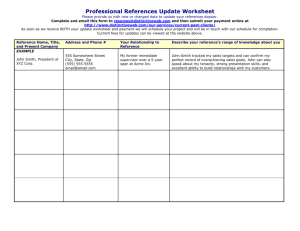

requirements - Louisiana Bankers Association

advertisement

Opening Deposit Accounts 2015 The material used in this text has been drawn from sources believed to be reliable. Every effort has been made to assure the accuracy of the material; however, the accuracy of this information is not guaranteed. The laws are often changed without prior notice from the government. The publisher and the editor are not engaging in the practice of law or accounting. We are not responsible for the actions of your company's employees. ©Gettechnical Inc. 1 Instructor Deborah L Crawford • Debbie is the President of Gettechnical Inc, a Baton Rouge based training company. Her combined banking and training experience began in 1984 and she is a deposit side expert. She received her Bachelors and Masters degrees from Louisiana State University. • If you have any questions just call 1-800354-3051 or email us at gettechnical@msn.com. • You can find our state law chart at gettechnicalinc.com under resource tab. These resources are free and will help you to locate your state law issues. ©Gettechnical Inc. 2 SINGLE PARTY OR INDIVIDUAL ACCOUNTS 3 Requirements 1. Required Information on Person or Entity (Before opening account): 2. IRS Reporting: 3. Documentary Requirements: (Reasonable time after opening) Individual Accounts Name Address For individuals, Date of Birth Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number Report in SSN of owner Valid identification on owner Signature Card signed by owner and if have an agent the agent must sign. 4 Requirements 4. Suggested nondocument verification: (Reasonable time after opening) 5. Account Styling: Individual or Single Party A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references John Smith 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: $250,000 for the individual who owns 5 Sample: Individual or Single Party 1 2 OWNERSHIP TITLE John Smith Individual or Single Party 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) John Smith SSN 6 CHECKLIST FOR INDIVIDUAL OR SINGLE PARTY ACCOUNTS Required information on owner Report to IRS in SSN of owner Valid identification on owner Nondocumentary verification Signature Card Account Styling: John Smith Account Ownership: Individual or Single Party Government lists 7 If John Smith wants someone to sign on her account First Option: Agent 1 2 OWNERSHIP TITLE John Smith Individual or Single Party 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) John Smith Signature SSN Betty Smith Agent 8 JOINT ACCOUNTS OR MULTIPLE PARTY 9 Requirements 1. 2. 3. Required Information on Persons Account: (Before opening account) Joint or Multiple Party Name Address For individuals, date of birth Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number IRS Reporting: Report in SSN of 1st Owner Documentary Requirements: Valid Identification on all owners (Reasonable period after ) Signature card signed by all owners (Some signature cards permit an agent on a joint account) 10 Requirements Joint or Multiple Party 4. Suggested nondocument Verification: (Reasonable period after ) A CIP program must also have nondocumentary verification. Suggestions include: 5. Account Styling: John Smith or Jane Smith (You should not have “and” in title or mixed conjunctions in joint/multiple party ownership) 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: $250,000 per joint owner. 8. Miscellaneous: All joint owners must sign the contract. Welcome letter Call to customer to thank for business Third party verification Previous financial institution references Whitepages.com 11 Two or more owners…. 1 2 OWNERSHIP TITLE John Smith or Jane Smith Joint or Multiple Party 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) SSN of first owner Jane Smith John Smith 12 Example of Joint with Agent 1 2 OWNERSHIP TITLE John Smith or Jane Smith Joint or Multiple Party WROS WOROS 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) John’s SSN Jane Smith John Smith Junior’s signature as Agent 13 CHECKLIST FOR JOINT ACCOUNTS Required information on all owners IRS reporting on 1st owner’s SSN Valid identification on all owners Nondocumentary verification Signature Card Account Styling: John Smith or Jane Smith Government lists 14 TESTAMENTARY REVOCABLE TRUST OR PAY ON DEATH (ITF/POD) ACCOUNTS 15 Requirements 1. Required Information on Persons Account: (Before opening account) 2. IRS Reporting: Testamentary Trust/POD Accounts Name Address For individuals, date of birth Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number Report in SSN of 1st Owner 3. Documentary Requirements: Valid identification on owners (Reasonable period after ) Signature card signed by all owners 16 Requirements 4. Suggested nondocument Verification: (Reasonable period after ) 5. Account Styling: Testamentary Trust/ITF/POD Accounts A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references POD, ATF or ITF recommended in the account styling or elsewhere You must list the beneficiaries on the signature card. John Smith or Jane Smith, ITF/POD OR John Smith ITF/POD Betty Smith, Sally Smith and Tim Smith 6. Consult Government Lists: In some states the conjunction between beneficiary matters so it is best to list beneficiaries elsewhere in contract if state law permits Section 326 List OFAC List 17 Requirements Testamentary Trust/ITF/POD Accounts 6.. Insurance: $250,000 per owner per beneficiary. For example: Mom or Dad ITF/POD Child 1, Child 2 and Child 3 7. Miscellaneous: No outside trust documents required 18 CHECKLIST FOR ITF/POD Required information on owner Report to IRS in SSN of owner Valid identification on owner(s) ITF/POD intention manifested in title or elsewhere List of Beneficiaries Nondocumentary verification Signature Card Account Styling: John Smith or Jane Smith, ITF/POD Government lists 19 Example of POD or ITF 1 2 OWNERSHIP TITLE John Smith or Jane Smith POD/ITF Pay on Death Name of Beneficiaries: Betty Smith Sally Smith Tim Smith 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) John’s SSN Jane Smith John Smith 20 Options for Children UTMA Child owns Child’s SSN Custodian Signs Child has no access Styling: Little Johnnie, a minor by Jane custodian under UTMA Ownership: UTMA Joint Account Child owns as co-owner Use child’s SSN Child signs Child has access WROS or WOROS ITF/POD Adult owns Adult’s SSN Child receives at death of owner(s) Child no access, no ownership until death Styling: Little Johnnie or Jane or John Styling: Jane or John POD/ ATF/ITF Little Johnnie Ownership: Joint Ownership: POD or ITF or ATF POD = Pay on death ATF = As trustee for ITF = In trust for 21 UNIFORM TRANSFER TO MINORS ACT (UTMA) 22 UNIFORM TRANSFER TO MINORS ACT • Under the Uniform Transfer to Minors Act (UTMA), a custodian may want to set money aside for the minor as an irrevocable gift. In this case, the money belongs to the child. If the custodian withdraws any of the money it must be used for the benefit of the child or the child may sue. Upon the age of majority (18-21), the funds will be turned over to the child. • Only one custodian (some states have two custodians) and one child are allowed per account. In the event of the death of the child, the child's estate will receive the funds. In the case of the death of the custodian, the guardian of the child will name a successor custodian. 23 Requirements 1. Required Information on Person Account: Uniform Transfer to Minors Name Address For individuals, date of birth (Before opening account) Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number 2. IRS Reporting: Report in child’s SSN 3. Documentary Requirements: Signature card signed by the custodian (Reasonable time after Valid identification on custodian. Children opening) may not have primary identification. You might accept a Social Security card and a birth certificate or student identification for the child. 