Overview of Research and Education Initiatives

advertisement

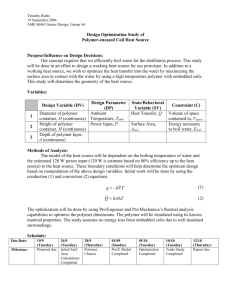

Overview of Research and Education initiatives Industry, Academia and Local Government Collaboration Sasol Polymer Technology Services Centre Modderfontein 25th May 2010 Gerry Mc Nally Director, New Business POLYMER PROCESSING RESEARCH CENTRES QUEEN’S UNIVERSITY BELFAST Contents 1. 2. 3. 4. 5. 6. 7. Introduction and Overview of Queens University Overview of PPRC/MPRI @ QUB and the local plastics Industry Research Areas & Publications Working with Industry Education & Training Popoposed New Industry Led Competence Centre Grant Mechanisms KTP and INI R&D Programmes Facts and Figures. • 163 years old 100 years old as a University • 3 Faculties - Engineering & Physical Sciences - Medicine, Health & Life Sciences - Arts, Humanities & Social Sciences • 21 Academic Schools • 2 Teaching Colleges •1,700 Academic staff •20,500 Undergraduates •4,500 Postgraduates •3,500 Primary Degrees awarded pa •1,000 Higher Degrees awarded pa •Total Income £241m pa •Graduation circa 1885 Belfast Queen’s University Belfast 2. Polymer research at Queens University Polymers Research Cluster • Scope of Research Leading edge multidisciplinary research into the processing, modeling and development of high performance polymeric materials, including their use in medical applications. • Research Centres within the Cluster Polymer Processing Research Centre (PPRC) formed in 1996, to focus on advanced extrusion, rotational moulding and thermoforming technologies. Self financing Centre of Excellence Medical Polymers Research Institute (MPRI), established in 2002 through a joint initiative with the School of Pharmacy,and dedicated to high technology R&D for healthcare industries in respect of medical materials and devices. • Infrastructure Excellent processing, analytical and testing facilities for undertaking high quality applied and fundamental research. Polymer Research Cluster Academics School of Mechanical Engineering QUB (formed 2007) Academic Staff Peter Hornsby (DR) Eileen Harkin-Jones John Orr Cecil Armstrong Gerry McNally Peter Martin Tony McNally Fraser Buchanan Steve Thompson Nicholas Dunne Marion McAfee Gary Menary Professor Professor Professor Professor Senior Lecturer Senior Lecturer Senior Lecturer Senior Lecturer Senior Lecturer Lecturer Lecturer Lecturer Processing Process Modelling Biomaterials Process Modelling Director of PPRC Thermoforming Modelling Nanocomposite Biomaterials Process Control Biomaterials Process Control Process Modelling Polymer Research Cluster has around 40-45 Post Grads, Post Docs, etc. Membership (65 staff/researchers) Academic (13) Managerial & Secretarial (3) Polymers Cluster Post-doctoral and KTP (20) Post-graduate (17) Project Engineers & Technical (12) 1. Overview • PPRC Established in 1996 INI (TDP) – £1.2 million (75%) • Prior to 1996 -1991-1995 Multilayer film and tube extrusion facilities (Chemical Engineering,funded by KTP/ INI R&D - Rotational Moulding Centre (Mechanical Engineering,funded by INI EU STRIDE (1994) 1. Overview Main Aims • To improve R&D capabilities of N.I. Plastics Industry (82 companies, 6000 employees, 78% SMEs) • To expand research activities at QUB • Provide state of the art facilities for undergraduate and postgraduate courses • To improve training for N.I. Industry • To become self financing – present 13 full-time staff Mission To become the centre of Excellence in Polymer Processing in UK and Europe Overview UK Polymer Industry Statistics 2008 UK overall (BPF) Primary Processing Companies Employees Sales turnover 3000 186,000 £13.1 bn Northern Ireland Plastics Processing Companies Employees Turnover 80 (75% SMEs) 6000 (6% of manufacturing in NI) £0.7bn Comparison of UK and NI industry average turnover per company average turnover per head £4.3 m (UK) £ 70 k (UK) £11.2 M (NI) £116 k (NI) NI plastics industry is now “ punching well above its weight “ SA polymer industry, 850 companies 35,000 employees,£2.1bn, 5% GDP 1. Introduction • PPRC is unique in the Faculty because it is a fully integrated, and visionary Centre of balanced excellence in terms of - providing enhanced teaching both locally and internationally - providing research outputs, knowledge transfer and improved competancies - providing outreach to the industrial community (training & support) - provides state-of-the-art facilities for undergraduates and postgraduates - self financing • Forward Business Plan and Research Strategy - MPRI (£4.2 million) – 2003 -Industry Lead Competence Centre (£10-12m) - New Building - 2010 2. Research Facilities at PPRC Packaging mono/multilayer cast&blown film mono/multilayer sheet mono/multilayer tubes Automotive multilayer tubes multilayer tanks Recycling thermoplastics thermosetts - SBR PPRC Core Competencies Extrusion Moulding Analysis & Testing Polymer Nanocomposites masterbatches for film/sheet masterbatches for tubes Construction Tanks, pipes, profiles, conveyor belts, grinding wheels, bathroomware Medical tubes – multilayer, multilumen films – multilayer injection moulding World Market in Medical Technologies • • • • • • • • • • The European Market, valued at $55bn and representing 30% of the global market is among the top three markets for medical technology USA $79 bn Europe $55 bn Japan $20 bn Germany, France Italy , UK—account for more than 72% of the European market Germany $19.0 bn France $9.0 bn Italy $6.2 bn Ireland $6.2 bn UK $5.8 bn Medical Device Market • World market for medical devices – valued at over £150 billion • Growth rate forecast – 8% per annum • High growth rate – due to improving technologies and increase in ageing population • UK industry – 1,500 companies (15,000 employees) • R.O.I Industry – 125 plants (25,200 employees) • N.I. Industry – 12 companies (approx. 