Underwriting/Processing training

advertisement

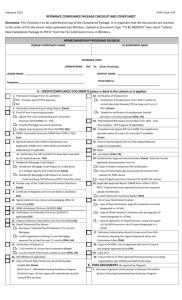

PENNSYLVANIA HOUSING FINANCE AGENCY UNDERWRITING/PROCESSING TRAINING Tom Wolf, Governor Brian A. Hudson, Executive Director PHFA Mission In order to make the Commonwealth a better place to live while fostering community and economic development, the Pennsylvania Housing Finance Agency provides the capital for decent, safe and affordable homes and apartments for older adults, persons of modest means and those with special housing needs. www.phfa.org PENNSYLVANIA HOUSING FINANCE AGENCY Agenda What is PHFA? Allowable Fees Programs for Homebuyers Assistance Programs Underwriting Guidelines Property Guidelines Programs for Homeowners Closing Requirements PENNSYLVANIA HOUSING FINANCE AGENCY PHFA, who are we? Created in 1972 Non-profit; Quasi Government Agency Headquarters in Harrisburg, PA Considered an “Investor” Compensation and Allowable Fees Seller’s Guide, Chapter 1 PENNSYLVANIA HOUSING FINANCE AGENCY Compensation The lender locks the interest rate as well as the price that PHFA will pay for the loan Price includes the origination and the servicing release premium (SRP) The loan price includes the SRP, and .625% will be withheld at the time of purchase and paid when the file is cleared according to the payout schedule Borrowers will be able to pay up to two discount points in exchange for a lower rate, or they may choose a higher rate for a credit to help towards closing costs PENNSYLVANIA HOUSING FINANCE AGENCY Compensation The maximum a lender may retain from the loan price is 103 percent of the loan amount Additional compensation above 103 must be provided to the borrower in the form of a credit towards their closing costs and shown as such on the GFE and HUD1 If less than the minimum is given, PHFA will deduct the applicable amount from the loan proceeds, apply it to the principal balance and require the lender to revise the HUD1 accordingly. Credit may not be used to fund any portion of the borrower’s downpayment An extra $250 would be paid for Access Mod loans PENNSYLVANIA HOUSING FINANCE AGENCY Allowable Fees: For Purchases Actual amount (or your standard fees) for items including, but not limited to: Credit report Appraisal fee Filing and recording fees Wood-destroying insect report DU/LP Tax certification fees can only be charged on conventional loans if it’s a pass thru fee to a third party. $750 Administrative fee to cover overhead such as underwriting, processing and doc prep PENNSYLVANIA HOUSING FINANCE AGENCY Loan Process Lender Application Process & Underwrite Close Turn-around time PHFA Lock Rate Review Loan Purchase Loan PENNSYLVANIA HOUSING FINANCE AGENCY Programs for Homebuyers Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY Homebuyer Products Conventional Financing Government Financing HFA Preferred Risk SharingTM Keystone Home Loan HFA PreferredTM Keystone Government (K-Gov) loan Keystone Home Loan (80% max) PENNSYLVANIA HOUSING FINANCE AGENCY Conventional Financing Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Loan Programs PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM For purchase and limited cash-out refinance Rate & term refis only – more details later Fully amortized MyCommunityMortgage…BUT No loan level pricing adjustments 30 year, fixed-rate term only And… PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM HFA Preferred Risk Sharing™ No mortgage insurance is required Risk is assumed by PHFA and Fannie Mae, NOT the lender (Normal reps & warrants per the Sellers Guide and the original MOSA apply) HFA Preferred™ Mortgage insurance provided by a Fannieapproved insurer Genworth, MGIC, Radian, United Guaranty, CMG, National MI & Essent PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM No first-time homebuyer requirement, the borrower may not have an ownership interest in any other residential dwelling at the time of loan closing. Must meet HFA income limits Appendix B Gross, annual income projected over the next 12 months Calculated on ALL adults who intend to occupy the home within one year from loan closing Loan amount cannot exceed the current Fannie Mae standard loan limits High cost areas do not apply PHFA delegated authority can not be used with these loans PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM No MI/HFA PreferredTM Lo MI Desktop Underwriter (DU) Use the “Additional Data” screen and select “HFA Preferred Risk Sharing” or “HFA Preferred Borrowers must have a FICO of at least 620 up to 97% LTV regardless with a DU finding of Approve/Eligible Max CLTV 105% Borrowers must contribute lesser of 1% or $1000 of own funds Approve/Eligible only Qualifying income, ratios, reserves, and credit score determined by DU No flexibility on PHFA’ s part No exceptions PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM No MI/HFA PreferredTM Lo MI Manual underwriting permitted Max LTV of 95%; Max CLTV of 105% Borrowers must have a FICO of at least 680 Maximum DTI for borrowers with FICO scores between 680 and 700 is 36% Maximum DTI for borrowers with FICO scores 700 or higher is 45% Borrowers with no credit scores or “thin” files are not acceptable Borrowers must invest lesser of 1% or $1000 Balance of required funds to close may come from PHFA Advantage loan and/or Fannie approved CommunitySeconds® PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Homebuyer Education: All borrowers with middle credit scores below 680 must complete an in person class session prior to closing Use PHFA approved counseling organizations No online courses are acceptable All borrowers must sign Form 68, Borrower’s Authorization for Post-Purchase Counseling (purchase & refis) This gives PHFA authorization to refer