24 Requirements 4. Documentary Requirements: (Reasonable time after opening) 5. Suggested nondocument Verification: (Reasonable time after opening) 6. Account Styling: Uniform Transfer to Minors Signature card signed by the custodian Valid identification on custodian. CIP requires you to identify the person acting for the minor. Some also identify the minor. Children may not have primary identification. You might accept a Social Security card and a birth certificate or student identification for the child. A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references Johnnie Smith a minor by Sally Smith, custodian under UTMA OR Sally Smith as custodian for Johnnie Smith, minor under UTMA (You must report in child’s Social Security number ) 25 Requirements 6. Consult Government Lists: 7. Insurance: 8. Miscellaneous: Uniform Transfer to Minors Section 326 List OFAC List Insured under child’s individual insurance for up to $250,000. One child and one adult per account in most states You cannot use as collateral for a loan At death, there may be a successor custodian if not and the child is 14 he or she has 60 days to name a custodian out of their family, if this time lapses then the guardian or other parent of the child becomes the new custodian. See law. You cannot have an “agent” on a custodial account. You may not put a ITF/POD on a custodial account. 26 DEATH Child Dies Custodian Dies Funds go to the Child’s Estate 1. 2. Documentation Death Certificate Letters of Administration or Letters of Testamentary This is subject to state law. Your state law links are at gettechnicalinc.com under resources Did Custodian name Successor? YES Successor Custodian takes over as Custodian 1. 2. 3. NO Child 14? Child can name successor or if child does not act then legal guardian Documentation Death Certificate on Custodian Identification on new Custodian New Signature Card 27 CHECKLIST FOR UTMA ACCOUNT Required information on custodian Report to IRS in SSN of minor Valid identification on custodian Nondocumentary verification on custodian Signature Card Account Styling: Johnnie Smith minor by Sally Smith, custodian under UTMA or Sally Smith as custodian for Johnnie Smith , Minor under UTMA Account Ownership: UTMA Government lists 28 Example of UTMA 1 2 OWNERSHIP TITLE Johnnie Smith minor by Sally Smith custodian under UTMA UTMA 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) Sally Smith, Custodian Johnny Smith’s SSN 29 MINOR BY ACCOUNTS • Many financial institutions over the years have opened accounts called the "Minor By" Account. These accounts are not protected or defined in any state or federal law. The minor by account has one person as owner and other parties as signers. IT IS RECOMMENDED THAT YOUR INSTITUTION NOT OPEN THIS ACCOUNT. CONSULT YOUR FINANCIAL INSTITUTION'S ATTORNEY BEFORE CONTINUING THIS PRACTICE. 30 JOINT ACCOUNTS WITH MINORS • Many institutions allow Joint accounts with minors and an adult family member. These accounts are often described in the deposit agreements between financial institution and their customers. Some financial institutions have the adult sign an additional form which states that the adult is responsible for the account. TALK TO YOUR FINANCIAL INSTITUTION'S LEGAL COUNSEL BEFORE OFFERING THIS TYPE OF ACCOUNT TO MAKE SURE YOUR DEPOSIT AGREEMENT COVERS THIS TYPE OF MINOR ACCOUNT. 31 Requirements 1. Required Information on Persons Account: (Before opening account) Joint Accounts with Minors Name Address For individuals, date of birth Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number 2. IRS Reporting: Report in SSN of first owner 3. Documentary Requirements: (Reasonable time after opening) Valid identification on owner Try to get the Social Security Card or birth certificate of child Signature Card signed by all parties 32 Requirements 4. Suggested nondocument Verification: (Reasonable time after opening) 5. Account Styling: 6. Consult Government Lists: Joint Accounts with Minors A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references Stan Smith or Sally Smith or Johnnie Smith Section 326 List OFAC List 33 Requirements 6. Insurance: Joint Accounts with Minors $250,000 per joint owner. See insurance Joint accounts. Remember if the owner does not sign the account is not insured as a Joint account. 7. Miscellaneous: Joint accounts with minors are a practice with many financial institutions. The minor cannot receive access to the money if he or she did not sign the signature card. 34 Example of Joint Or Multiple Party with Minor 1 2 OWNERSHIP TITLE Stan Smith or Sally Smith or Johnnie Smith Joint or Multiple Party 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) Stan Smith’s SSN or whoever is first on the account Sally Smith Stan Smith Johnnie Smith 35 CHECKLIST FOR JOINT OR MULTIPLE PARTY ACCOUNTS WITH A MINOR Required information on owners Report to IRS in SSN of 1st owner Valid identification on adult, some kind of identification on child (SS card, student ID) – see your CIP on minors Signature card Nondocumentary verification Account Styling: Stan Smith or Sally Smith or Johnnie Smith Government lists 36 PARENT FOR CHILD • A parent or parents can establish either a individual account or Joint account for themselves where the funds are "earmarked" for their child. See single or Joint accounts for ownership and access information. 37 Requirements 1. Required Information on Person Account: (Before opening account) 2. IRS Reporting: 3. Documentary Requirements: (Reasonable time after opening) 4. Suggested nondocument Verification: (Reasonable time after opening) Parent for Child Name Address For individuals, date of birth Taxpayer identification number U.S. Person will be Social Security number, Non U.S. Person will use passport number, ITIN number or other acceptable document number Report in SSN of first owner Valid identification on owner Signature card A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references 38 Requirements Parent for Child 5. Account Styling: John Smith or Mary Smith 6. Consult Government Lists: For Little Johnnie Smith* Section 326 List OFAC List 7. Insured under the ownership of the adult Insurance: 8. Miscellaneous: *This is an older type of styling used to earmark funds for a child. 39 Example of Parent for Child 1 2 OWNERSHIP TITLE Betty Smith Special Account Individual 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) Betty Smith’s SSN Betty Smith 40 OTHER FIDUCIARY ACCOUNTS When one person is named to act for another by contract, by law, by court or other legal arrangement, they are considered in a fiduciary capacity. 41 FIDUCIARY ACCOUNTS TYPE Set up by 1. Authorized Signers, Agents In-house Power of Attorney Signature card or attachments 2. Power of Attorney Outside Document Outside contract 3. Custodians On signature card through state law 4. Social Security Representative Payees On check by Social Security 5. Executors/Administrators Court 6. Guardians Court 7. Trustees Contract 42 General Rules for Fiduciary Accounts 1. No ITF/PODs may be attached to accounts 3-7. 2. No other authorized signers or power of attorneys may be listed on accounts numbers 3-7. 3. Except for authorized signers, the type of ownership is not Single-Party or joint but “fiduciary” or the specific ownership for each category on your platform system. If you have cards, check the “other” box and list the type of fiduciary. 4. Fiduciaries should sign name and job title. For example, “Jane Smith, trustee”. 43 Social Security Representative Payee • A Social Security account is an account for a person receiving Social Security benefits who is unable to act on their own behalf. The Social Security Administration has named a representative payee to act for the person. This can be for minor children or adults who are unable to act for themselves. The representative payee is the person with access to the funds and the other named individual on whose behalf they are acting is the actual owner of the account. 44 Requirements Social Security Representative Payee Accounts 1. Required Information on Name Person Account: Address For individuals, date of birth (Before opening Taxpayer identification number account) U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number 2. IRS Reporting: Report in SSN of beneficiary 3. Documentary Valid identification on representative payee Requirements: and if possible, the owner (Reasonable time after opening) Letter from Social Security Signature card provided by financial institution is signed by the representative payee even though the funds are owned by the beneficiary and reported in the beneficiaries SSN. 45 Requirements 4. Suggested Nondocument Verification: (Reasonable time after opening) Social Security Representative Payee Accounts A CIP program must also have Nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references 5. Account Styling: Sally Smith, Representative Payee For Betty Smith Or Betty Smith, Beneficiary Sally Smith, Representative Payee 6. Consult Government Lists: Section 326 List OFAC List 46 Requirements Social Security Representative Payee Accounts 7. Insurance: Insured under beneficiary individual coverage. 