Overview of Companies Act, 2013

advertisement

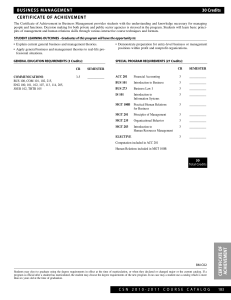

Compliance under Companies Act, 2013 CS Manish Gupta 1 Types of Compliance 1. Annual or periodic compliances. 2. Event based compliances. 3. Regular Compliance 2 Overview of Companies Act, 2013 Passed by Lok Shabha on 18-12-2012 Passed by Rajya Shabha on 08-08-2013 Got President Assent on 29th August 2013 & notified on 30th August, 2013 470 Sections (658) 29 Chapters (13) 7 Schedules (15) 99 Sections were notified on 12-09-2013 199 Sections were notified w.e.f 01-04-2014 172 Sections Yet to be notified 3 Chapter II – Incorporation of Company Section 5(6) - The Articles of the Company shall be in respective forms specified in Table F (Schedule ‐ I), as may be applicable on the Company. Section 12(3)(a) - Every Company shall paint or affix the name and address of registered office and keep the same painted/affixed, outside every office or place in which its business is carried on, in conspicuous position and legible letters. Section 12(3)(c) - Every Company shall get its name, address of registered office, CIN, telephone/fax no. (if any) and email/website address (if any) printed on all business letters, billheads, letter papers, Notices and other official publications. 4 Chapter II – Incorporation of Company Section 11 – Commencement of Business with in 180 days. Section 14(2) - Every alteration of Articles shall be filed with Registrar within 15 days of alteration, together with copy of altered Articles. Section 15(1) - Every alteration made in MOA and AOA shall be noted in every copy thereof. Section 20(1) – Service of Documents to Companies & ROC (Speed Post, Registered Post, Courier Service, by hand or by electronic means) 5 Chapter IV – Share Capital & Debentures Section 56(1) – Transfer of Shares – Transfer Deed SH - 4. Section 56(4) – Delivery of Certificates. To Subscribers On Allotment of Shares On Transfer of Shares On issue of Debentures Section 71 – Issue of Debentures – PAS – 3. Application Money Received before 31-03-2014 – Status & Compliances 6 Chapter V – Deposits Section 74(1) –Deposits accepted before commencement of the Companies Act, 2013. Section 76 – Acceptance of Deposits by Companies : Unsecured loan from Directors Credit Rating from the Specialized Agency Deposit Insurance Rule 16 – Return of Deposits - DPT – 3 upto 30th June. Eligible Companies : Having Net Worth <100 cr or turnover < 500 Cr and passed & filed with ROC, a Special Resolution in this regard, before making any deposits. 7 Chapter VI – Charges Section 77(1) – Registration of Creation & Modification of Charge upto 300 days by the Company / Lender. Section 82 (1) – Registration of Satisfaction of Charge. Section 2(16) - Charge - means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage. Whether Required on Vehicle Loan or not??? 8 Chapter VII – Management & Administration Section 88 Read with Rule (3) –Register of Members from the date of registration shall be in Form No. MGT‐1 – 6 months from date of commencement of rules. Section 88 Read with Rule (5) – Entries to be made in 7 days. Section 88 Read with Rule (8) – All entries in Register to be authenticated by CS and Date of Board Resolution authorizing the same to be mentioned. Section 88 Read with Rule (5)(2) – Registers to be kept at the Registered Office unless SR for with in the city or to any other place in India, if more than 10% of members resides. Section 88 Read with Rule (6) – Index of Members. 9 Chapter VII – Management & Administration Section 92(1) – Annual Return to be prepared in Form No. MGT‐7 to be filed with ROC within 60 days of Annual General Meeting having details upto the closure of financial year. To be signed by a Director and CS of the Company. For all Companies except Small & OPC Companies. Section 92(2) read with Rule 11 – All Listed Companies or companies having PUC of 10 cr or turnover of 50 cr, shall be certified by PCS in Form MGT - 8. Section 92(3) read with Rule 12 – Extract of the Annual Return in Form MGT – 9, shall be attached with Board Report. 10 Chapter VII – Management & Administration Section 384(2) : Section 92 shall apply on Foreign Companies, Annual Return to be filed in Form FC – 4 in 60 days. Section 94 Read with Rule (15) –Preservation of Records & Registers at Registered Office Register of Members Other Registers & Returns To maintain at any other place in India : More than 1/10 shareholders Special Resolution Advance intimation to ROC Section 102 (1) – Explanatory Statement to have interest of all directors / KMP / & their relatives. 11 Chapter VII – Management & Administration Section 103 - Quorum : For Private Limited - 2 Members Section 103 - Quorum : For Public Limited 5 Members upto 1000 members 15 Members upto 5000 members 30 Members more than 5000 members. Section 120 Read with Rule (27) – Maintenance of Document, Records, Registers & Minutes in electronic form. Section 121 Read with Rule (31) – Report on Annual General Meeting with in 30 days to ROC in Form MGT – 15. 12 Chapter X – Audit & Auditors Section 138 – Internal Auditor With in 6 months For Listed Companies For Public Companies (50 CR / 200 CR / 100 Cr / 25 cr) For Private Limited Companies (200 CR / 100 Cr) Section 139 – Appointment of Auditors First Auditor to be appointed in 30 days. Casual Vacancy - in 30 days & to be confirmed in GM with in 3 months. Prior Approval of Audit Committee (10 CR/100CR / 50CR) Section 140 – Auditors to File ADT – 3 with in 30 days of resignation. Section 144 – Auditor not to render services. Comply by 31/03. Section 146 – Auditor to attend Annual General Meeting. 13 Thank You Make Presentation much more fun CS Manish Gupta 09212221110 manish@rmgcs.com 14