Chapter 11

advertisement

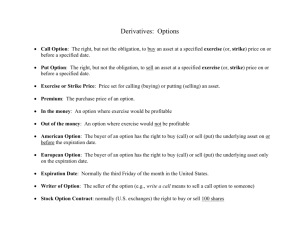

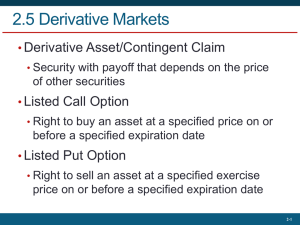

Chapter 11 AN INTRODUCTION TO DERIVATIVE SECURITIES Chapter 11 Questions What are the basic features of forward contracts, futures contracts, and options contracts? Why do derivative securities exist? How do they help meet investor needs and increase market efficiency? What are the similarities and differences between forward contracts and futures contracts? Chapter 11 Questions What terminology do we use to describe option contracts? What does a payoff diagram show? What are the risks and potential returns from option positions such as buying and writing calls; buying and writing puts; owning long and short positions in spreads, straddles, strangles, or butterfly spreads? Chapter 11 Questions What are the relationships among the prices of puts, calls, and futures? What are some uses of derivatives in investment analysis and portfolio management? Derivative Instruments Value is determined by, or derived from, the value of another instrument vehicle, called the underlying asset or security Forward contracts are agreements between two parties - the buyer agrees to purchase an asset, the seller agrees to sell the asset, at a specific date at a price agreed upon now Futures contracts are similar, but are standardized and traded on an organized exchange Derivative Instruments Options offer the buyer the right, but not the obligation, to buy or sell and underlying asset at a fixed price up to or on a specific date Buyer is long in the contract Seller or “writer” is short the contract The price at which the transaction would we made is the exercise or strike price The profit or loss on an option position depends on the market price Why Do Derivatives Exist? Assets are traded in the cash or spot market Sometimes have one’s fortunes dependent on spot price movements leads to considerable risk Various derivatives markets have evolved that allow some investors to manage these risks, while also creating opportunities for speculators to invest in the same contracts Potential Benefits of Derivatives Risk shifting Especially shifting the risk of asset price changes or interest rate changes to another party willing to bear that risk Price formation Speculation opportunities when some investors may feel assets are mis-priced Investment cost reduction To hedge portfolio risks more efficiently and less costly than would otherwise be possible Forward Contracts An agreement between two parties to exchange an asset at a specified price on a specified date Buyer is long, seller is short; symmetric gains and losses as price changes, zero sum game Contracts are OTC, have negotiable terms, and are not liquid Subject to credit risk or default risk Value realized only at expiration Popular in currency exchange markets Futures Contracts Like forward contracts… Buyer is long and is obligated to buy Seller is short and is obligated to sell Unlike forward contracts… Standardized – traded on exchange More liquidity - can “reverse” a position and offset the future obligation, other party is the exchange Less credit risk - initial margin required Additional margin needs are determined through a daily “marking to market” based on price changes Futures Contracts Chicago Board of Trade (CBOT) Grains, Treasury bond futures Chicago Mercantile Exchange (CME) Foreign currencies, Stock Index futures, livestock futures, Eurodollar futures New York Mercantile Exchange (NYMEX) Crude oil, gasoline, heating oil futures Development of new contracts Futures exchanges look to develop new contracts that will generate significant trading volume Futures Contracts Futures Quotations One contract is for a fixed amount of the underlying asset Prices are given in terms of the underlying asset 5,000 bushels of corn (of a certain grade) $250 x Index for S&P 500 Index Futures (of a certain maturity) Cents per bushel (grains) Value of the index Value of one contract is price x contract amount Settle is the closing price from the previous day Futures Contracts Example: Suppose you bought (go long) the most recent (Sept.) S&P 500 contract at the settle price (see Exhibit 11.5). What was the original contract value? Value = $250 x 1180.80 = $295,200 What is your profit if you close your position (sell a contract) for 1250.00? Value = $250 x 1250.00 = $312,500 Profit = $312,500 - $295,200 = $17,300 Options Option Terminology Option to buy is a call option Option to sell is a put option Option premium – price paid for the option Exercise price or strike price – the price at which the asset can be bought or sold under the contract Options Option Terminology Expiration date European: can be exercised only at expiration American: exercised any time before expiration In-the-money: the option has intrinsic value, and would be exercised if it were expiring Out-of-the-money: the option has no intrinsic value, would not be exercised if expiring If not expiring, could still have value since it could later become in-the-money Options Example: Suppose you own a call option with an exercise (strike) price of $30. If the stock price is $40 (in-the-money): Your option has an intrinsic value of $10 You have the right to buy at $30, and you can exercise and then sell for $40. If the stock price is $20 (out-of-the-money): Your option has no intrinsic value You would not exercise your right to buy something for $30 that you can buy for $20! Options Example: Suppose you own a put option with an exercise (strike) price of $30. If the stock price is $20 (in-the-money): Your option has an intrinsic value of $10 You have the right to sell at $30, so you can buy the stock at $20 and then exercise and sell for $30 If the stock price is $40 (out-of-the-money): Your option has no intrinsic value You would not exercise your right to sell something for $30 that you can sell for $40! Options Chicago Board Options Exchange (CBOE) Centralized facility for trading standardized option contracts Clearing Corporation is the opposite party to all trades, allowing buyers and sellers to terminate positions prior to expiration with offsetting trades Standardized expiration dates, exercise prices, and contract sizes Secondary market with standardized contracts Offer options on almost 1,400 stocks and also index options Options Stock Option Quotations One contract is for 100 shares of stock Quotations give: Underlying stock and its current price Strike price Month of expiration Premiums per share for puts and calls Volume of contracts Premiums are often small A small investment can be “leveraged” into high profits (or losses) Options Example: Suppose that you buy a January $60 call option on Microsoft (see Exhibit 11.10). What is the cost of your contract? Cost = $9 x 100 = $900 Is your contract in-the-money? Yes. The current stock price is $63.20, so the intrinsic value is $3.20 per share. Options Example (cont.): What is your dollar profit (loss) if, at expiration, Microsoft is selling for $50? Out-of-the-money, so Profit = ($900) Is your percentage profit with options? Return = (0-9)/9 = (100%) What if you had invested in the stock? Return = (50-63.20)/63.20 = (20.89%) Options Example (cont.): What is your dollar profit (loss) if, at expiration, Microsoft is selling for $65? Profit = 100(65-60) – 900 = ($400) Is your percentage profit with options? Return = (65-60-9)/9 = (44.44%) What if you had invested in the stock? Return = (65-63.20)/63.20 = 2.85% Options Example (cont.): What is your dollar profit (loss) if, at expiration, Microsoft is selling for $85? Profit = 100(85-60) – 900 = $1,600 Is your percentage profit with options? Return = (85-60-9)/9 = 177.78% What if you had invested in the stock? Return = (85-63.20)/63.20 = 34.49% Options Payoff diagrams Show payoffs at expiration for different stock prices (V) for a particular option contract with a strike price of X For calls: if the V<X, the payoff is zero If V>X, the payoff is V-X Payoff = Max [0, V-X] For puts: if the V>X, the payoff is zero If V<X, the payoff is X-V Payoff = Max [0, X-V] Option Trading Strategies There are a number of different option strategies: Buying call options Selling call options Buying put options Selling put options Option spreads Buying Call Options Position taken in the expectation that the price will increase (long position) Profit for a purchasing a Call Option: Per Share Profit =Max [0, V-X] – Call Premium Note that profits on an option strategy include option payoffs and the premium paid for the option The following diagram shows different total dollar profits for buying a call option with a strike price of $70 and a premium of $6.13 Buying Call Options 3,000 Profit from Strategy 2,500 Exercise Price = $70 2,000 Option Price = $6.13 1,500 1,000 500 0 (500) (1,000) 40 Stock Price at Expiration 50 60 70 80 90 100 Selling Call Options Bet that the price will not increase greatly – collect premium income with no payoff Can be a far riskier strategy than buying the same options The payoff for the buyer is the amount owed by the writer (no upper bound on V-X) Uncovered calls: writer does not own the stock (riskier position) Covered calls: writer owns the stock Selling Call Options 1,000 500 Profit from Uncovered Call Strategy Exercise Price = $70 Option Price = $6.13 0 (500) (1,000) (1,500) (2,000) (2,500) (3,000) 40 Stock Price at Expiration 50 60 70 80 90 100 Buying Put Options Position taken in the expectation that the price will decrease (short position) Profit for purchasing a Put Option: Per Share Profit = Max [0, X-V] – Put Premium Protective put: Buying a put while owning the stock (if the price declines, option gains offset portfolio losses) The following diagram shows different total dollar profits for buying a put option with a strike price of $70 and a premium of $2.25 Buying Put Options 3,000 Profit from Strategy 2,500 2,000 Exercise Price = $70 1,500 Option Price = $2.25 1,000 500 0 Stock Price at Expiration (500) (1,000) 40 50 60 70 80 90 100 Selling Put Options Bet that the price will not decline greatly – collect premium income with no payoff The payoff for the buyer is the amount owed by the writer (payoff loss limited to the strike price since the stock’s value cannot fall below zero) Selling Put Options 1,000 Profit from Strategy 500 0 Exercise Price = $70 (500) Option Price (1,000) = $2.25 (1,500) (2,000) (2,500) (3,000) 40 Stock Price at Expiration 50 60 70 80 90 100 Option Spreads Many other option strategies can be crafted using combinations of option positions Price spread (vertical spread) Buying and selling options on the same stock with the same expiration, but with different strike prices Time spread (horizontal or calendar spread) Buying and selling options on the same stock with the same strike price, but with different expirations Option Spreads Bullish spreads Buy a higher priced option and sell a lower priced option on the same stock Bearish spreads Sell a higher priced option and buy a lower priced option on the same stock Straddle Combination of a purchasing (long) or selling (short) a put and a call on the same expiration Betting on a large price movement (long straddle) or little price movement (short straddle) Option Spreads Strangle Combination of a call and put with the same expiration but different exercise prices (long or short) Similar to straddle strategies Butterfly spread Combination strategy with 4 options, similar to straddles and strangles, but with less risk of large losses The number of different strategies is potentially limitless Put/Call Parity Premiums for puts and calls are not completely independent otherwise arbitrage opportunities would exist Two investments with equally risky payoffs should have similar costs Parity relationships exist between options, also between options and futures, options and spot prices, and futures and spot prices