the borrower to a counseling agency if they fail to make a mortgage payment PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM No MI/HFA PreferredTM Lo MI Homebuyer Education: For loans where all borrowers have a middle credit score of 680 or higher: must complete the counseling session prior to closing; however, it only needs to be completed by one borrower. Use PHFA approved counseling organization OR PHFA online course OR PHFA approved mortgage insurance company online course. Online courses or telephonic counseling are acceptable ONLY for these borrowers At least ONE borrower MUST attend counseling for each loan; method determined by credit score No Homebuyer education is required on refi’s PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Eligible Properties One unit properties only Condos and PUDs are acceptable Condos project must be warranted by the lender, PHFA will not review and/or approve their acceptance Must meet Fannie Mae guidelines No manufactured housing Property must be primary residence No duplexes Non-occupying borrowers are not permitted Review Appendix I for additional property guidelines PENNSYLVANIA HOUSING FINANCE AGENCY HFA PreferredTM Mortgage Insurance Coverage requirements: 18% coverage for LTVs > 95% and <= 97% 16% coverage for LTVs > 90% and <= 95% 12% coverage for LTVs > 85% and <= 90% 6% coverage for LTVs > 80% and <= 85% Eligible Plans Monthly, Single Premium, and Split Premium Single Premium must be paid by the borrower (not lender paid) Single & Split Premium: borrower may finance the upfront premium in the first mortgage or in the subordinate Advantage Loan PENNSYLVANIA HOUSING FINANCE AGENCY Mortgage Insurance When using HFA Preferred you must adhere to the Mortgage Insurance Companies Guidelines even if they are more restrictive; no exceptions. PENNSYLVANIA HOUSING FINANCE AGENCY Desktop Underwriter (DU) 97% LTV products require DU® access Lenders that are not DU® approved can be set up to run DU® through PHFA Main contact should get in touch with Tammy Miller at tmiller@phfa.org Lenders will first need access to Desktop Originator (DO®) For information on how to register for DO®, visit https://www.efanniemae.com/is/brokcorresp/index.jsp PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Home Loan: Conventional PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Home Loan -Conventional Maximum LTV is 80%, due to lack of mortgage insurance options Borrowers must have a 620 minimum credit score Maximum DTI 45% Financing available in conjunction with FHA, VA and RD No Keystone Advantage on Conventional KHL Appendix A for Income and Purchase Price limits Specific program guidelines will follow PENNSYLVANIA HOUSING FINANCE AGENCY Recap of Conventional Financing Products HFA Preferred Risk Sharing/HFA Preferred Keystone Home Loan • For Purchase and limited cash out refinance • Max LTV 97% w/DU Approve/Eligible • Minimum FICO of 620 • Max LTV 95% w/manual underwriting • Minimum FICO of 680 • Max DTI 36% for scores 680 to 700 • Max DTI 45% for scores 700 or higher • CLTV 105% • Must contribute the lesser of 1% or $1000 • Downpayment & CCA available through Advantage • Mortgage Credit Certificate (MCC) available • Max LTV 80% • Combination Loans • 80/10/10 or 80/15/5 • Appendix A for Income and purchase price limits • No CCA available • Borrowers must have a 620 minimum credit score • Max DTI 45% • Can not be used with MCC PENNSYLVANIA HOUSING FINANCE AGENCY Government Financing Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Home Loan: Gov’t PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Home Loan-Government Income and purchase price limits Borrowers must contribute at least the lesser of 1% or $1000 from their own funds for FHA loans. Borrowers must have a 620 minimum credit score FHA, VA or RD financing available Appendix A Gross annual income of all adult occupants Following gov’t entity guidelines First-time homebuyer requirement Waived in 39 Target counties & 13 census tracts Waived for Veterans Applies to all non-target areas 3 Year rule May own other real estate; not primary residence Downpayment and/or closing cost assistance available through Keystone Advantage PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Home Loan PHFA Forms: Form 3: Mortgagor’s Affidavit Upfront Form & at closing 4: Recapture Tax Upfront or at closing PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Government (K-Gov) Loan PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Government Loan (K-Gov) Loans insured/guaranteed by FHA, VA or RD Borrowers must contribute the lesser of 1% or $1000 from their own funds for FHA loans. Borrowers must have a 620 minimum credit score No PHFA- specific limits No first-time homebuyer requirement FHA non-occupant co-borrowers are permitted Downpayment/CCA available through Keystone Advantage for eligible buyers PENNSYLVANIA HOUSING FINANCE AGENCY Recap of Government Financing Products Keystone Home Loan • FHA, RD &VA financing • Income and purchase limits- Appendix A • Borrowers must contribute the lesser of 1% or $1000 from their own funds. • Borrowers must have a 620 minimum credit score • Max DTI 45% • Must meet first time homebuyer requirement, but waived in 39 targeted counties &13 census tracts • Can own other residences but not primary residence • Downpayment & CCA available through Advantage • Can not be used with MCC Keystone Gov’t (K-Gov) • FHA, RD & VA financing • No PHFA income or purchase price limits • Downpayment & CCA available through Advantage • Borrowers must contribute the lesser of 1% or $1000 from their own funds. • Borrowers must have a 620 minimum credit score • Max DTI 45% • Non-occupant co-borrowers acceptable • Mortgage Credit Certificate (MCC) available PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY Assistance Programs Seller’s Guide, Chapter 4 PENNSYLVANIA HOUSING FINANCE AGENCY Mortgage Credit Certificate (MCC) PENNSYLVANIA HOUSING FINANCE AGENCY What is a Mortgage Credit Certificate? MCC = Homebuyer Tax Credit An MCC is an actual paper certificate that allows a homebuyer to claim an annual federal tax credit for the life of the original mortgage, as long as it remains the homeowner’s principal residence. • Homeowners can claim a tax credit of up to 50% of the mortgage interest they pay each year, not to exceed $2,000 annually. • The remaining mortgage interest paid may be claimed as a deduction per IRS guidelines. • The tax credit can not be more than the tax liability (unlike the First-time Homebuyer Tax Credit) PENNSYLVANIA HOUSING FINANCE AGENCY MCC Example Mortgage Amount $125,000 Mortgage Interest rate ($6,250) X 5% MCC percentage X .50 Eligible Credit Amount $ 3,125 • The credit can not exceed the amount of the federal tax owed after all other credits and deductions have been taken and can never exceed $2,000 in any given year. In this example, the borrower is entitled to a maximum of $2,000 in the form of a tax credit and the remaining $4,250 as a standard mortgage deduction using Schedule “A” of their annual federal tax return. • To claim the credit, the homeowner completes and submits IRS Form 8396 along with their federal tax returns. PENNSYLVANIA HOUSING FINANCE AGENCY MCC Requirements • An MCC can be used in conjunction with any PHFA purchase loan except for the Keystone Home Loan. • Eligible borrowers must meet the requirements for the PHFA first mortgage program, in addition to the requirements for the Keystone Home Loan program since the funding for the MCC program comes from the same source. • The following Keystone Home Loan eligibility requirements must be met: First-time Homebuyer Income Limit Purchase Price Limit PENNSYLVANIA HOUSING FINANCE AGENCY Lender Responsibilities The Participating Lender must file an annual report with the IRS using IRS Form 8329 for prior calendar year it made any loans with associated MCC’s. PHFA is not permitted to file the report on behalf of the lender, but we will provide the lender with the necessary data for the prior year’s MCC activity, if any PHFA will provide reminder letters to all applicable lenders in mid December A copy of the report must be submitted to PHFA, along with proof it was submitted to the IRS Records of the annual reports must be maintained by the lender for six years PENNSYLVANIA HOUSING FINANCE AGENCY Reissuance of Mortgage Credit Certificate • If the homeowner chooses to refinance, the MCC may be able to be reissued with the approval of PHFA • There will be a reasonable fee of $100 • MCC Benefit continues after refinancing, unlike the MRB program PENNSYLVANIA HOUSING FINANCE AGENCY Program Recap If your borrower: Is eligible for a PHFA 1st mortgage – Any program except the Keystone Home Loan Program (not refinances) Meets the income and purchase price limits of the MRB program, Appendix A And is a First Time Homebuyer, They may be the very lucky recipient of a 50% mortgage interest tax credit – worth thousands of dollars via a Mortgage Credit Certificate! PENNSYLVANIA HOUSING FINANCE AGENCY Mortgage Interest Paid $120,000 Loan Amount K-Gov Interest Paid (4.25%) Effective K-Gov Interest (4.25%) With MCC Savings Year 1 $5,061 $3,061 $2,000 Years 1-10 $46,171 $26,171 $20,000 Years 1-20 $79,307 $42,739 $36,568 Years 1-30 $92,518 $49,345 $43,173 PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan Downpayment and/or closing cost assistance for eligible homebuyers Borrowers must have a minimum credit score of 660 Can be used with these PHFA first mortgages: Preferred Risk SharingTM HFA PreferredTM Keystone Home Loan (Government loans only) Keystone-Government (K-Gov) HFA PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan Amortized subordinate mortgage (Second Lien) For existing homes: Loan amount = 4% of sales price or up to $6K, whichever is less For new construction (homes never occupied): Up to $6K 0% interest with a 10 year term Asset Limitation $50,000 borrowers liquid assets Retirement accounts excluded unless drawn without penalty PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan Must require maximum financing FHA, VA, RD requirements apply Not available on KHL Conventional loans Funds locked simultaneously with first mortgage Via Pipeline Plus PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan Eligible County Assistance Programs Acceptable Review Appendix D – Subordinate Financing Requirements Utilize assistance programs first be in 3rd lien position Copy of the note and the recorded county program mortgage is required (need to verify PHFA is in second position) Must Advantage Loan Payment Must be included in front end ratio PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan Assistance amount must be indicated in the “Details of Transaction” section 1003 Lender provides HUD1, TIL and GFE May use PHFA Form 56ADV or standard TIL Actual amount must be listed on HUD1 Rounded to nearest dollar Standard Paid Outside of Closing (POCs) items may be reimbursed to borrower Funded by the lender, reimbursed at loan purchased PENNSYLVANIA HOUSING FINANCE AGENCY Keystone Advantage Assistance Loan The first payment on the assistance loan begins at the same time as the first mortgage (no deferment period) PENNSYLVANIA HOUSING FINANCE AGENCY HOMEstead Loan PENNSYLVANIA HOUSING FINANCE AGENCY HOMEstead Loan Downpayment and/or closing cost in conjunction with a PHFA first mortgage Not eligible in all counties- Appendix 1 & 2 Conventional, FHA, VA and RD financing available