Demand Lecture II

DEMAND LECTURE II

1

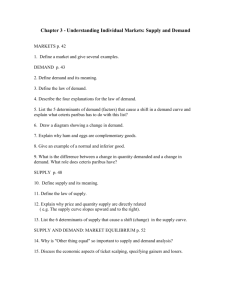

LETS LOOK AT THE COMMODITY

WHEAT

Price Surplus

P

1

Supply

P e

Demand

Q e

Quantity / unit of time

2

A SURPLUS

A. P e and Q e represent the market clearing price and quantity.

B. Assume the government sets a price at

P

1

:

1. There is a surplus of goods.

2. Price must fall for the market to clear.

3

LETS LOOK AT THE COMMODITY

GASOLINE

Price

Supply

P e

P

2

Demand

Shortage

Q e

Quantity / unit of time

4

A SHORTAGE

C. Assume the government sets a price at

P

2

:

1. There is a shortage of goods.

2. Price must rise for the market to clear.

5

SURPLUS AND SCARCITY?

D. We could have a surplus and still have a scarce commodity, RIGHT ?

1. Yes. This is due to there not being enough goods to meet demand at a price of zero.

6

7

DETERMINANTS OF DEMAND

As a commodity's own price changes, we move along the existing demand curve. (Law of Demand)

A. Other factors affect the demand curves position, shape, and slope.

8

DETERMINANTS OF DEMAND

These other determinants, in addition to the commodity's own price are: a. Consumer disposable income.

b. Price of substitutes.

c. Price of complements.

d. Consumer preferences.

e. Expectations about the future.

9

DETERMINANTS OF DEMAND f. Changes in the population.

g. Weather.

h. Length of adjustment period. i. Availability of substitutes.

j. Proportion of the consumer’s budget that a particular good represents.

10

Consumer’s Disposable Income

1. If we increase consumer's disposable income ceteris paribus, what happens?

· He/she is able to purchase more at all price levels.

11

2. The demand curve shifts to the right.

Price

D

0

D

1

Quantity

12

3. If we decrease the consumer's disposable income ceteris paribus, what happens ?

· The consumer cannot purchase the same amount of the commodity as before, over the entire range of prices.

13

4. The demand curve is said to shift to the left.

Price

D

1

D

0

Quantity

14

5. Associated with this income effect, we can create another sub-classification for commodities:

15

Normal Goods or Services

An Increase in disposable income, shifts

Demand curve right.

Id Demand

16

Price

D

0

D

1

Quantity 17

Normal Goods or Services

A Decrease in disposable income shifts

Demand curve left

Id Demand

18

Price

D

1

D

0

Quantity 19

Inferior Good or Service

An Increase in disposable income shifts curve left.

Id Demand

20

Price

D

1

D

0

Quantity 21

Inferior Good or Service

A Decrease in disposable income shifts curve right.

Id Demand

22

Price

D

0

D

1

Quantity 23

Inferior Good or Service

Examples:

Macaroni and cheese dinners,

potatoes, and rice

ROAD KILL !!

24

Change in the price of substitutes, ceteris paribus:

An increase in the price of a substitute will result in an increase in the demand for the commodity of interest

(COI)

(demand shifts right).

25

For example, lets look at beef while considering pork as a substitute:

Let the quantity of pork available become restricted. What happens?

· There is an increase in the price of pork.

26

Increase in price of pork due to a decrease in Supply of pork:

Price S

1

S

0

Pork Market

P

1

P

0

Q

1

D

Q

0

Qd of pork/ut 27

There is an increase in the demand for beef (COI) because of the increase in the price of pork (SUBSTITUTE).

Price S

0

P

1

Beef Market

P

0

D

0

D

1

Q

0

Qd of beef/ut

28

P

1

P

0

BEEF

S

0

D

1

D

0

P

1

P

0

PORK

S

1 S

0

D

0

29

Substitutes:

Therefore, an increase in the price of a substitute will shift the entire demand curve of the commodity of interest to the right.

30

Substitutes:

A decrease in the price of a substitute will shift the entire demand curve of the commodity of interest to the left.

31

Substitutes:

Immediate effect of a supply restriction for the substitute is a price increase.

This will affect the demand curve for the

COI by increasing demand (shifts to the right) for the COI.

32

Substitutes:

Immediate effect of a increase in supply is a price reduction.

33

Substitutes:

P sub

D

COI

AND

P sub

D

COI

34

Reflect Back:

We have talked about what has happened in agriculture when wage rates have increased. Capital and labor are substitutes for each other.

We have discussed that as the wage rate has increased, the demand for capital has increased.

35

Change in the price of a complement, ceteris paribus:

Complements are goods that go together, such as:

left and right shoes,

gas and cars,

milk and cereal,

bread and butter,

guns and ammo,

etc.

36

Compliments:

If the price of a complement increases, then the demand for the COI decreases.

P comp

D

COI

37

Compliments:

Price

Let the price of milk increase.

Since cereal is a complement of milk, its demand will decrease .

D

1

D

0

Qd/ut

38

Compliments:

If the price of a complement decreases, the demand for the COI increases.

P comp

D

COI

39

Compliments:

Price

Let the price of milk decrease.

Since cereal is a complement of milk, its demand will increase .

D

0

D

1

Qd/ut

40

Consumer preferences and taste

As preferences change the demand curve will also change.

For example: What would be the result of the following statements, if true, on the demand curve for each commodity ?

41

Animal fat leads to a higher risk of heart attacks.

