The Actuary's Role in the Audit Process

advertisement

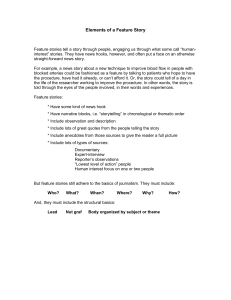

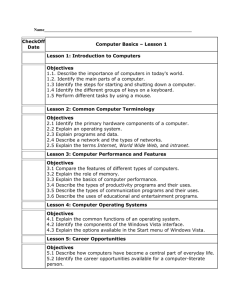

The Actuary’s Role in the Audit Process The Actuary’s Responsibility to Auditors and Examiners CLRS – September 9th, 2003 Matt Carrier, ACAS, MAAA Senior Manager Deloitte & Touche Agenda The Basics Comparisons Specific Situations / Issues Education / Value Adds 2 The Basics Comparisons Specific Situations / Issues Education / Value Adds Entities where Actuaries Support the Audit Insurance Companies Self-Insureds Pure Self-Insured Large Deductible / Retro Rated Captive Insurance Co. 3 The Basics Comparisons Specific Situations / Issues Education / Value Adds Entities where Actuaries Support the Audit Additional situations Asbestos / pollution Product warranties Member reward programs Bad debt reserves on loans 4 The Basics Comparisons Specific Situations / Issues Education / Value Adds Items Reviewed by Actuaries During an Insurance Co. Audit Loss and loss expense reserves Unearned premium reserves Anticipated Sub & Sal Premium deficiency reserves Reinsurance / risk transfer Discounting Retrospective premium reserves Other – 10K, Insurance Dept. questions 5 The Basics Comparisons Specific Situations / Issues Education / Value Adds Items Reviewed by Actuaries During a Self-Insured Audit Loss and loss expense reserves Discounting Risk margins / confidence intervals Retention levels / risk transfer Insurance policies 6 The Basics Comparisons Specific Situations / Issues Education / Value Adds Objective for Actuary in Supporting Audit Determine the reasonableness of entity’s position for items reviewed by actuary For example: loss and loss expense reserves, unearned premium reserve, etc. The approach to determine reasonableness may vary by client Review of client’s methodology Sensitivity testing based on client methodology Independent development of a corroborative range 7 The Basics Comparisons Specific Situations / Issues Education / Value Adds Insurance Co. Vs. Self-Insured Environment Insurance Co. Actuarial Statement of Opinion performed Data available / reliable Understands nature of risks Understands / accepts actuarial methods Credibility of the data Self-Insured Statement of Opinion typically not performed Often data issues Diversity of insurance knowledge Sometimes resistance to accept actuarial methods Incorporate external data Purpose of actuary in audit is to evaluate management’s best estimates 8 The Basics Comparisons Specific Situations / Issues Education / Value Adds Independent Testing Vs. Review Independent Testing Supplement entity’s methods / estimates Entity requests 2nd look Auditor request 2nd look Support State exams Focus on problem areas Review Strong analysis by entity Limited materiality of reserve balance Stability of results Predictable exposures Complexity of calculations Lack of data Often some combination approach is taken on an Audit 9 The Basics Comparisons Specific Situations / Issues Education / Value Adds Audit Support Vs. State Exams Audit Support Current View (12/31/03) Mix of review and indep. testing Often several statutory entities combined Statutory and GAAP Net focus Going concern aspect State Exams Historic view (12/31/02) but can use subsequent data Greater use of indep. testing Single statutory entity Statutory accounting Gross and net focus Solvency based 10 The Basics Comparisons Specific Situations / Issues Education / Value Adds Reliance on Company’s Actuary: Employee Vs. Consultant Employee Actuary Review analysis Support data collection Discuss company changes Discuss company insurance programs Consulting Actuary Review analysis Given nature of relationships (i.e. client, consulting actuary, auditor) typically provide limited support in other areas Provide broad context and perspective 11 The Basics Comparisons Specific Situations / Issues Education / Value Adds Discounting and discount rates for self-insureds 30% to 50% of self-insureds discount some or all of their loss reserves Issue of appropriate discount rate given economic conditions Support risk free rates (i.e. T-bills) that match liability duration Education of client and auditor 12 The Basics Comparisons Specific Situations / Issues Education / Value Adds Appropriate Risk Margins Often issue with self-insureds Example: Actuary provides self-insured hospital with estimate at 80% confidence level Hospital booked millions > conf level number Education of client and auditor 13 The Basics Comparisons Specific Situations / Issues Education / Value Adds Communication/Interaction with Company Request data Discuss operations and changes Collect and review data Communicate conclusions Education on process Value added observations/trends 14 The Basics Comparisons Specific Situations / Issues Education / Value Adds Education/Value Adds Audit actuaries and consulting actuaries can add value through benchmarking against the industry Audit process allows numerous opportunities to educate client (CFOs, Controllers, etc.) on actuarial concepts and the value it can generate Same opportunities arise for company employed actuaries We all need to use these opportunities… 15