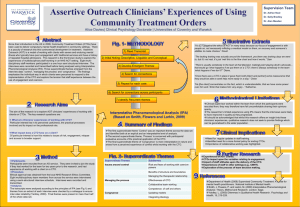

What is CTOS?

advertisement

Everything You Should Know About CTOS Many people only have a rough idea of what CCRIS and CTOS is. Most do not know how it works. In this second of a 2-part series, everything that you need to know about CTOS is explained. This includes how to make it work in your favour when making a loan application. CCRIS was explained in What is CTOS? CTOS is a lead information system widely used by the majority of the country’s Financial Institutions, Commercial Companies & Businesses, Legal Firms and other institutions. Unlike CCRIS, which is under Bank Negara Malaysia (BNM), CTOS is owned and managed by a Malaysian company, in business for over 20 years, collating information on Individuals and Companies from various sources found in the public domain. The information is formatted into an electronic database which provides for an easy, quick and efficient checking process for loan applications, trade and business credits and for decision making by credit grantors and lenders. The sources of CTOS information include amongst others: • • • • • • • • Legal notices in Newspapers Searches at the Companies Commission of Malaysia (CCM) or Suruhanjaya Syarikat Malaysia (SSM) Government Gazettes & Publications Searches at the Malaysia Department of Insolvency (MDI) or Jabatan Insolvensi Malaysia National Registration Department (NRD) or Jabatan Pendaftaran Negara (JPN) Searches at the Registrar of Societies (ROS) Contact information provided by creditors / litigators / trade referees Information voluntarily provided by subjects themselves Only CTOS subscribers can access the CTOS Information Database. What CTOS is Not? CTOS is not a blacklist. It does not provide opinions, ratings, rankings or recommendations on an Individual’s or Company’s credit worthiness. All lending policies, loan approvals and decision making are determined by the lenders or credit grantors themselves, not CTOS. Another misconception about CTOS is that it does not update its records. It is important to note, CTOS is like an electronic library of historical information captured from publicly available sources and archive as such. Updates are carried out by CTOS whenever it captures case settlements from parties involved namely the plaintiff, defendants, their lawyers or new information from related source documents. What categories of information does a CTOS Report contain? A CTOS report is split into 5 sections containing different categories of information: Ctos.com.my Section A – Identity Verification Helps to identify and verify the subject’s by Identity Number, Full Name, Company or Business Registration Number. This section helps to detect and prevent fraud and identity theft. Section B – Internal List / Group Exposure This is for the subscriber’s own information and reference. It relates to their own business experiences with their customers. Information here is only open to the subscriber’s own personnel. No other subscribers have access to this information Section C – Directorships and Business Interests Record a subject’s directorships and shareholdings in Malaysian incorporated companies and businesses. Banks use this section to help verify the true nature of a subject’s ostensible income, especially for company shareholders and business owners. Section D – Legal Actions Against Record the legal information. It helps one to have a better insight and understanding on a subject’s background, history and business experience. Banks use this section to look out for bankruptcy information, legal actions, and case statuses. Section E – Trade Referees and Subject Comments Trade Referees – Listed here is the name of Trade Referees. They are CTOS subscribers who may want to share their business experiences known as “Trade References” on subjects and their companies or businesses that they have dealt with. The trade references are the subscribers’ own information not CTOS. Therefore, communication of the trade reference is done directly via email between the trade referee and the inquirer. Subject’s Comments – This is a facility provided by CTOS to allow parties involved in a case to present their “side of the story”. Comments should be objective and confined only to the case. How long are the records kept? Unlike CCRIS where records are kept only for 12 months, CTOS records are kept indefinitely as an historical archive of one’s history and experiences. Will CTOS update the information in their database? Yes, the CTOS database is updated with new information collated from the various sources on a daily basis. Information contained in Section C is periodically updated to reflect the latest directorship and shareholdings of the subject at that point in time. Ctos.com.my Information in Section D – As a rule, in this section, information is never deleted except in cases of (1) Fraud OR (2) Mistake. The relevant supporting documents must be provided to CTOS for their checks and verification before a deletion can take place. I have settled a legal action against me / been discharged of Bankruptcy. But banks still reject my loan applications, citing “CTOS issue”. What can I do? Because of how CTOS operates, if you have had legal actions taken against you, it becomes your responsibility to provide updates to them, especially if the outcomes are in your favour. This can be done by contacting CTOS service centre. I have been a victim of identity theft, which has resulted in many unjustified lawsuits against me. The cases have not been resolved. What can I do? If you are able to provide proof of fraud (eg. police reports, letters of support from relevant banks/lawyers/litigators), CTOS will remove the relevant records from their system after verification. You may also provide subjective comments in defence of yourself to be added to your CTOS file. This ensures that all enquirers to your CTOS file will see your explanations. These will appear in Section E of your file. I was discharged as a bankrupt / paid off my creditors 6 months ago and have updated CTOS regarding my case? Why do banks still reject my loan applications, citing “CTOS issue”? Most likely, the issue is not with CTOS not updating your records, but with the bank’s internal credit approval policies. Most banks have internal policies that are not friendly to past delinquents. The more time that has passed between your last delinquency versus your loan application, the higher the chance of approval. A general rule is to have at least 1-2 years in between. I do not owe any banks any money. And to my knowledge, I have never been sued. How can it be that I have “CTOS issues”? Subscribers to CTOS are able to provide their contact details as “Trade Referees” for a subject. This appears in Section E of the CTOS report. As explained above, trade referees may want to share their business experiences known as “trade references”. It is likely the trade referee could have dealings with you and/or your company or business. Telco and utility companies have been known to put themselves as trade referees for subjects who have long-standing uncollectible debts with them, even for small amounts. In such instances, it’s advisable for you to contact the CTOS Service Centre to conduct a CTOS Self Check Report. From the report, you will know whether such is the case. Ctos.com.my