Corporate governance : Performance and Measurement

advertisement

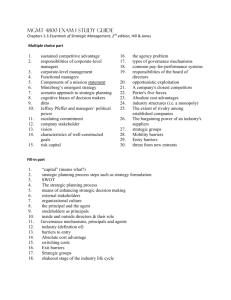

Corporate governance Performance and Measurement T.V.Mohandas Pai Member of the Board and CFO Infosys Technologies Limited Corporate Governance A system of checks and balances between the board, management and investors to produce an efficiently functioning corporation, ideally geared to produce long-term value The Conference Board Issues in Corporate Governance Asymmetry of power Asymmetry of information Interests of shareholders as residual owners Role of owner management Theory of separation of powers Division of corporate pie among stakeholders Current status on corporate governance Insistence on forms and structures Overarching regulations Regulatory overkill Lack of adequate number of strong, independent directors Large liabilities for companies and officers Has the pendulum swung too far? For the first time in the decade-long history of the Index of Economic Freedom, the U.S. is no longer among the top ten “most free” countries • Wall Street Journal and the Heritage Foundation “Index of Economic Freedom” Current status on corporate governance Comparison of Board structure – Indian top 50 Vs U.S. top 50 – Key Findings Parameter India (Nifty Fifty companies) US (top 50 out of NYSE 100 index) Ownership pattern 48% of Indian companies have largest shareholder holding over 50% Largest shareholder holds less than 10% in all cases Board size Largest Board independence board size – 17. smallest – 5 Largest 44% of the top 50 companies have more than 12 directors 66% 58% All of companies have a board majority of independent directors board size 18. smallest – 10 of the top 50 companies have more than 12 directors companies have a board majority of independent directors have less than 1/3rd of their directors independent 12% Executive directors in board In 35 companies 50% of the directors – or more – are executive directors Boards of 49 companies out of 50 have less than 25% executive directors Chairman and CEO 60% have separate Chairman and CEO Only 20% have separate Chairman and CEO Lead independent director 3 companies have lead independent directors 20 companies have lead independent directors Board committees All companies have audit committees – 54% have fully independent Audit Committees All companies have remuneration committees – of these 14 fully independent and 16 have majority independent committees 33 companies have fully independent audit remuneration and nomination committees companies have nomination committees – 6 are fully independent and 3 have majority independent committees 9 Source: Crisil Report on Corporate Governance Governance and performance Good governance leads to good performance It creates an open and transparent system It improves communication and breaks down systematic barriers to flow of information Good governance allows decision making based on data. It reduces risk Good governance helps in creating a brand and creates comfort for all stakeholders and society Does performance depend on governance Short term performance does not necessarily depend on governance Market asymmetries are responsible for this. However, this increases risk. This also creates barrier to long term growth We all know what happened to Enron? Does performance depend on governance Medium to long term performance requires governance Most companies which have grown in the last 25 years have outstanding performance and have good governance structure A good governance structure treats all stakeholders fairly Governance alone cannot ensure performance Governance and Performance - issues Is governance a luxury that can be afforded only by the performing companies? Do strategies and tactics need to change to accommodate governance with performance? Is there a time-lag between governance and performance? Are stakeholders concerned about “performance” or “promised performance” ? Governance and Performance measurement - issues Is governance behavior motivated by legislation? • Do standards vary with jurisdictions or do you adopt the best option? • Do you choose the right thing to do irrespective of whether it’s mandatory or not? Is performance evaluation limited to valuation metrics? • Is it only ROE, Net margin, growth, shareholder wealth creation? Do performance measures need to be holistic? • We need to encompass all stakeholders • Governance is an enabler for holistic performance How do managers better understand governance requirements? • Do we need market research for governance requirements? Investing in Corporate Governance Companies need to invest in good governance Corporate governance has a direct bearing on business performance and thereby ROI Leverage the power of IT On average, businesses with superior governance practices generate 20 percent greater profits than other companies A study based on 256 companies conducted at the MIT Sloan School of Management Thank You