Hawaii - CWAG Conference of Western Attorneys General

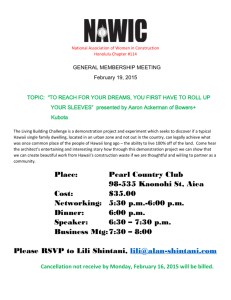

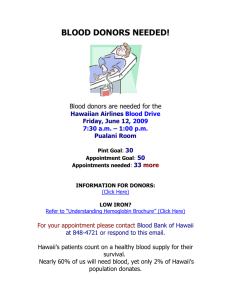

advertisement

David M. Louie Attorney General State of Hawaii Alaska 3020 mi California 2500 mi Indonesia 6800 mi Tahiti 2600 mi 2 3 1968- Report on the most feasible and expeditious means of achieving relief from the high price of gasoline in the State of Hawaii. 1995 – Regulating Hawaii’s Petroleum Industry. 4 1974 –Investigation of the Hawaii Gasoline Market. 1989 - the Hawaii Attorney General's Office began investigating the high pump prices of gasoline that followed the Exxon Valdez oil spill in Alaska. 5 Oct. 2, 1998: State filed a $500 million lawsuit against Hawaii's two refineries and major gasoline wholesalers for allegedly overcharging local consumers for years. Named in the lawsuit were 13 corporations, including Chevron Corp., BHP Hawaii Inc., Shell Oil Co., Texaco Inc., Tesoro Petroleum Corp., Tosco Corp. and Unocal Corp. 6 Encroachment/Divorcement legislation law limits a refiner's and/or marketer's ability to establish new company-operated stations within a certain distance of existing dealer-operated stations. Lease Rent Cap legislation Law imposed limits on rents that a refiner, marketer, or wholesaler/jobber can charge lessee-dealers for the use of company-owned stations. 7 March 1999: After successfully defending the oil companies’ motions to dismiss the state's antitrust suit, the State ups the amount of the lawsuit to $1.8 billion, saying the companies profited far more than first anticipated. January 2000: BHP Hawaii Inc. and Tesoro Petroleum Corp. settle the suit and deny wrongdoing. They pay the state $15 million. July 2001: The five remaining defendants -- Chevron Corp., Tosco Corp., Texaco Inc., Shell Oil Co. and Unocal Corp. -- file motions under seal seeking a summary judgment to dismiss the case. November 2001: Court hears arguments over the motions for summary judgment. 8 Among the facts uncovered in the litigation were the following for the period from 1988 to 1995: Metric CHEVRON Hawaii Market CHEVRON U.S. Market Sales Volume 3.1% 96.9% Profit 21.9% 78.11% 9 Chevron's average after-tax return on its capital investment from gas sales through dealers: ▪ Hawaii - 20.8% ▪ Los Angeles – 1.9% ▪ San Francisco – 9.8% 10 11 Settled??? Jan. 16, 2002: The State and the defendants reach a settlement that resulted in a total payment of $20 million to the State of Hawaii. 12 There was strong judicial sentiment that the evidence of collusion was not more than evidence of TACIT COLLUSION. - - - - “Once you decide it’s an oligopoly, you’ve got an explanation for the phenomenon of the high prices, the high margins, the high profits, the lack of vigorous price competition. That explains it all.” Statement by defense counsel at Summary Judgment hearing held on November 15, 2001. 13 April 2002-the lease rent cap law declared to be an unconstitutional regulatory taking. The Court: The State has a legitimate state interest in lowering consumer gasoline prices. [The lease rent cap law] does not substantially advance this legitimate state interest. 14 Lease Rent $ Increase wholesale prices to offset lost rental income Dealers will raise retail prices 15 Myths of the Hawaii Gasoline Market: #1 - It costs more to make gasoline in Hawaii than on the mainland. False: It costs less. #2 – Gasoline in Hawaii is in short supply. False: There is a gasoline surplus and it is being exported from Hawaii. #3 – Hawaii is a competitive gasoline market. False: The Hawaii market is profoundly uncompetitive 16 Jet fuel prices in Hawaii tracked California prices: 17 But not so for gasoline prices: 18 Imposed wholesale and retail price controls on regular unleaded gasoline beginning on July 1, 2004. The price cap provided the counterbalance to the lease rent cap. 19 STARTING LEGAL PREMISES: The State has a legitimate state interest in lowering consumer gasoline prices. Price regulation is permissible to protect the consumer welfare 20 STARTING FACTUAL PREMISES: That the participants in the market have chosen to secure excess profits primarily at the wholesale level. That the participants have chosen not to engage in competition. That affirmative action is needed to protect the consumers as well as businesses affected by high gasoline prices. 