8. Miscellaneous: The owner of the funds is not a signer on this account. Funds must be kept separate from the representative payee personal funds. An exception applies for a parent who has more than one child receiving checks. He or she may put all those checks into his or her own individual checking account. See A Guide for Representative. VA Accounts are similar but the person who is acting for the veteran is called a “fiduciary”. 47 Example of Social Security Representative Payee 1 2 OWNERSHIP TITLE Betty Smith, Beneficiary Sally Smith, Representative Payee Social Security Rep Payee 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) Betty Smith’s Sally Smith, Representative Payee 48 CHECKLIST FOR SOCIAL SECURITY REPRESENTATIVE PAYEE Required information on owner and representative payee Report to IRS in SSN of owner Valid identification on representative payee Check or letter from Social Security Nondocumentary verification Signature Card: Ownership is “Representative Payee” Account Styling: Sally Smith, Representative Payee for Betty Smith , OR Betty Smith, Beneficiary Sally Smith, Representative Payee Government lists 49 Guardianship and Conservator Accounts • When the court names some one to act for a child or adult, then they are a guardian or conservator. Court documents will accompany the right of the guardian to act for another person. 50 Guardianship Accounts/Conservator Accounts • If an adult is ruled incompetent or a minor is unable to manage his or her affairs, the court will appoint a guardian. The guardian's authority ceases at the death of the ward or mentally incapacitated adult (non compis mentis). If the person is older, the person named to represent him or her is called a conservator. 51 Requirements 1. Required Information on Person the Account: (Before opening account) 2. IRS Reporting: 3. Documentary Requirements: (Reasonable time after opening) Guardianship Accounts/Conservator Accounts Name Address For individuals, date of birth Taxpayer identification number U.S. Person will be Social Security number Non U.S. Person will use passport number, ITIN number or other acceptable document number Report in SSN of owner Valid identification on guardian or conservator Court order provided by the customer should be followed exactly as the court requires and letters of guardianship. Signature card signed by the guardian or conservator. 52 Requirements 4. Suggested Nondocument Verification: (Reasonable time after opening) 5. Account Styling: Guardianship Accounts/Conservator Accounts A CIP program must also have Nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references John Smith, Minor Jane Smith, Guardian Or John Smith, Owner Jane Smith, Conservator It is signed by the person ordered in the court order usually the guardian or conservator. Sometimes however it takes a court order to remove any money. 53 Requirements Guardianship Accounts/Conservator Accounts 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: Insured under the individual coverage of the owner or person it is for. 8. Miscellaneous: You can have court ordered accounts for both young and old. A young person would be called a Guardianship Account and an older person is usually called a Conservator Account. 54 Example of Conservator or Guardian Account 1 2 OWNERSHIP Conservator or Guardian TITLE John Smith, Owner Jane Smith, Conservator 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) Jane Smith, Conservator John Smith’s SSN 55 CHECKLIST FOR CONSERVATOR OR GUARDIANSHIP Required information on guardian and if possible, owner Report in SSN of owner Valid identification on Conservator or Guardian Letters of Guardianship or Conservatorship Court Order Nondocumentary verification Signature Card Account Styling: John Smith, Minor Jane Smith, Guardian or John Smith Owner Jane Smith, Conservator Government lists 56 Overview of Probate Formal Estate Letters Testamentary or Letters of Administration Close Decedent’s Accounts Open Estate Account 57 REQUIREMENTS: ESTATES REQUIREMENTS ESTATES 1. Required Information: (Before opening account) On entity: Name Address EIN of Estate (do not use SSN of decedent) U.S. Person will be social security number Non U.S. Person will use passport number, ITIN number or other acceptable document number 2. IRS Reporting: Report in EIN of estate 3. Documentary Requirements: (Reasonable time after opening) Valid identification on person opening the account Letters of Testamentary/Administration from the court. Signature card 58 REQUIREMENTS ESTATES 4. Suggested nondocument Verification: (Reasonable time after opening) A CIP program must also have non documentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous Financial Institution references 5. Account Styling: The Estate of Jane Smith 6. Consult government Lists: 326 Government Lists OFAC List 59 REQUIREMENTS ESTATES 7. Insurance: All funds, belonging to a decedent and invested in one or more accounts, whether held in the name of the decedent or in the name of his executor or administrator, are added together and insured to the $250,000 maximum. Such funds are insured separately from the individual accounts of any of the beneficiaries of the estate or of the executor or administrator. 8. Miscellaneous: Close decedent’s accounts, open estate accounts. 60 Example of Estate Account 1 2 OWNERSHIP TITLE Jane Smith Estate Account Estate Account 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER EIN of Estate SIGNATURES (Access) John Smith, Executor 61 Checklist for Estate Accounts Required information on Estate Valid identification on Executor/Executrix Report in EIN of Estate Letters of Testamentary Nondocumentary verification on Estate Signature Card Account Styling: Jane Smith Estate Account Account Ownership:Estate Government lists 62 BANKRUPTCY 63 Types of Bankruptcy Chapter 7 Chapter 11 Chapter 12 Completely unable to pay debts Reorganization usually for businesses Used for family farmers, similar to Chapter 13 Used for individuals who temporarily are unable to pay. Repay debt over long period Keep property and pay over 5 years Chapter 13 64 FORMAL TRUSTS 65 Customer (Grantor) creates a trust contract with an attorney Grantor Grantor puts assets in trust • House • Land • Financial Institution Accounts • Names Trustee Trustee takes care of assets in trust. When trustee dies successor trustee takes over. Trustee Successor Trustee Beneficiaries Upon death of all trustees the successor trustee takes out assets and gives to beneficiaries according to the trust. 66 Requirements Formal Revocable Trusts (Usually a Living Trust) 1. Required Information on Entity: Name Address (Before opening account) Taxpayer identification number U.S. Person will be Social Security number 2. IRS Reporting: Report in SSN 3. Documentary Requirements: Valid identification on trustees (Reasonable time after opening) Customer should provide a Certificate of Trust, Affidavit of Trust, or entire trust agreement (you will only maintain front and back page if he or she brings in the entire trust). Signature card provided by the financial institution should be signed by all trustees. Trust resolution provided by financial institution is a new form of documentation that many forms companies now use to standardize the information needed to maintain a trust. 67 Requirements 4. Suggested Nondocument Verification: Formal Revocable Trusts (Usually a Living Trust) A CIP program must also have Nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references John Smith or Jane Smith Living Trust OR John Smith or Jane Smith, trustees John or Jane Smith Living Trust u/t/d Section 326 List OFAC List 5. Account Styling: 6. Consult Government Lists: 68 Requirements Formal Revocable Trusts (Usually a Living Trust) 7. Insurance: $250,000 per owner per qualified beneficiary. 8. Miscellaneous: It is easiest to close existing accounts and transferring into the new ownership type. Sometimes the title of the trust will say “and” but either trustee may sign -- refer to the trust agreement. 