Borrowers must have a 620 minimum credit score Borrowers must contribute the lesser of 1% or $1,000 from their own funds (FHA loans only) Can be used to lower an eligible buyer’s front end ratio to 30% $1,000 to $10,000, based on need Non-interest bearing loan with no monthly payment PENNSYLVANIA HOUSING FINANCE AGENCY HOMEstead Loan Forgiven at 20% a year, over five years Income and purchase limits apply For areas that don’t receive federal HOME funds First time homebuyers only Homebuyer Education required regardless of FICO Liquid assets after closing may not exceed $5,000 Can’t be tenant occupied when Sales Agreement is signed Built after January 1, 1978 (some exceptions) Amount determined by Need Assessment Form (Appendix 3) PENNSYLVANIA HOUSING FINANCE AGENCY Access Modification Loans For Persons with Disabilities PENNSYLVANIA HOUSING FINANCE AGENCY Access Home Modification Loan With any PHFA home purchase program Conventional, FHA or RD $1,000 to $10,000 soft/silent subordinate mortgage Repayment is not required as long as buyer occupies home Modifications to be completed within 90 days of closing PENNSYLVANIA HOUSING FINANCE AGENCY Access Downpayment &CCA Used with a PHFA first AND a PHFA Access Home Modification Loan Household income can’t exceed $53,280 $1,000 to $15,000 Subordinate loan Borrowers must need maximum financing (may not have more than 3-5% down) No>$5,000 in liquid assets after closing PENNSYLVANIA HOUSING FINANCE AGENCY Asset Documentation $50,000 asset limitation for all borrowers under the Keystone Advantage $5,000 household liquid assets to other PHFA Assistance programs Must be provided for all adult occupants Verification of Deposit (VOD) with average balance completed OR Two months of bank statements Please note: For FHA loans: large deposits can not be greater than 2% of the sales price For Conventional loans: large deposits can not be greater than 50% of the borrowers total monthly qualifying income PENNSYLVANIA HOUSING FINANCE AGENCY Recap of Downpayment and/or Closing Cost Assistance Programs Keystone Advantage Assistance Loan HOMEstead Access Modification Loan Access Downpayment and Closing Cost Assistance • • • • The lesser of 4% of sales price, max $6K, for existing homes 0% interest with a 10 year term Must have a minimum credit score of 660 Used with KHL (gov’t), K-Gov and HFA Preferred Risk SharingTM and HFA PreferredTM • Up to $10K • Forgiven 20% a year over 5 years • Up to $10K -Soft second • Modification completed within 90 days • Used with Conventional, FHA and RD financing purchase products • Can be used with the Access Modification Loan • Up to $15K- Soft lien PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY Underwriting Guidelines Seller’s Guide, Chapter 6 PENNSYLVANIA HOUSING FINANCE AGENCY Preliminary Determinations PHFA does not issue preapproval or prequalification letters. Form 1 can be used to review questionable PHFA compliance issues prior to uploading the underwriting package The lender must determine if the loan is approved under FHA, VA, RD or Fannie Mae guidelines For HFA conventional loans-DU approval is required with 97% LTV loans PENNSYLVANIA HOUSING FINANCE AGENCY Underwriting Guidelines Job Stability Two year history showing stability Tenure, opportunity, education, training, etc. If a non-liable co-occupant is listed on the deed they should also appear on the mortgage, title, assignment of mortgage and TIL but not the note A processor’s certification must be in the underwriting file with name and SS# A Residential Mortgage Credit Report is required PENNSYLVANIA HOUSING FINANCE AGENCY Procedures Lender underwrites the file and uploads underwriting package via BlitzDocs to PHFA for review Use Form 51 (Compliance Package Checklist- Purchase) for required documents and submission instructions Use Form 51R for Refinance programs All loans must be locked with PHFA prior to uploading Compliance package Allow up to 5 business days for PHFA to make a decision PENNSYLVANIA HOUSING FINANCE AGENCY Form 51/Form 51R Complete the top portion and follow the instructions below it Check off each applicable item Place COPIES of documents in the correct order (or originals for conventional loans) Upload and submit to PHFA via BlitzDocs PENNSYLVANIA HOUSING FINANCE AGENCY Underwriting Results All notices and reports can be retrieved via Pipeline Plus Approval Notice: The loan is eligible for sale to PHFA Contains Purchase Conditions (these documents should be uploaded with the Purchase package) PENNSYLVANIA HOUSING FINANCE AGENCY Underwriting Results Suspense Notice: PHFA can not complete its review due to missing documentation or incomplete info This notice specifies the additional required info or documents All documents for suspended loans should be uploaded via BlitzDocs at one time Denial Notice: PHFA can not approve the loan May be based on underwriting criteria or program compliance issues PENNSYLVANIA HOUSING FINANCE AGENCY Income Documentation Programs Income Docs For Borrower(s) Income Docs for Adult Occupants Use Income for PHFA limits HFA Preferred Risk Sharing Full VOE OR Verbal VOE, Current Paystubs, 2yrs W-2s Current Paystubs, 2yrs W-2s Yes HFA Preferred Full VOE OR Verbal VOE, Current Paystubs, 2yrs W-2s Current Paystubs, 2yrs W-2s Yes Keystone Home Loan Full VOE OR Verbal VOE, Current Paystubs, 2yrs W-2s Current Paystubs, 2yrs W-2s Yes K-Gov Full VOE OR Verbal VOE, Current Paystubs, 2yrs W-2s N/A N/A * Self-employed borrowers two years of tax returns. Profit and Loss statement after the first quarter. PENNSYLVANIA HOUSING FINANCE AGENCY Sources of Funds Seller concessions (Conventional loans) 3% if LTV > 90% 6% if LTV < 90% If FHA, VA, RD those guidelines apply County programs