1000 employees) • Many multi-nationals – most of R&D is home-based Irish Plastics Processing Industry Statistics Plastics Processing Industry in Ireland (a) Northern Ireland Around 80 companies, 6,000 employees 70 % SMEs (b) Republic of Ireland, Around 150 companies, 12,000 employees, 75% SMEs Total, 230 companies, 18,000 employees, turnover $4Billion Medical Polymer Industry on the Island of Ireland ( The Irish Medical Device Association) 120 companies, 25,000 employees, turnover $9Billion. Overall total, 310 companies, 43,000 employees turnover $12Billion pa.75% SMEs Irish Medical Device Industry PPRC Trends in Medical Polymers GROWING need FOR MULTIDISCIPLINARY APPROACH Process Engineers Design Engineers Stress Engineers Chemical Engineers Polymer Chemist Pharmacist Biologist Clinicians Orthopaedic surgeons Cardiovascular Urologist Dentist Plastics surgeons • GROWING NEED FOR IDUSTRY LED CENTRES OF EXCELLENCE • MUTLIDISCIPLIARY ON UNIVERSITY CAMPUS • NEED FOR PILOT PLANT, ANALYSIS AND CHARACTERISTION FACITIES • EXPERT ENGINEERING RESEACH STAFF Medical Polymer Research Cluster at QUB Peter Hornsby Eileen Harkin-Jones John Orr Cecil Armstrong Gerry McNally Peter Martin Tony McNally Fraser Buchanan Steve Thompson Nicholas Dunne Marion McAfee Gary Menary Professor Professor Professor Professor Senior Lecturer Senior Lecturer Senior Lecturer Senior Lecturer Senior Lecturer Lecturer Lecturer Lecturer Processing Process Modelling Biomaterials Process Modelling Director of PPRC Thermoforming Modelling Nanocomposites Biomaterials Process Control Biomaterials Process Control Process Modelling Sean Gorman David Wolfson David Jones Karl Malcolm Professor Professor Professor Lecturer Infection control Control drug release Control drug release Control drug release Polymer Research Cluster has around 40-45 Post Grads, Post Docs, etc. Multilayer tube die Water cooling and haul off Air cooling Multilayer sheet dies 100 and 250mm wide Chill roll unit Pelletiser Multilayer tube extrusion with water cooling Compounding with die face pelletiser and air cooling Two x 20mm single screw extruders Die face pelletiser Kneader elements Two x 25mm single screw extruders Cross-sections Computer control system Multilayer sheet extrusion MPRI Extrusion Equipment Twin screw extruder (kneader) 4. Research Activities Polymer Cluster Research Themes Polymers Cluster Biomaterials Polymer Processing Nanomaterials Modelling & Control Polymer & ceramic based cements Structure & property relationships Melt blending of nanofillers Thermoforming Bioresorbable polymers & ceramics Free surface moulding Surface functionalisation of nanofillers Stretch blow moulding Marine biomaterials Polymer blends Modification of textile fibre Using nanofillers Rotational moulding Polymer foams reinforced With nanofillers Soft sensor viscosity control of polymer extrusion Dental materials Medical polymers Enhanced extrusion/ moulding technologies Nano-fibre-reinforced polymer biocomposites 4. Research Themes (Extrusion) 1. Films & Sheet • Multilayer for improved barrier performance. • Materials (nylons, PET, PVdF THV etc). • Packaging, automotive, Battle Dress. • Development of new TPOs as PVC replacements 2. Polymer Nanocomposites/ carbon nanotubes • For improved mechanical and barrier properties. • Investigated wide range of nanoclays. • Polymers nylon 12, nylons, polyethylenes, polypropylene. • Masterbatch manufacture. 3. Polymer Additives • PIB for stretch and cling wrap films. • Antimicrobials additives (silver based). • Pigments, oxygen scavengers. • Water based barrier emulsions for carton board. 4. Recycling – Thermoplastics, wood polymers, thermoset polyurethanes. 4. Rotomoulding Research • Material development & Process optimisation - PA / PVDF / PP / PET / PMMA / PPS / Pebax - Nanocomposites - Biodegradable materials - Fibres / Fillers • • • • Development of new generation metallocene materials Development of skin / foam technology – Micropellet analysis and development Microwave and induction heating 4. Worldwide Conferences (Approx. 