Why Math Is Important

advertisement

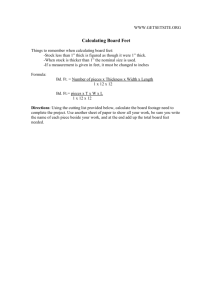

Why Math Is Important: Separating the Wheat from The Chaff 2013 AASHE Conference Jim Stephens & Elizabeth Swiman Presenters Jim Stephens Acting Director of Utilities & Engineering Services Elizabeth Swiman Director of Sustainability Decisions, Decisions, Decisions? Life is full of decisions, but before the decision should come questions. Decisions, Decisions, Decisions? Life is full of decisions, but before the decision should come a question. Decisions, Decisions, Decisions? Life is full of decisions, but before the decision should come a question. Decisions, Decisions, Decisions? Life is full of decisions, but before the decision should come a question. Do our decisions reflect sustainable values? Decisions, Decisions, Decisions? Life is full of decisions, but before the decision should come a question. Do our decisions reflect sustainable values? In life there are many ideas, concepts, and promises. How do we separate the wheat from the chaff? Analyze, Then Decide While you cannot put a number on every activity in life, there are many things that can be analyzed. Understanding the variables required for a project, coupled with appropriate mathematical review, can assist in selecting projects with the greatest impact. Other Benefits Cost Savings Sustainability & Energy Management A comprehensive sustainability and energy management program achieves the maximum result in greenhouse gas reduction and energy consumption reduction when combined with aggressive financial criteria for project approval and a reinvestment strategy. That Sounds Hard! But First – Would You Like to Play A Game? . Exercise – Part 1 We need five volunteer project managers. Choose from the list of potential energy related sustainability projects. Exercise – Part 1 At your request, the university has invested $1 million dollars in your project of choice. Why Math Is Important? Limited Financial Resources Why Math Is Important? Competing Needs Why Math Is Important? Financial Accountability Why Math Is Important? We need to be able to compare projects and select the best – Separate the wheat from the chaff. Best Good Not Good Enough Project Ranking – Why It Matters Good financial performing projects MAXIMIZE your efforts towards energy conservation and greenhouse gas reduction. -Projects may not be glamorous or exciting, but the return on investment is generally short. -Capital is available for reinvestment. Poor financial performing projects often MINIMIZE results. - Drain needed capital from projects that have a greater impact on energy conservation and greenhouse gas reduction. IMPORTANT POINT: Each organization sets their own goals and defines what is deemed a “successful project”. Math, when accurately used, can better measure a precise metric. Generally, it is measured in dollars, GHG reduction, etc. Other important factors - Competing priorities - Administrative support - Research - Regional variations in cost and/or available resources Our Process – Rules of Thumb 1. We want to prioritize high return projects ahead of low return projects 2. High capital, low return projects are highly scrutinized. 3. Low capital, high return projects are pushed forward. 4. In all cases, our energy related sustainability projects are required to have a 7 year or less payback based on energy savings alone. What About Alternative Energy? We wholeheartedly support alternative energy, but the same rules apply. Case In Point Solar Thermal at our Leach Student Recreation Center for pool heating Cost: $168,000 Annual Savings: ~ $30k per year with NO REBATES Alternative Energy? 1. Alternative energy projects CAN meet the criteria, but you must be careful to select the right projects. 2. Don’t get too excited about a specific project until you do the math. 3. Everybody loves alternative energy projects that have a good payback! Exercise – Part 2 •Project Manager Reports •Project Discussion •Reinvest in new projects Calculating a Project Return Simple is usually better – We recommend using the simple payback method Return = Total $ Cost __________ Total $ Savings Calculating a Project Return Life Cycle Analysis …can include a variety of assumptions. Even a simple payback calculation uses some assumptions. The trick is understanding how to select good assumptions (or estimates) in your model. Calculating a Project Return Cost Considerations That Must Be Included •How much will it cost to maintain the system? •Does the vendor estimate include installation? •Will I have to add staff to support the project long term? •How reliable is the system? How much savings will I lose related to downtime? •How much of the actual work to implement the project is provided by the customer? Research time? Data Entry? Data Collection? System integration? Very, very important for software related projects. Calculating a Project Return Understand Savings Assumptions •Vendors often overstate savings. Be sure you understand the real savings of the project. •Vendors often include inflator figures to make the savings appear larger. These include cost multipliers over time for energy rates. Are these realistic? You must understand Well do I have a where rates are going to understand your deal for you!!! long term project savings? Calculating a Project Return Understand Savings Assumptions •Projects savings often include cost of money assumptions that are high, particularly for life cycle analysis. •Vendors often count soft savings, such as behavioral changes as hard savings. Your results may or may not relate to these activities. Soft savings should generally be counted on as a fringe benefit, not the hard savings. Calculating a Project Return Understand Savings Assumptions •Does the real project savings pay for the true cost of the project within the rated equipment life? Calculating a Project Return Goal The real goal of your project return calculation is for you to be sure that your organization can achieve the returns promised by the project. ACCURACY is the key Exercise – Part 3 •Project Manager Reports •Project Discussion •Reinvest in new projects Reinvesting Savings At Florida State University, we use a 7 year payback for energy projects. The benefits include: •Long enough to support some in depth projects, but short enough to return funding for future projects. •For ever 1 million dollars spent, we return no less than $142,000 per year back to the University. •Our savings are in both dollars and greenhouse gas production. Accumulation Examples – Year 1 Project Portfolio A •Avg return = 5 years •Investment value = $1,000,000 •Annual return back to fund = $200,000 Project Portfolio B •Avg return = 20 years •Investment value = $1,000,000 •Annual return back to fund = $50,000 Accumulation Examples Project Portfolio A •Avg return = 5 years •Investment value = $1,000,000 •Annual return back to fund = $200,000 Year 5 Savings: $1,488,320 Year 10 Savings: $5,191,736 Year 20 Savings: $37,337,600 Project Portfolio B •Avg return = 20 years •Investment value = $1,000,000 •Annual return back to fund = $50,000 Year 5 Savings: $276,282 Year 10 Savings: $628,895 Year 20 Savings: $1,653,298 In a 20 year span, the high return project portfolio returned more than 22 times the low return portfolio. Exercise – Part 4 (Final) •Project Manager Reports •Project Discussion •Reinvest in new projects Conclusion Each organization may have different goals. Regardless of the types of project preferred, high return projects save more energy and reduce more greenhouse gases than low return projects. An understanding of how to leverage energy and sustainability funding can have a compounding impact over a long period of time. Conclusion Don’t just follow the herd. Do the math. Separate the wheat from the chaff and you will push forward the best projects to meet your goals. Questions?