69 Example of Revocable Trust 1 2 OWNERSHIP TITLE John Smith or Jane Smith, Trustees of the Jane and John Smith Living Trust u/t/d 8/15/2002 Formal Trust—Separate Agreement 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) John Smith’s SSN or whoever is first on the account Sally Smith, Trustee John Smith, Trustee 70 Checklist for Revocable Formal Trusts Required information on grantor/trustees Report in SSN of grantor/trustee Valid identification on trustees (recommended) Trust Agreement (front and back page) or Certificate of Trust Trust resolution (if any) Nondocumentary verification Signature Card Account Styling: The John Smith and Jane Smith Living Trust or John Smith or Jane Smith, Trustees of the Jane and John Smith Living Trust u/t/d 8/15/2002 Account Ownership: Formal Trust—Separate Agreement Government lists 71 Irrevocable Trust • The irrevocable trust is one that the creator/settlor of a trust cannot revoke or alter. The settlor of the trust has given up the right to change his/her mind and has relinquished the trust property either permanently or for some specified period of time. An irrevocable trust may be created by will or during the lifetime of the settlor. It may result from a revocable trust, which by its terms becomes irrevocable upon the death of the settlor. The use of irrevocable trusts can result in substantial savings in estate taxes and, to a lesser extent, in income taxes. 72 Requirements 1. Required Information on Entity: (Before opening account) 2. IRS Reporting: 3. Documentary Requirements: Irrevocable Trusts Name Address Taxpayer identification number—Use EIN on irrevocable trust. Report in EIN Valid identification on trustees Customer should provide a Certificate of Trust, Affidavit of Trust, or entire trust agreement (you will only maintain front and back page if he or she brings in the entire trust). Signature card provided by the financial institution should be signed by all trustees. Trust resolution provided by financial institution is a new form of documentation that forms companies now use to standardize the information needed to maintain a trust. (Reasonable time after opening) 73 Requirements 4. Account Styling: 5. Suggested nondocument verification: (Reasonable time after opening) 6. Consult Government Lists: 7. Insurance: 8. Miscellaneous: Irrevocable Trusts The John Smith or Jane Smith Irrevocable Trust A CIP program must also have Nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Third party verification Previous financial institution references Section 326 List OFAC List $250,000 per beneficiary Some living trusts can become irrevocable after the grantor/trustees die. At that time you will request an EIN and change the status to irrevocable. Sometimes the title of the trust will say “and” but either trustee may sign -- refer to the trust agreement. 74 Example of Irrevocable Trust 1 2 OWNERSHIP Formal Trust—Separate Agreement TITLE The John Smith or Jane Smith Irrevocable Trust 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER EIN on Trust unless Grantor trust then use SSN SIGNATURES (Access) John Smith, Trustee Sally Smith, Trustee 75 Checklist for Irrevocable Trusts Required information on Trust Report in EIN of Formal Trust Valid identification on trustees Trust Agreement (front and back page) or Certificate of Trust Nondocumentary verification Signature Card Trust resolution (if any) Account Styling: The John Smith or Jane Smith Irrevocable Trust Account Ownership: Formal Trust Government lists 76 CIP AND CDD PLUS PROPOSED CHANGES 77 CIP Entity (If Agent then CIP person acting for business) CIP: Identifying and Verifying the Identity of Customers CIP Signatories if in Your Policy CIP Exemptions Open Business Account 4 Elements of CDD Identifying and Verifying the Identity of Beneficial Owners of Legal Entity Customers CIP Beneficial Owners of Legal Entities Customers CIP Exemptions plus those for Beneficial ownership Understanding the Nature and Purpose of Customer Relationships Base transactional questions and more detailed questions for high risk accounts Assign Risk Conducting On-Going Monitoring 78 Element One Establish a CIP Procedure for all “customers” Information Required (Prior to opening an account) + Verification through documents (Reasonable time after opening account) + Nondocumentary verification (Reasonable time after opening account) + CIP Recordkeeping + Customer Notice = CIP COMPLIANCE 79 Element Two Establish beneficial ownership on legal entity customers Legal Entity Customers Ask for 25% Beneficial Owners + Ask for Controlling Person + Run Your Institution’s CIP + CDD Recordkeeping 80 Beneficial Ownership • The second element of CDD requires financial institutions to identify and verify the beneficial owners of legal entity customers. In this NPRM, FinCEN proposes a new requirement that financial institutions identify the natural persons who are beneficial owners of legal entity customers, subject to certain exemptions. The definition of “beneficial owner” proposed herein requires that the person identified as a beneficial owner be a natural person (as opposed to another legal entity). A financial institution must satisfy this requirement by obtaining at the time a new account is opened a standard certification form (attached hereto as Appendix A) directly from the individual opening the new account on behalf of the legal entity customer. 81 • Financial institutions would be required to verify the identity of beneficial owners consistent with their existing CIP practices. However, FinCEN is not proposing to require that financial institutions verify that the natural persons identified on the form are in fact the beneficial owners. In other words, the requirement focuses on verifying the identity of the beneficial owners, but does not require the verification of their status as beneficial owners. This proposed requirement states minimum standards. 82 Ownership Prong: Each individual, if any, who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, owns 25 percent or more of the equity interests of a legal entity customer; and 83 Control Prong: An individual with significant responsibility to control, manage, or direct a legal entity customer, including (A) An executive officer or senior manager (e.g., a Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, or Treasurer); or (B) Any other individual who regularly performs similar functions. 84 Exemptions from beneficial ownership requirement • Customers Exempt from CIP – Same as CIP except existing customers (financial institutions regulated by a federal functional regulator, publicly held companies traded on certain US stock exchanges, domestic government agencies and instrumentalities and certain legal entities that exercise governmental authority) – Plus some new exemptions • Existing and New Customers – Applies to legal entity customer that open a new account after the implementation date 85 Plus these new exemptions… FinCEN proposes that the following entities also be exempt from the beneficial ownership requirement when opening a new account because their beneficial ownership information is generally available from other credible sources: • • • • • • • • • An issuer of a class of securities registered under Section 12 of the Securities Exchange Act of 1934 or that is required to file reports under Section 15(d) of that Act; Any majority-owned domestic subsidiary of any entity whose securities are listed on a U.S. stock exchange; An investment company, as defined in Section 3 of the Investment Company Act of 1940, that is registered with the SEC under that Act; An investment adviser, as defined in Section 202(a)(11) of the Investment Advisers Act of 1940, that is registered with the SEC under that Act; An exchange or clearing agency, as defined in Section 3 of the Securities Exchange Act of 1934, that is registered under Section 6 or 17A of that Act; Any other entity registered with the Securities and Exchange Commission under the Securities and Exchange Act of 1934. A registered entity, commodity pool operator, commodity trading advisor, retail foreign exchange dealer, swap dealer, or major swap participant, each as defined in section 1a of the Commodity Exchange Act, that is registered with the CFTC; A public accounting firm registered under section 102 of the Sarbanes-Oxley Act; and A charity or nonprofit entity that is described in Sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code of 1986, that has not been denied tax exempt status, and that is required to and has filed the most recently required annual information return with the Internal Revenue Service. 