Foundations of Strategy Chapter 3

advertisement

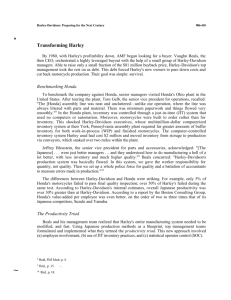

A Presentation by: Thomas Hutcheson, Kristina Giamportone , Stevie Kreidler, Brittney McQuesten, and Kevin Jones 6 OBJECTIVES • Role of a firms resources and capabilities as a basis of strategy • Identity and appraise the resources and capabilities of a firm • Evaluate the potential for a firms resources and capabilities to competitive advantage 6 OBJECTIVES • Use resources and capabilities to formulate strategies that exploit internal strengths • Identify the means through which a firm can develop its resources and capabilities • Recognize the difficulties that managers face in developing resources and capabilities of an organization Rise of hyundia Hyundai's Case • New Ceo Chung Mong Koo faced two key problems in 1999. – Building the companies production and research capabilities abroad. – Enhancing company’s market knowledge and marketing skills. Solution • Began opening production plants all over the world and customized their products based on locations culture. – Plush rear seats in China because most families have chauffeurs. – Adjusted structure and height of cars in India due to road conditions. Chapter Focus • Defining the difference between strategy and the internal environment. – A firms resources – A firms capabilties Internal Environment • As the environment becomes unstable, the internal resources are a more secure base for formulating strategy. • Competitive advantage is the primary source of profitability rather than industry attractiveness. How can resources be used? • When a company is facing a downfall with its major product, it can focus its resources towards another market. – Ex. Honda Motors – Ex. Canon Inc. Resources vs. Capabilties • Resources are the productive assets of the firm. Come in 3 kinds, tangible, intangible, and human resources. • Capabilities are things that the company can do with its resources. • Fig 3.4 Tangible Resources • Economizing asset usage and the control of resources being used within a firm. As well as cash and all receivable accounts. • Employing existing assets more profitably. Redeploying assets elsewhere. – Ex. British Airways. Intangible Resources • Reputation : Name or brand of the company, or how the company is viewed by consumers. • Technology : Intellectual property, patents, copyrights, and trade secrets. Human Resources • The ability to recruit and retain talented employees is critical to the company’s success and strategy. • At the same time, labor costs must be kept low to remain competitive. Organizational Capability • Capabilities that can provide a basis for competitive advantage. – Distinctive Competences – Core Competences • Ex. The success of Sony Functional Analysis • Identifies capabilities in relation to functional areas of the firm. – Ex. Corporate, Management info, R&D, Operations, Product design, Marketing, Sales. Value Chain Analysis • Separates activities into a sequential chain, then you can analyze the capabilities within each activity. 3 Factors that profits from the internal environment depend on • Fig 3.6 Establishing Competitive Advantage • In order to establish advantage, two conditions must be present. – Scarcity: If the resources are not widely available, then the firm has a competitive advantage. – Relevance: The resources the firm chooses to use must be relevant to the current market in order to be competitive. Sustaining Competitive Advantage • Durability over time in order to survive technological changes within the industry. • Transferability or the mobility of the resources used so that it can be traded amongst companies. • Replicability so that if the resource cannot be bought, then it can be made within the firm. Appropriating the returns • Defining who the “owner” is so that returns may be accrued. • However, capabilities rely heavily on the skills and efforts of employees, who may be seen as partial owners. • Dependent on the expertise required in each employee. 3 Steps in Appraising resources and capabilities, then guiding a strategy formulation • 1. Identify key resources and capabilties. • 2. Appraising resources and cabailities. • 3. Develop strategy implications. Identify key resources and capabilities • Look in each activity of the firm. • Within each activity, find what makes the certain activity successful. • Finally, look for factors within the firm as a whole that separate the firm from other competitors. Appraising Resources and Capabilities • Relies on two criteria: – Importance: which components are most important in ensuring the firm has a competitive advantage. – Strengths: What are the firms strongest assets and what are the weaknesses that could improve. (Relies on the use of benchmarking, or comparing performance to competitors) Develop Strategy Formulation • Step by step process: – Exploit firms strengths – Upgrade or remove firms weaknesses – Employ inconsequential strengths anywhere possible Developing Resources and Capabilties • In order to be a successful firm, you have to continue to try to develop new resources and capabilities. – Capabilities are not simply an outcome of the resources on which they are based. • Ex. GM vs. Honda, Pixar vs. Disney, Cisco vs. Alcatel Organizational Capabilities • Capabilities are usually a direct result of the history of the firm. • Early struggles or decisions shape the future capabilities. • Ex. Wal-Mart Rigid? Or not? • Most argue that Organizational Capabilities are rigid because they inhibit the firm from major changes or developing new capabilities. • However, the successful firms argue in two ways. – Flexibility in routines – Dynamic Capability Intel • Fab 42 • Will be completed in 2013 • Most advance semiconductor manufacturing facility in the world • 10 xers good to great Harley-Davidson Case History of Harley-Davidson: Fall and Rise • 1903 Founded • 1969 Acquired by AMF • 1981 Buyout of AMF’s Harley Davidson subsidiary • 1996 opened new plants, launched new models and began to explore international markets The Brand • Image and the loyalty are Harley’s greatest assets • The value that Harley represents-individuality, freedom and adventure-can be traced back to the cowboy and frontiersman of yesterday and before that to the quest that brought people to America in the first place The Product • Falls behind its competitors in the application of automotive technologies • Active in new product development • Every Harley rider has their own unique, personalized motorcycle • Harley offers a wide price range Distribution • Dealers have to carry a full line of Harley replacement parts/accessories and msust perform services on Harley bikes • Harley offers new services to customers Other Products • General merchandise represents 20% of total revenue in 2008 Harley-Davidson Case Closing Case • On May 1, 2009 Keith Wandell took over as CEO of HarleyDavidson, Inc. • Demand for luxury leisure products costing between $8,000 and $26,000 will continue to be subdued • Harley’s core market is the baby-boomer generation which is moving towards retirement homes than outdoor sports The question the company now faces is whether they should stay focused on what they do best or make smaller more affordable bikes that are more appealing to younger riders and overseas markets?