25 papers p.a.) 4. PPRC Presentations at SPE ANTEC Conferences Total: 170 Papers 4. Research Areas & Publications Polymer Processing Symposia at PPRC • 2002 – 21 papers (1 day event) • 2003 – 20 papers (1 day event) • 2004 – 36 papers (2 days) – SPE Europe event • 2006 – 40 papers (2 days) – SPE Europe event Polymer Processing Research Centre First Polymer Processing Research Symposium 24th January 2002 Extrusion Processing and Performance of Polymers, Polymer Blends and Additives Polymer Processing Research Centre Polymer Processing Research Centre Polymer Processing Symposium Second Polymer Processing Research Symposium 29th January 2003 28th and 29th January 2004 Extrusion Processing and Performance of Polymers, Polymer Blends and Additives Editor Editor Editor Gerard M. McNally Gerard M. McNally Gerard M. McNally SPE UK & Ireland Applied Research Programmes with the Polymer Industry Nationally and Internationally 5. PPRC Working with the Polymer Industry Good manufacturing business development leads to • Wealth creation • Job creation • Improvement in local economy Good manufacturing business development is achieved by • Knowledge generation (research at PPRC) • Knowledge transfer (partnerships with PPRC) • Knowledge enhancement (staff training at PPRC) 5. PPRC: Working with the Polymer Industry Industrial Partnerships with PPRC can contribute to • Increase in client base • Increase in product portfolio • Increase in turnover • Increase in no. of employees PPRC Partnerships with Industry, contribution to University profile • Greatly increased levels of research activity on Polymers • Publications in Journals and International Conferences • Invited papers and presentations worldwide • Underpins global recognition for PPRC 5. PPRC: Working with the Polymer Industry 1.Local Government ( Invest Northern Ireland ) R&D Assistance Grants KTP knowledge Transfer Programmes £70k 2years (75%) • Research and Development Programmes i.e. experimental/industrial research (START) 25% in-kind contribution from company • Near market product development (COMPETE Programmes) • Proof of Concept, academics only (£100k), industry relevant • Innovation Vouchers £4k 2.IntertradeIreland cross-border Grant Mechanisms • Fusion Programmes £60k 2years • Collaboration Programmes Innova £300-500k 30% in kind company contribution 5. PPRC: Working with the Polymer Industry 3.Central UK Government R&D Assistance Grants • DTI, Technology Strategy Board (TSB) Research and Development Programmes, industry consortium & academia. • DTI, Research Councils EPSRC, fundamental academic research 4.European Government Funding • Framework 7, R&D collaboration between consortia of companies from member states with research centres. New emphasis on SME collaboration • Framework 7, R&D collaboration between trade associations • Marie Curie grants to enable postgraduate mobility in Europe Knowledge Transfer Partnerships Gerry McNally Polymer Processing Research Centre Knowledge Transfer Programmes (KTPs) with Industry at Queen’s University Belfast • PPRC committed to working with the plastic industry • Involved in KTPs (TCS) since 1985 • Over 350 KTP to date, greatest no. for any UK University • 45 live KTP programmes at present • PPRC around 40 KTPs (TCS) since 1992 • KTPs has been the main driver in establishing the PPRC over 12 years ago • KTP activities has been one of the main sources of income for sustaining the PPRC and has been the main focus for generating research activities, (more recently with the medical polymer industries) • KTP activities has been one of main drivers in supporting the R&D in plastics industry in Northern Ireland and has led to growth in the local economy. KTP Mission ‘Europe’s most successful Knowledge Transfer Programme…’ • Knowledge Transfer Partnerships is Europe’s leading programme helping businesses to improve their competitiveness and productivity through the better use of knowledge , technology and skills that reside within the UK knowledge base. History 1975 launched as Teaching Companies Scheme (TCS) 2003 Knowledge Transfer Partnerships replaced TCS Colleges & Businesses Partnership scheme (CBP) 1 July 2007 transferred from the Department of Trade and Industry (DTI) to the Technology Strategy Board (TSB) and Project Criteria Strategic relevance to the business Stimulating and challenging for the academic team Intellectually challenging for Associate Sound business case Clear knowledge transfer Clear additionality Benefits likely to accrue Knowledge Transfer Partnership Costs – One Associate for One Year + Graduate salary £27K available (Company decides) + Associate Development + Travel & Subsistence ~ £6K + Equipment & Consumables + Access University Facilities & Expertise = Total Package worth ~ £60K per year = Cost to SME Company per year (1/3 total)~ £20K = Cost to Large Company (1/2 total) ~ £30K The actual amount is project specific depending on equipment, travel etc Company Benefits Long-term, strategic relationship with KB partner Recruitment of the ‘right’ people Transfer of knowledge/expertise Embedding of innovation culture Company Benefits Benefits per £1m Government spend: One-off increase in profit before tax ~ £68,805 Increase in annual profit before tax ~ £3.08m Investment in plant and machinery > £2.27m Jobs created 54 Company staff trained 395 5. Invest NI Knowledge Transfer Programmes with PPRC • 42 Programmes • 47 Associates • 30 Grade 1 • 3 National Awards 1997 - Best KTP with a SME Wilsanco 1998 – Best UK KTP - Jordan Plastics 2002 - Best UK KTP for Engineering Excellence (Royal Academy of Engineering) - Steve Orr LTD 2010 Best UK Industry Impact Award - Canyon Europe 5. KTP – Canyon Europe Associate Company Size RAE Returnable Income PPRC Income Emma Trainor / Neil Ryan 45 / 120 employees – Belfast, Vietnam and Japan £167,000 £42,000 The Company