86 Verification of Beneficial Owners • Standard Certification Form • Verification of Beneficial Owners – Do not have to verify status – Do have to verify identity like CIP 87 Updating Beneficial Ownership Information • No specific requirement to update periodically • Update when open new account • Update when activity changes with on-going monitoring 88 89 90 91 Element Three Ask Nature, Purpose and Transactional Questions Applies to all customers on a risk basis Nature and Purpose: Ask Transactional questions The third element of CDD requires financial institutions to understand the nature and purpose of customer relationships in order to develop a customer risk profile. A bank should obtain information at account opening sufficient to develop an understanding of normal and expected activity for the customer’s occupation or business operations. In addition, because this is a necessary step to identifying and reporting suspicious activities, which obligation applies to all “transactions…conducted or attempted by, at or through” the covered financial institution, its scope should not be limited to “customers” for purposes of the CIP rules, but rather should extend more broadly to encompass all accounts established by the institution 92 Go further for high risk customers: MSBs + MRBs + Cash Intensive Businesses + Third Party Payment Processors + Embassy, Foreign Missions and Consulates + Pay day Lenders + Nongovernment Organizations + Professional Service Providers And many more… 93 Monitoring Element Four Conduct on-going monitoring + Monitoring Part of SAR program Applies to everyone Refresh Customer information when necessary + Must apply not only to “customers” for purposes of the CIP rules, but more broadly to all account relationships maintained by the covered financial institution 94 WITHHOLDING AGENT 95 TO AVOID BACKUP WITHHOLDING ACCOUNT HOLDERS MUST SIGN: W-9 U.S. PERSONS, INCLUDING RESIDENT ALIENS W-8BEN E NONRESIDENT ALIEN ENTITY EVEN EXEMPT ACCOUNT HOLDERS SHOULD SIGN New W-8BEN E 96 Signature Cards • Most signature cards have six basic components 1 2 OWNERSHIP TITLE 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) 6 AUTHORIZED SIGNERS OR AGENTS 97 FORM W-9 ©Gettechnical Inc. 98 99 100 ©Gettechnical Inc. 101 Out of state businesses • Out-of-state businesses register in each state the business is in. • We only take out-of-state documents when the business has an account with us but actually does business in another state. • This happens when your financial institution is close to a state line or when companies multitier and partner with other companies. 102 Most resolutions have five basic components: Type of Business Statement of Business Authority Who is authorized? What they are authorized to do? Signed by critical person in that type of business Attested to by another 103 Most signature cards have five basic components: 1 2 OWNERSHIP TITLE 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) 104 Signature cards must be consistent. Ownership ___ ___ ___ ___ ___ ___ ___ Sole Proprietor Partnership Corporation LLC Nonprofit Escrow Other Must Match Title Must Match Signatures 105 Signature Cards: General Issues Institution’s agreement with your accountholder. Purchased from vendors or written by your own financial institution’s legal or compliance department. You must follow your institution’s account agreement. Do not: alter, erase, whiteout delete any parts of the card type in additions to the card This is a legal binding contract between you and your accountholder. 106 SOLE PROPRIETORSHIP 107 • To establish a sole proprietorship all an individual is required to do is to start conducting business for profit. There are no formal legal requirements for establishment. In most states these are owned by one person and cease at the death of that owner. Certainly the sole proprietorship can have other signers on the account. 108 Requirements Sole Proprietorship 1. Required Information on Entity: Name (Before opening account) Address Taxpayer identification—The account will use the Social Security number of owner or employer identification number of owner. 2. IRS Reporting: Report in SSN or EIN of owner 3. Documentary Requirements: Valid identification on sole proprietor (Reasonable time after My financial institution does/does not require opening) all signers to Complete CIP. County issued document such as Occupational license/Trade Name The customer applies in the county where he or she is doing business. Resolution: Provided by the financial institution for sole proprietorships and signed by the owner of the business. There may be other signers on the account. These signers may be changed at any time by the owner. Signature card: Provided by the financial institution, signed by those authorized in the Resolution. It is the contract between the financial institution and the customer. 109 Requirements 4. Suggested Nondocument Verification: (Reasonable time after opening) 5. Account Styling: 6. Consult Government Lists: 7. Insurance: Sole Proprietorship A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Previous financial institution references Joe Smith dba Floral Enterprises Section 326 List OFAC List A sole proprietorship is insured under individual coverage for a total of $250,000. 110 Resolution I, Joe Smith, am the sole owner of Floral Enterprises…. I authorize the following to sign on the account: Joe Smith Owner Mary Smith Authorized Signer Usually a list of what they can and cannot do Signed Joe Smith, Owner Sample: Sole Proprietorship 1 OWNERSHIP Sole Proprietorship 2 TITLE Joe Smith dba Floral Enterprises 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER Joe certifies SSN or EIN (EIN assigned to Joe personally…either way Joe is first on title) 4 SIGNATURES (Access) Joe Smith Mary Smith 112 Checklist for Sole Proprietorship Required information on sole proprietorship Report in SSN or EIN of owner Valid identification on sole proprietor Occupational License from county/Trade Name/Assumed Name Account Styling: Joe Smith dba Floral Enterprises Account Ownership: Sole Proprietor Nondocumentary verification Resolution Signature Card Government Lists 113 3 Kinds of Partnerships in Most States General Partnerships Limited Liability Partnerships Limited Partnerships County or SOS SOS SOS May have Agreement Partnership Agreement Partnership Agreement EIN EIN EIN Resolution & Signature Card Resolution & Signature Card Resolution & Signature Card 114 PARTNERSHIP: ALL THREE FOLLOW SIMILAR PROCEDURES ALTHOUGH DOCUMENTS MAY BE DIFFERENT The Uniform Partnership Act defines a partnership as an association of two or more persons to carry on a business as co-owners for profit. Partnerships are easily organized and may or may not have a formal partnership agreement. 115 Requirements 1. Required Information on Entity: (Before opening account) 2. IRS Reporting: Partnership Name Address Taxpayer identification—The account will use the employer identification number of the partnership. Report in EIN of business 116 Requirements 3. Documentary Requirements: (Reasonable time after opening) Partnership Valid Identification on partner(s) opening the account. My financial institution does/does not require all signers to complete CIP Partnership Agreement: When it is available it is helpful to identify all the partners by a copy of the partnership agreement. The key issue to a partnership account is to make sure all partners sign the resolution. Government Issued document at county or secretary of state (Domestic or Foreign) Certification of Beneficial Owner(s) Resolution: Provided by the financial institution for partnerships and signed by the partners. There may be other signers on the account and may be changed at any time by all of the partners. A change in the account requires a new resolution signed by all the partners. Signature Card: Provided by the financial institution, signed by those authorized in the resolution. It is the contract between the financial institution and the customer. 117 Requirements 4. Suggested Nondocument Verification: (Reasonable time after opening) Partnership 5. Account Styling: A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Previous financial institution references Johnson Enterprises 6. Consult Government Lists: 7. Insurance: 8. Miscellaneous: Section 326 List OFAC List A partnership is separately insured for $250,000 from the individual accounts of the partners. No PODs on partnerships. 