Financial Fitness for Life Presentation

advertisement

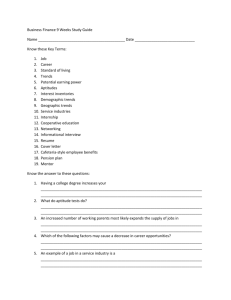

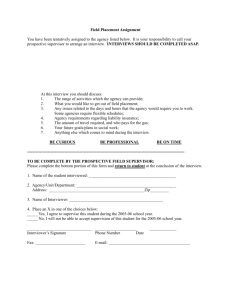

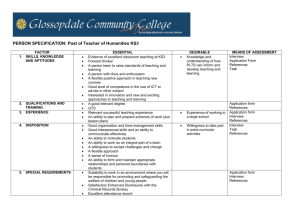

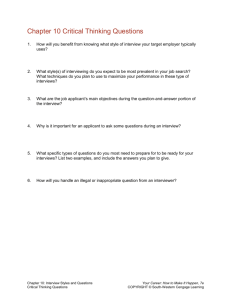

Age 3-5 Age 6-10 Age 11-13 Age 14-18 Age 19+ Most N.J. workers anxious about being able to afford retirement Nearly all New Jersey residents age 35 and older say they hope to retire one day, but two-thirds are anxious about saving enough money so they could afford it, according to a poll released Thursday by AARP. The Millionaires Characteristics There’s a difference between people who make millions and people who have millions. 1. They See Opportunities Instead of Obstacles. 2. They Understand the Power of Investing (Not Just Saving). 3. They Have a High Tolerance for Risk and Failure. 4. They Have a Sense of Self-Discipline 5. They Pursue Their Passions 6. They’re Normal People Who Play to Their Strengths 9 Rules for Improving Your Financial Life 1. 2. 3. 4. 5. 6. Get a good education. Work long, hard, and smart. Learn money-management skills. Spend less than you could spend. Save early and often. Invest in common stocks for the long term. 10 The Millionaires Quiz • Most millionaires inherited their wealth. False — About 80 percent of millionaires are first-generation affluent. • Most millionaires earn more than $500,000 per year. False — Less than 15 percent of millionaires have income over $500,000 per year. • College graduates earn about twice what high school graduates earn over a 40year work life. False — In fact, according to 2007 Census Bureau statistics, the average college graduate earned 78 percent more than the average high school graduate. People with professional degrees earned 255 percent more than high school graduates. • People who are self-employed rarely become millionaires. False — More than half of the millionaires are self-employed. 11 The Millionaires Quiz • All millionaires wear expensive clothes. False — Fifty percent of millionaires have never paid more than $400 for a suit; 90 percent of millionaires have never paid more than $1,000 for a suit. • Millionaires usually drive new cars. False — Less than 25 percent of millionaires drive a current-year car and more than half drive a car that is more than two years old. • Many millionaires drop out of college to start work. False — Four of five millionaires are college graduates. Eighteen percent have master’s degrees, 8 percent law degrees, and 6 percent Ph.D.’s. • It is impossible to save enough to be a millionaire. False — For example, if a 22-year-old saves just $50 per week ($2,600 per year) during his or her entire working life and earn a 9 percent rate of return on the investments, the saver would have more than $1 million by age 63. 12 Scarcity (n.) Scarce (adj.) Wants > Resources Scarcity What does it mean to be a resourceful person/employee? 13 Types of Resources 1. Capital resources: Man-made goods that are produced for the purpose of producing more goods and services. 2. Entrepreneur: A person who takes risk and gathers the resources to provide a new or improved good or service to the marketplace. 3. Human resources: People performing mental and physical work to produce goods and services. 4. Natural resources: Resources that occur naturally in and on the earth; these resources are used to make goods and services. 5. Productive resources: Basic resources used to produce goods and services: natural resources, human resources, capital resources, and entrepreneurial abilities. 14 The Economic Way of Thinking (The Handy Dandy Guide) 1. 2. 3. 4. People choose because productive resources are limited. All choices involve costs. People respond to incentives in predictable ways. People create economic systems that influence choices and incentives. 5. People gain when they trade voluntarily. 6. People’s choices have consequences for the future. 15 Opportunity Cost • An opportunity cost is what you give up in order to do or have something. If you choose to watch television rather than go for a walk, your opportunity cost of watching television is walking in your neighborhood. • When making a choice from numerous alternatives, the opportunity cost of the choice is the highest-valued alternative that is forgone as a result of making the choice. Because everything has a cost, by considering costs and doing a cost-benefit analysis, you make better economic decisions – in which the benefit outweighs the cost by the greatest possible amount. 16 Stay in or Drop out of School D • 1. High school dropouts can get a job and thus provide more financial help for their families than their friends in high school can. S • 2. High school graduates will have higher incomes in the future than the incomes of high school dropouts. S • 3. High school graduates are able to go on to college. D • 4. High school students must follow school rules, which limit freedom. 17 Stay in or Drop out of School D • 5. High school dropouts can work full-time and have a better car, clothes, and social life than their friends in high school. S • 6. Parents are happy when their children graduate from high school. S • 7. School activities, such as sports and music, are fun for many students. S • 8. Increased knowledge opens up increased choices and opportunities. 18 Five-Step Decision-Making Process 1. Problem: I don’t have enough time to finish two big assignments. 