20 questions and answ.. - Specialist Engineering Contractors' Group

advertisement

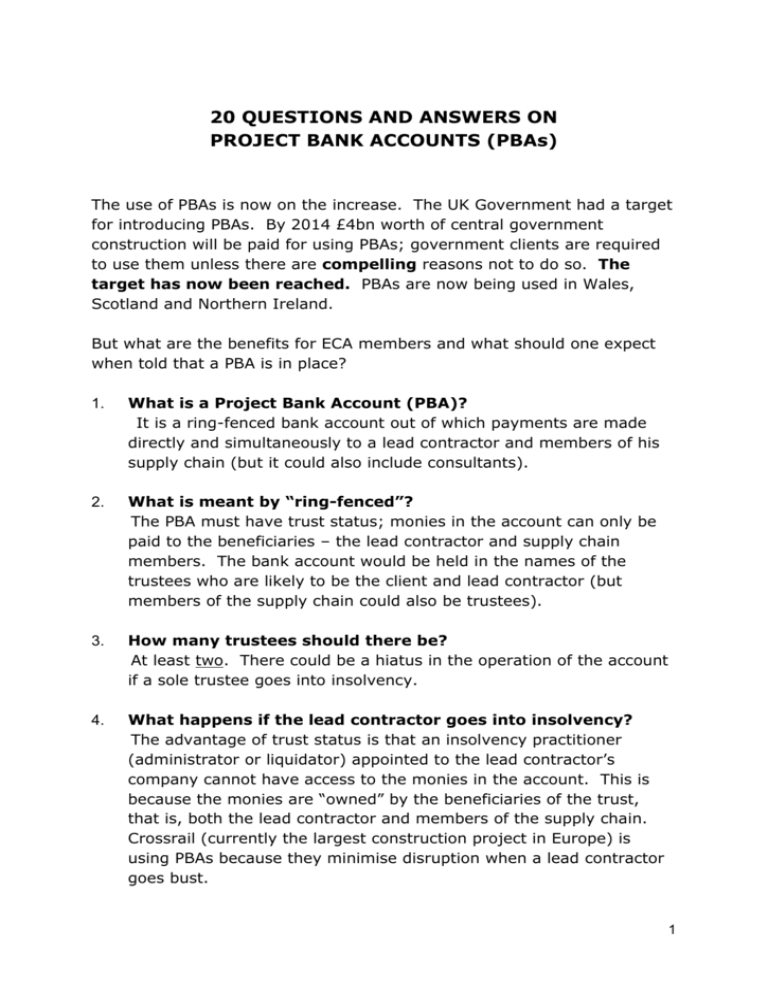

20 QUESTIONS AND ANSWERS ON PROJECT BANK ACCOUNTS (PBAs) The use of PBAs is now on the increase. The UK Government had a target for introducing PBAs. By 2014 £4bn worth of central government construction will be paid for using PBAs; government clients are required to use them unless there are compelling reasons not to do so. The target has now been reached. PBAs are now being used in Wales, Scotland and Northern Ireland. But what are the benefits for ECA members and what should one expect when told that a PBA is in place? 1. What is a Project Bank Account (PBA)? It is a ring-fenced bank account out of which payments are made directly and simultaneously to a lead contractor and members of his supply chain (but it could also include consultants). 2. What is meant by “ring-fenced”? The PBA must have trust status; monies in the account can only be paid to the beneficiaries – the lead contractor and supply chain members. The bank account would be held in the names of the trustees who are likely to be the client and lead contractor (but members of the supply chain could also be trustees). 3. How many trustees should there be? At least two. There could be a hiatus in the operation of the account if a sole trustee goes into insolvency. 4. What happens if the lead contractor goes into insolvency? The advantage of trust status is that an insolvency practitioner (administrator or liquidator) appointed to the lead contractor’s company cannot have access to the monies in the account. This is because the monies are “owned” by the beneficiaries of the trust, that is, both the lead contractor and members of the supply chain. Crossrail (currently the largest construction project in Europe) is using PBAs because they minimise disruption when a lead contractor goes bust. 1 5. PBAs are only for big projects. Is this correct? The simple answer is No. A PBA may be suitable for a £1m project or even smaller projects if there happens to be numerous subcontractors. At the beginning of 2013 the Northern Ireland government announced that PBAs will be used on public sector projects over £1m. 6. So, what are the benefits? 7. Once a public sector client has deposited the monies in the PBA the supply chain’s cash is safe since the PBA is ring-fenced. Payments out of the PBA are made simultaneously to everybody; payments become more efficient and cashflow management more transparent. Payment times are the same for the main contractor and firms in the supply chain. Clients also make savings (up to 2½%) since financing charges across the supply chain are reduced. There is less risk for clients of disruption and delay as a result of the supply chain suspending work for non-payment. PBAs increase collaboration since there is more trust. The delivery team can concentrate on working together without the distraction of payment delays and abuse. But will PBAs eradicate payment delays and abuse? Since the lead contractor doesn’t have access to his supply chain’s cash the temptation to use it isn’t there. This also applies to the position between tier 2 and tier 3 contractors. The table below illustrates this. 2 30 day payments often end up being 90 at the end of the supply chain Traditional contracting Project bank account Days 30 Client to Contractor Risk of abuse Days Client to PBA Contractor to sub-contractor Risk of abuse 30 30 Contractor + sub-contractors Sub-contractor to sub-subcontractor or supplier 5 35 30 (usually much more) Risk of abuse 90 This is the maximum length of time for the money to be in the PBA From the above it can be seen that the PBA removes a long-winded, potentially abusive and hierarchical payment structure. 