118 Partnership Resolution Names the Partnership: Floral Enterprises Lists who can sign What their job is Joe Smith Mary Smith Betty Smith Partner Partner Authorized Signer Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Joe Smith Mary Smith Signed by all the partners unless there is a partnership agreement with a managing partner named. 119 Sample: Partnership 1 OWNERSHIP General Partnership 2 TITLE Floral Enterprises 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER EIN of Partnership 4 SIGNATURES (Access) Joe Smith, Partner Mary Smith, Partner Betty Smith, Authorized Signer 120 Joe Smith Floral Enterprises Joe Smith 8/14/77 Mary Smith 9/15/76 Joe Smith Joe Smith 8/14/77 Joe Smith 123 Main St Monroe LA xxxxx 1243 Main St Monroe, LA xxxxx 123 Main St Monroe, LA 439-00-9999 439-11-0000 439-00-9999 1/6/2015 121 Checklist for Partnership Required information on Entity Report in EIN of Partnership Valid identification on partner(s) opening the account Documentary verification County document or SOS document Nondocumentary verification Signature Card Resolution Certification of Beneficial Owner(s) Account Styling: Johnson Enterprises Government Lists 122 CORPORATIONS 501c are exempt 123 Corporations • A corporation is formed when Articles of Incorporation are filed with the Secretary of State to approve the new business. Corporations doing business in more than one state must register as a "foreign corporation" in each state. The election of officers, usually contained in the minutes, is done at the first board meeting. The opening and closing of an account is authorized by the Board of Directors and carried out by the Corporate Secretary. 124 Requirements 1. Required Information on Entity: (Before opening account) 2. IRS Reporting: Corporations Name Address Taxpayer identification— The account will use the employer identification number of the corporation. Report in EIN of business 125 Requirements 3. Documentary Requirements: (Reasonable time after opening) Corporations Valid identification on corporate secretary My financial institution does/does not require all signers to Complete CIP. Domestic: Government issued document Foreign: Government issued document Fictitious Name: If the corporation is doing business under another name it must file a Certificate of Fictitious Name 126 Requirements 3. Con’t - Documentary Requirements: (Reasonable time after opening) Corporations Minutes from Board Meeting: The customer should provide an excerpt from the minutes of the last board meeting where officers were elected—specifically the Secretary of the corporation since this person must sign the resolution. Certification of Beneficial Owner(s) 4. Suggested Nondocument Verification: (Reasonable time after opening) Resolution: Provided by the financial institution signed by the secretary of the business. There may be other signers on the account. These signers may be changed at any time by the corporation, provided the corporation provides new minutes, new resolution and new signature card. Signature Card: Provided by the financial institution signed by those authorized in the resolution. It is the contract between the financial institution and the customer. A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Contact Secretary of State’s Office 127 Requirements 5. Account Styling: 6. Consult Government Lists: 7. Insurance: 8. Miscellaneous: Corporations Johnson Enterprises, Inc. Section 326 List OFAC List Each corporation is separately insured for $250,000. No ITF/PODs on Corporations. 128 Resolution Be it resolved at the last meeting of Floral Enterprises, Inc on July 4, 2011 the board of directors the following was decided: All of these will sign on the corporate account: Joe Smith President and Secretary Mary Smith Vice President and Treasurer Usually a list of what they can and cannot do Make Deposits and withdrawals Make loans Other Signed Joe Smith, Corporate Secretary Attested to by another officer 129 Sample: Corporation 1 OWNERSHIP Corporation 2 TITLE Floral Enterprises Inc 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER EIN of Corporation 4 SIGNATURES (Access) Joe Smith, Pres and Sec Mary Smith, VP and Treas 130 Joe Smith Floral Enterprises, Inc Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Mary Smith 09/15/1976 123 Main Street 439-11-0000 Monroe, LA xxxxx Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith Joe Smith 01/06/2015 131 Checklist for Corporations Required information on Corporation Report to IRS in EIN of Business Valid identification on Corporate Secretary Document from Secretary of State Domestic: Government issued document Foreign: Government issued document Fictitious Name (If required) Minutes from Board meeting to determine Corporate Secretary Nondocumentary verification (should check with Secretary of State to see if in good standing) Signature Card Resolution Certification of Beneficial Owner(s) Account Styling: Johnson Enterprises, Inc. Government lists 132 LIMITED LIABILITY COMPANY 133 Limited Liability Company (LLC) • A limited liability company offers the owners limited liability like a corporation with a taxing structure similar to a partnership. The income is passed through to the owners of the business. 134 Requirements Limited Liability Company 1. Required Information on Entity: (Before opening account) Name Address Taxpayer identification— The account can use the Social Security number of owner if a one person LLC or employer identification number of the business. 2. IRS Reporting: Report in EIN of LLC or may use SSN of member if the LLC is one person. 135 Requirements Limited Liability Company 3. Documentary Requirements: Valid identification on person opening the account (Reasonable time after My financial institution does/does not require all opening) signers to Complete CIP. Operating Agreement, if any: Provided by the customer, the agreement between the members of the LLC. It usually names the managing member. Domestic: Government Issued Document Foreign: Government Issued Document Certification of Beneficial Owner(s) Resolution: Provided by financial institution and signed by managing member authorizing others in organization to sign on accounts. Signature Card: Provided by financial institution; it is the contract between financial institution and customer. 136 Requirements Limited Liability Company 4. Suggested Nondocument A CIP program must also have nondocumentary Verification: verification. Suggestions include: (Reasonable time after opening) Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Check with Secretary of State’s Office 5. Account Styling: Name of business: Examples: Smith Electronics, LLC If a one person LLC using a Social Security number : Joe Smith Smith Electronics, LLC 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: $250,000 per LLC 8. Miscellaneous: No ITF/PODs on Limited Liability Companies May be a one person LLC May use a Social Security number 137 Limited Liability Company Resolution Names the Limited Liability Company: Floral Enterprises, LLC Lists who can sign What their job is Joe Smith Mary Smith Betty Smith Managing Member Member Authorized Signer Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Joe Smith, Managing Member Attested to by: Mary Smith, Member 138 Sample: Multiple Member LLC 1 OWNERSHIP Limited Liability Company 2 TITLE Floral Enterprises, LLC 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER EIN of LLC 4 SIGNATURES (Access) Joe Smith, Managing member Mary Smith, Member Betty Smith, Authorized signer 139 Joe Smith Floral Enterprises, LLC Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Mary Smith 09/15/1976 123 Main Street 439-11-0000 Monroe, LA xxxxx Joe Smith Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith 01/06/2015 140 Limited Liability Company Resolution Names the Limited Liability Company: Floral Enterprises, LLC Lists who can sign What their job is Joe Smith Mary Smith Betty Smith Managing Member Authorized Signer Authorized Signer Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Joe Smith, Managing Member 141 Sample: Single Member LLC 1 OWNERSHIP Limited Liability Company 2 TITLE Joe Smith Floral Enterprises, LLC 