2. Alternatives: 3. Criteria: I can do my math homework or finish my science project. I have an A average in math and a C average in science. The math assignment is worth 10% of my math grade; the science project is worth 35% of my science grade. I’ve missed two assignments in math; I haven’t missed any assignments in science. Because I’m not doing so well in science, and the science project is worth more, it’s more important for me to finish the science project. 4. Evaluate: 5. Decision: I’ll finish the science project. 19 Five-Step Decision-Making Process P A C E D 1. 2. 3. 4. 5. Define the Problem. List Your Alternatives. State Your Criteria. Evaluate Your Alternatives. Make a Decision. 20 Choosing a Career Would you rather have a job or a career? • A job provides you with the basics—cash and something to do to earn it. • A career is your chosen occupation. It too provides an income and an activity. But it also provides challenges, opportunities for advancement, and real satisfaction with what you do. 21 Get to Know Yourself • Describe life and work values that you hold. • Identify interests, aptitudes and personality traits that might influence your career choice. 22 Life and Work Values Income and wealth Security Independence Physical risk Recognition Creativity Personal growth Family Community Location 23 Life and Work Values Key Question Why is understanding your values important to career planning? To be a good choice, a career must closely fit with your life and work values. When your career matches your values you are likely to be happier in your work. 24 Interests, Aptitudes & Personality Interests Personal interests are activities you find rewarding over an extended period of time. What is the best way to determine your interests? To identify things you do that hold your attention Aptitudes An aptitude is a natural talent for learning some skills over others. 25 Interests, Aptitudes & Personality Turning Aptitudes into Skills A skill is an aptitude developed through training and experience. Example: Mrs. Whelan Example : Jodi Piccoult Aptitude Interest Skill Career Verbal Reading & writing Years of education English degree Author 26 Interests, Aptitudes & Personality Transferable Skills A transferable skill is a set of qualities that can be applied to any field or career, regardless of where they were first learned. Example: good communication skills Organizational skills time management working under pressure problem solving What transferable skills do you gain as a student? 27 Interests, Aptitudes & Personality Personality Your personality is the blend of qualities that defines you as an individual based on what you think, feel and believe. 28 Invest in Your Human Capital Human Capital: the stock of knowledge, skills, experience, habits, social and personality attributes, including creativity, embodied in the ability to perform labor so as to produce economic value Investing in human capital through education and training can make students more marketable in the workplace. 29 The Job Application Process 1. 2. 3. 4. 5. 6. Looking for Job Openings. The Letter of Application. The Resume. The Application. The Interview. The Thank-You Letter 30 7 Ways to Identify Possible Careers 1. 2. 3. 4. 5. 6. 7. Federal Government Sources of Information Private Sources of Career Information States’ Career Clusters Private Employment Agencies Make a Career Connection Be an Intern Volunteer 31 Occupational Information Network (O*NET) 32 Occupational Outlook Handbook 33 CareerOneStop 34 Private Sources of Career Information Internet Options: http://www.careeroverview.com/ http://www.monster.com/ http://www.careerbuilder.com/ http://www.careercast.com/ https://www.linkedin.com/ https://plus.google.com/ Private Sources of Career Information Non-Internet Options: 1. 2. 3. 4. Guidance Counselors/Career Placement Librarian/Libraries (professional/trade journal) Local Bookstores Local newspapers classified “Help Wanted” “Want ads” Interviewing for Jobs Before the Interview • Learn about the employer and the job. • List the materials to take with you. • Make a list of questions to ask, such as work schedules, benefits, and pay. • Be prepared to answer questions. • Polish your appearance (Be neat and clean. Dress modestly and conservatively with minimal makeup, jewelry or fragrance.) • Practice for the interview (mock interview). • Know where to go for the interview. • Do not smoke or chew gum. Goodheart-Willcox Publisher During the Interview -1 • Arrive on time or a little (5-10 min) early. Never be late. Go alone. • The attitude and appearance you display during the interview may be critical in getting the job • Greet the interviewer with a firm handshake. Establish eye contact. • Be poised and confident. Be positive, upbeat, and enthusiastic. • It is normal to be nervous, but try your best to appear relaxed. Do not appear overconfident or arrogant. • As the interviewer asks you questions, respond positively and honestly. During the Interview -2 • Be ready for some open-ended questions. "Tell me about your qualifications for this job.” • Keep your answers brief and to the point. Speak clearly. Avoid slang or improper language. • Listen carefully. Don't interrupt. Be responsive and truthful. • Have your questions ready to ask when invited to do so. • It is appropriate to ask when a hiring decision will be made and whether you will contacted. Typical Interview Questions • Please tell me about yourself. What are your qualifications for this position? • Why do you want to work for this company? Why are you applying for this job? • What were your best subjects (strengths) in school? • What were your toughest subjects (weaknesses) in school? What did you do to make good grades? • Describe a stressful or high