acceptable if approved by PHFA or Fannie Mae depending on loan program See Appendix D – Subordinate Financing Requirements for details PENNSYLVANIA HOUSING FINANCE AGENCY Proof of Mortgage Insurance For FHA loans, the signature section of the Loan Underwriting Transmittal Summary (LUTS) must either indicate a DU Accept or LP Approve AND the ZFHA number, OR it must be signed by the DE underwriter (either way, the DE underwriter must also complete the Conditional Commitment) Electronic signatures are acceptable on all conventional compliance documents FHA insured/guaranteed loans, electronic signatures will be accepted on third party docs only, such as sales agreement, per FHA guidelines. PENNSYLVANIA HOUSING FINANCE AGENCY Property Guidelines Seller’s Guide, Chapter 8 PENNSYLVANIA HOUSING FINANCE AGENCY Appraisal Full appraisal on all PHFA loans; the only acceptable form is 1004. Also 1004MC (Market Condition Addendum) For HFA PRS &HFA Preferred programs also submit appraisal through FNMA’s Universal Collateral Data PortalSM (UCDP) A “successful” UCDP Summary Report must be submitted in underwriting package All additional commentary must be included Submitted in the underwriting package For existing properties, original photographs of the front, rear and street scene along with internal photos of the subject property must be included PENNSYLVANIA HOUSING FINANCE AGENCY Appraisal Cont’d The census tract (if applicable) must be listed Include the Conditional Commitment/Direct Endorsement Statement of Appraised Value for FHA loans (HUD 92800.5b) Include the Certificate or Notification of Reasonable Value for VA loans Appendix I - PHFA Appraisal Review Sheet PENNSYLVANIA HOUSING FINANCE AGENCY Manufactured Homes Loan files for Manufactured Homes must contain the following documentation: the original vehicle title was retired for the file to be purchased by PHFA completed and endorsed PennDOT Form MV 16 If the home was purchased new from a dealer and in the dealer’s possession for less than 6 months, the original certificate of origin is required as proof it was never titled. PENNSYLVANIA HOUSING FINANCE AGENCY Manufactured Homes The VIN number should be referenced in the deed and the legal description of the mortgage Closings for this home type should not be scheduled until proper documentation is obtained If the title was never retired, it must be located to determine the date it was titled and if there are any liens Additional research with PennDOT may be required Manufactured Home Affidavit of Affixation Rider to be used for all manufactured homes (PHFA Form 60) PENNSYLVANIA HOUSING FINANCE AGENCY Property Eligibility Programs Acceptable Property Types Notes HFA Preferred Risk SharingTM & HFA PreferredTM 1 units only, PUDs, Condos Must meet FNMA guidelines No manufactured housing Keystone Home Loan One or two units; condos, PUDs, manufactured housing Must meet respective gov’t entity guide or conventional guidelines (FNMA standards) K-Gov One or two units, condos, PUDs, manufactured housing Must meet respective gov’t entity guidelines PENNSYLVANIA HOUSING FINANCE AGENCY Property Eligibility New or existing located in PA Principal residence occupied by owner within 60 days of closing and for life of loan No > 4 acres (up to 10 if meet exceptions) Remaining economic life > 30 years No > 15% of home used for business Taxes and insurance are ALWAYS escrowed PENNSYLVANIA HOUSING FINANCE AGENCY Property Standards Wood Destroying Insect Certification Existing homes only - all buildings included in appraisal E.g. detached garage Report must be dated within 120 days of closing A CLEAR wood-destroying insect certification must be included in the Purchase Submission, signed by the inspector. PENNSYLVANIA HOUSING FINANCE AGENCY Property Standards If evidence of infestation was observed, the commentary must be provided. This should be signed by the borrower(s) and the inspector. If infestation was active, proper control measures must have been taken and addressed prior to closing. Sellers often pay for this service. If structural damage resulted from the infestation, provide proof that the damage was satisfactorily repaired prior to closing. Sellers often pay for the repairs. PENNSYLVANIA HOUSING FINANCE AGENCY Property Standards Private Water Supply Appraiser must note the type of private water supply; “onsite” alone is not sufficient. PENNSYLVANIA HOUSING FINANCE AGENCY Property Standards Private Sewage Disposal Appraiser must note the type of system; “on-site” alone is not sufficient. If appraiser recommends or requires a septic certification OR if there is indication in the appraisal or sales agreement of an existing or potential problem, a clear septic dye test must be included in the Purchase Submission. Rural properties forced to utilize “wildcat disposal systems” because there is no alternative, may be acceptable under certain conditions (See Appendix W). When you encounter a non-traditional form of sewage disposal, contact the Agency for possible acceptability of it. PENNSYLVANIA HOUSING FINANCE AGENCY Property Standards Privately Owned and Maintained Streets For a property on a community or privately owned and maintained street, provide proof that an adequate, legally enforceable private road maintenance agreement was recorded. A copy of it, with recordation notation, must be included in the Purchase Submission. Provide proof of ingress, egress and regress. NOT required if the street is maintained by an HOA. Dirt basements Acceptable if appraiser notes they are common and typical for the area. The amenities (furnace, etc.) should be on concrete slabs. PENNSYLVANIA HOUSING FINANCE AGENCY Homeowner’s Insurance Term- at least one (1) year Fire and Extended