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER SSN of Joe Smith 4 SIGNATURES (Access) Joe Smith, Managing member Mary Smith, Authorized signer Betty Smith, Authorized signer 142 Joe Smith Floral Enterprises, LLC Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith Joe Smith 01/06/2015 143 Checklist for Limited Liability Company Required information on LLC Report to IRS in EIN (or SSN if one person LLC) Valid identification on managing member Operating Agreement, if any Documentation Domestic: Government Issued Document Foreign: Government Issued Document Account Styling: Smith Electronics, LLC OR Joe Smith, Smith Electronics, LLC Nondocumentary verification Certification of Beneficial Owner(s) Resolution Signature Card Government lists 144 MULTI TIERED BUSINESSES 145 Trade Name Resolution I, Floral Enterprises, Inc. am the sole owner of Plumbing Enterprises…. I authorize the following to sign on the account: Joe Smith Sally Smith Authorized Signer Authorized Signer Usually a list of what they can and cannot do You have to establish Authority…where does the authority come from? Signed Floral Enterprises, Inc by Joe Smith Corporate Secretary 146 Resolution (Some will also get a corporate resolution) Be it resolved at the last meeting of Floral Enterprises, Inc on July 4, 2011 the board of directors the following was decided: All of these will sign on the corporate account: Joe Smith President and Secretary Carol Smith Vice President and Treasurer Usually a list of what they can and cannot do Make Deposits and withdrawals Make loans Other Signed Joe Smith, Corporate Secretary Carol Smith Attested to by another officer 147 Adding the two -- documentation Start with the trade name: • One owner business –Corporate owner • May have more that one signer • Document usually filed at the county or Secretary of State (Fictitious Name, Trade Name or Assumed Name) • Use EIN of Corporate owner • Floral Enterprises, Inc dba Plumbing Enterprises • Resolution – Financial institution provided • Signature Card – Financial institution provided • Ceases at death of owner Add the corporate paperwork: • File Articles of Incorporation with Secretary of State • Usually receive Certificate • ID Corporate Secretary • Minutes of Meeting • Resolution signed by Secretary –Financial institution provided Don’t forget to CIP signers if that is in your policy! 148 Sample: Corporation dba 1 OWNERSHIP Corporation 2 TITLE Floral Enterprises Inc Dba Plumbing Enterprises You will have to figure out how to get the Trade Name Resolution when you select Corporate ownership. 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER 4 SIGNATURES (Access) EIN of Corporation Joe Smith Carol Smith 149 Sweetheart, LLP Floral Enterprises, LLC Who signs for LLC on Partnership Resolution? Who is the person in authority under the operating agreement and the resolution for the LLC? Chocolate Surprises, LLC Who signs for Chocolate Surprises on Partnership Resolution? Who is the person in authority under the operating agreement and the resolution for the LLC? 150 Partnership Resolution Names the Partnership: Sweetheart, LLP Lists who can sign What their job is Chocolate Surprises, LLC Floral Enterprises, LLC Betty Smith Partner Partner Authorized Signer Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Chocolate Surprises, LLC Partner by Joe Smith as Managing Member Floral Enterprises, LLC Partner by Carol Smith as Managing Member 151 Sample: Limited Liability Partnership 1 OWNERSHIP Partnership 5 TAXPAYER IDENTIFICATION NUMBER EIN of Partnership 2 TITLE Sweetheart , LLP 3 FEDERAL REGULATIONS 4 SIGNATURES (Access) Joe’s Signature Carol’s Signature Betty’s Signature as Authorized Signer 152 Adding the two LLCs– to get partnership documentation Start with the partnership documentation: • Document from secretary of state • Partnership agreement—this becomes the connecting paperwork • EIN of Partnership • Resolution – Provided by financial institution • Signature Card – Provided by financial institution • Some financial institutions run CIP on all signers Add the two LLCs documentation: • Document from Secretary of State—Certificate or Articles Stamped Filed • Operating Agreement • Resolution Don’t forget to CIP signers if that is in your policy! 153 What else might you need? • One entity + a second entity = Paperwork on three entities • Resolution and documentation on both partnerships • Establishes the paperwork and authorization for the third 154 Agency, Escrows and 1031 Exchange Agreements When one entity acts as agent for another, how do you establish authority… 155 Agency Agreements • An agreement between one business to act as “agent” for another business. • Examples: Collection Agencies Property Management What about Mary Kay? Avon? News paper Representatives? Are these agency agreements? 156 IOLTA • • • • • Interest on lawyer’s trust accounts Use EIN of foundation Pay reasonable rate of interest Do not let get overdrawn Do not connect with lawyer’s personal account • Paperwork set up through IOLTA • Interest sent to the foundation 157 Qualified Intermediary • 1031 Exchange Accounts • Exchange Agreement • Cannot touch money or have to pay capital gains • Customer exchanges one piece of property for another in a like kind exchange. 158 Court Ordered Arrangements • Bankruptcy, reorganizations • Court Order—establishes the authority • One business named to manage assets for another 159 FORMAL NONPROFIT OR UNINCORPORATED ASSOCIATION 160 REQUIREMENTS FOR FORMAL NON PROFIT OR UNINCORPORATED ASSOCIATIONS Requirements 1. Required Information: (Before opening account) 2. IRS Reporting: 3. Documentary Requirements: (Reasonable time after opening) Formal Nonprofit Or Unincorporated Associations Name Address Taxpayer identification— The account will use the employer identification number of the organization. Report in EIN of Organization Valid identification on person opening the account. Sometime financial institutions require identification on all signatories. My financial institution does/does not require all signers to complete CIP Charter, By-laws —provided by customer. Minutes of Meeting authorizing account opening 161 Requirements 3. Doc. Requirements (Continued) Formal Nonprofit Or Unincorporated Associations Financial Institution Provided Resolution Financial Institution Provided Signature Card Certification of Beneficial Owner(s) 4. Suggested nondocument verification: (Reasonable time after opening) 5. Account Styling: A CIP program must also have nondocumentary verification. Suggestions include: Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Previous financial institution references Name of organization. Examples: Rotary Lions Club Kiwanis 162 Requirements Formal Nonprofit Or Unincorporated Associations 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: $250,000 per Organization 8. Miscellaneous: Not for profit organizations may not have ITF/POD 163 Nonprofit Resolution Names the Nonprofit: Baton Rouge Rotary Lists who can sign What their job is Joe Smith Mary Smith Betty Jones President VP and Treasurer Secretary Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Betty Jones, Secretary Attested to by: Mary Smith, VP 164 Example of Formal Nonprofit Organization 1 2 OWNERSHIP TITLE Rotary Nonprofit 3 FEDERAL REGULATIONS 5 4 TAXPAYER IDENTIFICATION NUMBER SIGNATURES (Access) EIN of Rotary Mary Smith, Treas and VP Joe Smith, Pres Betty Jones, Sec 165 Joe Smith Rotary Joe Smith Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith 01/06/2015 166 Checklist for Formal Nonprofit Association Required information on nonprofit association Valid identification on signers as required in your CIP Charter, By-laws Minutes Report to IRS in EIN of Association Account Styling: Rotary Account Ownership: Nonprofit Nondocumentary verification Certification of Beneficial Owner(s) Resolution Signature Card Government lists 167 INFORMAL NONPROFIT OR UNINCORPORATED ASSOCIATION 168 REQUIREMENTS FOR INFORMAL NONPROFIT OR UNINCORPORATED ASSOCIATIONS Requirements 1. Required Information: (Before opening account) 2. IRS Reporting: 3. Documentary Requirements: (Reasonable time after opening) Informal Nonprofit Name Address Taxpayer identification— The account will use the employer identification number of the organization. Report in EIN of Organization Valid identification on all persons opening the account, since there will be no outside documents, such as charters or by by-laws Certification of Beneficial Owner(s) Financial Institution Provided Resolution Financial Institution Provided Signature Card 169 Requirements Informal Nonprofit 4. Suggested nondocument verification: (Reasonable time after opening) A CIP program must also have nondocument verification. Suggestions include: Welcome letter Call to customer to thank for business Delivery of checks to location by account officer Third party verification Previous financial institution references 5. Account Styling: Name of organization. Examples: Little League Flower Fund Hunting Club 1975 Class Reunion 170 Requirements Informal Nonprofit 6. Consult Government Lists: Section 326 List OFAC List 7. Insurance: $250,000 per Organization 8. Miscellaneous: Some small organizations will not have outside documents. You will have to identify all signatories if your financial institution decides to open these accounts. Do not set up as a personal account unless the SSN or the person on the account is signing and checks will be coming in made out personally to that person. 