RCMP Presentation

advertisement

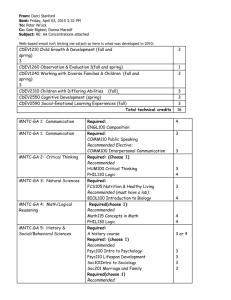

Jack Henry & Associates, INC. (JKHY) RCMP Presentation (Existing Company Analysis) 19th March 2015 Prateek Baveja Neha Saoji Siyu Xu Agenda Introduction 3 Company Review 7 Macroeconomic Conditions 14 Industry Prospects 15 Stock Market Review 18 Financial Analysis & Projections 19 Valuations 22 Recommendation 27 2 Jack Henry & Associates – An Introduction History Industry Founded by Jack Henry & Jenry Hill in 1976 Business Software & Services Headquarter ed in Monett, Missouri Serves commercial banks & credit unions Processing transactions Intro Company Automating business processes Macro Industry Stock Managing information Financials Valuations Recomm 3 Jack Henry & Associates – Major Product Line Intro Company JKHY Shareholder Meeting – Nov’2014 Macro Industry Stock Financials Valuations Recomm 4 Support & Services form major chunk of revenues Support & Services Hardware Sales License Intro JKHY 10K Pages 20-21 Company Macro Industry Stock Financials Valuations Recomm 5 Change in Business Model Intro Company JKHY Shareholder’s Meeting’2014 Macro Industry Stock Financials Valuations Recomm 6 Current Holding Current share price = $68.89 Current holding value = $13,563 (200 Shares) Constitutes 7.39% of invested holdings (without cash) Constitutes 3.18% of invested holdings (with cash) 4.35% ABBV Initial investment: $7,200 ABT 13.05% AEO 14.13% Unrealized gain: $11,736 AL 10.29% COF 12.72% JKHY NHC 13.99% SNA 7.87% UNP 8.24% WBA ZIXI 3.53% 7.39% 4.45% Intro Company Source: Yahoo! Finance RCMP Portfolio Macro Industry Stock Financials Valuations Recomm 7 History of JKHY transactions Nov 11, 1999 • Purchase • 200 shares @ $36 March 2, 2000 • 2 for 1 split • 400 shares @ $18 Mar 4, 2001 • 2 for 1 split • 800 shares @ $9 Jan 15, 2007 • Sold • 400 shares @ $22.53 (realized gain of $5,412) Nov 25, 2013 • Sold • 200 shares @ $56.75 (realized gain of $9,550) Dec 4, 2014 Intro • Hold • 200 shares @ $61.90 Company Source: Yahoo! Finance RCMP Portfolio Macro Industry Stock Financials Valuations Recomm 8 Recent news at a Glance BCB Community Bancorp Selects Jack Henry Banking to enhance efficiency & Workflow Management CUBG, nation’s largest Business Services Credit Union Organization announces alliance with ProfitStars division Oppenheimer upgrades JKHY from Perform to Outperform Shruti Miyashiro, President & CEO of Orange Country Credit Union, appointed to the board as an independent director ProfitStars' iPay Solutions first to implement NACHA's Bill Payment Exception Program Intro Company Macro Industry Stock Financials Valuations Recomm 9 Management Team Jack Prim Chairman of the Board and Chief Executive Officer • CEO since 2004, Chairman of the Board since 2012 • 38-year financial industrial experiences • Expertise across departments from outsourcing management, system implementation & support David Foss President Intro JKHY Website Company Mark Forbis VP & CTO Kevin Williams CFO & Treasurer Macro Industry Stock Financials Valuations Recomm 10 JKHY is among the best places to Work Intro Company JKHY Shareholder’s Meeting – Nov’2014 Macro Industry Stock Financials Valuations Recomm 11 Recent Acquisitions (2010 – 2014) 28 strategic acquisitions since end of fiscal year 1999 Integrated technology & payment processing solutions Intro JKHY 10K’2014 Page 6 Company Payment Processing solutions for credit unions Macro Industry Internet & telephone bill payment services Stock Financials Mobile banking, web development and dataenriched marketing technology Valuations Recomm 12 Strengths & Opportunities outweigh the negatives Strengths Opportunities 100 Heavy focus on R&D Robust financial position Should increase client base in core banking & credit union Should consider providing SaaS services 50 Strong FCF for M&A Consolidate Mobile Banking Solutions Threats Weakness Economic uncertainty -50 Relatively small in comparison to competitors -100 Highly concentrated operations & customer base Intro Company Security Threats Innovations arose out of acquisitions Macro Industry Larger Banks can start using their own software Stock Financials Prone to changes in banking & govt. regulations Valuations Recomm 13 Macro Economic Factors Improved GDP growth Increase in Loans Outstanding by Credit Union Falling Unemployment Source: U.S. Bureau of Economic Analysis (http://www.bea.gov/newsreleases/national/gdp/gdp_glance.htm) Bureau of Labor Statistics (http://data.bls.gov/timeseries/LNS14000000) Source: Federal Reserve Bank of St. Louis (http://research.stlouisfed.org/fred2/graph/?id=TOTALTCU) Intro Company Macro Industry Stock Financials Valuations Recomm 14 Industry - Business Software & Service Increase in the IT and business services outsourcing market The IT and business services outsourcing market was at 170 billion in 2012 and the banking process outsourcing services made up about 85 billion. Intro Company Macro Source: Hfs Research, 2013 