Canyon is a global organisation originally established in Japan in 1963. Canyon Europe Ltd was established as our European manufacturing base in 1987. Since then the company has successfully produced a wide range of dispensing products which have been distributed throughout the European and world markets. The Project To improve production and quality by minimising polymer material grades and types. Outcomes £11 M investment in 14 electric injection moulding machines New Canyon centre of excellence established 5. KTP – Cherry Pipes Associate Company Size RAE Returnable Income PPRC Income Dr Paul Beaney/ Justyna Graboska 20 employees – Based in Dungannon £167,600 £40,000 approx. Products • High Density Polyethylene Single Wall Drainage Pipes • High Density Polyethylene Twin Wall Drainage Pipes. • Pipe Diameters from 225 mm to 450mm. • Injection moulded pipe connectors and bends. Project • To reduce the environmental impact of the company • To improve the overall efficiency of the company’s production process. • To improve production procedures so that they meet BBA Specifications Main activities • Recent company expansion and investment (£10 million) • Infrared bottles sorting plant (4 tonnes/h) • Size reduction (granulators, shredders) • Washing plant ( 4 tonnes/h) • Compounding + palletizing line • 4 pipes extruders (twin wall, single wall, ducting pipes) for civil, construction and agricultural engineering Programme Activities • To recycle and reuse more waste plastic particularly HDPE (bottles) • Conform to pipe quality standards (ISO 9001, British Board Agreement) • Reduce material cost addition of low cost fillers • Continuous improvement in performance of products (drainage systems) manufactured from recycled plastic • To manufacture custom materials from blends of recycled HDPE • To research and develop new HDPE/PET blends INFLUENCE OF PROCESSING CONDITIONS AND POLYMER CHARACTERISTICS ON SURFACE TOPOGRAPHY OF SMALL BORE TUBES VALPAR INDUSTRIAL LTD. QUEEN’S UNIVERSITY BELFAST POLYMER PROCESSING RESEARCH CENTRE Overview Tubing Applications There are several industrial applications of small bore extruded tubing, such as.. Medical Device Automotive Domestic/Industrial Water Supply Telecommunication Pneumatics Marine and RV Beverage Dispense Manufacture of Beverage Dispense Tubing Valpar is a research focused company manufacturing and is one the worlds leading manufactures of beverage dispense tubing 3.TUBE COLLATION (python), exporting worldwide. 1. EXTRUSION 2.TUBE SELECTION 4.INSULATION 5. BEVERAGE DISPENSE Beverage Dispense Tubing Industry Python is an insulated bundle of plastic tubing for draught drinks dispense Single and multi-layer tubing for different applications such as beer, soft drinks, spirits, etc. Challenges in Beverage Dispense • The formation of biofilm is a common and problematic issue in the industry affecting the quality and freshness of the beverage • Routine cleaning is essential to maintain the freshness of the beverage but it is costly ( $300 per clean out ) • Surface roughness of the inner surface of tubing may promote the formation of biofilm • The topography of the inner surface of small bore extruded tubes used in fluid handling applications can also affect flow rates, fluid turbulence and biofilm adherence Inner bore surface roughness • Several reports in the literature on surface roughness of extruded polyethylene (sheet, films, rods)providing improved understanding of this phenomenon • Surface roughness may be due to melt fracture and/or sharkskin effect • Melt fracture reported to occur above critical shear rate • Critical shear has been reported to be dependant on molecular weight , chain branching, MWD, extrusion temperature processing additives (fluoropolymers) • Very few reports on factors affecting surface roughness of small bore tubes Rationale for this Research Urgent need to investigate the variables which affect the inner bore surface of tubes/pipes in order limit the biofilm formation over the time: Effect of molecular variables (MW, MWD, polymerisation type) Effect of extrusion processing conditions Extrusion die temperature, line speeds) Relation with Surface Roughness Measurement Relation with the Surface Energy / Contact Angle / Hydrophobicity 5. KTP – Perfecseal Associate Company Size RAE Returnable Income PPRC Income Dr Tom O’Brian/ Febe Fusmanto 188 employees – L’Derry & U.S.A £122,000 £21,000 The Company Perfecseal, a division of the Bemis Flexible High Barrier Group, is a global leader in the healthcare and pharmaceutical packaging market specializing in the manufacture of flexible forming films, foil barrier films, pouches, bags, thermoformed trays, lids, labels, coated Tyvek® and coated paper. Company turnover £22M/ Exports £17.5M, £15M Expansion planned The Project To improve manufacturing of trays and paper seals and investigate high barrier packages for drug eluting stents 5. KTP – Steve Orr Ltd. Associate Company Size RAE Returnable Income PPRC Income TBC 30 / 105 employees – Dromore & Kansas £122,000 £21,000 The Company Founded by Steve Orr in 1977, the FARMER'S Brand quickly established itself as the premium brand of blade crop packaging in the British Isles. FARMER'S brand is now available in 23 