171 Nonprofit Resolution Names the nonprofit: 1975 High School Reunion Lists who can sign What their job is Joe Smith Mary Smith President Secretary Usually a list of what they can and cannot do Make deposits and Withdrawals Make loans Other Joe Smith, President Attested to by: Mary Smith, Secretary 172 Sample: Nonprofit 1 OWNERSHIP Nonprofit 2 TITLE 1975 High School Reunion 3 FEDERAL REGULATIONS 5 TAXPAYER IDENTIFICATION NUMBER EIN of High School Reunion 4 SIGNATURES (Access) Joe Smith Mary Smith Gettechnical Inc 173 Joe Smith 1975 High School Reunion Joe Smith Joe Smith 08/14/1977 123 Main Street 439-00-9999 Monroe, LA xxxxx Joe Smith 01/06/2015 174 Checklist for Informal Nonprofit Association Required information on nonprofit association Valid identification on all signatories Some financial institutions have customer write a “Letter of Purpose” Report to IRS in EIN of Association Account Styling: 1975 High School Reunion Account Ownership: Nonprofit Nondocumentary verification Certification of Beneficial Owner(s) Resolution Signature Card Government lists 175 Beneficial Ownership of Legal Entity Customers CDD Element #2 176 Example #1 • • • • • ABC, Inc. President: Sally Smith VP: Bill Lite Treasurer: Betty Jones Secretary: Stan Long • Corporation is owned by Cindy Kass and Robert Richards 50/50 177 How many CIPs? • Seven CIPs • ABC, Inc • Four signatories (if your institution runs signers) • Two beneficial owners • Controlling person is one of the signatories 178 Example #2 • Floral Enterprises (Partnership) • Three partners – all sign resolution – Bill Smith 50% (does not participate in operation of business) – Jane Whitmore 25% Signs on account – Gladys Sizemore 25% Signs on account – John Betts (office manager signs on account) 179 How many CIPs? • Five CIP – Partnership – 3 Partners – 1 Signatory 180 Nature and Purpose CDD Element #3 181 Purpose and Source • What brought you to the bank today? • Where are you moving the funds from? • What is the purpose of this business account? – Operating, payroll, escrow • How is the business structured? Sole Proprietorship, LLC, Partnership, Corporation or other. • Do you have beneficial owners on this business who own 25% or more of this business? 182 Thanks for that information now we can tell you what documents we will need on the business and the parties involved… • CIP Business and Signers • CIP Beneficial Owners (Proposed) • Follow check lists on paperwork for the particular type of business. 183 Geography • Can you tell me the service area of your business? • Do all of the principals live in the same geographic region? 184 Transactional questions Now to get you in the right product, we will have to ask a few transactional questions. Expected Annual Deposits _______________________________________________________________ Types of banking services used _______________________________________________________________ _______________________________________________________________ _______________________________________________________________ Expected International Services _______________________________________________________________ _______________________________________________________________ ______________________________________________________________ 185 Products and Services • We have several options for the account that might work for you. Let me go over them with you. • We have some additional services that I can also offer you. – – – – Remote Deposit Capture Debit Cards Online banking Bill Pay • Now let’s make sure you understand all the benefits and fees of the choices you have made…. 186 Money Service Business • • • • • • • • • Does your company cash checks over $1000? Does your company issue cashier’s checks or money orders over $1000? Does your company exchange currency over $1000? Do you transmit currency even virtual currency at any dollar amount? Do you provide or sell prepaid cards? -Over $2000 Closed loop -Not for HSA, Government Benefits or Employee Benefits -Over $1000 -At any amount if allow for reloads from nonfinancial institutions or internationally • -If a seller, if you do not CIP or sell under $10,000 • If yes, then we will need your FinCEN Registration and state registration when applicable unless you are acting as an agent solely and can provide proof of the agency status. 187 Unlawful or lawful internet gambling Does your company have any games or financial activities on its website? Do you provide services to companies who provide internet gambling? If internet gambling is legal in your state, provide licensing. Otherwise have company sign certification that it is not engaged in unlawful internet gambling. 188 Private ATMs • Does the business have any private ATM machines located on the premises? Does your business own or lease from another contractor? We will need: • Copy of the ATM agreement with sponsoring entity • Exact physical location(s) of the ATM(s) • Copy of state registration (if required by state) • Copy of three months ATM activity statements • Description of currency servicing arrangements including • How is cash being replenished (store proceeds, armored car, etc) 189 Funds Availability on Checking • Here is our funds availability policy. You will notice that our funds are generally next day available but cash is available on the same day. • You can make a deposit from 9-5 at the teller window and it will be available generally by the next morning. 190 Debit Cards • We do issue debit cards for business accounts. Is this something that you are interested in? • You can order these for employees but I want to take a minute to go over the limits and what happens if there is an unauthorized transaction on you business debit card it is a little different than a personal account. • Explain 191 Marijuana Related Businesses • • • • • • • Are you a producer, processor or retailer of marijuana? Yes/No If yes, obtain copy of license What is your annual revenue? ________________________________ If a retailer, you agree that there is: -No employee under the age of 21 or allow anyone under the age of 21 on the premises No signage is visible from the public right of way -No display is visible from the public right of way -No employee or owner shall use the product on the premises Is this business a marijuana-related business? Type of Business ____________________________ (Example Insurance company, landlord, security systems etc. Approximate Annual Revenue ____________________________________________ What percentage of your business is directly tied to marijuana business? __________% What process do you have in place to make sure the marijuana business is licensed? ___________________________________________________________________________ 192 Checklist • • • • • • • • • • • • Customer Profile Resolution Signature Card W-9 or W-8Bene Documentation on Business Documentation on Signers and 25% Beneficial owners OFAC Business Debit Card Agreement, Online banking and Remote Deposit Capture Funds availability and unlawful internet gambling Registration for MSBs and state law registration State registration and licensing for marijuana businesses Risk rating of business 193 Thanks for participating! Debbie Crawford Gettechnical Inc 1-800-354-3051 gettechnical@msn.com www.gettechnicalinc.com ©Gettechnical Inc. 194