Price

Result: Demand for red meat

D

1

D

0

Qd/ut

42

Nitrites in bacon have been linked to cancer.

Price

Result: Demand for bacon

D

1

D

0

Qd/ut

43

Increasing fiber in the diet reduces the chance of getting colon cancer.

Price

Result:

Demand for high fiber cerals and popcorn.

D

0

D

1

Quantity / unit of time

44

Price

Trichinae can be eliminated in pork by a new irradiation process

Result: ???????

D

0

Quantity / unit of time

45

National Inquirer says that people who own and care for rose bushes live 20 years longer than the average person.

Price

Result: Demand for rose bushes

D

0

D

1

Quantity / unit of time

46

Expectations about the future

The peanut butter scare: a news release said that the peanut crop would be short that year and peanut butter prices were expected to double.

47

Expectations about the future

Result:

People bought 3 lbs. of peanut butter that month instead of 1lb.

Demand for peanut butter.

Due to Expectations of higher Price.

48

Expectations: The Self-Fullfilling

Prophecy !

Since consumers expect prices to increase, they all run out to buy NOW.

This causes demand to increase, and prices are pushed up very quickly!

49

Price

Graphically Speaking:

$2.00

D

1

D

0

1 3 lbs. per month 50

NOTE:

If the commodity we were analyzing was not storable, then the demand curve may

NOT shift.

51

Changes in the population of consumers

Price

Increase in population will result in increase in

Demand for G&S.

D

0

D

1

Quantitiy/unit time

52

Changes in the population of consumers

Price Decrease in population will result in decrease in Demand for G&S.

D

1

D

0

Quantitiy/unit time

53

Length of the Adjustment Period

This is tied to, or related to the availability of substitutes .

Price Short Run: Consumers have little time to find suitable substitues.

Demand is not very sensitive to price changes, c.p.

We say demand is relatively inelastic

D

Quantity per Unit of Time

54

Length of the Adjustment Period

Price Long Run: Consumers have time to find suitable substitutes.

Demand becomes more sensitive to prices changes as time progresses, c.p.

D

We say demand is relatively elastic.

Quantity Demanded per Unit of Time

55

An Example: Demand for Gasoline

If the price of gas increases from $1.20 per gallon to $2.20 per gallon, how will consumers respond?

First:

Are we asking how consumers will respond over the next day, week, month, year, etc.

56

It makes a difference!

Demand for gas will be different for different time periods

The longer the time period considered, the flatter the demand curve becomes; or the more elastic it becomes.

The more responsive demand becomes to changes in price!

57

What Occured in the 1970’s?

What was a simplified sequence of events that occurred when gas prices at the pump increased so dramatically in the

1970's?

58

The Sequence of Events:

(1) People griped.

(2) Car pools formed, and bus usage increased.

(3) Big cars were replaced with small ones.

(4) Some people moved closer to work.

(5) New technology that decreased fuel consumption was developed.

59

What was the result of this sequence of events on Demand?

Price

In Short Run, the very large increase in gas price resulted in a very small decrease in consumption of gasoline.

$2.20

Consumption of gas will not be very responsive to the increase in price.

$1.20

We say demand is relatively inelastic

D

Q

1

Q

0

Quantity demanded

60

As time progressed:

Price

In Long Run, consumers have time to find substitutes, and the very large increase in gas price will eventually result in a significant decrease in consumption of gasoline.

$2.20

This of course assumes that consumers perceive the increased price of gas to be persistant, not just a temporary price increase.

$1.20

D

Q

1

Q

0

Quantity demanded

61

The Availability of Substitutes

Price

P

1

If a commodity has FEW substitutes, demand for the commodity will tend to be more inelastic or less responsive to price changes.

Demand curve will tend to have a very steep slope.

P

0

D

Q

1

Q

0

Quantity/unit time

62

The Availability of Substitutes

P

1

Price

If a commodity has MANY substitutes, demand for the commodity will tend to be more elastic or more responsive to price changes.

Demand will tend to have a very flat slope.

P

0 D

Q

1

Q

0

Qd/unit time

63

Price

Proportion of the Consumers Budget a Good or Service Represents

Salt

If the price of SALT doubles, how much will this price increase affect the consumption of salt?

$1.00

Why?

$.50

D

Q

1

Q

0 Qd/u.t.

64

Proportion of the Consumers Budget a Good or Service Represents

The less of a consumers budget a commodity represents, the more inelastic the demand curve will tend to be.

The price of salt is such a small percentage of our budgets, that consumption of salt will not be affected very much by a price increase.

65

Price

Proportion of the Consumers Budget a Good or Service Represents

Automobile

If the average price of an AUTO doubles, how much will this price increase affect the consumption of Automobiles?

$40,000

Why?

$20,000

D

Q

1

Q

0

Qd/u.t.

66

Proportion of the Consumers Budget a Good or Service Represents

The more of a consumers budget a commodity represents, the more elastic the demand curve will tend to be.

The price of an automobile is such a large percentage of our budgets, that consumption of automobiles will be affected very much by a price increase.

67

Automobile Prices:

Business Week reported on Feb. 7, 1994 that the 1993 average price of a car was

$18,100

This was a 69% increase from 1983. What was the average price of a car in 1983?

$10,710

68

Real Price of a Car?

Based on median household income:

In 1983, it required 22 weeks of wages to purchase a new car.

In 1993, it required 26 weeks of wages to purchase a new car.

69

Real Price of a Car?

What did the real price of a car do between 1983 and 1993 based on median household income?

It Went Up!

70