File

advertisement

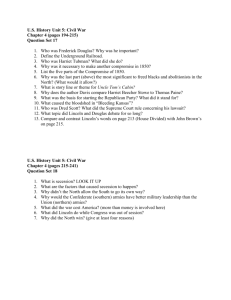

Planting seeds for the future Balancing retirement income security and wealth transfer Presenter Name Presenter Title March 18, 2016 ©2007 Lincoln National Corporation LFD0705-1421 Through a lifetime of hard work, planning and investing, you have built assets to use and enjoy. And while you may be primarily focused on securing your retirement income, planning your estate needs to be an integral part of that goal. By balancing these two goals, you can create a strategy that can both help you maintain your lifestyle as long as you live and ensure the remainder of your estate transfers to the those you care about most. . . ©2007 Lincoln National Corporation LFD0705-1421 Agenda The right balance Tools for managing and distributing wealth Steps to building an estate plan Will there be an estate tax Some planning solutions ©2007 Lincoln National Corporation LFD0705-1421 It begins with the right balance Income Management Variable expenses usually include travel, leisure activities, gifts, etc. Fixed expenses include mortgage/rent, utilities, monthly healthcare and prescription costs, and other regular and recurring bills. Wealth transfer is assets designated for your heirs or charity. Healthcare assets cover any expenses beyond routine prescriptions and doctors’ bills, such as an emergency and long-term care. Emergency/ opportunity funds are immediate cash for emergencies you may face or financial opportunities you want to explore. ©2007 Lincoln National Corporation LFD0705-1421 Tools for managing and distributing wealth Will Durable Power of Attorney and Health Care Directive Trusts Life Insurance Your Team ©2007 Lincoln National Corporation LFD0705-1421 Steps to building an estate plan Establish your goals ©2007 Lincoln National Corporation LFD0705-1421 Steps to building an estate plan Establish your goals Do the groundwork ©2007 Lincoln National Corporation LFD0705-1421 Steps to building an estate plan Establish your goals Do the groundwork Account for liquidity ©2007 Lincoln National Corporation LFD0705-1421 Steps to building an estate plan Establish your goals Do the groundwork Account for liquidity Focus on taxes ©2007 Lincoln National Corporation LFD0705-1421 Steps to building an estate plan Establish your goals Do the groundwork Account for liquidity Focus on taxes Plan for extending your legacy ©2007 Lincoln National Corporation LFD0705-1421 Will there be an estate tax? Federal estate tax exclusions and rates Year Exclusion Amount Minimum tax rate on Maximum tax rate 2006 $2,000,000 46% 46% 2007 $2,000,000 45% 45% 2008 $2,000,000 45% 45% 2009 $3,500,000 45% 45% 2010 N/A N/A N/A 2011 $1,000,000 41% 55% There are no federal estate taxes in 2010. On January 1, 2011, the tax law is scheduled to revert to the $1 million exclusion, unless legislation is enacted. ©2007 Lincoln National Corporation LFD0705-1421 Some planning solutions Survivorship Standby Trust Family Trust Purchasing Life Insurance Spousal Lifetime Access Trust ©2007 Lincoln National Corporation LFD0705-1421 Survivorship Standby Trust During Husband’s Life At First Death Irrevocable Life Insurance Trust Owner Transfer of Policy (by Contract or Gift) At Survivor’s Death: Trust Beneficiaries (i.e., children) ©2007 Lincoln National Corporation LFD0705-1421 Survivorship Standby Trust Taxation How to implement ©2007 Lincoln National Corporation LFD0705-1421 Family Trust Purchasing Life Insurance During Life of Surviving Spouse Spouse Receives income from marital trust, personal holdings, pensions, Social Security, etc. Consider reducing or stopping income B Trust Trustee reallocates income-producing property and purchases life insurance or annuity with trust assets Premiums Death Benefits Life Insurance Company At Death Children as Trust Beneficiaries Distributions ©2007 Lincoln National Corporation LFD0705-1421 Family Trust Purchasing Life Insurance Considerations for surviving spouse Considerations for beneficiaries Tax considerations How to implement ©2007 Lincoln National Corporation LFD0705-1421 Spousal Lifetime Access Trust Grantor (e.g., husband) Trust Beneficiaries (i.e., children) Irrevocable Life Insurance Trust Remainder Gift of Premium Distributions from Trust 5&5 Ascertainable Standard Sprinkling Power Grantor’s Spouse (e.g., wife) ©2007 Lincoln National Corporation LFD0705-1421 Spousal Lifetime Access Trust Considerations Taxation How to implement ©2007 Lincoln National Corporation LFD0705-1421 Planting seeds for the future ©2007 Lincoln National Corporation LFD0705-1421 Important disclosures. Please read. Insurance company products are issued by Lincoln Financial Group® affiliates. Products and features are subject to state availability. This material was prepared to support the promotion and marketing of insurance company products. Lincoln Financial Group® affiliates, their distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Please consult your own independent advisor as to any tax, accounting, or legal statements made herein. ©2007 Lincoln National Corporation Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations. www.LFG.com ©2007 Lincoln National Corporation LFD0705-1421