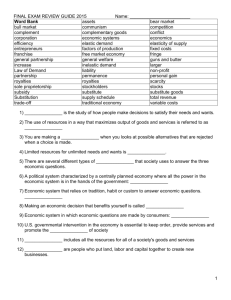

Welcome to Year 10 Business

advertisement

Unit 1 Outline • Module 1: Innovations and Entrepreneurs • Module 2: Small Business • Module 3: Marketing • Module 4: Accounting Reasons for establishing a small business Module 2 Factors leading to success or failure Establishing a Small Business Sources of finance + preoperational decisions Session 1: Learning Intentions • Define a small business • List the reasons for owning a small business • Identify the alternatives to establishing a small business • Identify the resources required to establish a small business • Distinguish between businesses based on the nature of their operations • Identify and explain the advantages and disadvantages of various ownership structures • Explain why some small businesses succeed where others fail Module 2 Timeline Week 3 Week 4 and Week 5 • Module 2: Slides 1-32 • Assessment: Element 3 • Module 2: Slides 33 - 65 • Assessment: Element 4 and 5 What is a Small Business? • Small businesses are businesses owned and managed by the same person and employ fewer than 15 people. • They represent 96% of all private sector businesses. • How many private sector small businesses exist in Australia? • 2.3 million! Small vs Medium vs Large Size of Business Employees Small < 15 Medium Large 15 - 199 > 200 Brainstorm 3 businesses you know that would fit each size description. Why is the Small Business sector important? • Small businesses employ almost 5 million people nationwide. • This is half of all private sector employment! • They also contribute strongly to Australia’s level of economic activity and production, exports and tax revenue. Owning a Small Business Reasons for owning a business include: • the profit motive • a desire for greater independence • the identification of a market opportunity • employment Owning a Small Business Most successful business owners are experts in their field, entrepreneurial, determined, confident, cordial, patient and willing to recognise their own limitations and seek assistance Risks of Small Business There are costs and risks associated with starting a small business: • Extra responsibilities (longer work hours and stress) • Loss of a secure income and other benefits (such as annual leave, sick pay and employer-funded superannuation) • Risk of investing own funds – if the business fails, personal investment funding will be lost Alternatives to Owning a Small Business Since small business ownership can be risky, an individual may prefer to invest elsewhere. The three main asset groups that can be used as alternative investment options to starting a small business: • Cash • Property • Shares Alternatives to Owning a Small Business Factors to consider when choosing investments: • Risk + Return risker investments usually have higher returns • Term (length) for investment options subject to business cycles and other fluctuations, a long-term investment may be required to generate an adequate return. • Liquidity how easily it can be converted back into cash if the individual needed their funds immediately Alternative Investments: Cash • Bank accounts + High liquidity - Low return • Term deposit = investment option that requires the investor to agree to invest for a specified length of time + Marginally higher return - Lower liquidity Alternative Investments: Property + Property investment provides a dual return: • Capital gain = a return generated from an investment in the form of an increase in the value of an asset that can be sold for more than its purchase cost. • Negative gearing = strategy used by investors to reduce their taxable income, by purchasing property which generates rental income which is less than the cost of the property. This is recorded as “loss” and thereby reducing taxable income. + Also provides income stream via rent. Alternative Investments: Property Risks of property investment: - Reliant on the property market which fluctuates - Dependent on ability of buyers to pay, which depends on the cost of borrowing (i.e. interest rates) - Rental income is not guaranteed and bad tenants can create costs - Low liquidity (property investment is medium to long-term - Capital gains tax (tax charged when a gain is made on the sale of an asset) Alternative Investments: Shares Share = part-ownership in a business + Higher returns (when sold, and also via dividend which is a share of the profit earned by a company that is distributed to shareholders) + Tax benefits (dividends are usually paid from profits that have already had company tax deducted, this reduces the tax that must be paid by the investor – we call this a franking credit). + Diversification (2200 companies on the ASX!) + High liquidity Alternative Investments: Shares - Dividend dependent on profitability of company - Capital gain dependent on share market - Capital loss can occur if market value of shares fall below their purchase price. Alternative Investments Practice Exam Question! Explain why an individual should explore alternative investments when considering starting their own small business. Planning a small business • A detailed business plan is essential before operations commence. The more information included in the plan, the greater the business’s chances of success • A business plan may make it easier to convince a financial institution to provide finance Planning: Elements of Business Plan • Business operations and description • Product or service description • Legal structure • Staffing requirements • Market analysis (inc. marketing strategies) • Projected sales figures and estimated running costs Business Operations • Nature of a business’ operations is determined by • the market; and • the product / service • Businesses can be classified by the nature of their operations: • Trading, • Service, or • Manufacturing businesses • In some cases, businesses will combine one or more types of operation Business Operations: Trading • Retail / Trading businesses purchase finished goods for the sole purpose of resale. • Stock is purchased from wholesalers / manufacturers at cost price, and then sold through a retail outlet at a marked-up selling price. • Cost price = original purchase price of stock Business Operations: Service • Service businesses perform a service for the customer so that what is being sold is the time, labour and expertise of the business. • There is no physical exchange of goods. Business Operations: Manufacturing • Manufacturing business produce the goods they sell, using a production process to transform raw materials into a finished product. Business Operations: Mixed Businesses • A business can combine one or more types of operations. Review 1. 2. 3. 4. 5. Practice Exam Questions! Explain how a trading firm earns a profit. State two examples of trading firms in Ararat. Explain how a service firm earns profit. Suggest 2 reasons why manufacturing firms sell predominantly to trading firms rather than the general public. Suggest 1 reason why manufacturing firms may open a factory outlet to sell direct to the public. Provide 2 examples of businesses in Ararat that are “mixed” businesses. Review 1. Explain how a trading firm earns a profit. State two examples of trading firms in Ararat. • A trading firm purchases finished goods for the sole purpose of resale. • Stock is purchased from wholesalers/manufacturers at a cost price, and then sold to consumers through a retail outlet at a marked-up selling price. • Examples: Zest Living, Safeway, Newsagency Review 2. Explain how a service firm earns profit. A service firm performs a service for the customer, so in fact what is being sold is the time, labour and expertise of the business. Review 3. Suggest 2 reasons why manufacturing firms sell predominantly to trading firms rather than the general public. • To make a greater profit • To guarantee sales Review 4. Suggest 1 reason why manufacturing firms may open a factory outlet to sell direct to the public. To generate additional sales (other than to trading firms) To generate a greater awareness of their product to the general public. Review 5. Provide 2 examples of businesses in Ararat that are “mixed” businesses Hairdresser Vines Assignment Session 1: Starting your own small business • If you were given a $10,000 grant to start a new business, what business would you start? • What would the business do? • Why would you choose that particular type of business? • Who would it employ? • Where would the business be located? Ownership Structures The choice of ownership structure will have consequences for a whole host of issues, including: • Owner’s personal accountability for the debts of the business • Tax liability • Firm’s ability to raise capital • Costs of establishing the business and compliance with government regulations • Ability to shut down the business • Control over the decision-making in the business Ownership Structures • The three principle ownership structures are: • Sole proprietorships • Partnerships • Companies Ownership Structures Sole Proprietorship Partnership Proprietary Company (Pty Ltd) Liability Unlimited Unlimited Limited Owner Single individual Two or more persons Separate legal entity What is limited / unlimited liability? • Limited liability = legal status of a company which means that the owners (shareholders) have no further responsibility for any liabilities incurred by the business unless they signed personal guarantees • Unlimited liability = legal status of sole proprietorships and partnerships, which does not recognise the owner as a separate legal entity, so the owner is personally liable for the debts of the business. Sole Proprietorship Sole proprietorship = business that is owned by a single individual, operating the business in their own right under their own name or a registered business name. Advantages Disadvantages • Easy and cheap to set up • Unlimited liability – this liability can • Owner has full control over extend to personal assets jointly owned decision-making by another person (eg. family home) • Owner receives all profits and • Business has limited life (if owner dies, has full access to capital of continuity of the business is at risk) the business • All start up capital must come from one • Simple to wind up or sell person • Owner may endure personal hardship (long work hours) Partnership Partnership = 2 or more persons in business together operating under their own names or as a registered business name, with a view to making profit. Advantages Disadvantages • Easy and cheap to set up • Greater access to capital and skills – more partners mean more resources • Simple to wind up or sell • Tax advantages can exist where partner are married (profits split between them, giving them 2 tax-free thresholds) • Unlimited liability – this liability can extend to personal assets jointly owned by another person (eg. family home) • Partnership has limited life (if 1 owner dies, is declared insane or leaves the business, the partnership is dissolved) • Control over decisionmaking is shared – can lead to disputes. • Profits are shared Proprietary Company (Pty Ltd) Proprietary Company = business that exists as a separate legal entity that is entitled to do business in its own right. • Comes into existence by incorporation under the Corporations Act 2001. • Can be owned and operated by 1 person (being both shareholder and director), but can have no more than 50 non-employee shareholders. • Being a separate legal entity means the company can sue and be sued, and is subject to taxation in its own right. Proprietary Company (Pty Ltd) Advantages • • • • Limited liability – directors have no personal responsibility for debts unless they caused the debts recklessly, negligently or fraudulently. Greater ability to attract capital (b/c of limited liability) Life of business is ongoing b/c separate legal entity (it exists until it is wound up) Can conduct business Australia wide using the company name. Disadvantages • • • • Establishment costs are high ($460 - $1000) Difficiult to attract additional capital because Pty Ltd not allowed to publicly advertise for funds. Hard to sell shares and recover investment b/c limitations on who can purchase shares High compliance costs – tax laws, ASIC Public Company • Proprietary companies (Pty Ltd) aka private / family companies. • A private company (Pty Ltd) tends to be of a small nature and their ownership is more difficult to transfer and they do not have to make their financial reports available to the public. • A public company (Ltd) is a large business structure that can publicly raise funds by advertising and selling shares though the Australian Stock Exchange. A public company is also open to scrutiny by the public and has to make its financial reports public. • Note: you cannot select a public company for your assignment since we are focusing on small business structures. Small Business • A prospective business owner can: • Start a new business, • Buy an existing business, or • Buy a franchise • Small businesses can also gain assistance from a variety of sources Starting A Business From Scratch Advantages: • Almost total freedom in determining how the business operates • Freedom to set customer expectations • No need to pay for goodwill • Rewarding for the owner knowing they have created the entire business What is goodwill? • Goodwill is an intangible asset representing the value of the firm’s reputation, clientele, viability and future growth prospects. Starting A Business From Scratch Disadvantages: • No track record, so greater risk of failure • No customer base – could mean low cash inflows in first months of operation • Large start-up capital required that will essentially have to be provided by the owner • More difficult to obtain finance Buying a Business Advantages: • A proven track record can increase the chances of success • All assets, practices, suppliers and customers are already established • An immediate income stream is available • Previous owner(s) and current employees can assist in the change of ownership as they can provide helpful advice Buying a Business Disadvantages: • Previous success may have been dependent on the skills of the previous owner(s) and their relationship with customers • Difficult to change existing procedures, staff and customer expectations • Must pay for goodwill (which is difficult to value accurately) • Existing assets may require major renovation, repair or even replacement Advantages And Disadvantages Of Starting A Business From Scratch Disadvantages: • No track record, so greater risk of failure • No customer base – could mean low cash inflows in first months of operation • Large start-up capital required that will essentially have to be provided by the owner • More difficult to obtain finance Buying a business Goodwill can bring both benefits and costs for the purchaser of an existing small business: • Purchasing an existing business (and thus its goodwill) means the reputation and clientele already exist, enabling the new owner to have an immediate income stream, and all practices are already established. However, purchasing an existing business means you have to pay for the goodwill, which is difficult to value accurately. Buying a franchise • A franchise is an arrangement under which one party (the franchisor) grants to another party (the franchisee) certain rights, including the use of the franchise name and business practices. Buying a franchise Advantages: • Recognised brand name/national advertising • Established (and proven) reputation and business practices • All equipment necessary to commence operations is provided • Bulk buying power through the franchise group. Buying a franchise Disadvantages: • High purchase price, ranging from $15 000 for a lawn-mowing business to upwards of a million dollars for a fast-food restaurant • Ongoing franchise fees (frequently based on sales) to cover expenses, such as advertising and administration) • Rigid guidelines for operations • Competition from fellow franchisees • Dependence on the operations of the franchisor. Recipe for a Successful Small Business Successful small businesses have: • High demand for their product or service • A location that is visible and easily accessible for customers • A thorough business plan that details all aspects of the firm’s operations • Sufficient starting capital that can support the business and the owner until the business is functioning in a profitable manner • An owner who exhibits the following qualities … Staffing a small business When staffing a small business you will need to consider the following factors: • How many staff are required? • Small businesses have < 15 employees • What qualifications will they have and what training will they need? • E.g. VCE Certificate, graduate diploma, bachelor degree. • What skills and knowledge will be required of management? • E.g. Do they need specific industry knowledge such as biotechnology or agriculture knowledge, or specific skills such as electrical engineering or plumbing? Staffing a small business Staff can be employed under a number of categories. • Some categories offer more flexibility for workers, while others provide more security for the business. • Choosing to employ staff under different categories can maintain flexibility in your workforce while also meeting the needs of the