countries. Distributed in the UK and ROI by Steve Orr Ltd and exported by UPU Industries Ltd, with approximately 50% of products shipped overseas Turnover £10M, Invested £14M in Junction City Plant 2004 3 Blown film lines, 9 Looms Dromore 4 Blown film lines, 12 Looms Kansas Invested £1.5m in 3 new Looms The Project To develop and improve performance in net wrap products to enable greater surface area bale coverage to improve weatherability and reduce crop spoilage By using LDPE/LLDPE blends to increse elasticity 5. Proof Of Concept 2 year project Total income to PPRC £153,000 Aims of the Proof of Concept • • • To develop a breathable chemically impervious material. Identify and develop high value products made using this material Set up a company to exploit this technology Progress to date • • • Two high end products identified for use in the aerospace industry In final stages of setting up a J.V. Company with MOD In discussion with a number of interested companies 5. Invest INI R&D Programmes with PPRC 5. InterTrade Ireland (all Ireland) FUSION Programmes with PPRC 5. Fusion - Creganna Medical Devices Associate Company Size RAE Returnable Income PPRC Income T.B.C. 78 employees / 2 Plants (Galway), 1 Plant in Mass. USA £17,000 £17,000 The Company The company has been in business for over 20 years initially providing engineering solutions to a range of industries. For the last 8 years, has focused solely on solutions for the medical device industry. Creganna offers a wide range of materials, designs and assemblies and provide complex moulding solutions for proximal device shafts. The products, components and sub-assemblies are available in a variety of metals and composite materials The Project To research and develop a range of new generation ‘hyper tube’ products for angioplasty and other invasive surgical procedures using high performance polymers as replacements for the current metal based hyper tubes 5. European Programmes FP7 EU CRAFT, Collective Current FP7 programmes Bandanna rotational moulding Ultravisc Extrusion -soft sensor, closed loop viscosity measurement and control of extrusion of recycled HDPE PP PS PVC incorporating ultrasonics Micro melt Induction heating in rotational moulding to reduce heating cycles 6. Education, Industrial Training, • MSc Polymer Engineering One year ( 3 semester) conversion course (established 1974 Msc Polymer Science and Engineering-Joint with the schools of Chemistry, Chemical Engineering and Mechanical Engineering) Entry requirements 2.1 Degree in different disciplines either: Mechanical Engineering Chemical Engineering, Material Science, Chemistry etc.(broader education and skills for industry) Semester 1 and 2 Six taught modules ( pass mark 50%) with major emphasis on laboratory processing analysis and characterisation 3rd semester Major 3 month research project mostly applied research with industry Student Intake Current student intake 5-12 2010 target intake 20 students ( Local, Europe, USA, India, China) Employment Either direct into industry, KTP associates or PhD studies then Industry • On-line (part-time) BEng Degree in Polymer Engineering (Level 7 degree) Entry requirements either a (level 6) Higher certificate in engineering, or a relevant craft certificate in Engineering, with a minimum of 5 years industrial experience Delivered by Sligo Institute of Technology and Athlone Institute of Technology Live on-line lectures, requires minimum travel and minimum downtime from work This programme is aimed primarily at persons employed in the polymer sector. Industrial Training and Education Seminars Programmes at PPRC Programmes conducted at PPRC or in-house Rotational Moulding – locally, UK and worldwide Extrusion - Principles of Extrusion (1-2 days) - Blown film – mono- and multi-layer (1-3 days) - Cast film - mono- and multi-layer (1-3 days) - Tube - mono- and multi-layer (1-3 days) - Sheet - mono- and multi-layer (1-3 days) - Materials appreciation (1-2 days) - Polymer rheology (1 day) 6. European MSc Polymer Engineering and Design 2003 – 2004 2004 – 2005 2005 – 2006 2006 – 2007 12 Students 15 Students 13 Students 10 Students Joint ,Universities of Zaragoza, Pau. Courses: Polymer Extrusion Principles Polymer Extrusion Applications Research Projects (3) Industrial Visits 6/7 now permanently employed in NI Polymer Industry New Partnership arrangements 2010 7. Recent Initiatives at PPRC 2. InterTrade Ireland 3. N.I.P.A. Special Interest Groups SIGs 4. Invest Northern Ireland Competence Centres 7. Recent Initiatives at PPRC InterTrade Ireland • Cross Border Collaboration of the Polymer Industry • Report “A Competitive Analysis of the Polymer and Plastics Industry on the Island of Ireland” (RAPRA) - 280 Companies, 22,000 employees - Turnover €3.3 Billion - 80% of Companies SMEs, - 17 recommendations. • Grant Proposal submitted to ITI £176K Deliverables • 6 Fusion, 2 Innova Programmes • Training & Upskilling • Polymer Degree/ Masters Courses on the Island • Benchmarking • Lean Manufacturing/ Bulk purchase/All-Island Export Drive etc. Strengths & Weaknesses Strengths Mature well established ‘profitable’ companies Diverse market sectors served Good labour productivity Weaknesses Island location Static levels of production