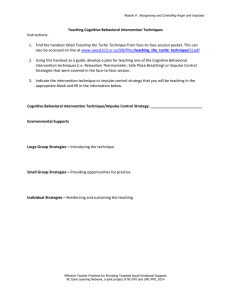

Impulse Buying and Today's Consumer

advertisement

Impulse Buying- Mental Addiction or Bad Habit By: Kadie Stamper English Comp. 101 June 7, 2010 The Problem Consumers now have the ability to purchase more than they ever could thirty years ago. Has impulse purchasing become an addiction to some people or just a bad habit? Thesis Today’s economy has changed drastically from thirty years ago. Consumers now have access to purchase anything and everything they could ever need or want for that matter. With so many ways to be approved for a credit card line or even a loan, stores are selling more and more these days to every race and either gender. Stores offer percentages off of your purchase when you open a new credit card, and these credit cards can be approved in sixty seconds or less, according to certain shopping centers. Someone that purchases large quantize of unnecessary items on a regular and random basis is an impulse shopper. Different studies indicate whether or not impulse shopping is a mental disorder or just a bad habit. There are three different types of impulse shopping that can and does occur. Available Credit & Types of Impulse Buying. Credit cards Personal loans Instant cash Pure impulse buying- purchasing an item at random Reminder impulse buying- purchasing one item reminds consumer they need another item Suggestion impulse buying-seeing a product for the first time and thinking of ways you the consumer could use the item and why you the consumer need the item. ADWEEK Survey 60% of respondents surveyed say they impulse purchased in the past year. 39% of respondents surveyed say they impulse purchased in the past month. 15% of respondents surveyed say the often buy items on impulse. 42% of respondents impulse buy “because it was a great price on sale” 18% of respondents impulse buy “because they had to have it” Conclusion In the end impulse buying comes down to be a bad habit rather than a mental addiction. Yes credit cards make spending easier and more money available but with careful planning and getting help from friends and family impulse buying can be controlled and even stopped. Ways to help control impulse buying include: making a list of items you plan to purchase before you leave the house, budget your expenses and set aside extra spending money for when you do want to go out and make unplanned purchases, decide exactly how much you want to spend at each store you shop at, know before you leave home how much money you need for other items or bills you have. But most importantly to cure this bad buying habit make your mid up before leaving home that you will not buy anything that is not written on your list and that you will not go past the amount you have set aside for each store you plan to visit. Works Cited Anonymous. "5 Factors That Cause Impulse Buying." OneMint-Helps You Make Better Financial Decisions. Web. 21 May 2010. <http://www.onemint.com/2010/01/15/5-factors-that-cause-impulse-buying/>. Dolliver, Mark. "Impulse Buying Is Alive and Well." CMO. 19 Nov. 2009. Web. 21 May 2010. <http://www.cmo.com/statistics/impulse-buying-alive-well>. Millinar, Ian. "Burying the Myth of Impulse Buying - Brand Strategy | HighBeam Research." Research - Articles - Journals | Find Research Fast at HighBeam Research. 1 Sept. 2002. Web. 21 May 2010. <http://www.highbeam.com/doc/1G192948716.html>. Montaldo, Donna L. "Impulse Buying Can Be a Good Thing." Coupons and Bargains - The Coupons and Bargains Homepage. Web. 21 May 2010. <http://couponing.about.com/od/groceryzone/a/impulse.htm>. Rook, Denis. "The Buying Impulse." The Journal of Consumer Research. Web. 14 May 2010. <http://www.jstor.org/stable/2489410>. Stern, Hawkins. "The Significance of Impulse Buying Today." American Marketing Association. Web. 14 May 2010. <http://www.jstor.org/stable/1248439>. Thomas, Cindy. "Impulse Shopping: A Cure for This Buying Disease." Associated Content -Associatedcontent.com. Web. 14 May 2010. <http://www.associatedcontent.com/article/29024/impulse_shopping_a_cure_for_this_buying.html>.