business. • Choose a structure for each staff member that suits the business and the employee. • E.g. may need a full-time administration worker but only a part-time IT employee. Each category has a different set of obligations for your business and your staff. • Full-time: generally employees work 38 - 40 hours per week • Part-time: employees work < 38 hours per week, with a guaranteed minimum number of hours. • Casual: employees work hours may vary per week, depending on the work available. • Fixed term: employees are generally employed for a set period of time. Staffing a small business To properly determine your obligations as an employer, it's important for you to distinguish if your workers are employees or independent contractors. This will help to determine wages and other conditions. When you hire people as employees, they: A contractor or independent contractor usually: • receive payment as wages or salary • have their tax taken out by their employer • are based at your business, work at your home or are mobile • can be full-time, part-time, apprentices, trainees or casual, and can be directed when, what and how to do a task. • doesn't receive wages but invoices for their work • runs their own businesses with an Australian Business Number (ABN) • does a set task, such as designing a computer system and once the task is done, the engagement ends • can work for more than one customer Recipe for a Successful Small Business … • a strong knowledge of the good or service that they are selling • business acumen – insight or good judgement when it comes to business dealings and decisions • humility – not being afraid to seek assistance for any areas that they feel they don’t have the required level of expertise; for example, legal or financial matters • friendly and fair – when dealing with the public, whether employees or customers • resilience – the ability to withstand failures, learn from mistakes and resolve issues and move on. Why do small businesses fail? 80% of small businesses fail in the first five years of operation. Reasons include: • Competition from other small and large businesses • A poor location • Insufficient start-up capital • Poor marketing, targeting either the wrong people or no one at all • Poor management skills and a lack of willingness to seek professional advice • Poor customer relations Example of Small Business • Piece of Cake sells cakes from a shop in Ararat. For the past 3 years it has been owned and operated as a sole proprietorship by Danica, who left her job as an analyst at an Google in search of greater independence. • Danica frequently called on her friend Ryder, who is an accountant, for assistance. Ryder has now expressed a desire to join Danica as a joint owner of the business. Example of Small Business Practice Exam Questions! 1. State 2 reasons why people leave paid employment to own a small business. 2. State 2 costs to Danica of leaving paid employment to start her own business. 3. Explain the difference between a sole proprietorship and a proprietary company in terms of their legal difference. 4. State one disadvantage of establishing the business as a proprietary company. 5. State one benefit Danica would derive from entering into a partnership with Ryder. 6. State two benefits Danica derived by buying an existing business rather than staring her own. 7. Explain one reason why this business may still fail. 8. State two sources from which Danica can seek alternative professional advice. Example of Small Business Question 1: State 2 reasons why people leave paid employment to own a small business. • Reason 1: Profit motive • Reason 2: Identifying a market opportunity OR unemployment Question 2: State 2 costs to Danica of leaving paid employment to start her own business. • Cost 1: Loss of secure income through paid employment • Cost 2: Potential risk of losing life savings if the business does not succeed OR loss of other benefits associated with paid employment, e.g. paid sick leave and holidays Example of Small Business Question 3: difference between a sole proprietorship and a proprietary company in terms of their legal difference. • A company has its own separate legal existence from that of its owner(s) and thus can sue or be sued in its own right and provides the owner(s) limited liability due to this. A sole proprietorship is not a separate legal entity and can only exist legally through its owner. Therefore, it has unlimited liability as if the business is to be sued it must be sued through the owner. Example of Small Business Question 4: State one disadvantage of establishing the business as a proprietary company. • Greater establishment costs • More compliance costs • Greater regulation Question 5: State one benefit Danica would derive from entering into a partnership with Ryder. • Greater access to capital and skills OR sharing of workload and any potential losses Example of Small Business Question 6: State two benefits Danica derived by buying an existing business rather than staring her own. • Benefit 1: Proven track record • Benefit 2: All assets and customers are established OR an immediate income stream OR previous owner and employees can assist in changeover Example of Small Business Question 7: Explain one reason why this business may still fail. • The previous success of the business may have been dependant on the skills and customer relations of the previous owner and Elena cannot replicate this. This may cause customers to shop elsewhere causing a loss of sales (income) and potential business failure. Other explanations are possible. Question 8: State two sources from which Danica can seek alternative professional advice. • Accountants / Solicitors / bank managers / small business agencies, e.g. SBCS (Small Business Counselling Service)