market sizing data Industry Stock Financials Valuations Recomm 15 Sustained growth in a Consolidating Industry Intro Company JKHY 2014 Shareholder’s Meeting Macro Industry Stock Financials Valuations Recomm 16 Porter’s 5F Analysis High & Increasing as some financial firms build their own set of software Moderate as terms cannot change between contract period Low as switching products is costly Little as major production is in house Medium but Increasing – Building trust takes time Intro Company Macro Industry Stock Financials Valuations Recomm 17 Stock Market Return JKHY returns are correlated with the market index but has much higher returns 5 yr annualized returns of 23.29% / Yr Intro Yahoo Finance Company Macro Industry Stock Financials Valuations Recomm 18 Financial Ratio Analysis Debt/Asset Greenblatt Ratio 20.00% 0.80 0.70 15.00% 0.60 0.50 10.00% 0.40 0.30 5.00% 0.20 0.10 0.00% 2010 2011 2012 EBIT/Tangible Assets 2013 2010 2014 2011 EBIT/EV 2012 2013 2014 Debt/Asset Decreasing Debt Consistent Growth Lower Volatility Stable Revenue Stream Intro 10K Company Macro Industry Stock Financials Valuations Recomm 19 DuPont Analysis 250.00% 200.00% 150.00% 100.00% 50.00% 0.00% 2010 Tax Burden 2011 2012 2013 2014 Interest Burden Operating Profit Margin Asset Turnover Leverage ROE Intro Company Macro Increasing ROE • Decreasing Leverage • Increasing asset turnover Increasing dividend payments Industry Stock Financials Valuations Recomm 20 Financial Projections – Income Statement 2014A Average Median 2015E 2016E 2017E 2018E Sales growth rate 7.1% 9.7% 8.6% 8.9% 10.8% 12.8% 13.9% 14.1% License -3.3% 0.4% 0.8% -3.0% -3.0% -3.0% -3.0% -3.0% Support and service 8.2% 11.2% 9.9% 10.0% 12.0% 14.0% 15.0% 15.0% Hardware -1.2% -2.1% -2.4% -1.7% -1.7% -1.7% -1.7% -1.7% Cost of sales yoy growth -1.1% -0.7% -0.6% 0.8% 0.9% 1.2% 1.1% 1.1% License -8.4% -7.2% -7.1% -7.2% -9.5% -10.1% -8.2% -8.7% Support and service -1.5% -0.9% -1.0% -0.9% -1.0% -1.2% -1.1% -1.1% Hardware 1.3% 0.2% 0.3% 0.2% 0.3% 0.6% 0.5% 0.4% Operating expenses 17.3% 18.4% 18.1% 17% 17% 17% 17% 17% SGA of revenue 11.8% 12.5% 12.3% 11.5% 11.5% 11.5% 11.5% 11.5% R&D of revenue 5.5% 5.9% 5.8% 5.5% 5.5% 5.5% 5.5% 5.5% Intro Company 10K – 2014 Income Statement Macro Industry Stock Financials Valuations 2019E Recomm 21 WACC & FCF Valuation cost of debt cost of debt (pre-tax) tax rate 2.9% 5% 35% Capital structure Million $ Weight Debt @ book value 7.75 0.14% Equity@ mkt cap 5470 99.86% FCF calculation EBIT - Corporate income tax (35%) - Depreciation and amortization - Change in working capital - Capital expenditures Free cash flow Cost of equity risk free rate market return market premium beta (five year) cost of equity (CAPM)75% realized return-25% 2014 309.1 108.2 107.8 -4.2 -33.20 279.7 Discount factor Present value of FCF Terminal value Total present value Shares Outstanding Price per share 5694.13 85.40M $66.68 Current Price $68.86 Intro Company Macro 2015E 345.4 120.9 114.3 20.47 -30.83 287.5 1 0.89 257.16 Industry 2016E 388.6 136.0 128.5 27.2 -31.24 322.6 11.8% 2.24% 7.79% 5.55% 1.03 7.97% 23.29% 2017E 446.8 156.4 148.5 35.7 -28.75 374.4 2 0.80 258.18 Stock WACC 11.79% Perpetual growth rate 3.00% 2018E 517.7 181.2 175.0 43.8 -25.10 442.6 3 0.72 268.04 2019E 600.6 210.2 209.0 50.5 -23.77 525.2 4 0.64 283.43 Financials NORMALIZED 813.53 284.73 209.0 50.5 -23.77 663.6 5 0.57 300.86 4326.46 Valuations Recomm 22 Sensitivity Analysis 66.68 9.79% 10.79% 11.79% 12.79% 13.79% 1.5% 75.70 66.58 59.27 53.29 48.31 2.5% 83.76 72.62 63.92 56.95 51.24 3.0% 88.68 76.22 66.68 59.06 52.92 3.5% 94.38 80.32 69.70 61.40 54.75 4.0% 101.07 85.03 73.15 64.01 56.77 Intro Company Macro Industry Stock Financials Valuations Recomm 23 Competitor Analysis Fidelity National Information (FIS): Offers financial institution core processing, card issuer, and transaction processing services, including the NYCE Network Fiserv (FISV): Provide various financial services technology solutions Financial Solutions Payment Solutions International Solutions Payments and Industry Products Financial Institution Services Globally focused Total system services (TSS): Provides electronic payment processing and other services to card-issuing and merchant acquiring institutions Offers issuer account solutions. Provides merchant processing and related services. Globally focused Intro Company Yahoo Finance & 10K’2014 Macro Industry Stock Financials Valuations Recomm 24 Valuation - Comparable Transactions Intro Source: Capital IQ Company Macro Industry Stock Financials Valuations Recomm 25 Technical Analysis - 1 Year Data Intro Bloomberg Company Macro Industry Stock Financials Valuations Recomm 26 Recommendation DCF Valuation - $66.68 Comparable Analysis Valuation $66.29 Current Stock Price $68.89 • 50 Days MA crosses 100 & 200 Days MA Growth • Steady growth projections • Long contracts periods • 78% recurring revenue Momentum Intro Company Macro Industry Stock Business Financials Valuations Recomm 27