pressure situation you have been in, how you handled it, and the outcome. Typical Interview Questions • What experiences do you have that will be helpful to you in this job? • What would you like to be doing five years from now, and how do you think this job can help you get there? What do you see yourself doing in five years? • Is there anything else I should know about you in considering you for this position? • What was the toughest decision you've ever made? • What do you do when you have trouble solving a problem? • What types of jobs are you trying to avoid? After the Interview • After an interview, immediately send a follow-up letter to thank the interviewer • Follow up with a telephone call if you do not hear from the interviewer • Do not be discouraged if you do not get a job offer right away • You may need to interview a number of times to get a job • Ask what the interviewer seeks in a job candidate • Ask the interviewer to recommend how you might improve your interview skills Unemployment and Median Earning 44 Uneducated = Unemployed 45 Note: Data are 2009 (great recession) annual averages for persons age 25 and over. Job Markets are Changing 46 Why Some Jobs Pay More Than Others? In one word: Human Capital • Education/Skills • Demand for the occupation • Natural ability (Talent) • Hard work • Getting along with others • Self-discipline • Health Another factor is the supply and demand of the occupation 47 Is education a good investment? On average, completing high school and earning a college degree will raise a person's income even after accounting for the direct costs (e.g., tuition and books) and the indirect costs (e.g., income that an individual could otherwise have earned during time spent in school) of getting an education. 48 Baby Boomers Face a Shocking Retirement Savings Shortfall The average Baby Boomer has a goal of accumulating enough of a nest egg to have $45,500 a year in retirement income, according to a new report from BlackRock. The average retirement portfolio, however, has just $136,200 in it, which would provide an average estimated income of $9,129. That would leave the average Boomer nearly $37,000 per year short of his goal. 49 Incomes & Taxes total amount of money a worker earns before any Gross Income (Pay) The deductions are made. _ Deductions Include mandatory and optional deductions = Net Income (Pay) Also called take-home pay or disposable income 50 Required (Mandatory) Deductions 1. 2. 3. 4. Social Security tax * Medicare tax * Federal income tax State income tax } FICA * Paid by both employers and employees FICA – Federal Insurance Contributions Act A World Without Taxes-1 51 Optional (Voluntary) Deductions 1. 2. 3. 4. 5. 6. Life Insurance Medical insurance Long-term disability Insurance Dental insurance Retirement savings plan, e.g., 401 (k) ….. 52 Question • Which of the following is NOT a deduction on a paycheck? A. B. C. D. Chapter 1: Computers and Digital Basics Social Security tax Medicaid tax State income tax Medicare tax 53 Question • Certain deductions are taken from your paycheck because: A. This money is put away until you turn 65 B. Employers get a percentage of what you earn C. They are required by the government D. They fund other programs of the company Chapter 1: Computers and Digital Basics 54 W-4 Chapter 1: Computers and Digital Basics 55 Paycheck Stub Question Chapter 1: Computers and Digital Basics 56 W-4 & W-2 The W-4 is a tax form used to calculate the correct amount of federal income tax that should be withheld from an employee’s pay. This form must be completed whenever an employee starts a new job. The W-2 is a tax form that employers give to their employees at the end of each year. This form includes the total amounts of wages earned, federal and state taxes withheld, and contributions to Social Security for a given tax year. After receiving it from his or her employer, the employee must submit this information when paying taxes in April with their Form 1040. Chapter 1: Computers and Digital Basics A World Without Taxes-2-W2-W4-1040 57 Chapter 1: Computers and Digital Basics 58 Already paid Has to pay Chapter 1: Computers and Digital Basics 59 Chapter 1: Computers and Digital Basics 60 Chapter 1: Computers and Digital Basics 61 Chapter 1: Computers and Digital Basics 62 Chapter 1: Computers and Digital Basics 63 Managing Your Money Three Principles of Managing Your Money 1. Spend less than you earn (Save). 2. Make your money work for you (Invest). 3. Protect your money (Protect). Three Principles of Personal Finance (Mint.com's) 64 Spend Share Save Invest 65 Q. How can we tell if somebody is wealthy?” By knowing where they live? what they wear? what they drive? where they travel? 66 Q. How can we tell if somebody is wealthy?” By looking at his/her Balance Sheet. Assets – Liabilities = Net Worth (Own – Owe = Wealth) Net Worth = Wealth 67 SMART Financial Goals 68 Budgeting – Spend Less Than You Earn 1. Get a grip on your spending (expense). 2. Tabulate what you earn (income). 3. Don’t forget to pay yourself first (saving). In other words, have a budget (a spending plan)! What is Your (Budget) Type? 69 Q. Are All Expenses the Same? No, there are 1. Fixed expenses. 2. Variable expenses. 3. Periodic expenses 4. Emergency fund 70 Q. What does it mean “Pay Yourself First?” Include your saving goals in the fixed expenses part of your balanced budget. Net Income = Expense (incl. Savings) 71 Q. Are All Expenses the Same? No, there are 1. Fixed expenses. 2. Variable expenses. 3. Periodic expenses 4. Emergency fund 5. Savings 72 Underwater Loan 73