21 THEORETICAL CONSTRUCT: That we need BOTH a wholesale price cap and a lease rent cap because there was an inverse relationship between wholesale prices and rental income: Chevron indicated that it would increase wholesale prices to offset reduced rental income via capped lease rent. With increased wholesale prices, dealer-lessees must increase retail prices thereby undermining the efficacy of the lease rent cap to reduce retail prices. 22 The Particulars 1. Baseline price ▪ Weekly average of the spot daily pipeline price for regular unleaded gasoline for 3 markets – LA, SF, and PNW. ▪ 1 data source for ease of reference – OPIS 23 The Particulars 2. Location adjustment factor ▪ Reflected the cost to move gasoline in bulk to Hawaii $.04/gallon 24 The Particulars 3. Marketing margin factor ▪ The gross margin needed to arrive at a net margin comparable to the West Coast - $.18/gallon 25 The Particulars Baseline Price LAF MMF Max Pre-tax Wholesale Price for Oahu 26 The Particulars 4. Neighbor island wholesale adjustment factor ▪ Consisted of 2 components: a – NI Location Adjustment Factor -reflects cost to transport fuel to the neighbor b - NI Marketing Factor -reflects the cost of marketing including storage, or distribution costs. islands terminaling, 27 The Particulars Now have 2 maximum wholesale prices: 1 – Max Pre-Tax Wholesale Price for Oahu 2 – Max Pre-Tax Wholesale Price for NI Max Pre-tax Wholesale Price for Oahu NI Wholesale Adjustment Factor Max Pre-tax Wholesale Price for NI 28 The Particulars 5. Retail marketing margin factor -the retail margin for regular unleaded gasoline sold on a self-serve basis - $.16/gallon 29 Effective date of the price cap law – July 1, 2004 ▪ But . . . 30 Removed the retail price cap. Change in the markets used from LA, SF, and PNW to LA, NY Harbor, and Gulf Coast. Created a zone pricing mechanism for 8 zones. Imposed a wholesale price cap on all grades of gasoline instead of only on regular unleaded gasoline. Effective date for the price cap: September 1, 2005 31 The deadliest and most destructive Atlantic hurricane of the 2005 Atlantic hurricane season. 32 September 5 ,2005: 34 states had more expensive gasoline than Hawaii. Commentator: "If the gas cap hadn't been in place, we might have been 40th rather than 35th. . . .” Critics of the price cap law said Hawaii's prices were relatively cheap only because the state's gasoline infrastructure was unaffected by Hurricane Katrina. 33 2006: The price cap law was suspended indefinitely. Empowered the Governor to reinstate the price cap law if necessary. Established a petroleum monitoring program to promote transparency on the market. 34 2006: Commentator: ▪ WHEN gasoline prices soared after Hurricane Katrina devastated the Gulf Coast, many motorists blamed Hawaii's price cap, which was based partly on that region's prices. ▪ Since Governor Lingle signed legislation that removed the caps, that theory has been disproved. ▪ In the past five weeks, Hawaii's gas prices, implemented Sept. 1, have returned to their pre-cap pattern of hovering above mainland prices, unaffected by the dips and peaks of the marketplace. ▪ If the oligopoly continues to impose artificially high prices through the rest of this year, legislators should consider reinstating the caps. 35 David M. Louie Attorney General State of Hawaii (808) 586-1282 David.m.louie@hawaii.gov 36