Coverage Required Protection against loss or damage from fire and other hazards covered by standard extended coverage endorsement In an amount equal to the LESSER of the loan amount OR the maximum insurable value of the improvements (subtract the land value from the final reconciliation of value on appraisal) Maximum deductible is $3,000 or 1% of the face amt of policy Mortgagee Clause - Endorsed in favor of PHFA and/or its successors or assigns, as their interest may appear; address is on Form 53 (closing instructions) Copy of HO6 (contents) coverage for condos Taxes and Insurance are ALWAYS escrowed PENNSYLVANIA HOUSING FINANCE AGENCY Flood Insurance Required for properties where any portion of the improvements are in a flood zone The maximum deductible permitted by PHFA is $5,000 unless the mortgage insurer/guarantor (such as FHA) requires a lower amount, but the borrower must still qualify at the lowest deductible permitted. If needed for a condo, obtain proof of Condo Association’s insurance. All PHFA loans require a “Life of Loan Certification” issued by a Flood Insurance company Insured as “Pennsylvania Housing Finance Agency, its Successors and Assigns” OR include a “Notice of Servicing Transfer” with the purchase package PENNSYLVANIA HOUSING FINANCE AGENCY Flood Insurance Mortgage qualification purposes, the standard policy rate should be utilized in calculating the debt to income ratios. The standard rate will also be the amount escrowed and included in the monthly PITI payment. PHFA uses Corelogic when conflicts arise Clay Rose, Product Account Executive 800.447.1772 ext. 3132 OR 512.977.3132, crose@corelogic.com Brenda Gould, Product Account Executive 800.447.1772 ext. 3128 OR 512.977.312, brgould@corelogic.com PENNSYLVANIA HOUSING FINANCE AGENCY Elevation Information In the 'Elevation Information' section of an application, the lowest floor, base floor, and base flood elevation must be listed and must match the elevation certificate If the ‘Elevation Difference’ is less than zero and the full risk (i.e., non-subsidized) NFIP premium at the lowest possible deductible is not provided, then the premium used to underwrite the file will be the lesser of 10 percent of the loan amount or $12,000 If you’d like to underwrite with the actual full risk rates, which may be significantly lower, ask insurance agents to provide completed applications PENNSYLVANIA HOUSING FINANCE AGENCY Flood Insurance Elevation Certs are not acceptable documentation to waive the flood insurance purchase requirement No one can waive the flood insurance requirement if the structure is shown to be located in the Special Flood Hazard Area on the FEMA Flood Insurance Rate Map except FEMA via Letter of map Amendment, etc. Flood insurance for properties in a participating Community must be written through the National Flood Insurance Program (NFIP) NFIP Publications can be ordered online at www.fema.gov/business/nfip/libfacts.shtm Review Chapter 12 for additional details PENNSYLVANIA HOUSING FINANCE AGENCY Taxes and Assessments Special Assessments Any special assessments, tax assessments OR any then due taxes or past due taxes must be paid by closing This includes unpaid lienable water/sewer rents and unpaid Condo/PUD Association fees PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY Programs for Homeowners Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY Homeowner Products Refinancing: Conventional HFA Preferred Risk SharingTM HFA PreferredTM Refinancing: Government FHA/VA Streamline Refinance PENNSYLVANIA HOUSING FINANCE AGENCY Allowable Fees: For Refinances Actual amount (or your standard fees) for items including, but limited to: Credit report (not needed for FHA/VA Streamline) Appraisal fee (not needed for FHA/VA Streamline) Filing and recording fees DU/LP (not needed for FHA/VA Streamline) Tax certification fees can only be charged on conventional loans if it’s a pass thru fee to a third party. $750 Administrative fee to cover overhead such as underwriting, processing and doc prep- for conventional financing $350 Administrative fee for FHA/VA Streamline Refinance program PENNSYLVANIA HOUSING FINANCE AGENCY Refinancing: Conventional Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Loan Programs Refinance Option PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM For purchase and limited cash-out refinance Rate & term refis only Available for all loan types Fully amortized MyCommunityMortgage…BUT No loan level pricing adjustment 30 year, fixed-rate term Same guidelines as mentioned in the homebuyer section but… PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Limited Cash Out refinances (rate & term refi) Cash back limited to lesser of 2% of the balance of the new loan or $2000 Must be obtaining maximum financing-determined by DU findings 95% vs. 97% Cash back must be used towards closing costs if the Advantage Assistance Loan is requested PENNSYLVANIA HOUSING FINANCE AGENCY HFA Preferred Risk SharingTM/ HFA PreferredTM Acceptable Uses: Pay off the unpaid principal balance of the existing first mortgage Pay off only subordinate mortgages used to purchase property PENNSYLVANIA HOUSING FINANCE AGENCY Refinancing: FHA/VA Seller’s Guide, Chapter 3 PENNSYLVANIA HOUSING FINANCE AGENCY FHA/VA Streamline Refinance Loan PENNSYLVANIA HOUSING FINANCE AGENCY FHA Streamline Refinance Only for existing FHA homeowners New loan can only include: The outstanding principal balance (from payoff stmt) Odd day’s interest Minus the applicable refund of the UFMIP Plus the new UFMIP up to a maximum amount of 97.75% of the original appraised value One month of annual MI for the current payment due on the existing loan may also be included PENNSYLVANIA HOUSING FINANCE