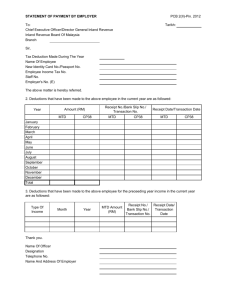

registration form

advertisement

FMM Institute, Penang Branch Tax Seminar Employer Income Reporting and Obligations 28 August 2015, Eastin Hotel,Penang With effect from the Year of Assessment 2014, employees may choose to treat Monthly Tax Deductions (MTD) from their salaries as the Final Tax with no further need to submit their Income Tax Returns. Pursuant to the Income Tax (Deduction from Remuneration) (Amendment) (No. 2) Rules 2014 [P.U. 362/2014] which were gazetted on 31 December 2014, it is mandatory for the employer to include the BIK and VOLA in MTD computation effective from 1 January 2015. This place additional responsibility on hence more crucial on company directors and managers to ensure that the New MTD rules are applied correct. However, to ensure the employer has sufficient time to prepare for its implementation a deferment up to March salary is allowed for the MTD computation on BIK and VOLA. As such, employer is required to determine MTD for BIK and VOLA not later than April's salary. By attending this seminar, participants will be able to: • Understanding the fundamental statutory requirements and practical issues on MTD and final tax for employees. • Examine how the MTD regulations work under the new rules and how individual tax liability is computed. • Have a thorough knowledge of what BIK and perquisites is tax exempt. • Employees and directors – is there any difference in the tax treatment? • Directors of controlled companies – what does it means? • Appreciate the company directors’ obligations and responsibilities under the new rules apply. Speakers Biodata Ms Yong Mei Sim holds an Honours Degree in Social Science (Majoring in Economics) from USM, Penang and Master Degree in Taxation from the Golden Gate University in San Francisco, USA. She is was formerly Senior Assistant Director of Inland Revenue at Bukit Mertajam, Penang and a Field Audit Manager for corporate sector. Program 8.30 am 9.00 am Registration Latest MTD procedures affecting employer’s reporting obligations which comes into effect from 1.1.2015. How not to commit MTD offences. How to avoid paying high compound fees/fines on MTD mistakes 10.00 am Coffee break 10.30 am What are the taxable perquisites and how to calculate these perquisites 12.30 am Lunch 1.30 pm What are the taxable benefits in kind and how to determine the value of these benefits to be taxed? Is there a difference in the tax treatment for benefits and perks given to directors and the employees? What are the tax-exempt benefits in kind? 3.00 pm How to calculate the value of living accommodation provided for staff and directors Afternoon coffee break How to calculate the value of living accommodation provided for staff and directors (Continue) End of Program 3.45pm 4.05pm 5.00 pm Who should attend? Company directors, business owners, HR managers, Payroll managers and corporate consultants who advise and assist in HR and payroll matters and anyone who need the knowledge in payroll matters. Fees : RM630 (FMM Members) RM740 (Non-Members) RM650 (Non-Member Tax Agency) The price above includes 6% GST. 10% discount for 3 registered participants from the same company. All fees are inclusive of course materials, lunch and refreshments. Attendance is by prior registration only. Registration form must be completed and returned to FMMInstitute with correct payment by cheque made in favour of ‘FMM INSTITUTE” and crossed “Account Payee Only”. Payment by cash is acceptable during the day of registration. Registration is on first-come-first-served basis. CANCELLATION MUST BE IN WRITING TO FMM. There will be no refund for cancellation within 3 days prior to the program. 50% refund for cancellation between 4 - 5 days and full refund for cancellation 6 days prior to the program.No additional cost for replacement. ENQUIRIES AND REGISTRATION Please contact Ms. Nazliza/ Haffiz / Norazwani FMM Institute (Penang Branch) No. 2767, Mukim 1, LebuhTenggiri 2, 13700 Bandar Seberang Jaya, Penang, Malaysia Tel :04-6302052 Fax :04-6302054 E-mail : nazliza@fmm.org. my CLOSING DATE :21 August 2015 REGISTRATION FORM Tax Seminar Employer Income Reporting and Obligations 28 August 2015, Eastin Hotel,Penang For further details please contact: FMM Institute Penang Branch Ms Nazliza / Mr. Haffiz / Ms. Norazwani E-mail:nazliza@fmm.org.my/haffiz@fmm.org.my /norazwani@fmm.org.my Tel: 04-6302052/50 Fax: 04-6302054 1. Name :________________________________ Designation : ____________________________ Email:__________________________________ 2. Name :_______________________________ Designation : ____________________________ Email:__________________________________ Email:__________________________________ 3. Name :_______________________________ Designation : ____________________________ Email:__________________________________ Email:__________________________________ Submitted by : Name:_______________________________________ _ Designation:___________________________________ Company:_____________________________________ Address:______________________________________ _____________________________________________ ____________________________________________ Tel :_________________________________________ Fax:_________________________________________ Email:________________________________________