value & productivity High labour costs High energy costs Low levels of R&D expenditure Opportunities & Threats Opportunities Buoyant construction and packaging markets Strong medical and pharmaceutical markets Productivity and efficiency improvements Innovation and development into new growth markets Collaboration on sourcing / market intelligence / promotion Threats Lower labour cost economies Labour skills shortages Lack of innovation / R&D / agility Environmental targets and legislation Network Activities Benchmarking / Best Practice Energy benchmarking survey completed in February 2009 5 Best Practice visits: - DuPont Nov 08: Health & Safety and Quality Systems - Athlone March 09: Energy Best Practice Workshop - Canyon Europe Aug 09: Waste Minimisation & Energy Efficiency - Clarehill Plastics Sept 09: Manufacturing Programming & Planning - Boxmore April 2010 Workshops / Networking Innovation Seminar, Armagh – December 2007 Innovation/Collaboration Seminar, Mullingar – March 2008 Resource/Waste Utilisation Seminar, Lurgan – May 2008 Energy Savings Seminar, Dundalk – Sept 2008 Synergy Workshop, Mullingar – October 2008 Sustainable Manufacturing Masterclass, Newry – February 2009 Network Activities Training & Upskilling Assisted roll-out of All-Island Learning network 76 participants (vs target of 41) in phase 1 9 modules delivered (vs target of 4) Target 50 participants in phase 2 Innovation/R&D 9 companies referred to FUSION programme 5 North/South industry partnerships referred to INNOVA programme Facilitated a number of North/South industry and industry/ academic collaborations – Innovation Vouchers, FP7 Research Connections Workshops - Belfast, Dublin, Athlone Joint Study Tour of Upper Austria Polymer Clusterland Future Role Current network funding period ended October 2009 Independent external evaluation – initial findings: - programme has delivered against main objectives - clear evidence of knowledge transfer, innovation & collaboration - good return on investment - issues around programme management Independent external evaluation – initial recommendations: - continue focus on innovation, best practice, energy efficiency, lean manufacturing - specific benchmarking study for sector - more frequent communications with companies - wider outreach of network activities - further development of website First Meeting of the Trade Associations Board Members on the Island of Ireland NIPA and Plastics Ireland at PPRC September 2008 • To Establish NIPA Special Interest Groups (SIGs) to promote Collaborative Networks or Clusters • To improve Competitiveness of the Northern Ireland Plastics Industry • through Innovation and Co-operation Proposed to Establish NIPA Special Interest Groups (SIGs) or Clusters in order to improve competitiveness of the industry by identifying the needs of these SIGs Help improve the competitiveness of Northern Ireland polymer processing Companies, by embedding industrially focused and accessible innovation in all sizes of companies Increase company engagement in innovation by collaboration and business case awareness To inform and support future research for advanced polymer processing by defining strategic research needs for the NI polymer industry and by actively supporting proposals to increase success/value Industry comprises 78 firms, turnover £700 million, employees 6000, 75% SMEs • • • • Film Extrusion UPU, Brow, Cirrus Plastics, Boran Mopak, Webtech, Extrusion Compounding Colorite, Cherry polymers. • Profile Extrusion Brett Martin, Boomer Industries, Camden Group, Erne Plastics , N.I Plastics • • • Sheet Extrusion Brett Martin, Griener Pipe/ Tube Extrusion Valpar, Radius, Cherry Pipes, Brett Martin, Wavin, Majo • Recycling Cherry Polymers • Thermoforming Griener, Perfecseal, JF McKenna, Adamsez • Injection Moulding Canyon, Denroy, Munster Simms, Plastics 2000, Brett Martin • • • Toolmakers Rotational Moulding Clarehill Plastics, Kingspan • Blow moulders Prim Pac, Beverage Packaging, Coca-cola, Pam Pack • • Thermosetts Healthcare Crossen Engineering, Brook Engineering, Diamond Engineering Classic Marble, Creative Composites, RFD Beaufort, Smiley Warner Chilcott, Eakin, Almac Proposed NIPA Clusters and SIGs Medical and Healthcare SIG Two seminars and workshops by Len Czuba at PPRC Canyon, Denroy, Perfecseal, Colorite, Munster Simms, Crossen Engineering. Thermoforming SIG Two day Thermoforming Workshop by Peter Cracknell at PPRC Attendees 20, Greiner (7) Perfecseal (5) Crossen Engineering (2) Solamatrix (2) Fibretech(1) PPRC(3) Blowmoulding SIG (proposed) Two day workshop on extrusion blow moulding, injection and injection stretch blow moulding planned for early June 2010 Materials SIG (proposed) Two day workshop on Engineering Materials planned for late June 2010 New Materials and Additives SIG • Engineering Polymers, Polymer blends • Functional additives. e.g. nanomaterials & anti-microbials • Foams e.g. chemical blowing agents. • Fillers • Biodegradables e.g. PLAs, Starch based, additives, etc. e.g. natural fibres, minerals etc Multi-layer structures SIG • Evaluate new generation polymers for improved gas/ vapour/liquid barrier properties. • Research and indentify suitable polymer structures, layer thickness, suitable tie