Scottish Courage

advertisement

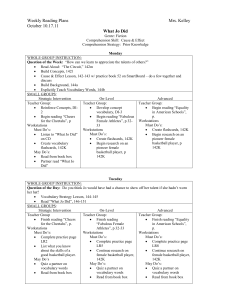

From Forecasting to Drink – and how we could be more sociable with business Peter Gormley, Business Development Manager, Gordon MacMillan, Promotional Analysis Manager, Scottish Courage Ltd. Scottish Courage Brands Ltd. • • • • • • • • • • Part of Scottish & Newcastle plc 26% domestic share, 30 core brands + own label 250 SKUs, 130 new each year 200 staff, £800m turnover, over £60m profit Market - Interbrew, Coors, Carlsberg, A-Busch, Guinness 11.3 million barrels, underlying growth 4% per annum 70% of volume from 3 brewers 53,000 outlets, but 4 store groups (1700 stores) = 30% 500 brands, but top 13 brands > half of volume Take Home 31% of UK beer market: USA - 70%, Germany 65%, France - 61%, Ireland - 10% Criticality of Forecasts • • • • • • • • • • Sales & Operations Planning - total beer business - 2 yr. All aspects of planning - sales, marketing, finance, supply.. Pricing and promotional activity - 60% sold on promotion Impacts on service, stock, waste, efficiency, profit On-trade stable, off-trade highly volatile Polarisation - grocers, wholesale, specialists, convenience.. Price and promotional offers, BOGOFs,…. In-store display and feature, events, weather, competitors.. Promiscuous, elastic market Highly seasonal Beck’s Bier Supply to Major Customer L eg end £11.49 £11.49 BE C KS 1 50 00 £12.49 12pk BOGOF £12.99 £12.49 £11.99 1 00 00 £12.49 5 00 0 £12.99 0 1 99 5 1 99 6 1 99 7 1 99 8 1 99 9 2 00 0 2 00 1 2 00 2 2 00 3 2 00 4 Forecast Process Evolution • • • • • • • • • Output - forecast by customer by SKU by period - 2 years Statistical forecast based on supply data Sales & Marketing edit forecast at various horizons Assumptions captured in database Valuation of forecast Forecast review meetings and submission to group S&OP Move to top down forecast managed by one function Information passed from Sales & Marketing Price and promotion models used Demand Factors Lancaster Regression Models • Different levels of forecast • Considered – price, price differential, media spend, promotion, multibuy, display, feature, temperature, sunshine, seasonality, distribution, etc. • Regression outperformed exponential smoothing model – 10% MAPE vs. 15% for total beer – 17% MAPE vs. 27% for major brands • Different brands reflected different driver weights • Significant factors: – Promotion, Price and price differential, Seasonality, Weather, Distribution • Effort relative to exponential smoothing Model Results for Total Lager Sales x 10 4 Long term (32 wks.) out-of-sample forecast originating at sample 99 : Tot.lagr 16 data model fit (within sample) forecast (out of sample) forecasting origin 14 12 10 8 6 4 19-Dec-1998 01-Aug-1998 14-Mar-1998 25-Oct-1997 07-Jun-1997 18-Jan-1997 2 Interrelationship Formed • SCB & Lancaster University • Methodologies analysed – – – – Wlodek Tych Transfer Function Models ACNielsen Promotional Evaluator SPSS implementation using Lagged Effects Procast • SCB recognition of benefits of new techniques • Permanent resource employed Price Focus • • • • • • Price - the single most important driver of sales volume Major cause of forecast error and stock shortages/surpluses Requirement of tactical and strategic price planning Series of requirements - advice & forecasting Comparing price to share (removing seasonality aspects) By total grocery market and individual customers, where EPOS data available • SKU & Brand versus product sector • SKU & Brand versus competitor brand • Cannibalisation effects Price Focus • How elastic is the Beer Market • What is the impact on competitors Price vs. Volume Price Ratio (100 = Parity) – Steal – Cannibalisation – Volume Brand X Vs Vs Brand Y 140.00 120.00 100.00 80.00 60.00 -0.1672 y = 221.13x R2 = 0.8122 40.00 20.00 0.00 0.00 50.00 100.00 150.00 Volume Ratio (100 = Parity) Source: ACNielsen Scantrack 200.00 250.00 