SCA workshop business planning presentation part two

advertisement

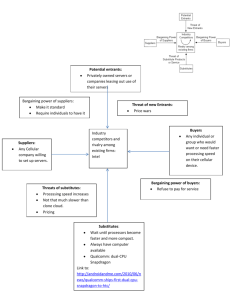

Defining the Business Model Organisations need to define their unique business model by making clear, strategic decisions An organisation’s business model is fundamental to the business’ direction, growth and sustainability A business model consists of 3 unique components: 1. WHO is our target consumer? o Customer segment o Geographic region o Size / value / volume 2. WHAT are we offering our consumer? o Product / service definition 3. HOW do we deliver our product / service? o Acquisition, Organic Growth or Strategic Alliance o Distribution channels / platforms o Marketing 2 Value Chain Analysis An organisation’s Value Chain includes all activities undertaken in producing their output These consist of Primary and Support activities undertaken in producing its goods or services SUPPORT ACTIVITIES FIRM INFRASTRUCTURE HUMAN RESOURCE DEVELOPMENT FINANCE / ACCOUNTING / PAYROLL TECHNOLOGY DEVELOPMENT INBOUND OPERATIONS LOGISTICS OUTBOUND SALES & LOGISTICS MARKETING SERVICE PRIMARY ACTIVITIES An organisation needs to determine which activities it must be involved in to deliver a product or service A decision can then be taken on how best to accomplish those activities (internally or externally) This decision will be based on degree of standardisation versus specialisation required 2 Defining the Market, Industry, Supplier and Competitive Factors Organisations need to develop a clear understanding of the environment in which they operate and intend to compete Various factors and drivers need to be analysed to best position and contextualise the offering, product or service Porter’s Five Forces BUYER POWER Factors determining power of suppliers relative to buyers Price Sensitivity - cost of purchases - profitability of buyers - relevance of product to quality of buyers’ product THREAT OF ENTRY - economies of scale - absolute cost advantages - capital requirements - product differentiation - access to distribution channels - governmental and legal barriers - retaliation by established producers Bargaining Power - size / concentration of buyers relative to suppliers - buyers’ switching costs - buyers’ information - buyers’ ability to backward integrate INDUSTRY COMPETITIVENESS - concentration - product differentiation - excess capacity - demand growth - cyclicality (eg. of demand) - exit barriers • Define the market and industry boundaries • Map the key players - identify who is doing what (note that certain players can take on multiple roles) • Clarify whether the analysis is from the perspective of an incumbent or an entrant Assess the power of each to influence price, cost and volumes. • THREAT OF SUBSTITUTES - buyer propensity to substitute - relative price performance of substitutes 1. Gauge which of the five forces pose a threat and to what extent 2. Assess how those key forces are likely to change over time, by SUPPLIER POWER Factors determining power of buyers relative to suppliers Price Sensitivity - cost of purchases - profitability of buyers - relevance of product to quality of buyers’ product 2 Bargaining Power - size / concentration of buyers relative to suppliers - buyers’ switching costs - buyers’ information - buyers’ ability to backward integrate considering the actions / responses of each group 3. Third, identify specific actions you can take to reduce the threats posed by these particular forces or to leverage them to your advantage Defining Critical Market, Industry and Team factors Organisations need to develop a clear understanding of the environment in which they operate and intend to compete Various factors and drivers of the opportunity need to be analysed to best position the offering, product or service MARKET DOMAIN INDUSTRY DOMAIN Seven Domains: MARKET ATTRACTIVENESS INDUSTRY ATTRACTIVENESS - Where is industry heading, what factors affect it? Define and gauge the three critical parameters of Market (buyers), Industry (sellers) and Team • Are the Market and Industry attractive? • Consider both Macro and Micro factors in determining MICRO-LEVEL - What is the size, growth rate and overall opportunity? • - Five forces analysis - buyers, suppliers, barriers (including regulatory and technological), substitutes, rivals - who holds the power / what are the drivers? - Definition of broad market, including / as defined by: similar services, substitutes and customer needs - Size, volume, value, trends and forecasts for the broad customer set - Are the forces favourable or unfavourable and to what extent - what, if anything can be done to mitigate? - Description of customer “pain”, needs, requirements along with potential solution BUYER POW ER F a c t o rs d e t e rm in in g p o w e r o f s u p p lie rs re la t iv e t o b u y e rs P ric e S e n s it iv it y - c o s t o f p u rc h a s e s - p ro f it a b ilit y o f b u y e rs - re le v a n c e o f p ro d u c t t o q u a lit y o f b u y e rs ’ p ro d u c t TH R EA T OF EN TR Y B a rg a in in g P o w e r - s iz e / c o n c e n t ra t io n o f b u y e rs re la t iv e t o s u p p lie rs - b u y e rs ’ s w it c h in g c o s t s - b u y e rs ’ in f o rm a t io n - b u y e rs ’ a b ilit y t o b a c k w a rd in t e g ra t e IN D U S T R Y C O M P E T IT IV E N E S S - e c o n o m ie s o f s c a le - a b s o lu t e c o s t a d v a n t a g e s - c a p it a l re q u ire m e n t s - p ro d u c t d if f e re n t ia t io n - a c c e s s t o d is t rib u t io n c h a n n e ls - g o v e rn m e n t a l a n d le g a l b a rrie rs - re t a lia t io n b y e s t a b lis h e d p ro d u c e rs - c o n c e n t ra t io n - p ro d u c t d if f e re n t ia t io n - e x c e s s c a p a c it y - d e m a n d g ro w t h - c y c lic a lit y ( e g . o f d e m a n d ) - e x it b a rrie rs T H R