Powerpoint Slides

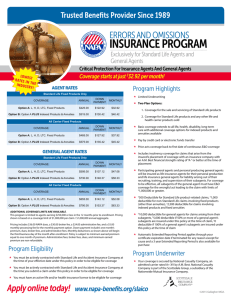

advertisement

Personal Finances in a Transition Army Career and Alumni Program (ACAP) Transition Assistance Program (TAP) Workshop USAG – Rock Island Arsenal, Illinois Jon C. Cook, AFC and Chris Gegenheimer (309) 782-1499 (309) 782-0815 jon.c.cook.civ@mail.mil christopher.j.gegenheimer.civ@mail.mil Army Community Service IMRI-MWA, Bldg 110, SE Corner www.riamwr.com/acs/financial-readiness Edition of November 18, 2013 At the End of this Personal Financial Management in a Transition portion of the workshop, you should have: • Tools of an integrated, Transition Budget over time. • 12-month Financial Planning. • Decision information to making insurance decisions, including health care and health insurance, plus long term care (LTC), life, annuities, property and liability. • Decision information regarding credit reports and improving your credit scores. • Tax planning tools. • Resources for fixing money problems. • Tools for estimating salary requirements What is the one thing that you want me to know about this personal finance workshop? That you (and your significant others) may have a smoother transition with more control and reduced stress when you complete proper planning steps and take actions based on your plans. Sequence of this Personal Financial Management in a Transition portion of the workshop: 1. 2. 3. 4. 5. 6. Introductions, Administration and Cautionary Notes. Underlying money concepts – laying a $ foundation. Job Search Objective elements and tying in your personal financial objectives. Tools of an integrated, Transition Budget over time. 12-month Financial Planning. Decision information to making insurance decisions, including health care and health insurance, plus long term care (LTC), life, annuities, property and liability. 7. Decision information regarding credit reports and improving your credit scores. 8. Tax planning tools. 9. Resources for fixing money problems. 10. Tools for estimating salary requirements 11. Wrap-up and final questions 1. Class Administration and Cautionary Notes This class has a “pre-disposition” for saving and investing over time – part of the Military Saves Campaign. Ask questions as we go. This class will provide to you a few “Scooby-Do Moments.” Because of the nature of the subject matter, there may need to be follow-up with a money coach or advisor to better refine your answers. Please do not jump to any large conclusions; apply the “sleep test” and consult with family members, mentors and your advisors.