Managing cash flow

advertisement

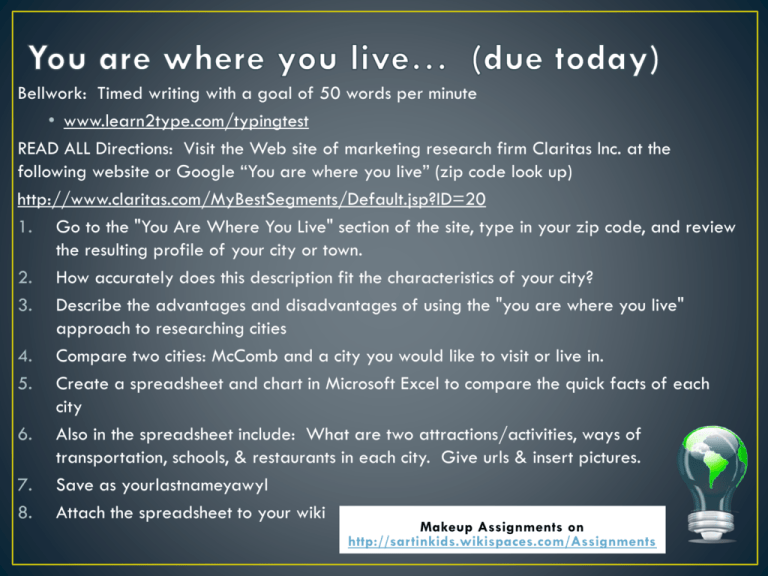

Bellwork: Timed writing with a goal of 50 words per minute • www.learn2type.com/typingtest READ ALL Directions: Visit the Web site of marketing research firm Claritas Inc. at the following website or Google “You are where you live” (zip code look up) http://www.claritas.com/MyBestSegments/Default.jsp?ID=20 1. Go to the "You Are Where You Live" section of the site, type in your zip code, and review the resulting profile of your city or town. 2. How accurately does this description fit the characteristics of your city? 3. Describe the advantages and disadvantages of using the "you are where you live" approach to researching cities 4. Compare two cities: McComb and a city you would like to visit or live in. 5. Create a spreadsheet and chart in Microsoft Excel to compare the quick facts of each city 6. Also in the spreadsheet include: What are two attractions/activities, ways of transportation, schools, & restaurants in each city. Give urls & insert pictures. 7. Save as yourlastnameyawyl 8. Attach the spreadsheet to your wiki Makeup Assignments on http://sartinkids.wikispaces.com/Assignments Entrepreneurship Assignment (Friday) Managing Cash Flow Directions: Use the Internet to answer the following questions on a sheet of paper. 1. Explain the importance of cash management to a small business's success. 2. Differentiate between cash and profits. 3. Understand the five steps in creating a cash budget and use them to create a cash budget. 4. Describe fundamental principles involved in managing the "Big Three" of cash management: accounts receivable, accounts payable, and inventory. 5. Explain the techniques for avoiding a cash crunch in a small company. Daily Activities • Character Building Video: Listening • Timed writing with a goal of 50 words per minute • www.learn2type.com/typingtest • Daily writing prompt • www.theteacherscorner.net • Type it! Current Events Worksheet from • http://coursecasts.course.com/ • Enrichment Activities: www.freerice.com • Canned Goods due Friday! Daily Activities 1. Character Building Video: Problem Solving 2. www.learn2type.com/typingtes t • Timed writing with a goal of 50 words per minute 3. www.theteacherscorner.net • Daily writing prompt 4. http://coursecasts.course.com/ • Current Events 5. http://sartinkids.wikispaces.co m for Family Project (due in entirety Wednesday); including parent interview 6. Enrichment: www.freerice.com Directions: Use the Internet to answer the following questions on a sheet of paper. 1. Define Communication. 2. What is your favorite form of communication. How often do you use it daily? How can this form of communication be used in education? 3. List and explain the essential elements of communication. 4. Describe the characteristics and functions of communication. 5. Define Axiom. 6. Identify and provide examples of five basic axioms of the communication process. Desiree Sartin-Williams MHS Entrepreneurship • Cash is the most important but least productive asset the small business has. • The manager must maintain enough cash to meet the firm's normal requirements (plus a reserve for emergencies) without retaining excessively large, unproductive cash balances. Without adequate cash, a small business will fail. • Cash and profits are not the same. More businesses fail for lack of cash than for lack of profits. • Profits, the difference between total revenue and total expenses, are an accounting concept. • Cash flow represents the flow of actual cash (the only thing businesses can use to pay bills) through a business in a continuous cycle. A business can be earning a profit and be forced out of business because it runs out of cash. • The cash budgeting procedure outlined in this chapter tracks the flow of cash through the business and enables the owner to project cash surpluses and cash deficits at specific intervals. The five steps in creating a cash budget are as follows: forecasting sales, forecasting cash receipts, forecasting cash disbursements, and determining the end-of-month cash balance. • Controlling accounts receivable requires business owners to establish clear, firm credit and collection policies and to screen customers before granting them credit. • Sending invoices promptly and acting on past-due accounts quickly also improve cash flow. The goal is to collect cash from receivables as quickly as possible. When managing accounts payable, a manager's goal is to stretch out payables as long a possible without damaging the company's credit rating. • Other techniques include: verifying invoices before paying them, taking advantage of cash discounts, and negotiating the best possible credit terms. Inventory frequently causes cash headaches for small business managers. Excess inventory earns a zero rate of return and ties up a company's cash unnecessarily. Owners must watch for stale merchandise. • Trimming overhead costs by bartering, leasing assets, avoiding nonessential outlays, using zero-based budgeting, and implementing an internal control system boost a firm's cash flow position. Also, investing surplus cash maximizes the firm's earning power. The primary criteria for investing surplus cash are security and liquidity.