layers • Evaluate processability and prove functionality • Transfer competence to companies • Applicable to most processes; • Multilayer packaging films • Multilayer sheet extrusion for thermoforming • Multilayer rotational moulding • Multilayer (two shot) moulding • Multilayer tubes and pipes Innovative Design SIG. • Urgent need for improved design facilities and capabilities • Modelling, simulation, rapid prototyping • For improved assembly functionality • Improved disassembly for recycling etc. Recycling and Revalorisation SIG • Evaluate improve existing technologies and practices for recycling and product end of life use for thermoplastics and composites • Translating new technologies to industry • e.g. Solid state shear extrusion processes for mixed plastics • New products from recycled polymers . Energy Efficient Processing SIG • Induction Heating • Extrusion barrels and dies • Injection moulding barrels and moulds • Rotational moulding • Improved instrumentation • Extrusion, Thermoforming, Blow moulding • Process modelling • Thermoforming, Injection moulding, Blow moulding, Rotational moulding • Marketing / Promotion SIG Provide easy access to lower levels of innovation for new companies Support companies moving up innovation hierarchy Help companies build their own business case for innovation Training/Education SIG Provide appropriate, accessible up-skilling for company technical staff If appropriate provide in-house training to industrial secondees Signpost other leading training providers and reference sites • Arrange for academic secondments to leading industrial plants • Undergraduate and postgraduate degree courses Recent Initiatives Invest Northern Ireland New Polymer Industry Initiatives 2007 • 2007 Polymer Clusters Seminar • 2007 Establish a N.I. Polymer Network –Workshop • 2008 NIPA applied for assistance (£200k) to appoint full time manager to coordinate NIPA activities, (a) to improve liaison with schools and colleges (b) drive the new apprenticeship scheme (c ) to co-ordinate energy reduction schemes in the industry (d) to co-ordinate recycling activities Information on Invest Northern Ireland (INI) Grant Assistance Programmes INDUSTRY LED COMPETENCE CENTRES Gerry McNally Polymer Processing Research Centre Invest Northern Ireland Industry Led Competence Centres (new initiative April 0209) Competence centres are a group of businesses and researchers coming together to agree and undertake collaborative strategic research of common interest. Why establish a Competence Centre? • Science, engineering and commerce are converging. Tomorrow’s successful companies will be those that focus on innovation and translate knowledge into new marketable and profitable products. • INI has long recognised the importance of R&D to the economy. A key part of support has been support for research infrastructure and establishing Research Centres of Excellence (PPRC/MPRI) which gave significant commercial returns and additional research expertise. • The future will require even deeper collaboration to fully grasp and exploit the opportunities offered by new technology. • Levels of funding - 75%-80% with 20-25% funding from industry (in kind) Invest Northern Ireland Competence Centres Who can participate. Any Northern Ireland company with an R&D strategy or vision that is open to working with like minded companies and prepared to collaborate with research performers. Company Benefits of Participation 1.Engaging in higher risk longer term research into market problems that once solved can offer them the competitive edge. 2. Having direct input into the strategic direction of the Centre’s research. 3. Being able to access IP and have early influence on it’s exploitation. 3. Networking with senior and influential researchers that could lead to involvement in EU and other R&D initiatives. Invest Northern Ireland Competence Centres Benefits of Participation for Researchers 1.Dynamic interaction with industry that will ensure research will deliver economic benefits. 2. Longer term funding mechanism allowing time to bring their research to fruition. 3.The possibility to spin out new commercial entities and exploit intellectual property. 4. Being able to access larger streams of funding to develop the research infrastructure by leveraging other research schemes. Innovation Hierarchy Mature Innovators Polymer Research Forum Fundamental Research Pure research International – FP7 Strategic innovation Applied Researchacademic focus CASE PhD Advanced Materials New process development Industrial Research – industrial focus Advanced Polymer Competence Centre Applied technology New materials development In-centre – seconded staff Business-focussed applied technology Materials development Short project Written Response Quick Process improvements Skills upgrading Improved instrumentation Materials sourcing ‘Simple’ Phone Query Entry Level Innovators Simple information Governance of Advanced Polymer C of C Chairman Industrially-led Non-Executive Board PPCC Director appointed by joint academic/industrial panel with industrial majority PPCC Director Business Development Manager Design Manager 12-15 members Chairman from industry PPCC Director Research Cluster Director 8 Industrial