on JGY feeders • Minimum 8 hrs 3-ph continuous power on Agriculture feeders • 1-ph with SDT for balance period on Ag. Feeders Distribution Initiatives Use of XLPE Coated and Aerial Bunch Conductor Bifurcation of overloaded feeders Replacement of old meters with precision meters Metering at Transformer centres Automatic Meter Reading for H T System Improvement, Metering & Energy Accounting Extensive installation checking Vigilance drives to curb power theft Distribution Initiatives Strict penalty for power theft including imprisonment 100 % billing & collection efficiency Disconnection for default in payment of energy bills 34 Designated Courts & 5 Police Stations Checking drives in tough areas with police for unauthorized use & theft Prompt theft assessment, compounding and prosecution Cost Minimization measures Debt Restructuring reduced Interest cost by Rs. 363 Crs Re-negotiation of PPAs reduced power purchase cost by Rs. 559 Crs Long term power 7615 MW tied up at competitive prices (Rs. 2.25-2.89) Power purchase as per Merit Order Protocol Intra State ABT – April 2010 Surplus power sale ( 7284 Mus - 2013-14 ) Sector Turnaround Sector turnaround from Rs 2,543 Crs loss in 2000-01 to a profit of Rs 203 Crs in 2005-06 Profitability (Rs Crs) 2000 203 0 -2000 -4000 539 583 634 2000-01 2005-06 2012-13 2013-14 2014-15 -2543 TURNAROUND OF DISCOMS FOR FUTURE 30 APPROACH OF GOVERNMENT OF INDIA ADDRESSING PROFITABILITY OF DISCOMS A) Internal Measures: Government approach is to bring the performance of Discom on track by focusing on: • Improvise Profitability of Discom • Lowering cost of supply • Operational efficiency • Cost reduction from central support B) External Measures: Government has introduced debt restructuring plan indicating permanent approach to address the funding of commercial losses IMPORTANT ASPECTS WHILE IMPLEMENTING TURNAROUND STRATEGIES (FOLLOWING DONT’S MAY BE CONSIDERED) • Pilot project approach : There are many “pilot project” solutions implemented but did not succeed. Pilot project approach may be done away and direct implementation may be adopted. • Carrot and Stick approach: The solution for reduction of AT&C losses will not only work through stick approach (using section 136 and 126 of the Act). Suitable strategy may be adopted. ACTIONS OF GOVERNMENT OF INDIA ADDRESSING PROFITABILITY OF DISCOMS • UDAY (Ujwal DISCOM Assurance Yojana) aims at permanent resolution of DISCOM issues through: • Enabling quarterly tariff increase • Operational Efficiency • Lowering Cost of power • Reduction in overall cost in entire chain • Addressing fuel issues – certainty of fuel • Land related issues – Land bill • IT enabled solutions WAY FORWARD/SUGGESTION TO ENSURE SUSTAINABILITY OF TURNAROUND • Internal Reform are essential to ensure the sustainability of the turnaround of Discoms through : • Operational efficiency • Effective strategy to reduce AT&C losses • Organization functions should be on sound commercial principle • Skilled and motivated workforce • No more Pilot Projects • Use of efficient and IT enabled technology • DSM is to be taken in a big way WAY FORWARD/SUGGESTION TO ENSURE SUSTAINABILITY OF TURNAROUND • • • • MYT – 5% increase in should be allowed subject to true up Framework for disincentive for not controlling T&D losses within limit Extensive use of smart metering and implementation of smartgrid DSM is to be taken up in larger scale REGULATORY SUPPORT • GERC has consistently allowed tariff revision to the distribution sector varying from 2.47% to 8.34% during last five year apart from the FPPPA pass through on a quarterly basis every year. NEXT STAGE REFORM (TURNAROUND WILL FACILITATE NEXT STAGE REFORM) • • Increase investment in Renewable Electricity Amendment Act, 2003 Thank you 37