300.00 Price Focus •Identify most profitable Price Level •Price (RPB) x Volume = Profit 20 Example: Brand X in Account when Brand Y @ £15.99 X Profit 15 10 Profit The Golden Egg 5 0 14 15 15.5 16 16.5 17 17.5 Price Maximising Profit Contribution 18 19 Price Elasticity Models • Use output from exponential smoothing model as base • Recognise confidence interval and implications • Document assumptions made • Used for temporary price reductions • Caution in use as guide for strategic price movement • Need to maintain models reflecting changes in market dynamics • Used with supervision from forecasting team currently Cross Elasticity Start Date End Date Premium Lager 12PK WE 29.08.98 WE 17.06.00 Instructions: 5% Confidence Intervals CARLING,12PK TENNENTS,12PK FOSTERS,12PK MILLER PILS,12PK CARLSB LAGER,12PK -6.41 -0.03 1.40 -1.95 CARLING,12PK -5.80 -5.18 0.83 1.69 2.39 3.37 2.47 6.90 0.23 -6.53 0.74 -1.70 The columns highlighted in yellow offer the cross and own-price elasticity's. The numbers in italics which straddle the elasticity estimates are the lower and upper bound confidence intervals respectively. The tables offer confidence intervals at both 5% and 10%, 5% being the most cautious. TENNENTS,12PK 0.70 1.17 -5.88 -5.23 1.42 1.65 2.10 5.00 1.26 1.69 -4.94 2.12 3.40 FOSTERS,12PK 1.74 2.23 2.36 3.03 -4.17 -3.40 2.82 3.53 6.86 10.32 0.41 1.38 0.75 -4.29 MILLER PILS,12PK 0.84 1.26 1.97 2.56 1.43 2.11 -3.67 -3.06 -0.29 0.14 -0.49 CARLSB LAGER,12PK 0.11 0.51 0.69 1.25 0.14 0.78 1.34 1.80 -4.82 2.24 3.97 FOSTERS,12PK 1.74 2.15 2.36 2.92 -4.17 -3.53 2.82 3.41 6.86 9.75 0.48 1.48 0.86 -4.19 MILLER PILS,12PK 0.84 1.19 1.97 2.46 1.43 2.00 -3.67 -3.16 -0.23 0.23 -0.39 CARLSB LAGER,12PK 0.11 0.44 0.69 1.16 0.14 0.68 10% Confidence Intervals CARLING,12PK TENNENTS,12PK FOSTERS,12PK MILLER PILS,12PK CARLSB LAGER,12PK -6.31 0.11 1.57 -1.22 CARLING,12PK -5.80 -5.28 0.83 1.55 2.39 3.21 2.47 6.17 0.31 -6.42 0.85 -1.16 TENNENTS,12PK 0.70 1.09 -5.88 -5.33 1.42 1.65 1.99 4.45 Regression Application • Price not only factor, need to understand all factors that drive beer sales – dynamic/changing market – increase in importance of 24Pk – seasonality/Xmas effect • Factors considered – price, competitor pricing, media spend, promotion, multibuy, display, feature, temperature, seasonality lagged effects, FABs and wine effects Methodology • Link with J.Canduela (PhD Napier University) • Multiple Regression Techniques • Three Autoregressive algorithms using SPSS – Cochrane-Orcutt – Exact maximum-likelihood – Prais-Winsten • Autobox • Trying to optimise Forecasts whilst keeping things easy for the user Current & Future • Methodology running in Multiple Grocer accounts – Price & Promotions – Strategic Planning • Infiltrate other segments – Wholesale, Convenience etc. • Understand & Test different mechanics to evaluate optimum performance • Continue to optimise profitability What Affects Sales ? Sales = + + + + + + + + Own Promotions + Own Trade Activity Competitor Promotions + Competitor Trade Activity Own Regular Price Own Regular Price vs Competitors Regular Price Own TV Advertising Competitor TV Advertising Distribution + Store Effects Seasonality Random Term Econometric Modelling • Identifying the relationship between volume sales and marketing activity from store-level data In-Store Activity 156+ weeks 250+ stores Modeling enables us to understand the impact on sales of price, promotions and advertising. Being More Sociable • Unfortunately – no samples • Why are we here – I want to learn from others – why wait? • Benchmarking – my experience – Compare performance – Discussion leads to new ideas, new approaches, new solutions – Reduce the number of pitfalls on the way to success • • • • • Networking – more informal Would like to identify other interested parties in supply chain Agree goals Actively involve others “Meet” on regular basis – may be electronically