members 4 Academic members Meets monthly to steer PPCC Moulding Manager Finance Director/Manager Rotational Manager Extrusion Manager Analysis Leader Work Programme – Technology/Process/Business mapping Injection Moulding Film / Sheet Extrusion Profile Extrusion Pipe Extrusion Tube Extrusion Thermoforming Compounding Blow Moulding Rotational Moulding Thermosets Healthcare 1.1 Next Generation Polymers 1 1 1 1 1 1 X X X X X 1.2 Nano enhanced polymers X X X X X X X X X 2 3 3 1 2 1 2 2 4 1 X POLYMER PROCESS TECHNOLOGY/ INNOVATION AREA 1. New Materials 1.3 Antimicrobials 1 1.4 Foams 2 1.5 Additives (functional) 3 1.6 Additives (filler) 3 1 2 X 3 1 X X 2. Multilayer Structures 2.1 Barrier 1 2.2 Aesthetics 1 1 X 4 3. Innovative Design 3.1 Rapid prototyping 1 2 2 2 X 3.2 Design for functionality 1 2 2 2 X 3.3 Design for recycling 1 X X X 3.4 Modelling 3 3 1 1 X 3.5 Simulation 2 2 1 1 3.6 Tool/die design/manufacture 2 3 2 2 4. Recycling 4.1 Collection / sorting 1 1 1 1 4.2 Reprocessability 2 2 2 2 4.3 Revalorisation (New product) 2 2 X 1 X 2 X X 4.4 Solid state shear extrusion 2 4.5 Super critical CO2 2 5. Next generation processing 5.1 Instrumentation 3 3 5.2 Induction heating 1 2 5.3 Improved control / sensors 2 2 4 1 3 1 1 2 3 3 3 2 3 1 3 3 X 6. Marketing / promotion 6.1 Promotion of innovation ongoing activity 6.2 Networking activities 6.3 Development of centre 7. Training 7.1 Delivery of appropriate training ongoing activity 8. Analysis/Testing Support Potential Northern Ireland Companies KEY: ongoing activity Canyon UPU Boomer Cherry Pipes Valpar Greiner Colorite Bev Park Clarehill Denroy Brow Camden Brett martin Radius Perfecseal Cherry Dale Farm Kingspan Munster Simms Cirus Erne Plastics Plastics 2000 Webtech Tool Design Perfecseal Crossen Eng. Boran Mopac year 1 activity Adamsez Prim Pack JF McKenna year 2 activity year 3 activity year 4 + activity 'X' - secondary interest Classic Marble RFD Warner Chilcott Eakin Smiley Monroe Almac Creative Comp. Perfecseal Resources Required • New Staff • Additional staff needed to carry out the selected technical programmes • Also staff to support business development in companies and APPCC • Staff growth from 10+ (now) to 18 in 2014 expected • Significant industrial secondments to/from APPCC are also expected • PhD/ MSc numbers additional to above numbers • New Equipment • Equipment refurbishment/renewal estimated at £1m over period • Space Allocation • Accomodation refurbishment and 800 sq. m. extension planned • Refurbishment cost approx 250k, new build approx £1.2m Invest Northern Ireland Grants for Research and Development INI Funding for New R&D Programmes Criteria -Small <50 employees/Individual -Not in receipt of Invest NI support for R&D in last 5 yrs -May have potential to export at a future date R&D project Up to 75% Project Definition – Funding Thresholds & Rate of Assistance • Maximum rates of support: SME’s Large Businesses Industrial Research 75% 65% Experimental Development 50% 40% As a guide, Project Definition assistance is expected to be circa 5-10% of the estimated total project costs of the main R&D project. Maximum support £50k Project Definition - Eligible Costs • Wages & Salaries • Overheads • Consultancy • Travel & Subsistence • Intellectual Property • Miscellaneous Invest Northern Ireland Grants for Research and Development Grant for R&D - Rates of Support Company Size Small Medium Collaborative Bonuses (up to max 80%) Large Small Medium Large Experimental Development 45% 35% 25% 60% 50% 40% Industrial Research 70% 60% 50% 80% 75% 65% INI Grant for R&D - Eligible Costs • Wages/Salaries • Overheads • Consultancy • Sub-Contracting • Equipment Depreciation • Trials & Testing • Intellectual Property • Other: • Materials • Travel & Subsistence • Miscellaneous 7. Recent Initiatives at PPRC 1.Society of Plastics Engineers (25,000 members worldwide) • • • • • • 10th Anniversary Conference at PPRC September 2006 SPE European Medical Polymers Division September 2008 Already – SPE Thermoforming European Division SPE European Medical Polymers Seminars (4) T.B.A. SPE Rotational Moulding Division T.B.A. SPE Flexible Films/Packaging Division 7. SPE Medical Polymers Conference 4th-7th September 2009 at PPRC Keynote Speakers and Invited Presentations 1. Assembly of Medical Devices 2. Polymers in Medical Devices 3. Packaging of Medical Devices 4. Sterilisation and Additives 5. Processing of Polymers 6. Biomedical Engineering Exhibitors (20+) Workshops (4+) 150 delegates from 14 countries Planning started for next Conference September 2010 Overview • Recognised world class research in Polymer Science at Stellenbosch • Urgent need for equivalent Polymer Processing base • Recommendations • Determine Workforce Development Plan specifically for the SA plastics industry • Commission report on Competitive Analysis of the SA plastics industry to identify; • Geographical clusters , market sectors, processes etc. Benchmark the industry against other global economies, quality, productivity, skills and education etc. • Identify threats weaknesses opportunities e.g import substitution, value added products etc. • Compile recommendations and report recommendations to DTI and secure funding to implement initial 3 year plan-5year plan.