E A T O F S U B S T IT U T E S - b u y e r p ro p e n s it y t o s u b s t it u t e - re la t iv e p ric e p e rf o rm a n c e o f s u b s t it u t e s S U P P L IE R P O W E R F a c t o rs d e t e rm in in g p o w e r o f b u y e rs re la t iv e t o s u p p lie rs P ric e S e n s it iv it y - c o s t o f p u rc h a s e s - p ro f it a b ilit y o f b u y e rs - re le v a n c e o f p ro d u c t t o q u a lit y o f b u y e rs ’ p ro d u c t attractiveness of opportunity • B a rg a in in g P o w e r - s iz e / c o n c e n t ra t io n o f b u y e rs re la t iv e t o s u p p lie rs - b u y e rs ’ s w it c h in g c o s t s - b u y e rs ’ in f o rm a t io n - b u y e rs ’ a b ilit y t o b a c k w a rd in t e g ra t e Does the opportunity offer compelling customer TARGET SEGMENT BENEFITS AND ATTRACTIVENESS • Does the team have the experience, capabilities and network to deliver results? • A low count on one parameter might be mitigated by a MACRO-LEVEL benefits as well as sustainable competitive advantage? SUSTAINABLE ADVANTAGE - Is there a target market segment to which we can offer compelling benefits? - Does the business model have an enduring economic viability? - Precise identification and definition of intended target segment - Sustainable competitive advantage (what do we have that is valuable, rare and hard to imitate?) - Size, volume, value, growth rate, trends etc. of this precise segment - How do our resources contribute to and sustain our advantage? - Clear description of these customers' requirements, the proposed solution and its associated compelling benefits / competitive differentiation - What have we got, what do we need, how should we get it (ally, acquire and/or grow organically)? higher count / combination of others TEAM MISSION, ASPIRATIONS, RISK PROPENSITY - Does the opportunity fit team’s and /or “investor’s” business mission, aspirations and risk propensity? - Is the market, industry, brand / product aligned with “investor’s” aspirations? 2 ABILITY TO EXECUTE ON CSF’s - Does team have clear understanding of critical success factors? - Does team have relevant experience, background and industry knowledge to deliver on opportunity and CSF’s? CONNECTED UP, DOWN & ACROSS VALUE CHAIN - Is team well connected up, down and across value chain so as to notice and adapt to change / evolving target if required to do so? - Does team have strong network to facilitate flexibility and evolution? Value Curves and Value Proposition Value Curves can identify product / service’s unique Value Proposition relative to those of competitors’ / substitutes Parameters used must be relevant and prioritised based on research of customer requirements and pain points Value Curve - News Delivery PERFORMANCE 10 Newspaper Can be defined and conducted at various levels and parameters from Macro to Micro Once identified, prioritised and compared to competitors, can be used to focus resources and capabilities to optimally position and support the service and ensure competitive advantage Considerations might include: 8 6 Online 4 Radio 2 TV 0 – Portability Information Coverage Accessibility Price – PARAMETER – Value Curve - Hardcopy News Delivery PERFORMANCE 10 – 8 6 4 2 0 Guardian Newsweek Express FT General Content Specific Content PARAMETER Frequency Price What factors can be reduced below the industry standard? What factors can be eliminated that the industry has taken for granted? What factors should be raised beyond the industry standard? What factors should be created that the industry has never offered? Also helps provide early identification of future threats and competitor dynamics – eg. greater quality of portable online media platform might mitigate / pose threat to current superior benefits of newspapers on that parameter Value Curves and Value Proposition Value Curves can identify product / service’s unique Value Proposition relative to those of competitors’ / substitutes Parameters used must be relevant and prioritised based on research of customer requirements and pain points The Body Shop - Illustrative Example The Body Shop made clear decisions regarding: – The Body Shop – – PERFORMANCE – Packaging & Advertising Hi-Tech Scientific Image Glamorous Image PARAMETERS Natural Ingredients "Ethical" Concerns What factors should be raised beyond the industry standard? What factors should be created that the industry had never offered? In so doing, The Body Shop created a unique business model, brand and position that ensured an sustainable competitive advantage The Body Shop’s robust business model and unassailable position was evidenced by L’Oreal’s acquisition of it in 2006 Despite being an established, extremely wellresourced competitor L’Oreal had been unable to compete against The Body Shop’s values and positioning…..whether The Body Shop’s values were compromised by its acquisition, however, is a different matter! Cosmetic’s Industry Price What factors could be reduced below the industry standard? What factors could be eliminated that the industry had taken for granted? Sources Growth / Sustainability Organisations need to deliver clear benefits / solutions to their customers’ pain / problems These benefits need to be “better” than available alternatives and more sustainable than potential direct competitors’ – What have we got, what do we need, how can we attain it? • Grow Pros – engender team dynamics / buy-in of constituents, embed organisational culture Cons - slow time to market, not aligned with core competencies • Acquire Pros – time-to-market, existing customer base, separate to avoid “contamination” of core capabilities Cons – integration issues, fair valuation • Ally Pros – value-adding synergies (1 + 1 = 3), new market entry, competitive advantage Cons – cultural integration / working practices, non-aligned incentives 2