AGENCY VA Interest Rate Reduction Refinancing Loan (IRRRL) New VA loan can include the outstanding principal balance plus the VA funding fee and eligible closing costs. Lenders must follow VA’s streamline refinance guidelines in effect at the time of loan application per VA Pamphlet 26-7, Revised -- Chapter 6, Section 1 and sections of chapters 5, 7 and 8 as they pertain to the VA IRRRL’s requirements. PENNSYLVANIA HOUSING FINANCE AGENCY FHA/VA Streamline Refinance Any and all subordinate loans must be resubordinated or paid off by the borrower; they cannot be paid off with the new loan. A lien search is required on all loans Title commitments are acceptable PHFA seconds will only be re-subordinated if the new refinanced loan is coming through PHFA Copy of the deed PENNSYLVANIA HOUSING FINANCE AGENCY FHA Guidelines Lenders must follow the FHA’s guidelines in effect at the time of loan application for the Streamline Refinance per the HUD Handbook 4155.1, Chapter 3, Section C and Chapter 6, Section C. Reference Mortgagee Letter 12-4 for information on premiums, as they differ depending on when the original loan was endorsed. PENNSYLVANIA HOUSING FINANCE AGENCY FHA Guidelines Mortgagee Letter 12-4 Streamline Refinance transactions for existing FHA loans ENDORSED ON OR BEFORE MAY 31, 2009, the UFMIP will decrease from 1% to 0.01% of the base loan amount. The Annual MIP for refinanced FHA loans ENDORSED ON OR BEFORE MAY 31, 2009 will be 55bps regardless of the base loan amount. Please review the entire Mortgagee Letter which also discusses premium increases that went into effect on or after April 9, 2012. PENNSYLVANIA HOUSING FINANCE AGENCY Additional PHFA Requirements For FHA/VA Streamline Refinance Loan Program PENNSYLVANIA HOUSING FINANCE AGENCY PHFA Requirements 30 year fixed rate only Owner occupied One or two units, principal residences only Both the existing and new loan must meet this requirement Non credit qualifying option is acceptable without an appraisal but a verbal VOE is required on all refis Maximum mortgage limit is $417,000 Real estate taxes and insurance must be escrowed regardless of the LTV PENNSYLVANIA HOUSING FINANCE AGENCY PHFA Requirements For loans currently serviced by PHFA: The amount needed to pay off the borrower’s existing PHFA loan will be reduced by the balance in the borrower's existing escrow account. The payoff statement used must come directly from PHFA staff The calculation of the new loan amount would still be done normally per the applicable program guidelines. The lender will perform the standard escrow analysis to ensure sufficient funds are collected to pay for any taxes and insurance due within the next 12 months, and will also provide the initial escrow account disclosure statement. PENNSYLVANIA HOUSING FINANCE AGENCY PHFA Requirements Non-occupying co-borrowers cannot be added to the new loan Permitted only when they were on the original FHA loan Co-borrowers on the original loan can be removed from the new loan with additional documentation These must be underwritten according to FHA's credit qualifying guidelines, although an appraisal is not needed. PENNSYLVANIA HOUSING FINANCE AGENCY Lender Instructions and Procedures PHFA will review the HUD1 to verify that the premium was accurately applied The allowable lender administration fee is $350 (not $750) Less paperwork for these loans No additional fees may be charged except for the reasonable and customary third party fees and closing costs Lock the loan with PHFA via Pipeline Plus – see chapter 2 of the Sellers Guide for details PENNSYLVANIA HOUSING FINANCE AGENCY Lender Instructions and Procedures Underwriting Requirements and Documentation If a co-borrower is being removed, the loan must be underwritten and documented using FHA’s Credit Qualifying Streamline Refinance guidelines without an appraisal. The following items will be required: Credit report Income verification A full loan application (1003) with all sections completed PHFA’s overlays would apply PENNSYLVANIA HOUSING FINANCE AGENCY Lender Instructions and Procedures PHFA delegated underwriting system is not permitted The underwriting/compliance package must be submitted to PHFA using Form 51R prior to closing PHFA specific documents are not required: Mortgagor’s/Seller’s Affidavit (Form3) Recapture Tax Notice (Form 4) PENNSYLVANIA HOUSING FINANCE AGENCY BlitzDocs Instructions Appendix E PENNSYLVANIA HOUSING FINANCE AGENCY Accessing Blitzdocs Utilize Appendix E – BlitzDocs Instructions Can be found at www.phfa.org/lenders/forms.aspx# Log into the PHFA Pipeline Plus system To access BlitzDocs each person must have a PHFA Pipeline Plus account Continue to use the PHFA Pipeline Plus system to check loan status and view reports/notifications PHFA will make sure existing Pipeline Plus account users have a corresponding BlitzDocs account when requested Account Administrators would add the BlitzDocs menu option to those users submitting any portion of a file to PHFA PENNSYLVANIA HOUSING FINANCE AGENCY Accessing BlitzDocs When creating new Pipeline Plus accounts for an employee that needs access to BlitzDocs, the administrator must email lenders@phfa.org PHFA will contact BlitzDocs to obtain login info Select BlitzDocs from your menu and click the link to launch BlitzDocs in a new window When a compliance package is submitted via BlitzDocs the purchase package must also be submitted via BlitzDocs PENNSYLVANIA HOUSING FINANCE AGENCY Accessing Blitzdocs “Submission Contact” File size limited to 50MB Determines who will receive the submission confirmation email from BlitzDocs and can be different for each submission If larger submit two separate uploads PHFA Employees files cannot be sent via