8. How does the process actually work? PBAs do not cut across the contractual provisions governing entitlement to and discharge of payments. They are simply a safe receptacle for the cash. Once the lead contractor has agreed his application with the client the agreed amount is paid into the PBA. The contractor then issues the authority to the bank listing the names of the recipients and the individual amounts to be paid. The client will also sign off the authority. All payments in and out of the account are made electronically which means that monies should not be in the account for more than 5 days. The lead contractor and supply chain are paid simultaneously. If, for whatever reason, there is a shortfall in the account the lead contractor remains bound to pay what is due to his supply chain members. This is not a pay when paid mechanism. 9. What about notices to pay less? Can monies still be withheld by the paying party? Yes, provided the payer has issued a notice to pay less in time (i.e. before the final date for payment). Since the cash is not in the 3 payer’s pocket there is no incentive to issue spurious notices in order to hang on to it. 10. Aren’t PBAs bureaucratic to set up and operate? Not as bureaucratic as setting up and operating multi-layered payment systems. In fact, they are very simple to set up and operate. 11. Who gets the interest for the periods when the funds are in the PBA? This is a matter for agreement between the client, lead contractor and supply chain. In practice it is likely that interest earned will go to discharge the cost of setting up the PBA which will be relatively small. 12. Are the commercial banks supportive? Yes. Barclays, Bank of Scotland and HSBC offer standard packages. 13. What role do the banks actually play? They set up the account at the instance of the client and/or lead contractor. The operation of the account is governed by the Account Bank Agreement between bank, client and lead contractor. Under this Agreement funds are remitted to the PBA by the client. 14. Do the standard contracts have PBA provisions? Yes. All of them: the New Engineering Contract (NEC3), the Project Partnering Agreement (PPC2000), published by the Association of Consultant Architects and JCT contracts. 15. What should the supply chain expect if there is a PBA in operation? You must be named as a beneficiary under the trust deed ringfencing the PBA. Furthermore: You must have details of the PBA. You must know who the trustees are. You must be kept informed of the respective amounts to be paid into the PBA, dates of paying the amounts into the PBA and discharge of such amounts. 4 16. Who decides whether I’m named as a beneficiary? It is usually the case that the client names the trades he wishes to benefit through the PBA. Occasionally the main contractor will be left to determine the beneficiaries but this is not a desirable option. 17. Can sub-sub-contractors (i.e. tier 3 contractors) be included within the PBA arrangements? Absolutely. The Highways Agency – which is now using PBAs throughout its construction programme – has extended the PBA arrangement to sub-sub-contractors. 18. Is there any guidance on PBAs? Yes, the Government has published guidance in May 2012. This can be downloaded from www.cabinetoffice.gov.uk/resource.library/project-bank-accounts. The Government has set minimum standards for the operation of PBAs; these are in the Guide. 19. What should I be doing as an ECA member? There are 4 actions you could consider: Read the Government’s PBA guide. Use the Mystery Shopper service for complaints about payment practices on public sector projects. http://procurement.cabinetoffice.gov.uk/policy-capability/doing-businessgovernment/mystery-shopper 20. Encourage end-user clients to use PBAs. Report any experiences of PBAs back to AIS whether good or bad. Where do we go from here? For some years ECA and its umbrella body, the Specialist Engineering Contractors’ Group, have been campaigning for the use of PBAs. We are now making significant progress. The next stage is to encourage their use by local authorities and health trusts. Word count: 1,323 5