BlitzDocs Paper files must be sent directly to PHFA marked “Personal and Confidential” Compliance packages sent to Tammy Miller Purchase packages sent to Karen Zapotosky PENNSYLVANIA HOUSING FINANCE AGENCY Submitting New Compliance Package Only create a folder when ready to submit a complete compliance package Do not create multiple folders for the same borrower When completing the Folder Attributes, you must use PHFA Loan Number Listed on the reservation confirmation In PHFA Pipeline Plus system PENNSYLVANIA HOUSING FINANCE AGENCY Submitting New Compliance Package Submission Contact entered should be the person who will receive email notifications for the loan For the PHFA Delegated Loan section Only select “PHFA-Delegated” if you are an approved PHFA Delegated lender AND the file you are submitting has been entered into PHFA’s Delegated Underwriting System For all other lenders, select “PHFA Non-Delegated” PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY Submitting New Compliance Package Compliance package must be in the stacking order of Form 51/51R Upload Compliance Package: Documents>>Upload; Document Type: **To Be Indexed** Crucial final step! Select: File Submission >> Submit New Compliance Package to PHFA. Upload the original version of the Appraisal if at all possible If completed separately, you can select Appraisal as the Document Type Must be an adobe version not XML PENNSYLVANIA HOUSING FINANCE AGENCY Submitting New Compliance Package Please do not click File Submission more than once You can verify if your field was properly submitted by checking the notes section within the loan folder There will be a note with the description of “Submitted New Compliance Package to PHFA” if it was successful Please avoid submitting duplicates of any document PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Conditions: Approval, Suspense & Denials Review Compliance notifications posted to PHFA Pipeline Plus Search in BlitzDocs for folders in status of Approved, Suspended and/or Denied/Cancelled Make sure you have the necessary documentation please wait to upload the information before submitting conditions Only complete submissions will be reviewed. PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Suspended Obtain suspense notification from PHFA Pipeline Plus system Review and collect ALL outstanding items All conditions are to be submitted at one time All mail is to be submitted through BlitzDocs DO NOT send documents via email to compliance officer or to HOPcompliance@phfa.org PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Suspended Upload Suspense Conditions: Documents>>Upload; Document Type: Compliance Suspense Conditions Crucial final step! Select: File Submission >> Submit Compliance Suspense Conditions to PHFA. PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Suspended Please do not click File Submission more than once You can verify if your field was properly submitted by checking the notes section within the loan folder There will be a note with the description of “Submitted Suspense Conditions to PHFA” if it was successful Please avoid submitting duplicates of any document PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Denied Review Compliance Denial notification via Pipeline Plus system If denial can be disputed, collect and upload any supporting documentation: Documents>>Upload; Document Type: Change Request Conditions Crucial final step! Select: File Submission >> Submit Change Request to PHFA. If the denial cannot be disputed: No action is required PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Denied Please do not click File Submission more than once You can verify if your field was properly submitted by checking the notes section within the loan folder There will be a note with the description of “Submitted Change Request to PHFA” if it was successful Please avoid submitting duplicates of any document PENNSYLVANIA HOUSING FINANCE AGENCY Submitting Compliance Conditions: If Approved Review Compliance Approval Notification and collect all outstanding items These documents must be submitted when the purchase submission package is uploaded There’s no file submission action for approval conditions Documents will not be reviewed until the completed purchase package has been uploaded and submitted PENNSYLVANIA HOUSING FINANCE AGENCY Change Requests The “Submit Change Request” should not be used to upload approval or suspended compliance conditions This option is used for major changes to the loan that need to be made and reviewed before closing PENNSYLVANIA HOUSING FINANCE AGENCY Notifying PHFA of Cancelled/Denied Loans If a loan previously submitted via BlitzDocs will be cancelled or denied by your organization, you must cancel it on the Pipeline Plus System Be sure to include the reason for cancellation. PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY Contact Information Business Development Unit Coleen Baumert cbaumert@phfa.org 717.780.1871 Michael Brightbill mbrightbill@phfa.org 717.780.1801 Justin Coleman jcoleman@phfa.org 717.780.3993 Compliance Unit Tammy Miller tmiller@phfa.org 717.780.3884 Denise Wolfgang dwolfgang@phfa.org 717.780.3923 Betsy Stilo bstilo@phfa.org 717.780.4321 PENNSYLVANIA HOUSING FINANCE AGENCY Contact Information Purchasing/Final Docs Unit Karen Zapotosky kzapotosky@phfa.org 717.780.3973 General purchasing questions: sfpurchasing@phfa.org General final docs questions: sffinaldocs@phfa.org Secondary Marketing Unit Jordan Laird secondary@phfa.org Leah Finley secondary@phfa.org 717.780.3843 717.780.1872 Homeownership Hotline 1.800.822.1174 PENNSYLVANIA HOUSING FINANCE AGENCY PENNSYLVANIA HOUSING FINANCE AGENCY THANK YOU FOR YOUR TIME AND ATTENTION 3/10/15 www.phfa.org